Gaza Escalation: Impact on Oil & Gas Markets

Escalation in gaza impact on oil and gas markets – Gaza Escalation: Impact on Oil & Gas Markets is a topic that has sparked global concern, as the conflict in Gaza has the potential to significantly disrupt the delicate balance of the global energy market. The escalating tensions in the region are raising serious questions about the future of oil and gas prices, supply chains, and the broader economic landscape.

The historical context of the conflict in Gaza is crucial to understanding its current significance. The region has been a flashpoint for decades, with multiple rounds of conflict leaving a lasting impact on the geopolitical landscape. The current escalation is a stark reminder of the fragility of peace in the Middle East, and its ramifications are felt far beyond the borders of Gaza.

The potential for the conflict to escalate further, with unpredictable consequences for regional stability and international relations, adds another layer of complexity to the situation.

Escalation in Gaza

The recent escalation of violence in Gaza has once again thrust the region into the spotlight, highlighting the complex and long-standing conflict that continues to plague the Middle East. Understanding the historical context of this conflict is crucial for grasping its significance in the current geopolitical landscape and the potential ramifications it holds for regional stability and international relations.

Historical Context and Significance

The conflict between Israel and Palestine has deep historical roots, dating back to the early 20th century and the British Mandate for Palestine. The creation of Israel in 1948, following the displacement of hundreds of thousands of Palestinians, marked a turning point in the conflict, leading to multiple wars and ongoing tensions.

The recent escalation in Gaza has had a significant impact on oil and gas markets, with concerns about supply disruptions and geopolitical instability. However, the turmoil isn’t just confined to the Middle East; it’s also rippling through the Israeli tech industry, with startups exploring overseas moves amid judicial changes, as reported in this article.

This uncertainty further adds to the complexity of the oil and gas market, highlighting the interconnected nature of global events.

The Gaza Strip, a densely populated Palestinian territory bordering Israel, has been at the center of this conflict for decades. The ongoing Israeli-Palestinian conflict has become a focal point of global attention, raising concerns about regional stability and the potential for wider conflict.

Potential Ramifications of the Escalation, Escalation in gaza impact on oil and gas markets

The escalation of violence in Gaza has the potential to significantly impact regional stability and international relations. The conflict has the potential to destabilize the region, potentially triggering further conflict and violence between Israel and its neighbors. It could also lead to a resurgence of extremist groups and further complicate peace efforts.

Additionally, the conflict has the potential to strain relations between major powers involved in the region, such as the United States, Russia, and China.

The recent escalation in Gaza has already sent ripples through the oil and gas markets, with concerns about potential disruptions to supply chains and increased demand for energy. It’s a complex situation, and keeping an eye on upcoming economic indicators like inflation and jobs data, which are in focus here , is crucial for understanding the broader economic impact of this conflict.

The situation in Gaza is a stark reminder of how geopolitical events can have a significant impact on global energy markets.

Role of Major Powers

Major powers play a significant role in the conflict, with their interests often intertwined with the broader geopolitical landscape. The United States, a strong ally of Israel, has historically provided significant military and financial support, playing a crucial role in shaping the conflict.

The escalation in Gaza has already sent shockwaves through the oil and gas markets, with prices fluctuating wildly. This uncertainty is compounded by global events, like the recent free trade deal between the EU and New Zealand, projected to increase bilateral trade by 30% , which could further impact global energy demand.

The coming weeks will be crucial in gauging the long-term effects of these events on the oil and gas markets, as the situation in Gaza remains volatile.

Russia, on the other hand, has sought to maintain its influence in the region, forging closer ties with some Palestinian factions. China, an emerging power, has increasingly become involved in the Middle East, seeking to expand its influence and secure its interests in the region.

The actions and positions of these major powers significantly impact the conflict’s trajectory and any potential for a peaceful resolution.

Oil and Gas Market Dynamics: Escalation In Gaza Impact On Oil And Gas Markets

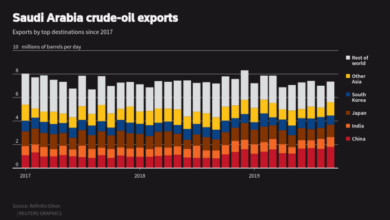

The escalation in Gaza has the potential to significantly impact the global oil and gas market. The region is a key transit route for oil and gas, and any disruption to these flows could have ripple effects on prices and supply chains worldwide.

Understanding the dynamics of the oil and gas market is crucial to assess the potential consequences of the conflict.

Key Factors Influencing Oil and Gas Prices

The global oil and gas market is influenced by a complex interplay of factors, including:

- Supply and Demand:The fundamental principle of economics dictates that prices rise when demand exceeds supply, and vice versa. Global oil and gas production levels, as well as consumption patterns, play a significant role in determining prices. For instance, an increase in global demand for oil due to economic growth can lead to higher prices.

- Geopolitical Events:Political instability, wars, and sanctions can disrupt oil and gas production and transportation, leading to price fluctuations. The current escalation in Gaza, for example, could disrupt supply chains and impact prices if it escalates further.

- Economic Conditions:Economic growth, inflation, and interest rates can influence oil and gas prices. A strong economy with high demand for energy can drive up prices, while economic downturns can lead to lower prices.

- Technological Advancements:Technological advancements in oil and gas extraction, transportation, and alternative energy sources can impact prices. For instance, the development of fracking technology in the United States has increased domestic oil production, contributing to lower global prices.

- Speculation and Investor Sentiment:Market sentiment and investor expectations can also influence oil and gas prices. For example, if investors anticipate a future supply shortage, they may buy oil futures contracts, driving up prices.

Impact on Oil and Gas Supply Chains and Production

The escalation in Gaza could potentially disrupt oil and gas supply chains and production in several ways:

- Disruption to Shipping Routes:The Gaza Strip is located near key shipping routes for oil and gas, including the Suez Canal. Any disruption to these routes, due to security concerns or port closures, could significantly impact the flow of oil and gas to global markets.

- Impact on Production:While Gaza itself is not a major oil and gas producer, the conflict could indirectly impact production in neighboring countries. For example, if the conflict escalates and spreads, it could disrupt production in countries like Israel or Egypt, which are important oil and gas producers in the region.

- Uncertainty and Investment:The escalation could create uncertainty for investors in the oil and gas sector, leading to a decline in investment in new projects or exploration activities. This could potentially limit future oil and gas production and exacerbate supply concerns.

Potential for Price Volatility and Market Disruptions

The escalation in Gaza has the potential to cause significant price volatility and market disruptions:

- Price Spikes:If the conflict disrupts supply chains or leads to a decrease in production, oil and gas prices could spike as a result of the supply shortage. The severity of the price spike would depend on the duration and extent of the disruption.

- Market Uncertainty:The conflict could create uncertainty and volatility in the oil and gas markets, making it difficult for businesses and consumers to plan for the future. This uncertainty could lead to reduced investment and economic growth.

- Impact on Consumer Prices:Higher oil and gas prices would translate into higher energy costs for consumers, impacting their budgets and potentially leading to inflation.

Economic and Financial Implications

The escalation in Gaza has significant economic and financial implications, both for the region and the global economy. The conflict disrupts trade, investment, and tourism, impacting regional economies and potentially triggering broader financial market volatility.

Impact on Regional Economies

The conflict directly impacts the economies of Israel and Palestine. Israel’s economy, while resilient, is affected by the cost of military operations and the potential disruption of tourism and trade. The Palestinian economy, already fragile, suffers from severe economic losses due to damage to infrastructure, business closures, and loss of livelihoods.

The conflict also has broader regional consequences. Neighboring countries, such as Egypt and Jordan, face increased economic and security burdens due to the influx of refugees and the potential for spillover effects.