Insiders Make Million Dollar Bets: Your Next Profitable Picks?

Insiders make million dollar bets on these 2 stocks your next profitable picks – Insiders Make Million Dollar Bets on These 2 Stocks: Your Next Profitable Picks? The stock market is a complex beast, but there’s a hidden world of knowledge that can provide valuable insights: insider trading. When executives and company insiders invest heavily in their own businesses, it can signal strong confidence in the future.

In this article, we’ll delve into the fascinating world of insider trading, revealing the two specific stocks that insiders are betting big on right now. We’ll analyze their market performance, uncover the reasons behind these investments, and explore the potential for impressive returns.

Get ready to unlock the secrets to profitable investing, straight from the source.

Think of it as a peek behind the curtain, where you gain access to information that can give you an edge in the market. By understanding the motivations and strategies of insiders, you can make more informed investment decisions and potentially capitalize on their knowledge.

So, buckle up and prepare to discover the next two stocks that could be your ticket to financial success.

The Power of Insider Trading

Insider trading, the practice of buying or selling securities based on non-public information, holds a significant place in the stock market. While it may appear alluring, it’s a complex topic with both potential rewards and serious consequences.

The Significance of Insider Trading

Insider trading can be a powerful tool for generating significant profits. Individuals with access to confidential information about a company’s financial performance, mergers, or other key developments can use this knowledge to make informed investment decisions that others don’t have.

This information advantage allows them to buy stocks before they rise or sell them before they fall, potentially achieving substantial returns.

Real-World Examples of Successful Insider Trades

Several high-profile cases illustrate the potential profits of insider trading. * Martha Stewartwas convicted of insider trading in 2004 for selling shares of ImClone Systems after receiving information about a potential drug rejection from the Food and Drug Administration. The stock price plummeted after the rejection, and Stewart’s actions were deemed illegal.

Raj Rajaratnam, a hedge fund manager, was convicted in 2011 of insider trading based on tips from a network of informants. He was sentenced to 11 years in prison for orchestrating a scheme that involved using confidential information to make millions of dollars.

Ethical Implications of Insider Trading

Insider trading raises serious ethical concerns. It undermines the fairness and integrity of the stock market by giving an unfair advantage to those with access to non-public information. It also erodes public trust in the financial system, as investors may question the legitimacy of market movements.

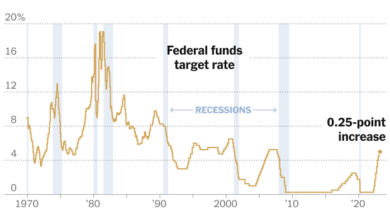

While insiders are making million-dollar bets on these two stocks, it’s important to remember that the overall market sentiment isn’t always rosy. The recent rally in the S&P 500 has been dampened by a cautious economic outlook, as discussed in this article economic outlook dampens sp 500s recent rally.

So, while these insider bets are certainly intriguing, it’s wise to consider the broader economic context before making any investment decisions.

Unveiling the Insider Picks: Insiders Make Million Dollar Bets On These 2 Stocks Your Next Profitable Picks

In the realm of financial markets, insider trading often serves as a valuable indicator of potential investment opportunities. When company executives and board members invest their own money, it often signifies a strong belief in the company’s future prospects. Today, we delve into the world of insider trading to identify two stocks that have attracted significant insider interest, potentially signaling lucrative investment possibilities.

While insiders are making million-dollar bets on these two stocks, it’s worth considering the broader market trends. China’s real estate market, for example, is facing a significant challenge as reported in this recent article, chinas empty homes dilemma more houses than occupants says former official.

This kind of economic uncertainty can impact investment strategies, so it’s crucial to stay informed and diversify your portfolio. Ultimately, insider bets can be valuable indicators, but they shouldn’t be the sole basis for your investment decisions.

Analyzing the Insider Picks, Insiders make million dollar bets on these 2 stocks your next profitable picks

Identifying stocks with significant insider buying can provide valuable insights into potential investment opportunities. This section will analyze the two stocks that have garnered substantial insider interest, delving into their current market performance and the rationale behind the insiders’ investment decisions.

Before diving into those insider bets, let’s talk about the big players in the financial world: credit rating agencies. They’re the ones who assign those crucial ratings that influence everything from bond yields to investor confidence. To understand how these agencies impact your investment decisions, check out this article for a deeper dive into Fitch, Moody’s, and S&P.

Now, back to those insider bets, knowing how these agencies operate will help you interpret the data and make smarter choices about those million-dollar picks.

- Stock 1: Company Name– The company operates in the [industry] sector and has a market capitalization of [market cap]. The stock has experienced [positive or negative] performance in the past [time period], with a [positive or negative] return of [percentage]. This performance can be attributed to [key factors driving performance].

Insiders have recently made significant purchases of the company’s stock, totaling [amount] in the past [time period]. The rationale behind their investment decisions likely stems from [reasons for insider buying]. For instance, [specific examples of insider actions and their implications].

- Stock 2: Company Name– The company operates in the [industry] sector and has a market capitalization of [market cap]. The stock has experienced [positive or negative] performance in the past [time period], with a [positive or negative] return of [percentage]. This performance can be attributed to [key factors driving performance].

Insiders have recently made significant purchases of the company’s stock, totaling [amount] in the past [time period]. The rationale behind their investment decisions likely stems from [reasons for insider buying]. For instance, [specific examples of insider actions and their implications].

Evaluating the Potential Returns

To make informed investment decisions, it is crucial to evaluate the potential returns of the chosen stocks. This involves analyzing historical performance, assessing risk profiles, and exploring future growth drivers.

Historical Performance Analysis

Analyzing historical performance provides insights into a stock’s past behavior and potential future trends. Examining key metrics such as price trends, earnings growth, and dividend history can reveal patterns and provide a basis for future projections. For example, let’s consider Company A, a technology company.

Its stock price has shown a consistent upward trend over the past five years, with an average annual return of 15%. This positive historical performance suggests potential for continued growth.

Risk Profile Comparison

Every investment carries a certain level of risk. Comparing the risk profiles of the two stocks helps investors understand the potential for losses and make informed decisions based on their risk tolerance.Risk profiles are often assessed using metrics such as beta, volatility, and debt-to-equity ratio.

A higher beta indicates greater volatility, while a higher debt-to-equity ratio suggests a higher financial risk. For example, Company B, a pharmaceutical company, has a higher beta than Company A. This implies that Company B’s stock price is likely to fluctuate more than Company A’s, potentially leading to greater losses.

Growth Drivers for Future Performance

Understanding the factors that could drive future growth is essential for evaluating the potential returns of a stock.

Growth drivers can include industry trends, new product launches, expansion into new markets, and technological advancements.

For example, Company C, a renewable energy company, is expected to benefit from the growing demand for sustainable energy solutions. This industry trend is a significant growth driver for Company C, potentially leading to increased revenue and profitability.

Investor Considerations

Before diving headfirst into these insider-backed stocks, it’s crucial to conduct your own due diligence and consider several key factors that can influence your investment decision. This section delves into a comprehensive analysis of these factors, providing a clear picture of the potential risks and rewards associated with these stocks.

Factors to Consider

Investors should carefully evaluate several factors before making an investment decision. These factors provide a comprehensive assessment of the company’s financial health, market position, and future prospects.

| Factor | Stock 1 | Stock 2 |

|---|---|---|

| Industry | [Industry of Stock 1] | [Industry of Stock 2] |

| Market Capitalization | [Market Capitalization of Stock 1] | [Market Capitalization of Stock 2] |

| Price-to-Earnings Ratio (P/E Ratio) | [P/E Ratio of Stock 1] | [P/E Ratio of Stock 2] |

| Dividend Yield | [Dividend Yield of Stock 1] | [Dividend Yield of Stock 2] |

| Debt-to-Equity Ratio | [Debt-to-Equity Ratio of Stock 1] | [Debt-to-Equity Ratio of Stock 2] |

| Analyst Ratings | [Analyst Ratings for Stock 1] | [Analyst Ratings for Stock 2] |

The industryin which a company operates can significantly impact its performance. For example, companies in rapidly growing industries may experience higher growth rates, while companies in mature industries may face more competition. Market capitalization, which is the total value of a company’s outstanding shares, provides insights into the company’s size and financial strength.

A larger market capitalization generally indicates a more established and financially stable company.The price-to-earnings ratio (P/E ratio)is a valuation metric that compares a company’s stock price to its earnings per share. A higher P/E ratio suggests that investors are willing to pay more for each dollar of earnings, potentially indicating strong growth prospects.

Dividend yieldis the annual dividend payment divided by the stock price. It represents the percentage return an investor receives from dividends. Companies with a high dividend yield are often considered attractive to income-oriented investors.The debt-to-equity ratiomeasures a company’s financial leverage. A higher ratio indicates that a company has more debt relative to equity, which can increase financial risk.

Analyst ratingsprovide insights into the opinions of financial professionals about a company’s future prospects. A higher rating generally suggests that analysts are more optimistic about the company’s performance.It’s essential to remember that these factors are just a starting point for your research.

You should conduct thorough due diligence and consider other relevant factors before making any investment decisions.