Global Stocks with Israel Ties Decline After Hamas Attack

Global stocks with Israel ties witness decline after Hamas attack, a stark reminder of the interconnectedness of global markets and geopolitical events. The recent Hamas attack on Israel has sent shockwaves through financial markets, leading to a significant downturn in the value of Israeli companies with global exposure.

This event highlights the vulnerability of global economies to regional conflicts and the potential for economic ripple effects to spread far beyond the immediate area of conflict.

The attack has raised concerns about the stability of the Israeli economy and the potential for further escalation in the region. Investors are grappling with the uncertainty surrounding the situation and its potential impact on their portfolios. The decline in Israeli stocks has also triggered a broader sell-off in global markets, as investors seek to reduce their exposure to risk.

Impact on Israeli Economy

The Hamas attack on Israel has sent shockwaves through the Israeli economy, with global stocks with ties to Israel witnessing a decline. The immediate impact is evident in the stock market, but the long-term implications are still unfolding and could significantly impact various sectors.

Short-Term Economic Implications

The attack has triggered a wave of uncertainty and fear, leading to a decline in investor confidence and a sell-off in Israeli stocks. This decline is particularly pronounced in sectors directly affected by the conflict, such as tourism, hospitality, and transportation.

The short-term implications also include:

- Increased Volatility in the Stock Market:The immediate response to the attack has been a sharp decline in the Tel Aviv Stock Exchange (TASE), with investors pulling out of their holdings. This volatility is likely to continue in the short term, as the situation remains fluid and uncertain.

- Decline in Tourism:The attack has already led to cancellations of flights and tours to Israel, significantly impacting the tourism sector, which is a vital contributor to the Israeli economy. The decline in tourism is expected to continue in the short term, further impacting businesses in the hospitality and entertainment industries.

The recent Hamas attack has sent shockwaves through global markets, with stocks tied to Israel experiencing a sharp decline. It’s a reminder of the interconnectedness of the world economy, and how geopolitical events can have a ripple effect. Meanwhile, despite OPEC’s efforts to restrain supply, oil prices dip , reflecting concerns about global economic slowdown amidst this volatile backdrop.

The situation in the Middle East will continue to be a key factor for investors to watch, as its impact on global markets is likely to be felt for some time.

- Disruptions in Supply Chains:The conflict could disrupt supply chains, impacting businesses that rely on Israeli goods and services. This could lead to delays in production and deliveries, potentially impacting global markets.

Long-Term Economic Implications

The long-term economic implications of the attack depend on the duration and intensity of the conflict. If the conflict escalates or becomes protracted, it could have significant consequences for the Israeli economy. These implications include:

- Decline in Foreign Investment:The attack could deter foreign investors from investing in Israel, leading to a slowdown in economic growth. This is especially concerning as Israel relies heavily on foreign investment to fuel its technology and innovation sectors.

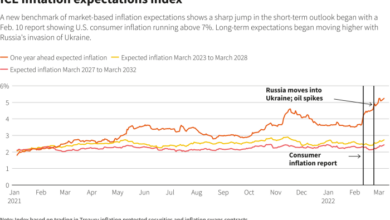

- Increased Government Spending:The government is likely to increase spending on defense and security, diverting resources from other areas like infrastructure and social programs. This could lead to a decrease in economic efficiency and a potential rise in inflation.

- Impact on High-Tech Sector:While Israel’s high-tech sector is a key driver of economic growth, it is not immune to the effects of the conflict. The decline in investor confidence and the potential for disruptions in global supply chains could negatively impact this sector.

Sectors Most Affected, Global stocks with israel ties witness decline after hamas attack

The sectors most affected by the decline in Israeli stocks include:

- Tourism and Hospitality:The tourism sector is expected to be severely impacted due to cancellations and a decline in tourist arrivals. This will affect hotels, restaurants, tour operators, and other businesses in the hospitality industry.

- Transportation:The conflict has led to disruptions in transportation, including air travel and road closures. This has impacted airlines, transportation companies, and logistics firms.

- Real Estate:The uncertainty surrounding the conflict could impact the real estate market, leading to a slowdown in sales and a decrease in property values.

- Defense and Security:While the defense and security sector may experience a short-term boost due to increased government spending, the long-term impact is uncertain.

Comparison to Past Economic Shocks

Israel has faced various economic shocks in the past, including wars, recessions, and terrorist attacks. These past experiences have taught valuable lessons about resilience and recovery. The current situation presents a unique set of challenges, but the country has demonstrated its ability to adapt and overcome adversity.

Potential Recovery Strategies

The Israeli government is likely to implement a range of measures to mitigate the economic impact of the attack and support businesses and individuals. These measures could include:

- Fiscal Stimulus:The government could introduce fiscal stimulus packages to boost economic activity and support businesses affected by the conflict.

- Monetary Policy Adjustments:The Bank of Israel could lower interest rates or take other monetary policy measures to encourage borrowing and investment.

- Investment in Infrastructure:The government could invest in infrastructure projects to stimulate economic growth and create jobs.

- Support for Businesses:The government could provide financial assistance and tax breaks to businesses affected by the conflict.

Global Market Reactions: Global Stocks With Israel Ties Witness Decline After Hamas Attack

The decline in Israeli stocks following the Hamas attack reverberated across global markets, prompting a wave of reactions from investors and analysts alike. This response was driven by a complex interplay of factors, including investor sentiment, geopolitical concerns, and potential economic ripple effects.

The global stock market is feeling the impact of the recent Hamas attack, with companies with ties to Israel experiencing significant declines. It’s a reminder that geopolitical events can ripple across the globe, affecting everything from stock prices to individual investor portfolios.

And speaking of ripples, the drama surrounding Elon Musk and his involvement in the Virgin Islands lawsuit against JPMorgan over the Epstein case continues to unfold, as reported in this article. This lawsuit, with its connections to a complex web of finance and alleged wrongdoing, further highlights how even seemingly isolated events can have far-reaching consequences, potentially impacting global markets and the individuals involved.

Impact on Global Stock Indices

The attack on Israel triggered a decline in global stock indices, reflecting investor concerns about the potential economic and geopolitical consequences of the conflict. For instance, the S&P 500, a broad measure of US stock market performance, experienced a slight dip in the days following the attack.

The recent Hamas attack has sent shockwaves through the global markets, with stocks tied to Israel experiencing significant declines. While the world grapples with this crisis, the cryptocurrency market, perhaps seeking refuge from the volatility of traditional markets, has been roused from its slumber as Bitcoin’s volatility surges, as reported in this article.

It’s a stark reminder that even in times of geopolitical turmoil, the digital asset space can offer a haven for investors seeking alternative avenues for capital preservation and growth.

Similarly, the FTSE 100, a leading index for the UK stock market, also registered a modest decline. These movements, while not dramatic, underscore the sensitivity of global markets to events in the Middle East.

Factors Influencing Market Reactions

- Investor Sentiment:The attack on Israel, coupled with the uncertainty surrounding the conflict’s duration and potential escalation, dampened investor sentiment. This led to a risk-off approach, with investors shifting their portfolios towards safer assets like government bonds.

- Geopolitical Concerns:The conflict raised concerns about potential regional instability and its impact on global energy supplies. Israel is a major player in the energy sector, and any disruption to its operations could have significant ramifications for the global economy.

- Economic Ripple Effects:The attack’s impact on the Israeli economy, a major technological hub, raised concerns about potential economic disruptions. This uncertainty further contributed to the negative sentiment in global markets.

Performance of International Companies with Ties to Israel

Several international companies with significant ties to Israel witnessed a decline in their share prices following the attack. This reflects the market’s perception of potential economic and operational risks associated with the conflict. For example, Intel, a major technology company with a significant presence in Israel, saw its stock price decline in the days following the attack.

Similarly, Teva Pharmaceutical Industries, a leading Israeli pharmaceutical company, also experienced a dip in its share price. These movements highlight the interconnectedness of global markets and the impact of geopolitical events on individual companies.

Political and Security Considerations

The Hamas attack on Israel has far-reaching implications beyond the immediate human cost. It has the potential to significantly alter Israel’s political landscape and its international relations, while also raising critical security concerns that will impact future investment decisions.

Impact on Israel’s Political Landscape

The attack has already sparked intense debate within Israeli society, with some calling for a more aggressive response and others advocating for a more cautious approach. The political ramifications of the attack are likely to be significant, potentially leading to a shift in public opinion, a change in government priorities, and a re-evaluation of security strategies.

Security Implications and Investment Decisions

The attack has heightened security concerns in Israel and beyond. Investors may be hesitant to commit to projects in Israel, particularly in areas that are seen as vulnerable to future attacks. The attack could also lead to increased security measures, which could have a negative impact on economic activity and tourism.

Stakeholder Responses

The attack has prompted a range of responses from key stakeholders, including:

- The Israeli Government:The government has responded with a military operation aimed at targeting Hamas infrastructure and leadership. The government is also facing pressure to address the root causes of the conflict, including the ongoing Israeli-Palestinian dispute.

- The International Community:The international community has condemned the attack and called for an end to the violence. However, there are differences in opinion on how to achieve this goal, with some countries calling for a negotiated solution and others advocating for a more forceful response.

- The Palestinian Authority:The Palestinian Authority has condemned the attack but has also criticized Israel’s response. The Authority is facing pressure to take a more active role in resolving the conflict.

- Investors:Investors are closely monitoring the situation and assessing the potential risks to their investments. Some investors may choose to divest from Israeli assets, while others may see opportunities to invest in sectors that are likely to benefit from increased security spending.

Investor Perspective

The recent Hamas attack on Israel has sent shockwaves through the global financial markets, leaving investors grappling with uncertainty and trying to assess the potential impact on their portfolios. While the immediate reaction has been a decline in Israeli stocks, the long-term implications remain unclear.

Investors are now navigating a complex landscape, weighing the potential risks and opportunities presented by this unprecedented event.

Short-Term Risks and Opportunities

The short-term outlook for Israeli stocks is clouded by the immediate fallout of the attack. The heightened geopolitical tensions and the potential for prolonged conflict create a volatile environment, making investors cautious. The tourism sector, a crucial contributor to the Israeli economy, is likely to be significantly impacted, leading to further economic uncertainty.

However, some sectors, such as defense and cybersecurity, may see an increase in demand, potentially creating investment opportunities.

Long-Term Considerations

While the short-term outlook remains uncertain, the long-term prospects for Israeli stocks depend on the resolution of the conflict and the government’s response to the crisis. If the conflict is resolved swiftly and the Israeli economy remains resilient, investors may see a rebound in stock prices.

However, if the conflict escalates or the economic fallout is severe, investors may face significant losses.

Key Factors for Investment Decisions

Investors need to consider a range of factors when making investment decisions related to Israeli stocks, including:

| Factor | Description |

|---|---|

| Conflict Resolution | The speed and nature of the conflict resolution will significantly impact the economic outlook and investor sentiment. |

| Economic Impact | The extent of the economic damage, particularly in sectors like tourism and trade, will influence investor confidence and stock valuations. |

| Government Response | The government’s ability to stabilize the economy and restore confidence will be crucial for investors. |

| Global Market Sentiment | The broader global economic climate and investor sentiment will also play a role in shaping investment decisions. |

“Investors should be aware that the current situation is fluid and unpredictable. They should carefully assess their risk tolerance and investment goals before making any decisions.”