Dollar Strengthens Pound at 14-Month High Ahead of Bank of England Decision

Dollar strengthens pound at 14 month high ahead of bank of england decision – Dollar Strengthens Pound at 14-Month High Ahead of Bank of England Decision: The global currency markets are buzzing with anticipation as the US dollar strengthens against the British pound, reaching a 14-month high just before the Bank of England’s critical interest rate decision.

This unexpected surge in the pound’s value is a captivating development that has sparked a wave of speculation and analysis. What factors are driving this shift, and what implications might it have for global trade, investment, and the UK economy?

This dynamic situation is a result of a complex interplay of economic forces. The US dollar’s strength can be attributed to several factors, including the Federal Reserve’s aggressive interest rate hikes, a robust US economy, and a perception of safety and stability in the US financial system.

However, the pound’s recent rise is somewhat perplexing, given the UK’s economic challenges, including high inflation and a cost-of-living crisis. The Bank of England’s interest rate decision is expected to be a key factor in determining the pound’s future trajectory.

The Bank faces a delicate balancing act, needing to tame inflation without further damaging the UK’s already fragile economy.

Dollar Strength Against the Pound

The US dollar has recently strengthened against the British pound, reaching a 14-month high. This trend is influenced by a combination of factors, including interest rate differentials, economic performance, and political uncertainty.

Factors Contributing to Dollar Strength

The recent surge in the dollar’s value against the pound is attributed to several factors:

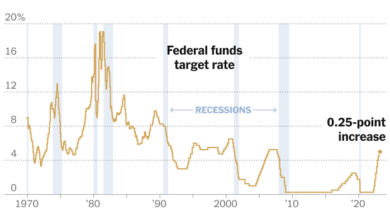

- Interest Rate Differentials:The US Federal Reserve has been more aggressive in raising interest rates than the Bank of England. Higher interest rates in the US make dollar-denominated assets more attractive to investors, increasing demand for the dollar and pushing its value higher.

- Economic Performance:The US economy has shown resilience, with a strong labor market and steady growth. This economic strength makes the dollar a more desirable currency for investors. Conversely, the UK economy faces challenges, including high inflation and concerns about a recession.

The dollar’s surge against the pound, hitting a 14-month high ahead of the Bank of England’s decision, highlights the global economic uncertainty. While this is happening, the blockchain world is buzzing with news of potential mergers and acquisitions, with the likes of Gavin Wood’s involvement in gavin wood chain mergers and acquisitions being a major talking point.

It’s interesting to see how these two seemingly separate worlds, finance and blockchain, are interconnected and influencing each other in these volatile times.

- Political Uncertainty:Political instability in the UK, including recent changes in leadership and policy shifts, has created uncertainty among investors. This uncertainty has weighed on the pound, making it less attractive compared to the dollar.

Implications of Dollar Strength

The strengthening dollar has significant implications for global trade and investment:

- Impact on Global Trade:A stronger dollar makes US exports more expensive for buyers in other countries, potentially reducing demand. Conversely, it makes imports into the US cheaper, which could benefit consumers.

- Impact on Investment:A stronger dollar can make US assets, such as stocks and bonds, more expensive for foreign investors. This could lead to reduced foreign investment in the US. However, it can also make it more attractive for US investors to invest abroad.

Impact on Businesses and Consumers

The strengthening dollar can impact businesses and consumers in both the US and the UK:

- US Businesses:US exporters may face challenges as their products become more expensive in foreign markets. However, US importers could benefit from lower import costs.

- US Consumers:US consumers could benefit from lower prices on imported goods, but they may also see higher prices for domestically produced goods if businesses pass on increased costs associated with a stronger dollar.

- UK Businesses:UK businesses that export to the US may see a decrease in demand due to higher prices. UK importers could benefit from lower import costs.

- UK Consumers:UK consumers may see higher prices for imported goods from the US.

Bank of England’s Interest Rate Decision

The Bank of England’s Monetary Policy Committee (MPC) is set to announce its latest interest rate decision, and the outcome could have a significant impact on the pound’s value. With the dollar strengthening against the pound to a 14-month high, investors are keenly watching for any signals from the MPC about the future trajectory of UK interest rates.

Impact on the Pound’s Value

The Bank of England’s decision on interest rates is a key driver of the pound’s value. A rate hike would typically strengthen the pound, as it would make the UK a more attractive destination for foreign investment. This is because higher interest rates generally attract investors seeking higher returns on their investments.

Conversely, a rate cut or a hold decision could weaken the pound, as it would make the UK less attractive to foreign investors.

Economic Conditions in the UK and the US

The Bank of England’s decision will be influenced by the current economic conditions in the UK and the US. The UK economy is facing a number of challenges, including high inflation, a cost-of-living crisis, and a potential recession. These factors are putting pressure on the Bank of England to raise interest rates to combat inflation.

However, the MPC must also consider the potential impact of higher interest rates on the already fragile UK economy.The US economy, on the other hand, is showing signs of resilience, with a strong labor market and continued growth. The Federal Reserve has already raised interest rates several times this year to combat inflation, and further rate hikes are expected.

The dollar’s strength against the pound, hitting a 14-month high ahead of the Bank of England’s decision, is just one of many market movements happening today. Meanwhile, Warren Buffett’s Berkshire Hathaway has finalized its divestment of TSMC holdings, as reported in this article.

This news, combined with the upcoming Bank of England decision, adds another layer of uncertainty to the already volatile market.

The divergence in economic conditions between the UK and the US could lead to a widening interest rate differential, which could further weaken the pound against the dollar.

The dollar’s surge against the pound, reaching a 14-month high ahead of the Bank of England’s decision, highlights the global economic uncertainty. It’s a stark reminder that even as we navigate these turbulent waters, there are individuals who seek to exploit the system for personal gain, as evidenced by the recent sentencing of a Massachusetts father and son for a $20 million lottery scam, detailed in this article massachusetts father and son receive prison sentences for 20 million lottery scam.

The Bank of England’s decision will likely have a significant impact on the pound’s trajectory, but it’s important to remember that even in times of economic volatility, ethical behavior and responsible actions remain paramount.

Implications for the UK Economy

The Bank of England’s decision on interest rates will have significant implications for the UK economy. A rate hike could help to curb inflation but could also slow economic growth and lead to higher borrowing costs for businesses and consumers.

Conversely, a rate cut or a hold decision could allow the economy to continue growing but could also exacerbate inflationary pressures.The MPC faces a difficult balancing act in trying to manage inflation while supporting economic growth. The outcome of the MPC’s decision will be closely watched by investors and businesses alike, as it will provide valuable insights into the Bank of England’s outlook for the UK economy.

Market Reactions to the Dollar-Pound Exchange Rate: Dollar Strengthens Pound At 14 Month High Ahead Of Bank Of England Decision

The recent strengthening of the dollar against the pound has significant implications for various market indicators and the UK’s financial landscape. Understanding these reactions is crucial for investors, businesses, and policymakers alike.

Impact on Key Market Indicators

The dollar-pound exchange rate fluctuations can influence several key market indicators, including:

- Inflation:A stronger dollar makes imports cheaper for UK consumers, potentially mitigating inflationary pressures. However, UK businesses importing raw materials or finished goods from the US might face higher costs, potentially contributing to inflation.

- Interest Rates:The Bank of England (BoE) might be pressured to raise interest rates to counter the inflationary impact of a weaker pound. Higher interest rates could make borrowing more expensive for businesses and consumers, potentially impacting economic growth.

- Investment:A weaker pound can make UK assets less attractive to foreign investors, potentially leading to lower investment in the UK economy. This could impact sectors like real estate, manufacturing, and technology.

- Trade:UK exports become more expensive in dollar terms, potentially reducing demand for British goods and services in the US. Conversely, imports from the US become cheaper, potentially boosting demand.

Impact on the UK’s Financial Markets

The dollar-pound exchange rate can have a significant impact on the UK’s financial markets. For instance:

- Equity Markets:Companies with significant US operations or exposure to the US market might experience volatility in their share prices due to exchange rate fluctuations. For example, a weaker pound could negatively impact the earnings of UK-based companies that generate revenue in dollars.

- Bond Markets:A stronger dollar could lead to increased demand for UK government bonds (gilts) as investors seek a safe haven. This could drive down yields, making it cheaper for the government to borrow money. However, it could also make it more difficult for businesses to raise capital through bond issuance.

- Currency Markets:The exchange rate fluctuations can lead to increased volatility in the currency markets, making it riskier for businesses to hedge against currency risk. This can impact international trade and investment decisions.

Impact on Various Sectors of the UK Economy

The following table illustrates the potential impact of the dollar-pound exchange rate on various sectors of the UK economy:

| Sector | Potential Impact of a Strong Dollar |

|---|---|

| Tourism | Increased inbound tourism from the US as it becomes cheaper to travel to the UK. |

| Manufacturing | Higher input costs for businesses importing raw materials from the US, potentially leading to reduced competitiveness. |

| Retail | Lower prices for imported goods from the US, potentially leading to increased consumer spending. |

| Energy | Higher energy prices for businesses and consumers as the UK imports a significant portion of its energy from the US. |

| Financial Services | Increased demand for UK financial services from US investors seeking a safe haven, potentially boosting the sector’s growth. |

Historical Context and Future Outlook

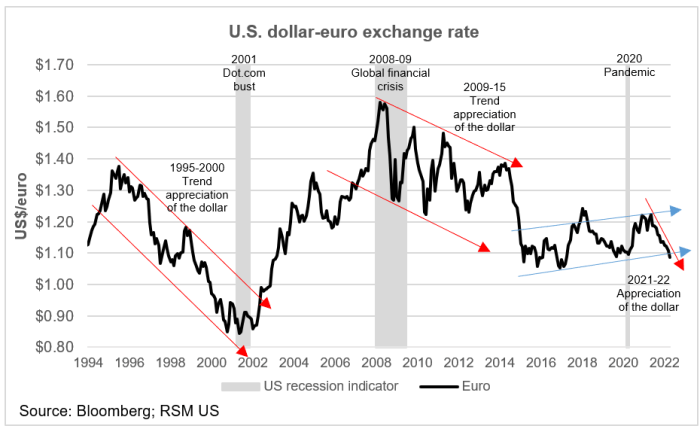

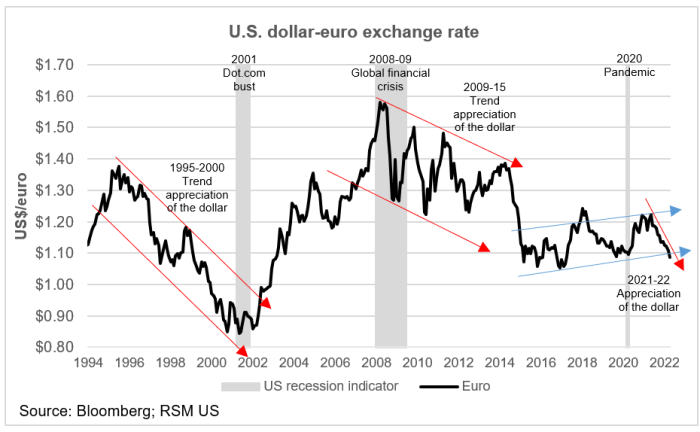

The current strength of the dollar against the pound, reaching a 14-month high, is a significant development in the foreign exchange market. To understand the context of this move, it is essential to consider historical trends and the factors that might influence the future trajectory of the dollar-pound exchange rate.

Historical Trends

The dollar-pound exchange rate has fluctuated considerably over the years, driven by a complex interplay of economic, political, and geopolitical factors. A look at historical trends reveals key periods that have shaped the relationship between these two currencies:

- The Post-World War II Era:Following World War II, the dollar emerged as the dominant global currency, while the pound experienced a period of decline due to the war’s impact on the British economy. This led to a weakening of the pound against the dollar.

- The 1970s and 1980s:The introduction of floating exchange rates in the 1970s led to increased volatility in the dollar-pound exchange rate. The strong dollar of the early 1980s, driven by high US interest rates and a robust US economy, resulted in a significant depreciation of the pound.

- The Global Financial Crisis (2008-2009):The global financial crisis led to a sharp depreciation of the pound against the dollar as investors sought safe haven assets in the US.

- Brexit (2016-present):The UK’s decision to leave the European Union has had a significant impact on the pound. Uncertainty surrounding the Brexit negotiations and the potential economic consequences have led to a decline in the pound’s value.

Potential Factors Influencing Future Trajectory, Dollar strengthens pound at 14 month high ahead of bank of england decision

Several factors could influence the future trajectory of the dollar-pound exchange rate:

- Interest Rate Differentials:The interest rate differential between the US and the UK is a key factor influencing the exchange rate. Higher interest rates in the US tend to attract foreign investment, increasing demand for the dollar and strengthening it against the pound.

- Economic Growth:The relative strength of the US and UK economies plays a significant role. Stronger economic growth in the US, compared to the UK, could lead to a stronger dollar.

- Geopolitical Events:Global events, such as trade wars, political instability, or natural disasters, can significantly impact the dollar-pound exchange rate. For example, the ongoing Russia-Ukraine conflict has created uncertainty in global markets, impacting both currencies.

- Monetary Policy:The policies of the Federal Reserve (US) and the Bank of England (UK) can influence the exchange rate. For example, if the Federal Reserve raises interest rates more aggressively than the Bank of England, it could lead to a stronger dollar.

Timeline of Major Events

Here is a timeline of major events that have impacted the dollar-pound exchange rate in the past: