Fed Chair Powells Words & Market Moves: What to Expect

Fed chair powells words and market moves what to expect – Fed Chair Powell’s words and market moves: what to expect? This is a question on the minds of investors and economists alike. Powell’s recent pronouncements on monetary policy and inflation have sent shockwaves through the financial world, leaving many wondering what the future holds.

From the immediate market reaction to the potential economic implications, understanding the Fed’s stance is crucial for navigating the current landscape.

This post will delve into the key takeaways from Powell’s latest statements, analyzing how his words have influenced market behavior and what it all means for the economy. We’ll explore the potential trajectory of interest rates, the expected impact on inflation and growth, and the possible scenarios for the Fed’s future actions.

Ultimately, this analysis aims to provide insights into the investment strategies and considerations that investors should be aware of in this evolving environment.

Powell’s Recent Statements

Jerome Powell, the Chair of the Federal Reserve, has recently delivered a series of public remarks that have sent ripples through the financial markets. These statements have provided crucial insights into the Fed’s current monetary policy stance and its outlook on inflation.

The Fed’s Stance on Monetary Policy

Powell’s latest pronouncements have reinforced the Fed’s commitment to combating inflation. He has repeatedly emphasized the need for continued interest rate hikes to bring inflation back down to the Fed’s target of 2%. While acknowledging that inflation has begun to moderate, Powell has cautioned that the fight against inflation is far from over.

He has indicated that the Fed is prepared to keep interest rates elevated for an extended period to ensure that inflation remains on a sustainable downward trajectory.

Fed Chair Powell’s recent comments on inflation and interest rates have sent shockwaves through the markets, leaving investors wondering what to expect next. The news that China’s exports witnessed a sharp 14.5% drop in July amidst a global demand slowdown adds another layer of complexity to the situation.

This indicates a potential weakening in global economic growth, which could further influence Powell’s decisions and impact market movements in the coming months.

Key Takeaways from Powell’s Remarks, Fed chair powells words and market moves what to expect

Here are some key takeaways from Powell’s recent statements:

- The Fed is determined to bring inflation down to its 2% target, even if it means continuing to raise interest rates.

- The Fed is prepared to keep interest rates elevated for an extended period, even if this leads to a slowdown in economic growth.

- The Fed is closely monitoring inflation data and will adjust its monetary policy stance as needed.

Powell’s Tone Compared to Past Periods

Powell’s current tone is more hawkish than it was in the early stages of the Fed’s rate-hiking cycle. In the past, he has expressed a willingness to be patient and allow inflation to run above target for a period of time.

However, recent inflation data, which has remained stubbornly high, has led Powell to adopt a more aggressive stance. He has signaled that the Fed is willing to do whatever it takes to bring inflation under control, even if this means causing some economic pain.

How Powell’s Statements Differ from Previous Pronouncements

Powell’s recent statements represent a shift in tone from his previous pronouncements. In the past, he has emphasized the need for flexibility and data dependency in the Fed’s policy decisions. However, in recent months, he has adopted a more hawkish stance, emphasizing the need for decisive action to combat inflation.

With Fed Chair Powell’s recent comments on inflation and interest rates, the market is on edge, waiting to see how these pronouncements will translate into actual policy moves. While the broader market grapples with this uncertainty, the cryptocurrency market seems to be holding its own, with Bitcoin experiencing a slight dip and Ethereum inching upwards, as indicated in this recent cryptocurrency market update.

This resilience suggests that investors remain optimistic about the future of crypto, even amidst the broader economic headwinds. It will be interesting to see how the crypto market continues to perform in the coming weeks, as the Fed’s decisions continue to shape the global financial landscape.

This shift in tone reflects the Fed’s growing concern about inflation and its determination to bring it back under control.

Market Reactions to Powell’s Words

The market’s response to Powell’s recent speech was a mixed bag, reflecting the ongoing uncertainty surrounding the Federal Reserve’s path for interest rates and the broader economic outlook. While some investors interpreted Powell’s comments as signaling a potential pause in rate hikes, others remained concerned about the persistence of inflation and its impact on the economy.

Immediate Market Response

Following Powell’s speech, the stock market initially reacted positively, with major indices like the S&P 500 and Nasdaq Composite rising. This upward movement suggests that investors perceived Powell’s comments as less hawkish than anticipated, potentially signaling a more accommodative stance from the Fed.

Fed Chair Powell’s words are always closely watched by market participants, and his recent comments about the need for continued rate hikes have sent ripples through the financial world. This comes at a time when the stock market has been roiled by a shocking September jobs report, leaving the Federal Reserve facing a tough decision on the path forward.

This article delves into the complexities of this situation, highlighting the challenges ahead for the Fed as it tries to balance inflation control with economic growth. We can expect more volatility in the markets as investors grapple with the implications of these economic developments.

However, the gains were short-lived, and the market quickly reversed course, ending the day with losses. This reversal highlights the lingering uncertainty and volatility surrounding the Fed’s policy direction.

Impact on Major Stock Indices, Bond Yields, and the Dollar

The immediate market response to Powell’s speech was a mixed bag. While the stock market initially rallied, it quickly reversed course, ending the day with losses. This suggests that investors are still uncertain about the Fed’s future path. The bond market also reacted with some volatility, with yields rising initially before settling back down.

This indicates that investors are still expecting the Fed to continue raising rates, but the pace of future hikes is now in question. The dollar also weakened against other major currencies, reflecting the market’s perception that the Fed may be less aggressive in its fight against inflation.

Reasoning Behind the Market’s Reaction

The market’s mixed reaction to Powell’s speech can be attributed to several factors. First, Powell’s comments were deliberately ambiguous, leaving investors unsure about the Fed’s future course. This ambiguity created uncertainty, leading to volatile trading. Second, the market is still grappling with the impact of inflation and the Fed’s efforts to control it.

Investors are unsure whether the Fed’s rate hikes will be sufficient to bring inflation under control without triggering a recession. Third, the market is also sensitive to geopolitical risks, such as the war in Ukraine and rising tensions between the US and China.

These risks add to the overall uncertainty and volatility in the market.

Investor Sentiment and Risk Appetite

Powell’s speech has undoubtedly impacted investor sentiment and risk appetite. While some investors remain optimistic about the long-term outlook for the economy, others are more cautious, given the uncertainty surrounding inflation and the Fed’s policy direction. This shift in sentiment is reflected in the recent volatility in the stock market, as investors adjust their portfolios to reflect their changing risk tolerance.

Economic Outlook and Implications: Fed Chair Powells Words And Market Moves What To Expect

Powell’s recent statements have sent ripples through the financial markets, leaving investors and economists alike pondering the future trajectory of the US economy. His pronouncements provide valuable insights into the Fed’s thinking and shed light on the potential course of monetary policy.

Interest Rate Trajectory

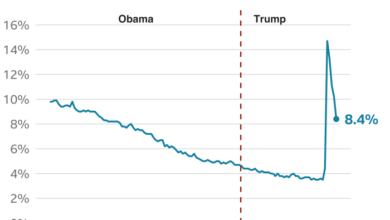

The Fed’s stance on interest rates is a key determinant of economic activity. Powell’s recent comments suggest that the central bank remains committed to combating inflation, even if it means further interest rate hikes. The Fed’s target rate is currently in the range of 5.25% to 5.5%, and Powell has hinted that further increases may be necessary to bring inflation down to the 2% target.

This suggests that the Fed is prepared to tolerate some economic slowdown in order to achieve its inflation goals.

Inflation and Economic Growth

The interplay between inflation and economic growth is a complex one. While higher interest rates can help to curb inflation by slowing down economic activity, they can also stifle investment and consumer spending, leading to a potential recession. The Fed’s goal is to achieve a “soft landing,” where inflation is brought under control without triggering a recession.

However, the path to a soft landing is narrow, and there is a risk that the Fed’s actions could inadvertently push the economy into a downturn.

Scenarios for the Fed’s Future Actions

The Fed’s future actions will depend heavily on the evolving economic data. If inflation continues to fall at a steady pace, the Fed may be able to pause or even reverse course on interest rate hikes. However, if inflation proves to be more persistent, the Fed may need to continue raising rates, potentially even more aggressively.

There are also scenarios where the Fed could adopt a “wait-and-see” approach, closely monitoring economic data before making any significant changes to monetary policy.

Investment Strategies and Considerations

Powell’s recent statements have provided valuable insights into the Federal Reserve’s monetary policy stance and its potential implications for the economy. These insights can be instrumental in formulating informed investment strategies.

Investment Strategies Based on Powell’s Statements

Understanding the potential impact of Powell’s statements on various asset classes is crucial for developing effective investment strategies. The following table summarizes potential investment strategies based on Powell’s recent pronouncements:

| Asset Class | Recommended Action | Rationale |

|---|---|---|

| Stocks | Maintain a balanced portfolio with a focus on quality companies with strong fundamentals. | While potential for growth remains, a more cautious approach is warranted due to economic uncertainties. |

| Bonds | Consider diversifying bond holdings across maturities and credit ratings. | Rising interest rates may negatively impact bond prices, but diversifying can mitigate risk. |

| Commodities | Explore opportunities in commodities with potential for price appreciation due to inflation. | Commodities like gold and oil may offer protection against inflation and potential economic volatility. |

Comparing Different Investment Approaches

Various investment approaches can be adopted based on individual risk tolerance and market outlook. The following table compares different investment approaches and their potential outcomes:

| Investment Approach | Potential Outcomes |

|---|---|

| Passive Investing | Consistent returns with lower risk, but potentially lower growth potential compared to active investing. |

| Active Investing | Potential for higher returns, but also higher risk due to market volatility and active management fees. |

| Value Investing | Focus on undervalued companies with strong fundamentals, potentially leading to long-term growth. |

| Growth Investing | Investment in companies with high growth potential, but may involve higher risk due to volatility. |

Detailed Explanation of Investment Strategies

Understanding the rationale behind each investment strategy is essential for making informed decisions.

Maintaining a Balanced Portfolio

A balanced portfolio aims to mitigate risk by diversifying investments across different asset classes. This approach helps to reduce the impact of any single asset class’s performance on the overall portfolio. In the current economic climate, maintaining a balanced portfolio with a focus on quality companies with strong fundamentals can provide stability and potential for long-term growth.

Diversifying Bond Holdings

Diversifying bond holdings across maturities and credit ratings helps to mitigate risk associated with rising interest rates. As interest rates rise, bond prices generally fall. However, diversifying across maturities and credit ratings can help to offset this risk by ensuring exposure to bonds with varying sensitivities to interest rate changes.

Exploring Opportunities in Commodities

Commodities like gold and oil can provide protection against inflation and potential economic volatility. Gold, a traditional safe-haven asset, can preserve wealth during periods of uncertainty. Oil, a key commodity in the global economy, can benefit from rising energy demand and potential supply constraints.

Passive Investing

Passive investing involves tracking a specific market index, such as the S&P 500, without actively managing the portfolio. This approach offers consistent returns with lower risk, but potentially lower growth potential compared to active investing.

Active Investing

Active investing involves actively managing a portfolio by buying and selling securities based on market research and analysis. This approach offers the potential for higher returns, but also higher risk due to market volatility and active management fees.

Value Investing

Value investing focuses on identifying undervalued companies with strong fundamentals. This approach seeks to capitalize on market inefficiencies and invest in companies with the potential for long-term growth.

Growth Investing

Growth investing focuses on companies with high growth potential, often in emerging industries or sectors. This approach involves higher risk due to the volatility of growth companies, but offers the potential for significant returns.