Jobs Report, AI Hype, and Debt Ceiling Deal: This Weeks Economic Focus

Key focus this week jobs report and ai hype take center stage following debt ceiling deal – With the jobs report, AI hype, and the debt ceiling deal taking center stage this week, the economic landscape is buzzing with activity. These intertwined factors are shaping the future of work, industry, and government spending, and their impact will be felt for years to come.

Let’s delve into the details of each, exploring the implications for individuals, businesses, and the global economy.

The latest jobs report is a key indicator of the health of the US economy. We’ll examine the unemployment rate, job creation, and wage growth, comparing them to past trends and expectations. This analysis will shed light on the Federal Reserve’s likely course of action regarding interest rates and monetary policy.

Jobs Report Analysis

The latest jobs report has emerged as a focal point in the current economic landscape, offering crucial insights into the health of the labor market and its implications for future economic trajectory. With the recent debt ceiling deal providing a temporary reprieve from fiscal uncertainty, the jobs report stands as a key indicator of the economy’s resilience and direction.

Key Figures and Trends

The jobs report typically provides a snapshot of the labor market through key metrics, including unemployment rate, job creation, and wage growth. These figures offer valuable insights into the dynamics of the labor market and its overall performance.

- Unemployment Rate:The unemployment rate reflects the percentage of the labor force actively seeking employment but unable to find it. A lower unemployment rate generally indicates a strong economy, while a higher rate suggests a weaker labor market.

- Job Creation:The number of new jobs created each month provides a measure of the economy’s growth and its ability to generate employment opportunities. A higher number of job creations typically signifies a robust economy, while a decline in job creation could indicate a slowdown.

- Wage Growth:Wage growth measures the rate at which wages are increasing, providing insights into the purchasing power of workers and their ability to participate in the economic expansion. Strong wage growth can fuel consumer spending and drive economic growth, while stagnant wages can dampen economic activity.

Comparison with Previous Trends and Expectations

Analyzing the latest jobs report involves comparing its key figures with previous trends and market expectations. This comparison helps to gauge the performance of the labor market relative to historical data and prevailing economic sentiment.

- Unemployment Rate:Comparing the current unemployment rate to previous months and years can reveal trends in joblessness and provide insights into the overall health of the labor market. For instance, if the unemployment rate has been steadily declining, it suggests a strong and improving labor market.

Conversely, if the unemployment rate has been increasing, it could indicate a weakening economy.

- Job Creation:Comparing the current job creation figures to previous months and years helps to assess the pace of economic growth and the labor market’s ability to create new jobs. A consistent trend of strong job creation suggests a robust economy, while a decline in job creation could signal a slowdown or potential recession.

- Wage Growth:Comparing wage growth figures to previous periods provides insights into the purchasing power of workers and the rate of inflation. Strong wage growth can fuel consumer spending and drive economic growth, while stagnant wages can dampen economic activity and contribute to inflationary pressures.

This week’s economic news is dominated by the jobs report and the continued hype around AI, all while the country breathes a sigh of relief following the debt ceiling deal. But amidst the macro-economic chatter, a story of greed and deception caught my attention: a Massachusetts father and son were sentenced to prison for their role in a $20 million lottery scam.

This case serves as a stark reminder that while the economy may be on the upswing, individual stories of corruption and fraud still exist, reminding us to be vigilant and critical of the information we consume.

Impact on Federal Reserve Monetary Policy

The jobs report plays a crucial role in shaping the Federal Reserve’s monetary policy decisions. The Fed, responsible for managing inflation and maintaining economic stability, closely monitors the labor market to gauge the strength of the economy and the potential for inflationary pressures.

- Interest Rate Decisions:A strong jobs report, characterized by low unemployment, robust job creation, and healthy wage growth, can provide the Fed with justification to raise interest rates to curb inflation. Conversely, a weak jobs report could prompt the Fed to maintain or even lower interest rates to stimulate economic growth.

- Inflation Expectations:The jobs report provides insights into the labor market’s ability to absorb wage increases without fueling inflation. Strong wage growth coupled with low unemployment can create upward pressure on inflation, potentially leading the Fed to take action to cool down the economy.

Conversely, weak wage growth could suggest that inflation is not a significant concern, allowing the Fed to maintain a more accommodative monetary policy.

AI Hype and Its Impact on the Job Market

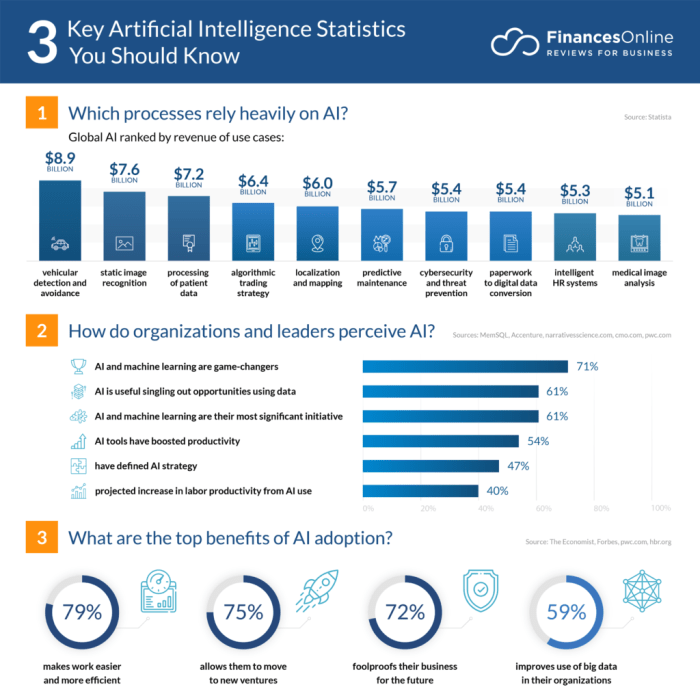

The recent surge in AI development has sparked widespread discussions about its potential to revolutionize various industries and impact the job market. From self-driving cars to personalized medicine, AI is poised to transform how we live and work, raising concerns about job displacement and the need for workforce adaptation.

The Current State of AI Development and Its Potential Disruption

AI has rapidly advanced in recent years, fueled by breakthroughs in machine learning, deep learning, and natural language processing. This progress has enabled AI systems to perform tasks previously thought to be exclusive to humans, such as image recognition, language translation, and even creative writing.

The potential for AI to disrupt various industries is immense, as it can automate tasks, improve efficiency, and generate new products and services.

Industries Expected to Be Most Impacted by AI Advancements

Several sectors are expected to experience significant disruption due to AI advancements. These include:

- Manufacturing:AI-powered robots and automation systems are already being used in factories to perform repetitive tasks, increasing efficiency and reducing labor costs. This trend is likely to continue, leading to job displacement in certain roles while creating new opportunities in areas like AI maintenance and programming.

- Transportation:The development of self-driving vehicles has the potential to revolutionize the transportation industry. While this could lead to job losses for truck drivers and taxi drivers, it could also create new jobs in areas like vehicle design, software development, and AI maintenance.

- Healthcare:AI is being used to develop personalized medicine, diagnose diseases earlier, and improve patient care. This could lead to job creation in areas like medical research, AI-assisted diagnostics, and data analysis, but it could also displace some healthcare professionals.

- Finance:AI is being used to automate financial processes, detect fraud, and provide personalized financial advice. This could lead to job losses in traditional finance roles, but it could also create new opportunities in areas like AI-powered financial analysis and risk management.

- Customer Service:AI-powered chatbots and virtual assistants are increasingly being used to handle customer inquiries, reducing the need for human customer service representatives. This could lead to job losses in this sector, but it could also create new opportunities in areas like chatbot development and AI training.

AI’s Potential to Create New Jobs While Displacing Existing Ones, Key focus this week jobs report and ai hype take center stage following debt ceiling deal

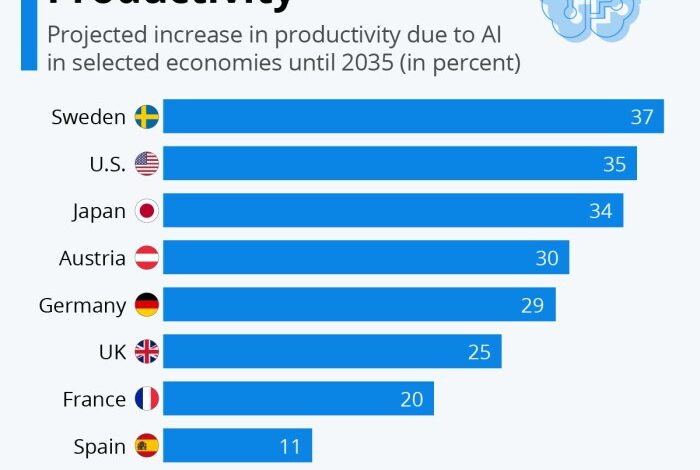

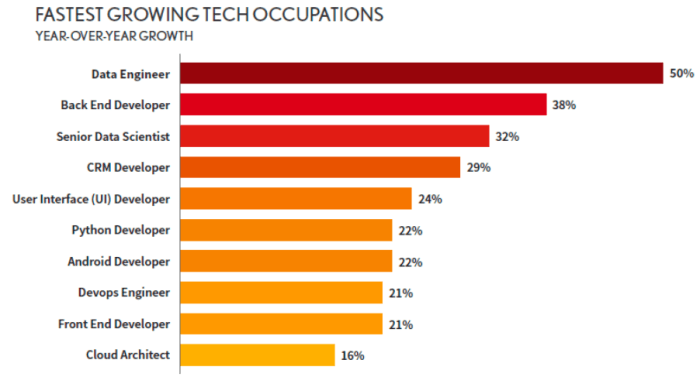

While AI has the potential to displace some jobs, it also has the potential to create new ones. This is because AI can create new opportunities in areas like AI development, data science, and AI-related services. For example, the development of AI-powered systems requires skilled professionals in areas like machine learning, deep learning, and data engineering.

Furthermore, AI can create new business models and industries, leading to the creation of new jobs.

Ethical Considerations Surrounding AI’s Impact on Employment and Society

The widespread adoption of AI raises several ethical considerations, particularly in relation to its impact on employment and society. One major concern is the potential for job displacement, as AI systems become capable of performing tasks currently done by humans.

This could lead to increased unemployment, social inequality, and economic instability. Another ethical concern is the potential for AI to be used in discriminatory ways. For example, AI systems trained on biased data could perpetuate existing inequalities in areas like hiring, lending, and criminal justice.

It is crucial to ensure that AI systems are developed and deployed in a fair and equitable manner.

Debt Ceiling Deal and Its Economic Implications

The recent agreement to raise the debt ceiling has averted a potential financial crisis, but its long-term implications for the US economy remain uncertain. The deal involves a two-year suspension of the debt limit, accompanied by spending cuts and a review of government programs.

While the deal provides immediate relief, its impact on various economic factors is likely to be complex and multifaceted.

Short-Term and Long-Term Economic Implications

The debt ceiling deal’s short-term impact is primarily characterized by a sense of relief and stability. By preventing a default, the deal has calmed financial markets and eased concerns about a potential economic downturn. This has led to a boost in investor confidence and a slight uptick in stock prices.

However, the long-term implications are more nuanced and could potentially influence the trajectory of the US economy in the coming years.

Impact on Government Spending, Interest Rates, and Inflation

The deal’s impact on government spending is a key area of concern. The agreement includes spending cuts, although their exact nature and magnitude are still being debated. These cuts could potentially lead to reduced funding for essential programs and services, impacting social welfare and infrastructure development.

The economic landscape is shifting rapidly, with the jobs report and AI hype taking center stage following the debt ceiling deal. But amidst all the financial buzz, it’s crucial to remember that our well-being extends beyond just our bank accounts.

Taking care of our health is equally important, and finding a balance between the two is key to a fulfilling life. For tips on achieving this balance, check out this excellent article on balancing your finances and health top tips for achieving both.

Ultimately, a healthy mind and body allow us to navigate the economic tides with greater resilience and success.

The deal also aims to review government programs, which could lead to further spending cuts or program modifications. This could have significant implications for the economy, depending on the specific programs affected.The deal’s impact on interest rates is also uncertain.

This week, the jobs report and AI hype are taking center stage, but a major subplot is unfolding with Elon Musk facing a subpoena in the Virgin Islands lawsuit against JPMorgan over the Epstein case. This development could have ripple effects, adding another layer of intrigue to the already complex landscape of economic and technological shifts.

While the agreement provides short-term relief by preventing a default, it does not address the underlying issue of the national debt. This means that the US government will continue to borrow heavily, potentially leading to higher interest rates in the future.

Increased borrowing costs could impact businesses and consumers, potentially slowing economic growth.The deal’s impact on inflation is also a matter of debate. Some argue that the spending cuts included in the deal could help to curb inflation by reducing government spending.

However, others argue that the deal’s focus on deficit reduction could potentially slow economic growth, leading to higher unemployment and further inflationary pressures. The actual impact on inflation will likely depend on the specific implementation of the deal and its broader economic consequences.

Political Landscape and Future Fiscal Policy

The debt ceiling deal has exposed deep divisions within the US political landscape. The agreement was reached after intense negotiations and political maneuvering, highlighting the challenges of achieving bipartisan consensus on fiscal policy. The deal’s impact on future fiscal policy is uncertain, but it is likely to continue to be a source of political contention.The deal’s success in averting a default suggests that both parties are willing to compromise, but it also highlights the potential for future gridlock.

The political landscape surrounding the deal could influence future fiscal policy decisions, potentially leading to more short-term solutions and a continued lack of long-term planning.

Impact on Investor Sentiment and Market Volatility

The debt ceiling deal has had a mixed impact on investor sentiment and market volatility. The agreement has provided some short-term relief, leading to a rebound in stock prices and a decrease in market volatility. However, the long-term implications of the deal remain uncertain, which could continue to create volatility in the markets.Investors are likely to be closely monitoring the implementation of the deal and its impact on various economic indicators.

The potential for further political gridlock and the uncertainty surrounding future fiscal policy could continue to weigh on investor sentiment and contribute to market volatility.

The Interplay of Economic Factors

This week’s economic news cycle has been a whirlwind, with the jobs report, AI advancements, and the debt ceiling deal all vying for attention. These events, while seemingly distinct, are intricately interconnected and have the potential to significantly shape the overall economic outlook.

Understanding their interplay is crucial for navigating the complexities of the current economic landscape.

The Interconnectedness of Economic Factors

The jobs report, AI advancements, and the debt ceiling deal are not isolated events but rather intertwined threads in the fabric of the economy. Each factor influences the others, creating a complex web of cause and effect. The jobs report, a key indicator of economic health, reflects the current state of the labor market.

A strong jobs report, indicating low unemployment and robust hiring, can boost consumer confidence and spending, stimulating economic growth. Conversely, a weak jobs report can signal economic weakness and dampen consumer sentiment.AI advancements are transforming industries and creating new opportunities while also raising concerns about job displacement.

The adoption of AI technologies can lead to increased productivity, efficiency, and innovation, potentially boosting economic growth. However, it also raises concerns about the potential for job losses as automation replaces certain tasks.The debt ceiling deal, while seemingly a political issue, has significant economic implications.

A failure to raise the debt ceiling could have triggered a default on US debt, leading to a financial crisis with far-reaching consequences. The deal, while avoiding a default, still involves spending cuts and could impact economic growth and government programs.

The Impact of Intertwined Factors on the Economic Outlook

The interplay of these factors can create both challenges and opportunities for the economy.

- Potential Challenges

- Increased Job Displacement:AI advancements, while potentially creating new jobs, could lead to job displacement in sectors susceptible to automation. This could exacerbate income inequality and create social unrest.

- Slower Economic Growth:The debt ceiling deal, while averting a crisis, could lead to reduced government spending and slower economic growth. This could impact infrastructure projects, research and development, and social programs.

- Inflationary Pressures:AI-driven productivity gains could lead to lower prices for goods and services, but the impact of the debt ceiling deal on government spending could also contribute to inflationary pressures.

- Potential Opportunities

- Innovation and Productivity:AI advancements can drive innovation, leading to new products, services, and industries. This can boost economic growth and create new jobs.

- Economic Diversification:AI advancements can help diversify the economy by creating new sectors and opportunities, reducing reliance on traditional industries.

- Improved Efficiency:AI technologies can improve efficiency in various sectors, leading to lower costs and higher productivity, potentially boosting economic growth.

Implications of Each Factor on the Economy

The following table summarizes the key implications of each factor on the economy:

| Factor | Positive Implications | Negative Implications |

|---|---|---|

| Jobs Report | Strong jobs report indicates economic health, boosts consumer confidence, and stimulates growth. | Weak jobs report signals economic weakness, dampens consumer sentiment, and slows growth. |

| AI Advancements | Increased productivity, efficiency, and innovation, leading to economic growth and new job creation. | Job displacement in sectors susceptible to automation, potentially exacerbating income inequality. |

| Debt Ceiling Deal | Averts a financial crisis and prevents a default on US debt, providing stability to the financial markets. | Potential for reduced government spending, slower economic growth, and impact on government programs. |

Looking Ahead: Key Focus This Week Jobs Report And Ai Hype Take Center Stage Following Debt Ceiling Deal

The recent economic developments, including the debt ceiling deal, the robust jobs report, and the ongoing AI hype, paint a complex picture for the future. While the current economic landscape seems positive, navigating the potential impacts of AI on the job market and addressing the emerging challenges in this rapidly evolving technological landscape will be crucial.

The Future of the Job Market

The rapid advancements in AI and automation are expected to reshape the job market significantly in the coming years. While AI can create new jobs and enhance productivity, it also poses potential threats to existing roles. The impact of AI on the job market will likely be uneven, with some sectors experiencing significant job losses while others witness the creation of new opportunities.

For instance, the rise of AI-powered customer service chatbots may lead to job losses in call centers, but it could also create new roles for AI developers and trainers.

Government Policy and AI’s Impact on Employment

Government policies play a crucial role in mitigating the negative impacts of AI on employment. Initiatives such as retraining programs, upskilling initiatives, and income support for displaced workers can help individuals adapt to the changing job market. Furthermore, government policies can encourage investment in AI research and development, fostering innovation and creating new economic opportunities.

Emerging Trends and Challenges in AI

The field of AI is constantly evolving, presenting both opportunities and challenges. Ethical considerations, such as bias in AI algorithms and the potential for misuse, require careful attention. Regulatory frameworks are still developing to address the complexities of AI, and a balance between fostering innovation and mitigating potential risks is essential.

Workforce development initiatives are crucial to equip individuals with the skills needed to thrive in an AI-driven economy.