Forex Dollar Rises Despite US Credit Downgrade and Strong Jobs Report

Forex dollar rises despite US credit downgrade and strong jobs report – it’s a perplexing situation, isn’t it? While a credit downgrade typically weakens a currency, the US dollar is defying expectations and climbing. How is this possible? The answer lies in a complex interplay of factors, with a strong jobs report pushing the dollar upwards despite the negative news of the credit downgrade.

The US economy is facing a unique set of circumstances. The Federal Reserve’s aggressive interest rate hikes, aimed at curbing inflation, are making the US dollar more attractive to investors seeking higher returns. This demand for the dollar is outweighing the concerns surrounding the credit downgrade, creating a scenario where the dollar is strengthening despite the negative news.

The Paradox of the Dollar’s Rise

The recent rise of the US dollar, despite a credit downgrade and a strong jobs report, presents a puzzling situation. While the credit downgrade should typically weaken a currency, the strong jobs report should have strengthened it. This unexpected behavior begs the question: what forces are driving the dollar higher?

It’s been a wild ride for the dollar lately, rising despite a US credit downgrade and a strong jobs report. This seems to be a trend in the financial world, with the SEC initiating a lawsuit against Coinbase amid rising regulatory pressure on the cryptocurrency sector.

Perhaps investors are seeking safe havens in traditional markets as the crypto world faces more scrutiny. Whatever the reason, it’s clear that the financial landscape is shifting, and we’ll have to see how the dollar fares in the coming weeks.

Factors Influencing the US Dollar’s Value

The value of the US dollar is influenced by a multitude of factors, including:

- Interest Rates:Higher interest rates attract foreign investors, increasing demand for the dollar and pushing its value up. Conversely, lower interest rates can make the dollar less attractive, leading to a depreciation.

- Economic Growth:A strong economy typically boosts investor confidence, leading to increased demand for the dollar. Conversely, a weak economy can lead to a decline in the dollar’s value.

- Government Policies:Fiscal and monetary policies implemented by the Federal Reserve can impact the dollar’s value. For instance, quantitative easing can weaken the dollar, while tightening monetary policy can strengthen it.

- Geopolitical Events:Global events such as wars, political instability, or natural disasters can influence the dollar’s value, often creating safe-haven demand for the currency.

- Market Sentiment:Investor confidence and market expectations play a significant role in determining the dollar’s value. Positive sentiment can lead to appreciation, while negative sentiment can lead to depreciation.

The Contrasting Effects of the Credit Downgrade and Strong Jobs Report

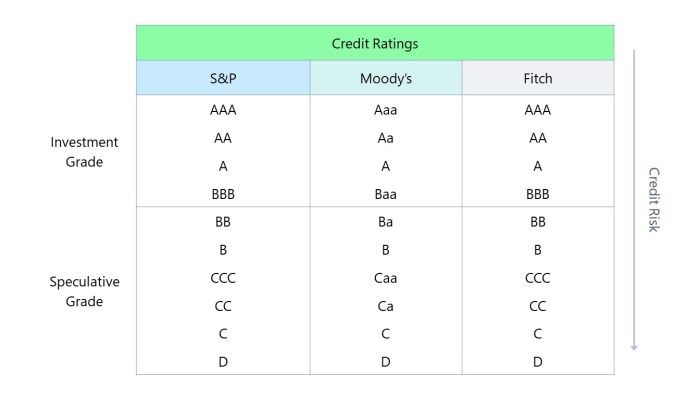

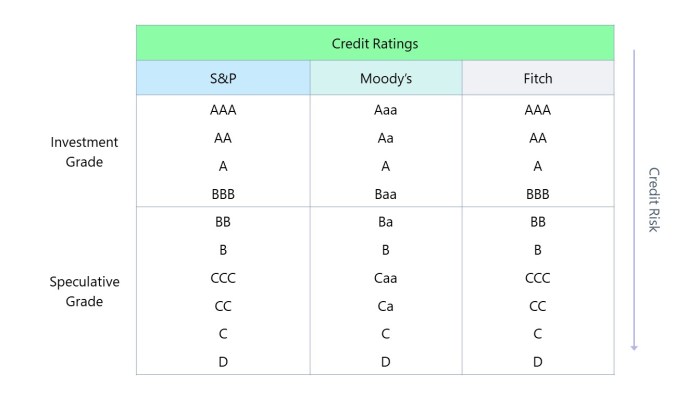

The recent credit downgrade by Fitch Ratings was a significant event that typically weakens a currency. This is because a credit downgrade signals a higher risk of default, making the country’s debt less attractive to investors. However, the strong jobs report, indicating a robust US economy, should have strengthened the dollar.

This is because a strong economy usually attracts foreign investment, increasing demand for the currency.

Prevailing Market Sentiment and the Dollar’s Rise

Despite the conflicting news, the dollar has risen, indicating that market sentiment is currently favoring the US currency. This suggests that investors are prioritizing other factors, such as the perceived strength of the US economy and the Federal Reserve’s commitment to fighting inflation.

The recent rise in US interest rates, driven by the Fed’s aggressive tightening policy, has made the dollar more attractive to foreign investors seeking higher returns. Additionally, the global economic outlook remains uncertain, with concerns about potential recessions in other major economies.

This has led to a flight to safety, boosting demand for the US dollar as a safe-haven currency.

The dollar’s rise, despite the conflicting news, highlights the complex interplay of factors that influence currency values. Market sentiment, investor confidence, and global economic conditions often play a more significant role than individual economic data points.

It’s a wild ride out there in the financial markets! The dollar is strengthening despite a US credit downgrade and a strong jobs report, which is a bit of a head-scratcher. Meanwhile, Tesla is trying to stay ahead of the curve in the increasingly competitive electric vehicle market by launching a global customer referral program, as seen in this article: tesla introduces global customer referral program amid rising electric vehicle price competition.

I guess we’ll see if this is enough to keep Tesla on top as the competition heats up. Maybe the dollar’s strength is a sign that investors are looking for safe havens amid all the economic uncertainty, but who knows?

It’s a crazy world out there!

Impact of the Credit Downgrade

The recent credit downgrade of the United States by Fitch Ratings sent shockwaves through the financial markets. While the dollar initially weakened, it surprisingly rebounded and strengthened against other major currencies. This unexpected development raises questions about the true impact of the downgrade and its potential implications for the US economy.

Reasons for the Downgrade and its Potential Implications for the Economy

Fitch Ratings cited several factors in its decision to downgrade the US credit rating. These included the country’s projected fiscal deterioration over the next three years, the high and rising government debt burden, and the erosion of governance standards, particularly in relation to the repeated debt ceiling standoffs.

The downgrade has the potential to impact the US economy in several ways.

- Higher Borrowing Costs:A lower credit rating could make it more expensive for the US government to borrow money, potentially leading to higher interest rates on government bonds and increasing the cost of financing the national debt.

- Reduced Investor Confidence:The downgrade could erode investor confidence in the US economy, potentially leading to a decrease in foreign investment and slowing economic growth.

- Increased Volatility in Financial Markets:The downgrade could lead to increased volatility in financial markets, as investors adjust their portfolios in response to the perceived increased risk associated with US assets.

Impact on Investor Confidence and Borrowing Costs, Forex dollar rises despite us credit downgrade and strong jobs report

The credit downgrade could have a significant impact on investor confidence. Investors may become more hesitant to invest in US assets, perceiving them as riskier due to the downgrade. This could lead to a decline in foreign investment, which is a crucial driver of US economic growth.Additionally, the downgrade could make it more expensive for the US government to borrow money.

This is because investors may demand a higher return on US government bonds to compensate for the perceived increased risk. Higher borrowing costs could put pressure on the government’s budget and potentially lead to higher taxes or spending cuts.

The US dollar’s recent rise, despite a credit downgrade and strong jobs report, suggests a complex interplay of market forces. This comes at a time when global markets are also grappling with the unexpected news of Alibaba’s leadership overhaul, with CEO Zhang being replaced in a move that sent shockwaves through the tech industry.

alibaba leadership overhaul ceo zhang replaced in unexpected move The dollar’s strength may be driven by factors such as safe-haven demand, even as economic indicators paint a mixed picture.

Comparison with Typical Market Reactions to Credit Downgrades

The market’s reaction to the US credit downgrade was somewhat unusual. While credit downgrades typically lead to a weakening of the affected country’s currency, the dollar initially weakened but then rebounded and strengthened. This suggests that other factors, such as the strong US jobs report, may have overshadowed the impact of the downgrade.It is important to note that the long-term impact of the credit downgrade remains uncertain.

The market’s initial reaction may not reflect the full extent of the consequences. It is possible that the downgrade could have a more significant impact on investor confidence and borrowing costs in the coming months and years.

Significance of the Strong Jobs Report: Forex Dollar Rises Despite Us Credit Downgrade And Strong Jobs Report

The recent strong jobs report, despite the US credit downgrade, has sent shockwaves through the financial markets. While the downgrade might have suggested a weakening economy, the robust jobs data paints a different picture. This report offers crucial insights into the health of the US economy and its implications for future economic trajectory.

Impact on Inflation and Interest Rate Expectations

A strong jobs report typically fuels inflation concerns. When the labor market is tight, employers often need to offer higher wages to attract and retain workers. This increase in labor costs can then be passed on to consumers in the form of higher prices, leading to inflation.

In this context, the strong jobs report could reinforce the Federal Reserve’s hawkish stance on monetary policy. The Fed might be more inclined to continue raising interest rates to combat inflation, especially if the report indicates persistent wage pressures.

For instance, the recent jobs report showed a significant increase in average hourly earnings, indicating a potential for upward pressure on inflation.

Influence on the Federal Reserve’s Monetary Policy Decisions

The Federal Reserve closely monitors the jobs report as a key indicator of the economy’s health and inflation trajectory. A strong jobs report, particularly one that shows strong wage growth, could signal that the economy is overheating and that the Fed needs to act more aggressively to cool down inflation.

This could translate into more aggressive interest rate hikes in the coming months.

The Fed’s dual mandate is to maintain price stability and maximize employment. A strong jobs report could push the Fed to prioritize controlling inflation, even at the expense of some job growth.

Potential Short-Term and Long-Term Effects

The rise of the dollar, while seemingly paradoxical given the recent credit downgrade and strong jobs report, can have significant implications for various sectors of the economy. Understanding these effects is crucial for businesses, investors, and policymakers to navigate the changing economic landscape.

Short-Term and Long-Term Effects on the Economy

The potential short-term and long-term effects of the dollar’s rise can be categorized across various sectors of the economy. The table below summarizes these effects, highlighting potential risks that may arise:

| Sector | Short-Term Effects | Long-Term Effects | Potential Risks |

|---|---|---|---|

| Exports and Imports |

|

|

|

| Domestic Businesses |

|

|

|

| Financial Markets |

|

|

|

| International Trade |

|

|

|

Global Market Reactions

The dollar’s recent surge, despite the US credit downgrade and a strong jobs report, has sent ripples across global markets. This unexpected strength has significant implications for other currencies, financial markets, and global trade patterns.

Impact on Other Currencies

The dollar’s rise typically leads to a weakening of other major currencies. This is because investors tend to move their funds towards the perceived safer haven of the US dollar during times of uncertainty. For example, the euro, Japanese yen, and British pound have all depreciated against the dollar in recent weeks.

This depreciation can impact a country’s competitiveness in global trade, as its exports become more expensive.

Influence on Global Trade Flows and Investment Patterns

A stronger dollar can influence global trade flows in several ways. Firstly, it makes US exports more expensive for foreign buyers, potentially leading to a decrease in demand. Conversely, it makes imports cheaper for US consumers, which could boost domestic consumption.

This can have a mixed impact on US businesses, depending on their reliance on exports or imports. A strong dollar can also affect investment patterns. It can make US assets, such as stocks and bonds, less attractive to foreign investors, as they will receive fewer units of their own currency when converting back.

This can lead to a decrease in foreign investment in the US, potentially impacting the country’s economic growth.

Potential Risks and Opportunities for Different Countries and Regions

The dollar’s rise presents both risks and opportunities for different countries and regions. For countries with large dollar-denominated debts, a stronger dollar can increase their debt burden, making it more difficult to service their obligations. This can put pressure on their economies and potentially lead to financial instability.On the other hand, countries with significant export-oriented economies may benefit from a weaker domestic currency, as their exports become more competitive.

However, they may also face challenges if they rely heavily on imported goods, as these will become more expensive.

“The dollar’s rise is a complex phenomenon with far-reaching implications for global markets. It is essential for policymakers and businesses to carefully analyze its potential impact and adjust their strategies accordingly.”

Analyzing the Future Trajectory

The recent divergence between the US dollar’s strength and the credit downgrade, coupled with a strong jobs report, presents a complex picture for the future trajectory of the greenback. Several factors, including inflation, interest rate differentials, and global economic growth, will play a crucial role in shaping the dollar’s path.

Possible Scenarios for the US Dollar

To understand the potential outcomes, we can analyze different scenarios based on the current economic indicators and market sentiment:

| Scenario | Key Drivers | Potential Outcomes |

|---|---|---|

| Continued Dollar Strength |

|

|

| Moderate Dollar Appreciation |

|

|

| Dollar Correction |

|

|