Global Energy Traders Seize Venezuelas Oil Reserves After US Sanctions Ease

Global energy traders act swiftly on venezuelas oil reserves post us sanctions easing sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset.

The easing of US sanctions on Venezuela’s oil industry has unleashed a wave of activity among global energy traders, who are eager to capitalize on the country’s vast oil reserves. This move comes after years of sanctions that crippled Venezuela’s oil production and exports, leaving a gaping hole in global oil markets.

The lifting of sanctions has opened up a new chapter in Venezuela’s oil industry, with major players like Chevron, Eni, and Rosneft already making moves to secure access to the country’s resources.

The potential for increased Venezuelan oil production and exports has sparked excitement and uncertainty alike. While the easing of sanctions promises economic benefits for Venezuela, the country’s political landscape and the role of the government in the oil industry remain major concerns.

Global energy traders are navigating a complex landscape of political risks, environmental considerations, and logistical challenges as they seek to tap into Venezuela’s oil reserves.

Global Energy Traders’ Response: Global Energy Traders Act Swiftly On Venezuelas Oil Reserves Post Us Sanctions Easing

The easing of US sanctions on Venezuela has opened up opportunities for global energy traders to access the country’s vast oil reserves. Several key players are expected to be highly active in Venezuela’s oil market, aiming to capitalize on this newfound access.

Key Global Energy Traders

Several factors will influence the decisions of these traders, including the prevailing oil price dynamics, the political stability in Venezuela, and the associated risks.

- Trafigura:A leading independent oil trader, Trafigura has already shown interest in Venezuelan oil. The company has experience in dealing with complex geopolitical situations and possesses the infrastructure to handle Venezuelan crude.

- Vitol:Another prominent independent oil trader, Vitol has a long history of trading Venezuelan oil and has expressed willingness to resume operations. Vitol’s expertise in navigating challenging markets makes it a likely player.

- Glencore:Glencore, a global commodity trading and mining company, has a significant presence in the oil market and could potentially become a key player in Venezuela’s oil sector. Glencore’s experience in managing risks associated with political instability and sanctions makes it a viable contender.

- Gunvor:Gunvor, an independent oil trader, has also expressed interest in Venezuelan oil. The company has a strong presence in the Latin American market and possesses the infrastructure to handle Venezuelan crude.

- Lukoil:Lukoil, a Russian oil and gas company, has a long-standing relationship with Venezuela and could potentially increase its involvement in the country’s oil sector. Lukoil’s expertise in developing and producing oil in challenging environments could be beneficial.

Factors Influencing Traders’ Decisions

The decision of global energy traders to engage in Venezuela’s oil market will be influenced by several factors, including:

- Oil Price Dynamics:The price of oil is a key driver for any oil trading activity. If oil prices remain at current levels or rise further, it will incentivize traders to increase their involvement in Venezuela’s oil market.

- Political Stability:Political stability in Venezuela is crucial for attracting foreign investment and ensuring the smooth flow of oil production and exports. Traders will closely monitor the political situation and its potential impact on their operations.

- Potential Risks:There are significant risks associated with operating in Venezuela, including the potential for political instability, sanctions, and corruption. Traders will need to carefully assess these risks and develop mitigation strategies.

Impact on Global Oil Markets, Global energy traders act swiftly on venezuelas oil reserves post us sanctions easing

Increased Venezuelan oil supply could have a significant impact on global oil markets.

- Increased Supply:The return of Venezuelan oil to the global market could increase supply, potentially putting downward pressure on oil prices.

- Market Share Competition:The re-entry of Venezuelan oil could lead to increased competition for market share, potentially affecting the profitability of other oil producers.

- Geopolitical Implications:The resurgence of Venezuela as a major oil exporter could have significant geopolitical implications, potentially impacting regional and global power dynamics.

Challenges and Opportunities

The easing of US sanctions on Venezuela presents a complex landscape for global energy traders, opening doors to potential opportunities while also presenting significant challenges. The country’s vast oil reserves, once a major source of global supply, have been significantly impacted by years of economic instability and political turmoil.

While the return of Venezuelan oil to the market could alleviate global energy supply concerns, traders must carefully navigate the intricate web of political, economic, and logistical hurdles to capitalize on this potential.

Challenges in Accessing and Transporting Venezuelan Oil

The challenges associated with accessing and transporting Venezuelan oil are multifaceted and require careful consideration by global energy traders. The country’s oil infrastructure has suffered from years of underinvestment and neglect, leading to a decline in production capacity and efficiency.

- Deteriorated Infrastructure:Venezuela’s oil infrastructure, including refineries, pipelines, and storage facilities, has been significantly damaged by years of underinvestment and neglect. This necessitates significant investments in repairs and upgrades to restore production and transportation capabilities.

- Sanctions and Legal Restrictions:The US has imposed sanctions on Venezuela, making it difficult for some companies to engage in business with the country. These sanctions create legal and regulatory complexities that need to be navigated carefully by global energy traders.

- Political Instability:Venezuela’s political landscape remains volatile, posing risks to foreign investments and operations. Ongoing political uncertainty can lead to disruptions in oil production and transportation, making it challenging for traders to secure reliable supply.

- Financial Constraints:Venezuela’s economy is heavily indebted, and its state-owned oil company, PDVSA, faces significant financial challenges. These financial constraints can hinder investments in infrastructure upgrades and production expansion, impacting the ability of global energy traders to access and transport Venezuelan oil.

Environmental and Social Impacts of Increased Oil Production

The potential increase in oil production in Venezuela raises concerns about the environmental and social impacts associated with such activities.

- Environmental Degradation:Increased oil production can lead to environmental degradation, including oil spills, deforestation, and habitat destruction. The potential for environmental damage necessitates careful planning and implementation of environmental protection measures to mitigate these risks.

- Social Disruptions:The oil industry’s expansion can also lead to social disruptions, including displacement of communities, land conflicts, and potential for social unrest. Engaging local communities and addressing their concerns is crucial to minimize social impacts and ensure sustainable development.

Opportunities for Investment and Development

Despite the challenges, the easing of sanctions presents opportunities for investment and development in Venezuela’s oil sector.

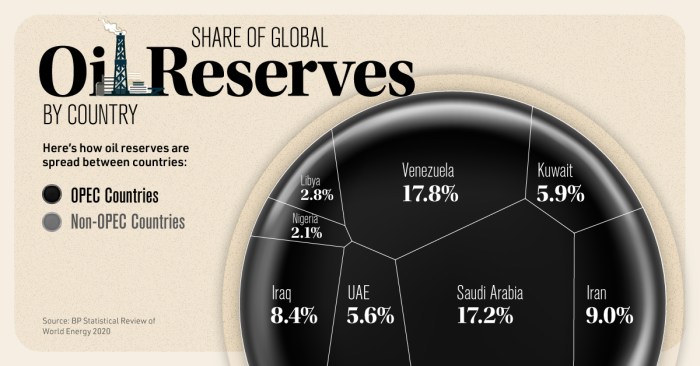

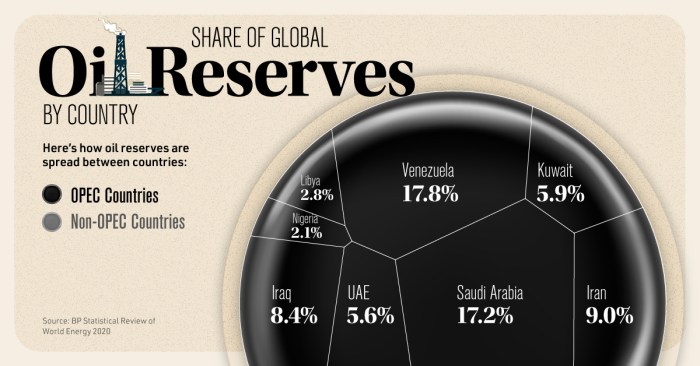

- Attractive Oil Reserves:Venezuela boasts the world’s largest proven oil reserves, making it a potentially lucrative investment destination for global energy companies. Accessing these reserves can contribute to global energy security and supply.

- Infrastructure Rehabilitation:The need for significant investments in infrastructure upgrades and repairs presents opportunities for global energy companies to participate in the rehabilitation of Venezuela’s oil sector. This can create jobs and contribute to economic growth.

- Potential for Production Growth:The potential for increased oil production in Venezuela can benefit global energy markets by adding supply and potentially lowering energy prices. This can provide opportunities for global energy traders to secure access to affordable and reliable oil supplies.

It’s been a whirlwind week in the world of finance and energy. Global energy traders are scrambling to secure Venezuelan oil reserves following the easing of US sanctions, while the Elon Musk subpoena in the Virgin Islands lawsuit against JPMorgan over the Epstein case is adding a layer of intrigue to the mix.

The potential for a new oil supply chain from Venezuela is certainly exciting, but the legal fallout from the Epstein case could have far-reaching consequences for the financial world.

It’s fascinating to see how quickly global energy traders react to geopolitical shifts. The easing of US sanctions on Venezuela has opened up a new market for oil, and traders are already moving in. It’s a stark contrast to the news about Peloton recalling 2.2 million bikes over injury and fall concerns , a reminder that even the most popular products can have unforeseen safety issues.

While Venezuela’s oil reserves present an opportunity, it remains to be seen how the market will evolve in the long term.

The easing of US sanctions on Venezuela has sparked a flurry of activity in the global energy market, with traders rushing to secure access to the country’s vast oil reserves. This renewed interest in Venezuelan oil comes at a time when the US stock market is experiencing a pause in its rally, a development that has seen short sellers profit handsomely, as reported in this recent article.

While the stock market may be taking a breather, the energy sector is buzzing with excitement over the potential for Venezuelan oil to re-enter the global market.