Forex Dollar Hits Two-Month High as Fed Rate Cut Hopes Fade

Forex dollar hits two month high as expectations for fed rate cuts fade, marking a significant shift in market sentiment. The US dollar’s recent surge against other major currencies reflects a confluence of factors, including a resilient US economy, hawkish pronouncements from the Federal Reserve, and a global appetite for dollar-denominated assets.

This unexpected turn of events has caught many investors off guard, leading to questions about the future direction of interest rates and the potential impact on global markets.

The strengthening US dollar has far-reaching implications, impacting everything from international trade to the value of investments. As the greenback gains strength, it becomes more expensive for businesses in other countries to import goods from the US, potentially leading to inflation and economic instability.

Meanwhile, investors holding assets in other currencies could see their holdings lose value as the dollar appreciates.

Forex Dollar Strength

The US dollar has been on a tear recently, reaching a two-month high against a basket of major currencies. This surge is driven by a confluence of factors, primarily the fading expectations of interest rate cuts by the Federal Reserve.

Factors Contributing to the Dollar’s Rise

The recent rise in the US dollar’s value can be attributed to several key factors:

- Fading Expectations of Fed Rate Cuts:The market is now pricing in a higher probability of the Fed keeping interest rates steady or even raising them further. This is a significant shift from earlier expectations of rate cuts, which had weighed on the dollar.

The forex dollar’s surge to a two-month high is a clear indicator of the market’s growing confidence in the Fed’s commitment to controlling inflation. This shift in sentiment comes as expectations for rate cuts fade, a trend perhaps influenced by the recent controversy surrounding AI-generated deepfakes, as seen in the case of Taylor Swift.

Microsoft CEO Nadella’s address on the matter highlights the growing concern over the ethical implications of such technology, which could potentially impact financial markets through manipulation and misinformation. This ongoing debate over AI’s potential for both good and harm will undoubtedly influence investor sentiment and, in turn, the trajectory of the forex dollar.

- Strong US Economic Data:Recent economic data, including robust job growth and resilient consumer spending, has bolstered confidence in the US economy. This positive outlook has made the dollar more attractive to investors.

- Safe-Haven Demand:The US dollar is often considered a safe-haven currency during times of global uncertainty. The current geopolitical tensions and economic volatility have fueled demand for the dollar, further driving its appreciation.

- Relative Interest Rate Differentials:The US continues to offer higher interest rates compared to many other developed economies. This interest rate differential attracts foreign investors seeking higher returns, increasing demand for the dollar.

Implications for Global Markets

The strengthening US dollar has several implications for global markets:

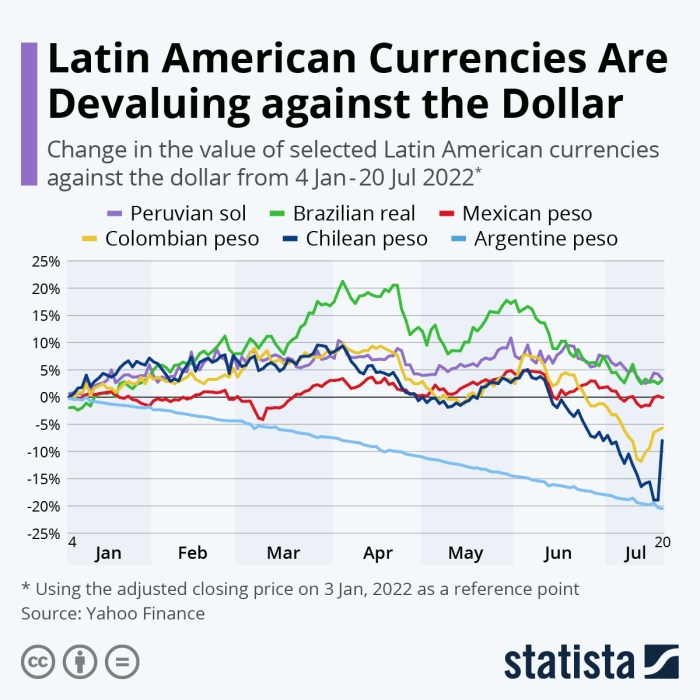

- Impact on Emerging Markets:A stronger dollar can make it more expensive for emerging market countries to service their dollar-denominated debt. This can put pressure on their currencies and economies.

- Commodity Prices:The dollar’s rise can negatively impact commodity prices, as commodities are typically priced in dollars. This can affect exporters of commodities, particularly those in emerging markets.

- Global Trade:A stronger dollar can make US exports more expensive, potentially hurting American businesses competing in international markets. Conversely, it can make imports cheaper for US consumers.

- Currency Volatility:The recent volatility in the US dollar can create uncertainty and risk for businesses and investors operating in global markets.

Historical Perspective

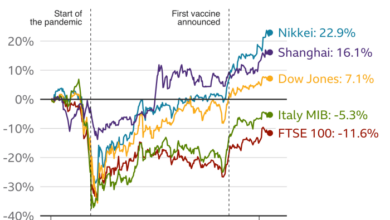

Over the past few months, the US dollar has exhibited a mixed performance.

- Early 2023:The dollar experienced a period of weakness, driven by expectations of Fed rate cuts and a slowdown in the US economy.

- Mid-2023:The dollar began to strengthen as economic data improved and expectations of Fed rate cuts faded.

- Recent Surge:The dollar has experienced a sharp rally in recent weeks, fueled by the factors discussed earlier.

Expectations for Fed Rate Cuts

The recent surge in the US dollar, hitting a two-month high, has been driven by fading expectations for Federal Reserve rate cuts. This shift in sentiment reflects a combination of factors, including persistent inflation, a robust labor market, and concerns about potential economic overheating.

Reasons for Fading Expectations

The prevailing view among market participants is that the Federal Reserve will maintain its current monetary policy stance for the foreseeable future, rather than embarking on a path of rate cuts. This shift in sentiment stems from a number of key developments:

- Persistent Inflation:While inflation has moderated somewhat from its peak, it remains stubbornly above the Fed’s target of 2%. This persistent inflation has led to concerns that the Fed may need to keep interest rates higher for longer to bring inflation under control.

- Strong Labor Market:The US labor market continues to exhibit strength, with low unemployment rates and robust job creation. This indicates that the economy is still operating at a healthy level, suggesting that the Fed may not need to ease monetary policy to support growth.

- Concerns about Economic Overheating:The strong economy and persistent inflation have raised concerns about potential economic overheating. The Fed may be reluctant to cut rates in this environment, as it could exacerbate inflation and potentially lead to a more severe economic downturn.

Impact on the US Economy and Financial Markets

The fading expectations for Fed rate cuts have had a significant impact on the US economy and financial markets.

- Higher Interest Rates:The prospect of higher interest rates for longer has led to a rise in borrowing costs for businesses and consumers, potentially slowing economic growth. This can be observed in higher mortgage rates, which have already led to a decline in home sales.

- Stronger Dollar:The rising dollar has made US exports more expensive, potentially impacting competitiveness in global markets. Additionally, a strong dollar can have negative implications for US multinational corporations operating overseas, as their foreign earnings are worth less when converted back to dollars.

The forex dollar recently hit a two-month high as expectations for Fed rate cuts faded, fueled by persistent inflation and a resilient US economy. This upward trend seems to be holding steady ahead of the upcoming Fed meeting, as analysts closely scrutinize economic data to predict the central bank’s next move.

This forex update on the dollar’s steady position ahead of the Fed meeting amid economic data analysis provides further insight into the market’s current sentiment and potential future shifts. The dollar’s recent surge, however, may be a short-term phenomenon, as the market continues to grapple with the uncertainty surrounding future interest rate decisions.

- Volatility in Financial Markets:The uncertainty surrounding the Fed’s future policy path has led to increased volatility in financial markets. This can make it challenging for investors to make informed decisions, potentially leading to market instability.

Economic Data and Indicators: Forex Dollar Hits Two Month High As Expectations For Fed Rate Cuts Fade

The recent surge in the US dollar, pushing it to a two-month high, has been largely driven by a shift in market sentiment regarding the Federal Reserve’s monetary policy. While expectations for rate cuts were previously prevalent, recent economic data has fueled a growing belief that the Fed might maintain its hawkish stance for longer.

The forex dollar reaching a two-month high is definitely making headlines, and it’s no surprise given the fading expectations of Fed rate cuts. It seems like everyone’s looking for stability in a turbulent market, and the dollar is providing that right now.

Meanwhile, a different kind of financial story is unfolding in Massachusetts, where a father and son have been sentenced to prison for a staggering $20 million lottery scam, as reported in this article. It’s a stark reminder that even in the face of global economic uncertainty, the lure of quick riches can lead to some pretty serious consequences.

So, while the dollar is climbing, it’s worth remembering that there are still plenty of risks out there, and it’s always best to be cautious with your investments.

Inflation Data and Rate Cut Expectations

Inflation data has been a key driver of market sentiment in recent months. The release of the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index, both of which measure inflation, have provided insights into the stickiness of inflation and its impact on the Fed’s policy decisions.

Inflation data has been a key driver of market sentiment in recent months.

While inflation has shown signs of cooling, it remains above the Fed’s target of 2%. This has led to a debate among economists and investors about whether the Fed will continue to raise rates or pivot towards cuts.

While inflation has shown signs of cooling, it remains above the Fed’s target of 2%.

Employment Data and Consumer Confidence

Employment data, particularly the monthly non-farm payrolls report, has also played a significant role in shaping rate cut expectations. A strong labor market, as evidenced by robust job creation and low unemployment, can support the Fed’s continued tightening of monetary policy.

Employment data, particularly the monthly non-farm payrolls report, has also played a significant role in shaping rate cut expectations.

Consumer confidence surveys, such as the University of Michigan Consumer Sentiment Index, provide insights into consumer spending patterns and overall economic sentiment. A decline in consumer confidence could signal a weakening economy and potentially influence the Fed’s policy stance.

Consumer confidence surveys, such as the University of Michigan Consumer Sentiment Index, provide insights into consumer spending patterns and overall economic sentiment.

Market Reactions and Analysis

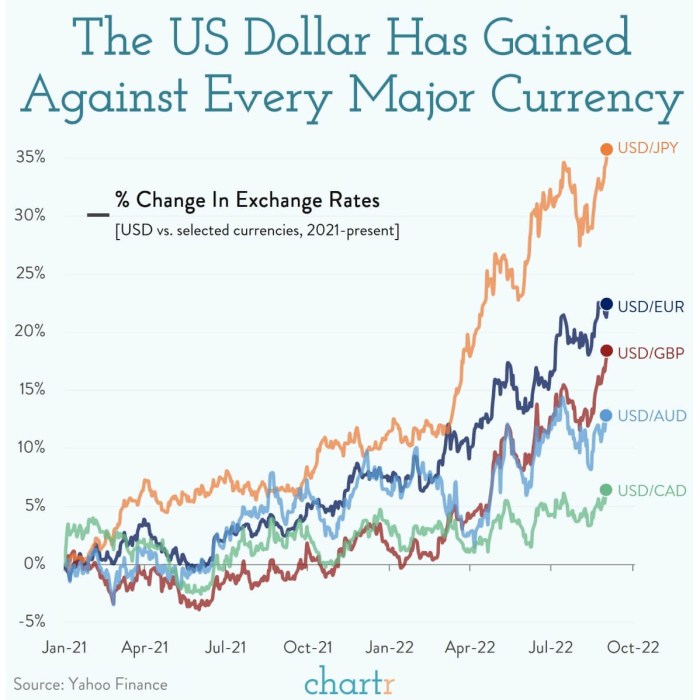

The US dollar’s surge to a two-month high has sent ripples through the currency markets, impacting major currency pairs and prompting analysts to reassess the outlook for global currencies. The dollar’s strength is primarily attributed to fading expectations of Federal Reserve rate cuts, which has bolstered investor confidence in the US economy.

Performance of Currency Pairs

The rise of the US dollar has resulted in notable movements across major currency pairs. The dollar’s strength is reflected in the weakening of other currencies.

- The Euro (EUR/USD) has weakened significantly, falling below the 1.0900 level, its lowest point in several weeks. This decline reflects the eurozone’s economic struggles and the widening interest rate differential between the US and the eurozone.

- The Japanese Yen (USD/JPY) has also depreciated against the US dollar, trading above the 140.00 level. The yen’s weakness is partly due to the Bank of Japan’s accommodative monetary policy and the widening interest rate differential between the US and Japan.

- The British Pound (GBP/USD) has faced downward pressure, trading below the 1.2500 level. The pound’s weakness is linked to concerns about the UK’s economic outlook and the potential for a recession.

- The Australian Dollar (AUD/USD) has also declined against the US dollar, falling below the 0.6700 level. The Aussie’s weakness is attributed to concerns about slowing economic growth in China, a major trading partner for Australia.

Comparison to Previous Periods of US Dollar Strength

The current surge in the US dollar’s strength echoes previous periods of dollar dominance. In the past, periods of US dollar strength have been driven by factors such as robust economic growth, attractive interest rates, and safe-haven demand during periods of global uncertainty.

- In the early 2000s, the US dollar strengthened significantly due to the US economic boom and the “Greenspan put,” a perceived willingness of the Federal Reserve to intervene to support the stock market.

- During the global financial crisis of 2008-2009, the US dollar rose as investors sought safe-haven assets. The US dollar’s strength was fueled by the Federal Reserve’s aggressive monetary easing measures and the relative stability of the US economy.

Outlook and Implications

The recent surge in the US dollar, fueled by fading expectations of Fed rate cuts, raises significant questions about the currency’s future trajectory and its implications for global markets. While a strong dollar can offer benefits, it also presents challenges that businesses and investors need to carefully consider.

Potential Trajectory of the US Dollar, Forex dollar hits two month high as expectations for fed rate cuts fade

The dollar’s strength is likely to persist in the near term, as the Federal Reserve maintains a hawkish stance on interest rates. The Fed’s commitment to combating inflation, even at the cost of slowing economic growth, suggests that rates will remain elevated for an extended period.

However, the trajectory of the dollar will depend on several factors, including the pace of inflation, the strength of the US economy, and the actions of other major central banks.

- Inflation:If inflation remains stubbornly high, the Fed is likely to continue raising rates, further bolstering the dollar. However, if inflation starts to cool more rapidly than expected, the Fed might adopt a less aggressive stance, potentially weakening the dollar.

- US Economic Growth:A robust US economy, characterized by strong job growth and consumer spending, would support the dollar. Conversely, signs of economic weakness or a recession could lead to a decline in the dollar’s value.

- Global Economic Conditions:The strength of the US dollar is also influenced by the performance of other major economies. A slowdown in global economic growth or a weakening of other currencies could boost the dollar’s relative value.

Implications for Businesses and Investors

A strong US dollar can have both positive and negative implications for businesses and investors.

- Exporters:A strong dollar makes US exports more expensive for foreign buyers, potentially hurting businesses that rely on international sales. This can lead to reduced profits and a decline in competitiveness.

- Importers:A strong dollar makes imported goods cheaper for US consumers, benefiting businesses that import products or raw materials. This can lead to lower costs and increased profits.

- Investors:A strong dollar can impact the value of investments held in foreign currencies. Investments in foreign assets may lose value when translated back into US dollars. Conversely, US investments may become more attractive to foreign investors.

Impact on Global Trade and Economic Growth

A strong US dollar can have a significant impact on global trade and economic growth.

- Trade:A strong dollar can make US exports less competitive, potentially leading to a decline in global trade. This can hurt businesses in both the US and other countries that rely on exports.

- Economic Growth:A strong dollar can slow economic growth in countries that rely heavily on exports to the US. This is because a stronger dollar makes US goods more expensive, reducing demand for those goods.