Wall Street Navigates Mixed Earnings, Awaits Fed Decision

Live news coverage wall street faces mixed earnings reports and anticipates fed rate decision – Live news coverage: Wall Street faces mixed earnings reports and anticipates the Federal Reserve’s rate decision. This week, the financial world is holding its breath as investors grapple with a wave of corporate earnings reports and the impending announcement from the Fed.

The recent mixed performance of major Wall Street companies has left many wondering about the future trajectory of the market. Amidst this uncertainty, the Fed’s decision on interest rates is expected to have a significant impact, potentially influencing everything from inflation to economic growth.

The first half of the year has been a roller coaster ride for investors. While some sectors have shown resilience, others have struggled to maintain their momentum. This mixed bag of earnings reports reflects the ongoing challenges facing businesses, including rising inflation, supply chain disruptions, and geopolitical tensions.

Adding to the complexity is the Federal Reserve’s ongoing efforts to combat inflation. With the Fed poised to make a decision on interest rates, investors are anxiously awaiting the outcome, as it could have a ripple effect throughout the economy.

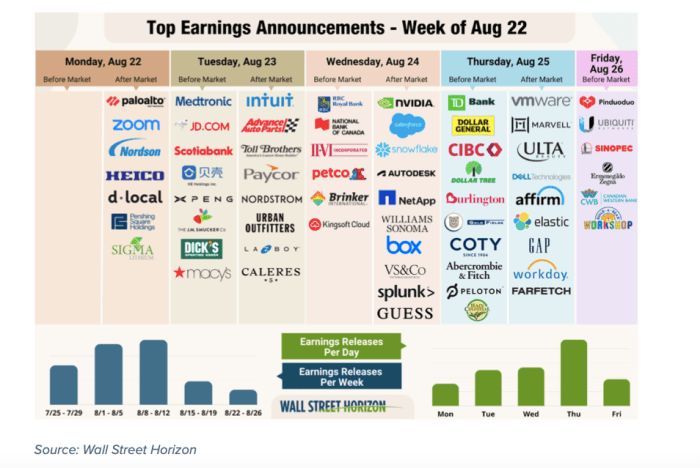

Wall Street Earnings Reports

Wall Street is navigating a complex landscape of mixed earnings reports and an anticipated Federal Reserve interest rate decision. While some companies have delivered strong results, others have struggled to meet expectations, reflecting the ongoing economic uncertainties and industry-specific challenges.

Key Trends in Earnings Reports

Recent earnings reports from major Wall Street companies have revealed several key trends.

Wall Street is navigating a choppy market today, with mixed earnings reports and a watchful eye on the Fed’s upcoming rate decision. But amidst the financial uncertainty, there’s a glimmer of optimism from Ark Invest, who believe Tesla’s Cybertruck could achieve mainstream success comparable to the Model Y, as seen in their recent report here.

Whether the Cybertruck’s success can translate into a broader market rebound remains to be seen, but it’s a welcome dose of positive sentiment in a market that’s currently seeking stability.

- Strong Revenue Growth in Certain Sectors:Companies in sectors like technology and consumer discretionary have reported strong revenue growth, driven by robust consumer demand and continued digitalization. For example, Apple’s revenue surged in the most recent quarter, fueled by strong sales of iPhones and Macs.

This growth reflects the resilience of the tech sector and the ongoing shift towards digital consumption.

- Profitability Pressures:Despite strong revenue growth, many companies are facing profitability pressures due to rising inflation, supply chain disruptions, and labor shortages. The increased cost of raw materials, labor, and logistics has eroded profit margins, impacting the bottom line. For instance, Ford Motor Company reported a decline in its quarterly profit, citing rising material costs and supply chain challenges.

- Mixed Performance Across Industries:While some sectors are performing well, others are facing headwinds. The energy sector, for example, has benefited from higher oil and gas prices, but the banking sector is facing challenges due to rising interest rates and a potential economic slowdown.

This mixed performance underscores the diverse impact of economic conditions on different industries.

Performance of Different Sectors

The performance of different sectors has been uneven, reflecting the varied impact of economic conditions and industry-specific factors.

Wall Street is on edge today, juggling mixed earnings reports and anticipating the Fed’s rate decision. But amidst the financial frenzy, news from across the Atlantic has caught everyone’s attention: Spain has just slapped Amazon and Apple with a hefty €194 million fine for anticompetitive practices, a move that could have significant implications for tech giants globally.

Whether this news will impact the market’s direction remains to be seen, but it’s certainly adding another layer of complexity to an already volatile day.

- Technology:The technology sector has continued to perform well, with companies like Apple, Microsoft, and Amazon reporting strong revenue growth and healthy profits. This growth is driven by the continued adoption of cloud computing, digital services, and e-commerce. However, some technology companies have faced headwinds from slowing global economic growth and rising interest rates, which could impact future growth prospects.

- Consumer Discretionary:Companies in the consumer discretionary sector, which includes retailers and restaurants, have benefited from robust consumer demand and a reopening economy. However, rising inflation and supply chain disruptions have put pressure on margins. For instance, Walmart, the largest retailer in the United States, reported strong revenue growth but warned of higher costs and supply chain challenges.

- Energy:The energy sector has seen strong performance, driven by higher oil and gas prices due to the ongoing war in Ukraine and global energy shortages. However, the industry faces long-term challenges from the transition to renewable energy sources. While oil and gas companies are generating record profits, they are also facing pressure to invest in cleaner energy technologies.

Wall Street is glued to their screens today, digesting a mixed bag of earnings reports and bracing for the Fed’s rate decision. But amidst the financial drama, a glimpse into the future is emerging. HP’s CEO forecasts an AI-driven revolution in computers within two years , which could drastically reshape the tech landscape and impact how we interact with information.

Whether the market can handle both a potential rate hike and this technological upheaval remains to be seen, but one thing is clear: the future is coming faster than we think.

Factors Driving Mixed Earnings Results, Live news coverage wall street faces mixed earnings reports and anticipates fed rate decision

Several factors are driving the mixed earnings results, including economic conditions, industry-specific challenges, and company-specific strategies.

- Economic Conditions:The global economy is facing headwinds from rising inflation, supply chain disruptions, and the ongoing war in Ukraine. These factors have created uncertainty for businesses and impacted consumer spending. The Federal Reserve’s aggressive interest rate hikes are also weighing on economic growth and could lead to a recession.

- Industry-Specific Challenges:Different industries are facing unique challenges. For example, the automotive sector is struggling with supply chain disruptions and semiconductor shortages, while the retail sector is facing rising costs and shifting consumer preferences. Companies are adapting to these challenges by adjusting pricing, sourcing materials from different suppliers, and investing in automation.

- Company-Specific Strategies:Companies are employing various strategies to navigate the current economic environment. Some companies are focusing on cost-cutting measures, while others are investing in growth initiatives. For example, Amazon is investing heavily in its cloud computing business, while Walmart is focusing on reducing costs and improving its supply chain.

Federal Reserve Rate Decision: Live News Coverage Wall Street Faces Mixed Earnings Reports And Anticipates Fed Rate Decision

The Federal Reserve’s upcoming rate decision is a major event that will likely have significant implications for Wall Street and the broader economy. Investors are eagerly awaiting the Fed’s announcement, as it will provide insights into the central bank’s outlook on inflation and economic growth.

The decision could impact interest rates, borrowing costs, and overall market sentiment.

Impact of a Rate Hike or Pause

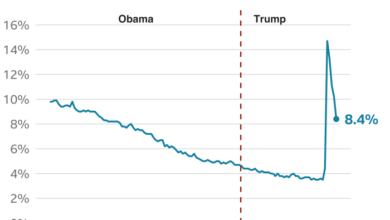

The Fed’s decision to raise or hold interest rates will have a direct impact on borrowing costs for businesses and consumers. A rate hike would make it more expensive to borrow money, potentially slowing economic growth. On the other hand, a pause on interest rates could encourage borrowing and spending, boosting economic activity.The current inflation and economic growth environment is a key factor in the Fed’s decision-making process.

Inflation has been stubbornly high, eroding consumer purchasing power. While economic growth has slowed, it remains positive, suggesting the economy is not in a recession. The Fed is tasked with balancing the need to control inflation with the desire to maintain economic stability.

Potential Effects on Key Economic Indicators

The Fed’s rate decision will likely impact various economic indicators, including:

- Inflation:A rate hike is generally expected to help cool inflation by reducing demand and increasing borrowing costs. However, the effectiveness of this strategy depends on factors such as the magnitude of the rate hike and the persistence of inflationary pressures.

- Economic Growth:Higher interest rates can slow economic growth by making it more expensive for businesses to invest and for consumers to borrow money. This can lead to a decrease in spending and investment, which can dampen economic activity.

- Stock Market:The stock market is sensitive to interest rate changes. A rate hike can lead to a decline in stock prices as investors become more risk-averse. Conversely, a pause on interest rates could boost stock prices as investors become more optimistic about economic growth prospects.

- Interest Rates:The Fed’s decision will directly impact short-term interest rates, which are the rates at which banks lend to each other. This, in turn, can influence long-term interest rates, affecting the cost of borrowing for mortgages, auto loans, and other forms of credit.

| Scenario | Impact on Inflation | Impact on Economic Growth | Impact on Stock Market | Impact on Interest Rates |

|---|---|---|---|---|

| Rate Hike | Potentially lower inflation | Potentially slower growth | Potentially lower stock prices | Higher interest rates |

| Pause on Rates | Potentially higher inflation | Potentially higher growth | Potentially higher stock prices | Lower interest rates |

Market Volatility and Investor Sentiment

The stock market has been experiencing heightened volatility in recent weeks, a trend driven by a confluence of factors, including mixed corporate earnings reports and the anticipation of the Federal Reserve’s upcoming interest rate decision. This volatility reflects the uncertainty surrounding the future direction of the economy and the potential impact of monetary policy on corporate profits and investor returns.

Investor Sentiment Analysis

Investor sentiment is a crucial indicator of market direction, reflecting the overall mood and expectations of investors. In the current market, sentiment appears to be a mix of optimism, pessimism, and uncertainty. While some investors remain optimistic about the long-term growth potential of the economy, concerns about rising inflation, supply chain disruptions, and geopolitical tensions are weighing on sentiment.

The mixed earnings reports, with some companies exceeding expectations and others falling short, have further contributed to this uncertainty. For example, the recent earnings reports from tech giants like Apple and Amazon have shown mixed results, reflecting the challenges faced by the sector in a changing economic landscape.Investors are also closely watching the Federal Reserve’s upcoming interest rate decision.

The Fed is expected to raise interest rates to combat inflation, but the magnitude of the rate hike and the future path of monetary policy remain uncertain. These uncertainties are contributing to market volatility, as investors grapple with the potential impact of higher interest rates on economic growth and corporate earnings.The following table summarizes the key factors driving market volatility and investor sentiment:

| Factor | Impact on Volatility | Impact on Sentiment |

|---|---|---|

| Mixed Earnings Reports | Increased volatility as investors assess company performance and future prospects. | Mixed sentiment, with some investors optimistic and others pessimistic depending on individual company performance. |

| Anticipated Fed Rate Decision | Heightened volatility as investors anticipate the potential impact of interest rate hikes on the economy and corporate earnings. | Uncertainty, with some investors concerned about the potential for economic slowdown while others are optimistic about the Fed’s ability to control inflation. |

| Inflation | Increased volatility as investors assess the impact of rising prices on corporate margins and consumer spending. | Pessimism, with some investors concerned about the erosion of purchasing power and potential for economic slowdown. |

| Supply Chain Disruptions | Increased volatility as investors assess the impact of supply chain disruptions on corporate profits and economic growth. | Uncertainty, with some investors concerned about the potential for shortages and price increases while others are optimistic about the resilience of businesses. |

| Geopolitical Tensions | Increased volatility as investors assess the potential impact of geopolitical tensions on global markets and economic activity. | Uncertainty, with some investors concerned about the potential for economic instability while others are optimistic about the ability of governments to resolve conflicts. |

Outlook for the Future

The current market environment is characterized by a delicate balancing act between optimism and uncertainty. While recent earnings reports have offered some positive signals, the looming Federal Reserve rate decision and the ongoing geopolitical tensions continue to cast a shadow over investor sentiment.

Experts are divided on the trajectory of the stock market in the coming months, with varying perspectives on the potential impact of these factors.

Key Risks and Opportunities

The current market environment presents both risks and opportunities for investors. Understanding these dynamics is crucial for navigating the potential volatility ahead.

- Inflation and Interest Rates:The Federal Reserve’s decision on interest rates will be a key determinant of market direction. A more aggressive rate hike could lead to higher borrowing costs for businesses and consumers, potentially dampening economic growth and putting downward pressure on stock prices.

Conversely, a more moderate approach could provide some relief for the market.

- Geopolitical Tensions:The ongoing conflict in Ukraine and heightened tensions between the US and China continue to create uncertainty and volatility in the global economy. These geopolitical risks can disrupt supply chains, increase energy prices, and negatively impact investor confidence.

- Earnings Growth:Corporate earnings are a key driver of stock prices. While recent earnings reports have been mixed, analysts are closely watching for signs of slowing growth. A sustained decline in earnings could lead to a correction in the market.

- Market Valuation:The stock market is currently trading at relatively high valuations. This means that investors are paying a premium for stocks, making them more susceptible to price declines if earnings growth slows or interest rates rise.

Impact of Global Economic Trends

Global economic trends will also play a significant role in shaping the future of Wall Street. The global economy is facing a number of challenges, including rising inflation, supply chain disruptions, and the ongoing pandemic. These factors can impact corporate profits and investor sentiment.

- Global Growth:The International Monetary Fund (IMF) has recently downgraded its global growth forecast, citing the war in Ukraine, rising inflation, and supply chain disruptions. A slowdown in global economic growth could negatively impact US companies with significant international operations.

- China’s Economy:China’s economy is facing headwinds from the ongoing “zero-COVID” policy and a property market slowdown. A significant slowdown in China’s economy could have a ripple effect on the global economy and US stock market.

- Energy Prices:The war in Ukraine has led to a surge in energy prices, which is putting upward pressure on inflation and impacting corporate costs. The impact of energy prices on the economy and stock market will depend on the duration of the conflict and the effectiveness of policy responses.

Expert Opinions and Forecasts

Analysts and economists offer a range of perspectives on the future trajectory of the stock market. Some believe that the market is poised for further gains, citing strong corporate earnings and a resilient economy. Others are more cautious, pointing to the risks of inflation, interest rate hikes, and geopolitical uncertainty.

- Bullish Outlook:Some analysts argue that the stock market is well-positioned for continued growth, driven by strong corporate earnings and a robust economy. They point to the ongoing recovery from the pandemic and the potential for continued consumer spending.

- Bearish Outlook:Other analysts are more cautious, citing the risks of inflation, interest rate hikes, and geopolitical uncertainty. They believe that these factors could lead to a correction in the market.

- Neutral Outlook:Some analysts take a more neutral stance, acknowledging both the potential for growth and the risks to the market. They believe that the market will likely experience volatility in the coming months, as investors navigate the current environment.