Dollar Slides, Stocks Rally: US Inflation Data in Focus

Dollar slides stocks rally ahead of us inflation data market highlights – Dollar Slides, Stocks Rally: US Inflation Data in Focus sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset.

The stock market is on a tear, driven by a weakening dollar and anticipation of the upcoming U.S. inflation data release. This unexpected dynamic has investors buzzing, with the potential for significant market shifts depending on the inflation figures. The dollar’s decline is attributed to a combination of factors, including interest rate differentials, economic outlook, and safe-haven demand.

Meanwhile, the stock market is riding high, fueled by optimism about corporate earnings and the potential for a “soft landing” for the U.S. economy. But this bullish sentiment could be quickly reversed if the inflation data comes in hotter than expected, potentially pushing the Federal Reserve to maintain its aggressive interest rate hikes.

Dollar Weakness and Stock Market Rally

The recent decline in the U.S. dollar has been a significant factor in the stock market’s rally. As the dollar weakens, U.S. stocks become more attractive to foreign investors, leading to increased demand and higher prices. This phenomenon can be attributed to several factors, including interest rate differentials, the economic outlook, and safe-haven demand.

Interest Rate Differentials

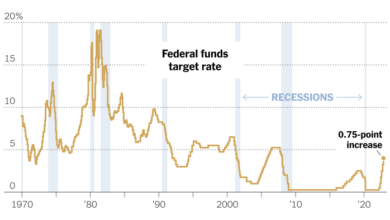

Interest rate differentials refer to the difference in interest rates between two countries. When the Federal Reserve raises interest rates, it makes the dollar more attractive to foreign investors, as they can earn a higher return on their investments. However, when the Fed lowers interest rates or keeps them low, the dollar can weaken as investors seek higher returns elsewhere.

The dollar’s slide and stock market rally ahead of US inflation data highlights the market’s sensitivity to economic indicators. While traditional assets react to these macro factors, it’s also crucial to understand how cryptocurrencies are valued, as they often move independently.

For a deeper dive into the intricacies of crypto pricing, check out this article on decoding crypto prices understanding how cryptocurrencies are valued. With the US inflation report looming, the market is poised for volatility, making it even more important to stay informed on all asset classes, including cryptocurrencies.

The current environment of rising interest rates in other major economies, particularly in Europe and the UK, has made the dollar less appealing to foreign investors. This is because the potential returns on investments in those regions are now more attractive compared to the U.S., leading to a decline in demand for the dollar.

Economic Outlook

The economic outlook also plays a significant role in determining the dollar’s strength. When investors are optimistic about the U.S. economy, they tend to invest in dollar-denominated assets, driving up demand and strengthening the currency. Conversely, a pessimistic outlook can lead to a weakening dollar as investors seek safer havens.Recent economic data suggests that the U.S.

economy is slowing down, raising concerns about a potential recession. This has led to a decline in investor confidence, contributing to the dollar’s weakness.

The dollar’s slide and the stock market’s rally ahead of US inflation data are just the latest chapters in the ongoing saga of market volatility. This week, the S&P 500 is on the verge of a significant milestone, adding to the sense of uncertainty.

As investors navigate this turbulent landscape, it’s crucial to keep an eye on key economic indicators and understand the factors driving market movements. The recent market volatility is a stark reminder that even as the S&P 500 approaches a new high, the path ahead remains uncertain.

Market volatility persists as SP 500 approaches milestone , and investors must be prepared for the unexpected. The upcoming inflation data will be a critical factor in determining the direction of the market in the coming weeks.

Safe-Haven Demand

During periods of global uncertainty or economic turmoil, the dollar is often considered a safe-haven currency. Investors tend to flock to the dollar as a safe haven, driving up demand and strengthening the currency. However, in times of relative stability and economic growth, the demand for safe havens declines, leading to a weakening dollar.The current geopolitical environment, marked by the ongoing war in Ukraine and rising tensions between the U.S.

and China, has created a sense of uncertainty in global markets. This has reduced the dollar’s safe-haven appeal, contributing to its recent decline.

The dollar’s slide and stock market rally are captivating, but while we wait for US inflation data, let’s consider a different kind of investment: your time. If you’re a student, you might not have the capital for traditional investments, but you can still build passive income streams.

Check out passive income ideas for students without investment for some inspiration. Back to the markets, the upcoming inflation figures will likely have a significant impact on the direction of the dollar and stocks, so stay tuned!

Benefits of a Weak Dollar

A weak dollar can benefit U.S. companies and the broader economy in several ways.* Increased Exports:A weaker dollar makes U.S. goods and services more affordable for foreign buyers, boosting exports and increasing revenue for U.S. companies.

Enhanced Competitiveness A weaker dollar can make U.S. companies more competitive in the global marketplace, allowing them to capture a larger share of international markets.

Stimulated Economic Growth Increased exports and enhanced competitiveness can lead to higher economic growth, job creation, and increased investment.However, a weak dollar can also have negative consequences, such as higher import prices and inflation.

It is important to note that the relationship between the dollar’s strength and the stock market is complex and can be influenced by various factors. While a weakening dollar can be beneficial for the stock market in the short term, it can also have long-term implications for the economy.

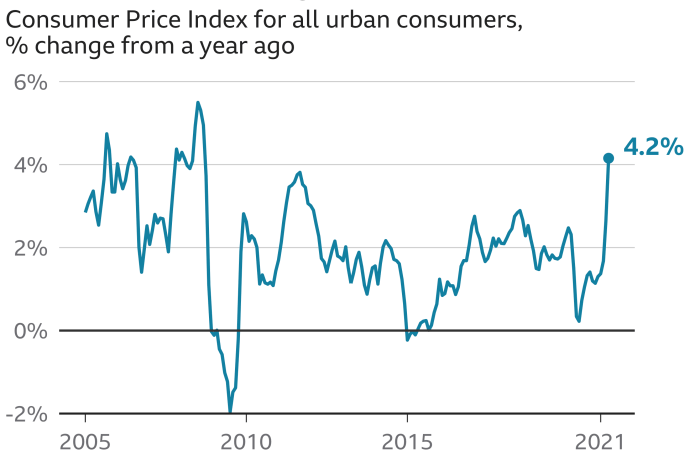

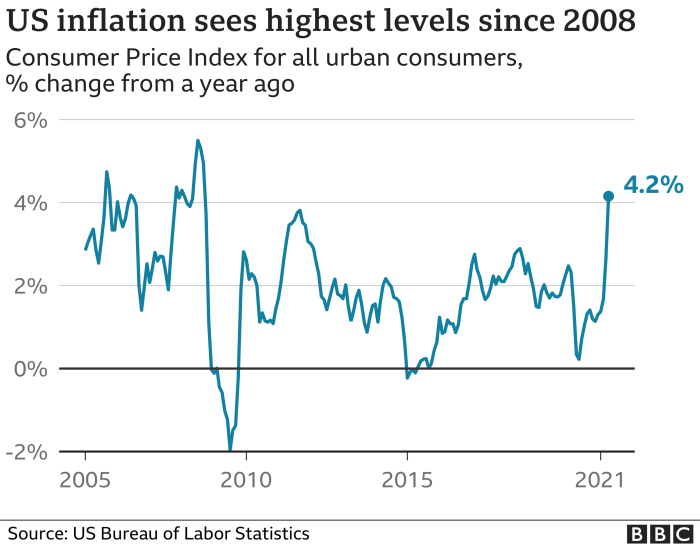

Anticipation of Inflation Data

The upcoming release of U.S. inflation data is a major event for financial markets, as it will provide valuable insights into the trajectory of price pressures and the Federal Reserve’s monetary policy stance. Investors are closely watching for any signs of easing or persistence in inflation, as this will have significant implications for asset prices and economic growth.

Impact on Interest Rate Decisions

The inflation data will be a key factor in the Federal Reserve’s decision-making process regarding interest rates. The Fed’s primary objective is to maintain price stability, and it will carefully analyze the inflation data to determine whether further interest rate hikes are necessary to curb inflation.

If inflation remains elevated or accelerates, the Fed is likely to continue raising interest rates to cool the economy. Conversely, if inflation shows signs of slowing, the Fed may become more dovish and consider pausing or even reversing its rate hikes.

Influence on Investor Sentiment and Market Volatility, Dollar slides stocks rally ahead of us inflation data market highlights

Inflation data can significantly impact investor sentiment and market volatility. If inflation data comes in higher than expected, it could lead to increased concerns about the Fed’s aggressive monetary policy and its potential impact on economic growth. This could trigger a sell-off in stocks and bonds, as investors become more risk-averse.

Conversely, if inflation data comes in lower than expected, it could boost investor confidence and lead to a rally in risk assets. This is because lower inflation would reduce the pressure on the Fed to raise interest rates, which could support economic growth and corporate earnings.

Market Highlights: Dollar Slides Stocks Rally Ahead Of Us Inflation Data Market Highlights

The recent stock market rally has been driven by a confluence of factors, including the Federal Reserve’s pause in interest rate hikes, improving economic data, and optimism about corporate earnings. This has resulted in strong performance across various sectors, with some outperforming others.

Sector Performance

The recent stock market rally has been characterized by strong performance in specific sectors. The technology sector, particularly the large-cap tech companies, has led the charge, benefiting from the easing of interest rate concerns and a resurgence in investor confidence.

The energy sector has also performed well, driven by rising oil prices and strong demand. The consumer discretionary sector has seen gains, driven by increased consumer spending and a reopening economy.

- The technology sector has seen strong gains, fueled by a combination of factors, including the easing of interest rate concerns, strong earnings, and continued growth in cloud computing, artificial intelligence, and other emerging technologies. Notable examples include companies like Apple, Microsoft, and Amazon.

- The energy sector has also experienced a surge in performance, driven by rising oil prices and strong demand. This is attributed to the global economic recovery, the ongoing conflict in Ukraine, and the ongoing transition to renewable energy sources. Key players in this sector include ExxonMobil, Chevron, and ConocoPhillips.

- The consumer discretionary sector has benefited from increased consumer spending and a reopening economy. This sector includes companies that sell non-essential goods and services, such as automobiles, apparel, and restaurants. Notable examples include Tesla, Nike, and McDonald’s.

Asset Class Performance

The recent stock market rally has been accompanied by a divergence in performance across different asset classes. While stocks have rallied, bonds have generally declined in value. This is primarily due to rising interest rates, which have negatively impacted bond yields.

Commodities, particularly oil and gold, have also experienced price increases, reflecting supply chain disruptions and geopolitical uncertainties.

- The stock market rally has been driven by a combination of factors, including the Federal Reserve’s pause in interest rate hikes, improving economic data, and optimism about corporate earnings. This has resulted in strong performance across various sectors, with some outperforming others.

- Bonds have generally declined in value due to rising interest rates. When interest rates rise, the value of existing bonds falls, as investors demand higher yields on new bonds. This has been particularly evident in the U.S. Treasury market, where yields have risen significantly in recent months.

- Commodities have experienced price increases, reflecting supply chain disruptions and geopolitical uncertainties. The conflict in Ukraine has disrupted global energy markets, leading to higher oil prices. Gold prices have also risen, as investors seek safe haven assets amid economic uncertainty.

Potential Risks and Challenges

While the recent stock market rally fueled by dollar weakness and anticipation of inflation data is encouraging, investors should remain mindful of potential risks and challenges that could impact the market’s trajectory. Navigating the complexities of the current market requires a balanced approach, considering both the positive momentum and the potential headwinds that could arise.

Geopolitical Tensions

Geopolitical tensions continue to be a significant source of uncertainty for global markets. The ongoing conflict in Ukraine, heightened tensions between the United States and China, and the ongoing instability in the Middle East can create volatility in financial markets.

These events can disrupt supply chains, increase energy prices, and impact investor sentiment.

Economic Uncertainty

The global economy is facing a number of challenges, including inflation, rising interest rates, and slowing economic growth. Central banks around the world are raising interest rates to combat inflation, which can slow economic activity and potentially lead to a recession.

“The Federal Reserve’s aggressive interest rate hikes are intended to cool the economy and bring inflation under control, but they also carry the risk of pushing the economy into a recession.”

Rising Interest Rates

Rising interest rates can impact the stock market in a number of ways. Higher interest rates make it more expensive for companies to borrow money, which can slow economic growth and reduce corporate profits. Additionally, higher interest rates can make bonds more attractive to investors, potentially leading to a shift away from stocks.