Federal Reserve September Rate Decision: Impact and Outlook

Federal reserves september rate decision significance and market outlook – Federal Reserve September Rate Decision: Impact and Outlook sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset. The Federal Reserve, the central bank of the United States, plays a pivotal role in shaping the nation’s economic landscape.

Its decisions on interest rates have far-reaching consequences for inflation, employment, and the overall health of the economy. This article delves into the significance of the Federal Reserve’s September rate decision, exploring the factors that influenced it, its potential impact on the market, and the broader economic outlook.

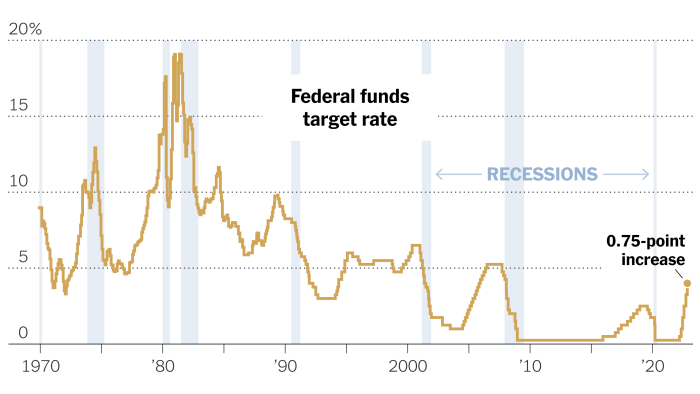

The September rate decision arrived amidst a complex economic environment. Inflation remained stubbornly high, although there were signs of cooling. The labor market remained strong, with unemployment low but wage growth showing signs of moderation. The Federal Reserve had to balance these competing forces, aiming to tame inflation without triggering a recession.

This intricate dance between economic stability and growth is the central theme of this article, providing a comprehensive analysis of the Federal Reserve’s decision and its implications.

The Federal Reserve’s Role in the Economy

The Federal Reserve, often referred to as the Fed, is the central bank of the United States. It plays a crucial role in maintaining the stability of the U.S. financial system and promoting economic growth.

The Federal Reserve’s Primary Responsibilities

The Federal Reserve has several primary responsibilities that contribute to a healthy and stable economy. These responsibilities include:

- Conducting Monetary Policy:The Fed’s most significant responsibility is setting monetary policy, which involves controlling the money supply and interest rates. This is done through tools like adjusting the federal funds rate, buying or selling government bonds (open market operations), and setting reserve requirements for banks.

- Supervising and Regulating Financial Institutions:The Fed oversees and regulates banks and other financial institutions to ensure their safety and soundness, preventing financial crises. This includes setting capital requirements, conducting stress tests, and monitoring their activities.

- Providing Financial Services:The Fed provides essential financial services to the government, banks, and other financial institutions. These services include clearing checks, transferring funds, and managing the government’s account.

- Maintaining Financial Stability:The Fed acts as a lender of last resort, providing liquidity to the financial system during times of crisis. This helps to prevent a collapse of the financial system and ensures that banks can continue to operate.

Economic Outlook in the Aftermath: Federal Reserves September Rate Decision Significance And Market Outlook

The Federal Reserve’s decision to maintain or adjust interest rates has significant implications for the economy. Understanding the Fed’s projections and potential risks and opportunities is crucial for investors and businesses alike.

Federal Reserve’s Projections for Future Interest Rate Adjustments, Federal reserves september rate decision significance and market outlook

The Federal Reserve’s projections for future interest rate adjustments provide insights into the central bank’s outlook for the economy. The Fed’s projections are based on its assessment of inflation, unemployment, and economic growth. In its September meeting, the Fed released its Summary of Economic Projections (SEP), which Artikels the median expectations of Federal Open Market Committee (FOMC) members.

The SEP provides a range of potential scenarios for interest rate adjustments, based on economic conditions. For example, if inflation remains elevated and the labor market remains strong, the Fed might signal further rate hikes. Conversely, if inflation cools more quickly and the economy shows signs of weakness, the Fed might pause or even reverse course on rate increases.

Potential Risks and Opportunities for the Economy

The economic outlook in the aftermath of the September rate decision is subject to various risks and opportunities.

Risks

- Persistent Inflation:If inflation remains stubbornly high, the Fed may need to continue raising interest rates, potentially leading to a recession. For instance, if the supply chain disruptions persist, leading to higher prices for goods and services, the Fed might be forced to tighten monetary policy further, potentially slowing down economic growth.

- Global Economic Slowdown:A global economic slowdown could impact the U.S. economy, reducing demand for U.S. goods and services. For example, a recession in Europe or China could weaken demand for U.S. exports, leading to job losses and slower economic growth.

- Geopolitical Uncertainty:Geopolitical tensions, such as the ongoing war in Ukraine, can create uncertainty and volatility in financial markets, potentially disrupting global trade and investment.

Opportunities

- Strong Consumer Spending:Consumer spending remains robust, driven by a strong labor market and pent-up demand. If this trend continues, it could support economic growth despite rising interest rates. For instance, if consumers continue to spend on goods and services, it could offset the impact of higher interest rates on economic activity.

- Business Investment:Businesses may continue to invest in expansion and innovation, driven by low interest rates and strong demand. For example, businesses may invest in new equipment, technology, and facilities, leading to job creation and economic growth.

- Technological Advancements:Continued technological advancements, such as artificial intelligence and automation, can drive productivity and economic growth. For example, the adoption of new technologies can lead to efficiency gains, cost reductions, and new products and services, boosting economic growth.

Key Factors Influencing the Economic Outlook

The economic outlook in the aftermath of the September rate decision will be influenced by several key factors.

- Inflation:The trajectory of inflation will be a key determinant of the Fed’s future policy decisions. If inflation remains high, the Fed may continue to raise interest rates, potentially slowing down economic growth. However, if inflation cools more quickly, the Fed might pause or even reverse course on rate increases.

- Labor Market:The strength of the labor market will also influence the Fed’s policy decisions. If unemployment remains low and wage growth remains strong, the Fed may be more inclined to continue raising interest rates to curb inflation. Conversely, if the labor market weakens, the Fed may be more cautious about raising rates.

- Economic Growth:The pace of economic growth will also play a role in the Fed’s policy decisions. If economic growth remains strong, the Fed may be more likely to continue raising interest rates to prevent overheating. However, if economic growth slows, the Fed may be more inclined to pause or even reverse course on rate increases.

The Federal Reserve’s September rate decision will undoubtedly shape the market outlook for the coming months. While the focus will be on inflation and its trajectory, we can’t ignore the impact of recent events like the exploit that hit Curve Finance, which sent its token plummeting.

This incident highlights the vulnerability of the DeFi space and raises concerns about the broader crypto market, potentially influencing the Fed’s decision-making process.

The Federal Reserve’s September rate decision will undoubtedly send ripples through the market, influencing everything from borrowing costs to investment strategies. But while we dissect these economic complexities, it’s fascinating to consider the potential impact of advancements like those explored in unveiling the future neuralinks quest to enable mind controlled computers.

Such groundbreaking technologies could reshape our world in ways we’re only beginning to imagine, just as the Fed’s decisions continue to shape our economic landscape.

The Federal Reserve’s September rate decision will have a significant impact on the market, particularly for those looking to purchase a home. With interest rates fluctuating, it’s crucial to explore different strategies for maximizing home loan repayment, like those outlined in this helpful article on maximizing home loan repayment exploring the pros and cons of various approaches.

Understanding these options will empower you to navigate the current market effectively and make informed decisions about your mortgage, ultimately leading to financial stability and peace of mind.