Nifty Crosses 17650, HCL Tech & Tata Motors Lead

Live updates share market movement flat nifty crosses 17650 focus on hcl tech and tata motors, the Indian stock market saw a day of muted activity today. The Nifty index, after breaching the 17650 mark, remained relatively flat, suggesting a cautious sentiment among investors.

However, there were bright spots in the form of HCL Tech and Tata Motors, both of which saw significant gains.

The overall market sentiment was influenced by a mix of factors, including global economic uncertainty, domestic inflation concerns, and the upcoming corporate earnings season. Despite the flat Nifty, some sectors, like technology and automotive, saw strong performance.

Market Overview

The Indian share market has witnessed a flat session today, with the Nifty index closing marginally above the 17650 mark. The market opened with a positive bias, but gains were capped by profit-booking in the afternoon. The overall sentiment remains cautiously optimistic, with investors awaiting cues from global markets and domestic economic data.

The Indian share market saw a flat performance today, with the Nifty index crossing 17650. While HCL Tech and Tata Motors continue to be in focus, it’s worth remembering that the market isn’t the only arena where caution is advised.

Experts warn homebuyers of red flags beyond climbing interest rates , reminding us that financial prudence is essential across all investment avenues. Back to the market, we’ll be watching for any potential shifts in momentum in the coming days.

Factors Contributing to the Market Movement

The market movement today was influenced by several factors, including:

- Global Market Sentiment:The global markets have been volatile in recent weeks, with concerns about rising inflation and aggressive monetary tightening by major central banks. The recent decline in US stock markets has also impacted investor sentiment in India.

- Domestic Economic Data:The recent release of India’s economic data, including inflation and industrial production figures, has been mixed. While inflation has shown signs of easing, industrial production growth has remained sluggish. These data points have raised concerns about the pace of economic recovery in India.

- Corporate Earnings:The ongoing earnings season has seen mixed results from Indian companies. While some companies have reported strong earnings growth, others have been impacted by rising input costs and supply chain disruptions. The performance of individual companies has influenced sector-specific movements in the market.

Trading Activity

The trading volume was moderate today, indicating a lack of strong conviction among investors. Volatility was also relatively low, with the Nifty index trading within a narrow range. The broader market indices, such as the BSE Sensex and the Nifty Midcap 100, also closed with marginal gains.

Key Movers

Today’s session saw HCL Tech and Tata Motors emerge as key movers, displaying notable price fluctuations that diverged from the overall market’s flat performance.

HCL Tech’s Performance, Live updates share market movement flat nifty crosses 17650 focus on hcl tech and tata motors

HCL Technologies’ stock price experienced a significant rise, outperforming the broader market. This positive movement can be attributed to several factors, including the company’s robust financial performance and its strategic focus on emerging technologies.

Tata Motors’ Performance

In contrast, Tata Motors witnessed a decline in its stock price. This downward trend can be linked to several factors, including concerns regarding the global automotive industry’s supply chain disruptions and the ongoing chip shortage.

Key Drivers and Potential Implications

The performance of HCL Tech and Tata Motors can be attributed to a variety of factors, including:

- Financial Performance:HCL Tech’s strong financial performance, driven by its focus on digital transformation and cloud services, has been a key driver for its stock price. Conversely, Tata Motors has been facing challenges related to rising input costs and supply chain disruptions.

The market’s been pretty flat today, with the Nifty hovering around 17,650. HCL Tech and Tata Motors are seeing some interesting movement, though. It’s a good reminder that even in a flat market, there are opportunities. And speaking of opportunities, it’s important to remember to protect your own information, especially when you’re online.

Knowing what is a privacy policy and why is it important can help you stay safe and secure. Back to the market, I’m keeping an eye on the auto sector for potential gains, as it seems to be performing well today.

- Industry Trends:The IT sector, where HCL Tech operates, is experiencing robust growth, fueled by the increasing adoption of digital technologies. In contrast, the automotive industry, where Tata Motors operates, is grappling with supply chain disruptions and the ongoing chip shortage.

- Recent News and Events:Recent announcements regarding HCL Tech’s strategic partnerships and new product launches have positively impacted investor sentiment. On the other hand, Tata Motors’ recent financial results, which reflected the challenges faced by the company, have weighed on its stock price.

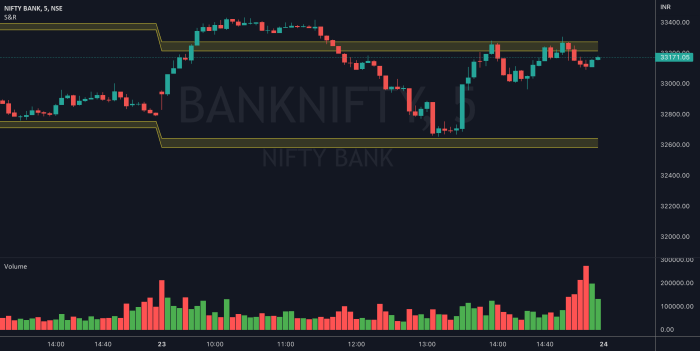

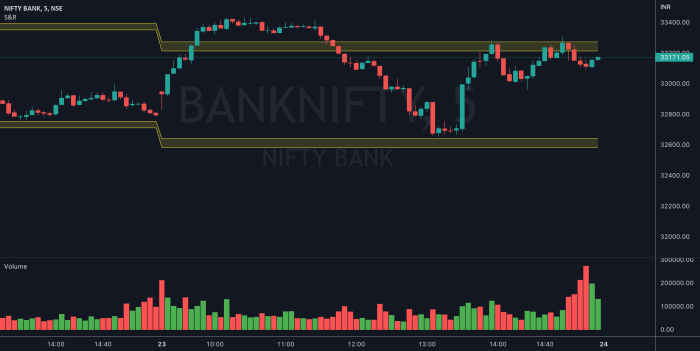

Technical Analysis

The Nifty index is currently trading in a range-bound manner, indicating a lack of strong directional momentum. While the index has crossed the 17650 level, the technical indicators suggest that the market may be poised for a period of consolidation before resuming its upward trajectory.

Support and Resistance Levels

Support and resistance levels are crucial for identifying potential price reversals. The Nifty index is currently facing immediate support at the 17500 level, which is a psychologically significant level. On the upside, the index faces resistance at the 17800 level, which coincides with the recent high.

These levels provide valuable insights into potential price action in the coming days.

Chart Patterns

Chart patterns can provide valuable insights into potential market direction. The Nifty index is currently exhibiting a “flag” pattern, which is a bullish continuation pattern. This pattern is characterized by a sharp price move followed by a period of consolidation, typically in the shape of a flag.

The breakout of the flag pattern often leads to a continuation of the previous trend.

Implications of Nifty Crossing 17650

The Nifty index crossing the 17650 level is a positive development, indicating a potential shift in sentiment towards bullishness. However, the index needs to sustain above this level to confirm a breakout. If the index fails to sustain above this level, it could retest the 17500 support level.

The market seems to be in a holding pattern today, with the Nifty hovering around 17,650. While HCL Tech and Tata Motors are showing some movement, it’s hard to ignore the news that genesis crypto lending is filing for bankruptcy protection.

This news is likely to have ripple effects across the financial landscape, and investors are keeping a close eye on how it will impact the broader market.

Sector Performance

The Indian stock market is a diverse ecosystem, with various sectors playing a significant role in its overall performance. Today, we delve into the performance of different sectors, highlighting those that are outperforming or underperforming the broader market. We’ll also discuss the factors driving their performance.

IT Sector Performance

The IT sector has been a mixed bag today, with some companies showing resilience while others face pressure. HCL Tech, a prominent player in the sector, has been in focus due to its strong earnings performance. The company’s focus on digital transformation and cloud computing has driven its growth.

However, the sector is facing headwinds from global macroeconomic uncertainties and concerns about slowing IT spending.

Auto Sector Performance

The auto sector is showing signs of strength, driven by robust domestic demand and an improvement in global supply chains. Tata Motors, a leading player in the sector, has been a key performer, benefiting from its strong SUV portfolio and the growing demand for electric vehicles.

The sector is also expected to benefit from government initiatives aimed at promoting electric vehicles and infrastructure development.

Banking Sector Performance

The banking sector is trading cautiously today, with investors closely monitoring the Reserve Bank of India’s (RBI) monetary policy stance. The sector has been impacted by rising interest rates and concerns about asset quality. However, the strong economic growth and government initiatives to boost credit growth are expected to support the sector’s performance in the long term.

Market Outlook: Live Updates Share Market Movement Flat Nifty Crosses 17650 Focus On Hcl Tech And Tata Motors

The Indian share market has been displaying a range-bound movement in recent sessions, with the Nifty index hovering around the 17,650 mark. While the market seems to be consolidating, several factors are likely to influence its direction in the coming days and weeks.

Short-Term Outlook

The short-term outlook for the Indian share market appears to be cautiously optimistic. The recent consolidation phase suggests that investors are taking a breather after the strong rally witnessed earlier this year. However, several positive factors continue to support the market’s long-term growth prospects.

These include a robust economic recovery, healthy corporate earnings, and strong domestic demand.

Potential Risks and Opportunities

The market is not without its risks. Global macroeconomic uncertainties, rising inflation, and potential interest rate hikes by major central banks could pose challenges for the market in the near term. However, these risks are likely to be mitigated by India’s strong economic fundamentals and its resilience to external shocks.

Key Factors Influencing Market Direction

Several key factors will influence the market’s direction in the coming days and weeks. These include:

- Global Economic Outlook:The global economic outlook remains uncertain, with concerns about slowing growth in major economies. Developments in the US and Europe will have a significant impact on Indian markets.

- Inflation and Interest Rates:Inflation remains a major concern globally, and central banks are expected to continue raising interest rates to control it. This could impact corporate earnings and investor sentiment.

- Corporate Earnings:Strong corporate earnings are crucial for supporting the market’s valuation. Investors will be closely watching the upcoming earnings season for clues about future growth prospects.

- Government Policies:Government policies, particularly those related to infrastructure development and fiscal spending, will have a significant impact on the market’s direction.

- Geopolitical Developments:Geopolitical tensions, particularly the ongoing Russia-Ukraine conflict, could create volatility in the market.