Decoding Crypto Prices: Understanding How Cryptocurrencies Are Valued

Decoding crypto prices understanding how cryptocurrencies are valued – Decoding crypto prices and understanding how cryptocurrencies are valued takes center stage in this exploration. The world of digital assets is both fascinating and complex, with prices fluctuating wildly based on a myriad of factors. Unraveling these dynamics is crucial for anyone looking to navigate this dynamic landscape.

This article will delve into the intricacies of cryptocurrency valuation, examining the fundamental and technical analysis tools used to predict price movements. We’ll explore the influence of market sentiment, regulatory landscape, and the evolving adoption of cryptocurrencies. By understanding these key drivers, investors and enthusiasts alike can gain a deeper appreciation for the forces shaping the crypto market.

Introduction to Cryptocurrency Valuation

Cryptocurrency valuation is a complex and dynamic process, unlike traditional asset valuation methods. Understanding how these digital assets are priced is crucial for investors, traders, and anyone interested in the crypto market.

Unique Characteristics of Cryptocurrencies

Cryptocurrencies possess distinct features that set them apart from conventional assets:

- Decentralization:Cryptocurrencies operate on decentralized networks, eliminating reliance on central authorities. This fosters transparency and security.

- Limited Supply:Many cryptocurrencies have a predetermined maximum supply, creating scarcity and potentially influencing price appreciation.

- Volatility:Cryptocurrency prices are known for their extreme fluctuations, driven by factors like market sentiment, news events, and technological advancements.

- Anonymity:Transactions on the blockchain can be anonymous, making it challenging to track ownership and usage.

Factors Influencing Cryptocurrency Prices

Numerous factors contribute to the ever-changing prices of cryptocurrencies:

- Market Sentiment:Investor confidence and overall market mood play a significant role. Positive news or adoption by major players can boost prices, while negative sentiment can lead to declines.

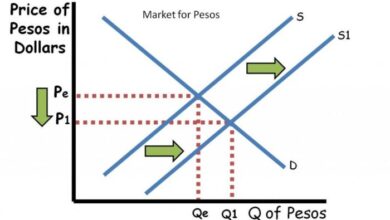

- Supply and Demand:The basic principles of economics apply to cryptocurrencies. High demand and limited supply can drive prices up, while low demand and abundant supply can lead to price drops.

- Adoption and Usage:Increased adoption of cryptocurrencies for payments, investments, and other applications can drive demand and price appreciation.

- Technological Advancements:Innovations in blockchain technology, such as scalability solutions and new use cases, can positively impact cryptocurrency valuations.

- Regulation:Government policies and regulations can influence investor confidence and market stability, impacting prices.

- Competition:The cryptocurrency landscape is highly competitive, with numerous projects vying for investor attention. Strong competition can drive innovation but also create price volatility.

Historical Overview of Cryptocurrency Price Fluctuations

The history of cryptocurrencies is marked by periods of explosive growth and sharp corrections:

- 2010-2013:Bitcoin’s early years were characterized by slow growth and limited adoption.

- 2013-2017:The rise of altcoins and increased mainstream interest led to significant price surges, culminating in the Bitcoin bubble of late 2017.

- 2018-2019:A market correction brought prices down significantly, followed by a period of consolidation.

- 2020-2021:The COVID-19 pandemic and institutional investment sparked renewed interest, driving another bull market.

- 2022-Present:Market volatility and macroeconomic factors have contributed to price fluctuations and a bear market.

Fundamental Analysis of Cryptocurrencies

Fundamental analysis is a crucial tool for understanding the intrinsic value of cryptocurrencies and predicting potential price movements. It involves evaluating the underlying factors that drive the demand and supply of a cryptocurrency, providing insights beyond just price fluctuations.

Key Metrics Used in Fundamental Analysis

Fundamental analysis of cryptocurrencies relies on several key metrics that shed light on their underlying value proposition and future potential.

- Market Capitalization:This metric represents the total market value of a cryptocurrency, calculated by multiplying the current price by the circulating supply. It provides a measure of the overall size and influence of a cryptocurrency in the market.

- Network Activity:This metric reflects the level of engagement and usage of a cryptocurrency network. Indicators such as transaction volume, active addresses, and block confirmation times can reveal the health and adoption of a cryptocurrency.

- Developer Activity:The level of development activity around a cryptocurrency, such as code commits, community contributions, and bug fixes, reflects its ongoing development and potential for future improvements.

- Community Size and Engagement:A strong and active community is crucial for the success of any cryptocurrency. Metrics such as social media engagement, community forums, and user reviews provide insights into the level of support and interest in a cryptocurrency.

- Technology and Use Cases:The underlying technology and use cases of a cryptocurrency are fundamental to its value. Evaluating factors such as scalability, security, and the potential for real-world applications can provide insights into the long-term viability of a cryptocurrency.

Comparison of Fundamentals

Different cryptocurrencies possess distinct fundamental characteristics that shape their value proposition and potential.

- Bitcoin:Known as the “digital gold,” Bitcoin is valued for its decentralized nature, limited supply, and established track record. Its strong community and widespread adoption have solidified its position as the leading cryptocurrency.

- Ethereum:Ethereum is a platform for building decentralized applications (dApps) and smart contracts. Its robust ecosystem, including DeFi protocols and NFTs, drives significant demand and network activity. However, its scalability limitations are a concern.

- Stablecoins:Stablecoins are designed to maintain a stable price peg to a fiat currency, such as the US dollar. Their value proposition lies in their ability to mitigate price volatility and facilitate transactions. However, their reliance on external mechanisms can pose risks.

Decoding crypto prices is like trying to understand the value of a lottery ticket – it’s all about perceived potential. Just like studying understanding mega millions tips to increase your chances of winning might lead you to pick more numbers, analyzing crypto market trends and adoption rates can give you a better sense of a coin’s future value.

But remember, just like with lottery tickets, there’s always an element of risk and uncertainty involved.

Applying Fundamental Analysis to Price Predictions

Fundamental analysis can be applied to predict cryptocurrency price movements by considering the interplay of various factors.

- Increased Network Activity:A surge in transaction volume or active addresses could indicate growing adoption and demand, potentially leading to price appreciation.

- Positive Development Updates:Significant upgrades, new features, or partnerships can enhance the value proposition of a cryptocurrency and drive price growth.

- Regulatory Clarity:Favorable regulatory developments can increase investor confidence and lead to price increases. Conversely, negative regulations can dampen investor sentiment and lead to price declines.

- Market Sentiment:Overall market sentiment and investor confidence play a significant role in cryptocurrency price movements. Positive news and strong fundamentals can create bullish sentiment, while negative events can lead to bearish sentiment.

Technical Analysis of Cryptocurrency Prices

Technical analysis is a method of forecasting asset price movements based on historical price and volume data. It involves studying charts and patterns to identify trends and predict future price movements. This approach is often used in conjunction with fundamental analysis, which focuses on the underlying value of an asset.

Common Technical Indicators, Decoding crypto prices understanding how cryptocurrencies are valued

Technical indicators are mathematical calculations that are applied to price and volume data to identify trends and patterns. They are used to generate buy and sell signals and to confirm or refute other trading signals. Here are some of the most common technical indicators used in cryptocurrency analysis:

- Moving Averages:Moving averages are calculated by averaging the price of an asset over a specific period of time. They are used to smooth out price fluctuations and identify trends. Common moving averages include the 50-day moving average (MA), the 100-day MA, and the 200-day MA.

A crossover of two moving averages can be interpreted as a buy or sell signal. For example, if the 50-day MA crosses above the 200-day MA, it could be a bullish signal. Conversely, if the 50-day MA crosses below the 200-day MA, it could be a bearish signal.

- MACD (Moving Average Convergence Divergence):The MACD is a momentum indicator that shows the relationship between two moving averages. It is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day EMA. The result is then plotted on a chart, along with a signal line (9-day EMA of the MACD).

When the MACD crosses above the signal line, it could be a buy signal. When the MACD crosses below the signal line, it could be a sell signal.

- RSI (Relative Strength Index):The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is calculated using a formula that compares the magnitude of recent gains to recent losses.

Understanding how cryptocurrencies are valued can be a complex process, similar to weighing the pros and cons of a major purchase like a car. Just as you might research gas vs electric vehicles which is a better deal know the experts suggestions to make the right decision, decoding crypto prices requires analyzing factors like market sentiment, technology adoption, and regulatory landscape.

This comprehensive approach helps investors make informed decisions about their crypto investments.

The RSI is typically displayed as an oscillator that ranges from 0 to 100. When the RSI is above 70, it is considered overbought, and when it is below 30, it is considered oversold.

Chart Patterns

Chart patterns are recurring formations in price charts that can be used to predict future price movements. They are based on the idea that history tends to repeat itself and that traders tend to react to certain price patterns in predictable ways.

Here are some of the most common chart patterns:

- Head and Shoulders:This pattern is a bearish reversal pattern that indicates a potential change in trend from an uptrend to a downtrend. It is characterized by three peaks, with the middle peak being the highest (the head) and the two outer peaks being lower (the shoulders).

A neckline is drawn between the two troughs of the pattern. Once the price breaks below the neckline, it is considered a sell signal.

- Double Top:This pattern is a bearish reversal pattern that is similar to the head and shoulders pattern but has only two peaks. The two peaks are at roughly the same price level, and a neckline is drawn between the two troughs of the pattern.

Once the price breaks below the neckline, it is considered a sell signal.

- Triple Bottom:This pattern is a bullish reversal pattern that indicates a potential change in trend from a downtrend to an uptrend. It is characterized by three lows at roughly the same price level. A neckline is drawn between the three highs of the pattern.

Once the price breaks above the neckline, it is considered a buy signal.

Technical Analysis Tools and Applications

| Tool | Application |

|---|---|

| Moving Averages | Identifying trends, generating buy and sell signals |

| MACD | Measuring momentum, confirming trend direction |

| RSI | Identifying overbought and oversold conditions |

| Chart Patterns | Predicting future price movements, confirming trend direction |

| Volume Indicators | Confirming price movements, identifying potential breakouts |

Market Sentiment and Psychology

Cryptocurrency markets, like any other financial market, are driven by a complex interplay of factors, including fundamentals, technical indicators, and market sentiment. While fundamentals and technical analysis provide insights into the intrinsic value and price patterns of cryptocurrencies, market sentiment plays a crucial role in shaping short-term price fluctuations and overall market direction.

The Role of Market Sentiment

Market sentiment refers to the overall prevailing attitude or feeling among market participants towards a particular asset. In the cryptocurrency market, sentiment can range from bullish (optimistic) to bearish (pessimistic), influencing trading decisions and ultimately impacting prices. When sentiment is bullish, investors are more likely to buy, driving prices up.

Conversely, bearish sentiment leads to selling pressure, pushing prices down.

Impact of News Events, Social Media Trends, and Investor Psychology

News events, social media trends, and investor psychology can significantly influence market sentiment and, consequently, cryptocurrency prices.

News Events

Major news events, such as regulatory announcements, technological advancements, or adoption by large institutions, can trigger strong reactions in the cryptocurrency market. Positive news tends to fuel bullish sentiment, while negative news can lead to selling pressure and price declines.

For example, the announcement of a new cryptocurrency exchange listing can lead to a surge in demand and price appreciation, while news of a regulatory crackdown can cause a sell-off.

Social Media Trends

Social media platforms have become increasingly influential in shaping market sentiment, particularly in the cryptocurrency space. Online communities, forums, and social media influencers can quickly spread news, opinions, and hype, impacting trading decisions and price movements. For instance, a tweet from a prominent figure in the cryptocurrency industry can spark a rally or a sell-off, depending on the sentiment expressed.

Figuring out the value of cryptocurrencies can feel like a wild ride, constantly shifting with market sentiment and news. It’s a bit like the Peloton recall news – a sudden, unexpected event that can shake things up. Just as the Peloton recall raises questions about safety and product reliability, crypto valuations are influenced by factors like regulatory changes, adoption rates, and even broader economic trends.

Investor Psychology

Investor psychology also plays a significant role in driving market sentiment and price fluctuations. Fear, greed, and herd behavior can lead to irrational decision-making, creating bubbles and crashes. For example, during a bull market, investors may become overly optimistic, leading to a surge in prices driven by FOMO (fear of missing out).

Conversely, during a bear market, fear can lead to panic selling, exacerbating price declines.

Sentiment Analysis

Sentiment analysis is a technique used to understand and measure market sentiment by analyzing text data from various sources, including news articles, social media posts, and online forums. By identifying patterns in language and tone, sentiment analysis tools can provide insights into the prevailing sentiment towards a particular cryptocurrency or the market as a whole.

This information can be valuable for traders and investors in making informed decisions.For example, a sentiment analysis tool might identify an increase in positive sentiment surrounding a specific cryptocurrency, indicating potential bullish momentum. Conversely, a surge in negative sentiment could suggest a risk of price declines.

Sentiment analysis can also be used to track the impact of specific news events or social media trends on market sentiment.

Regulatory Landscape and Legal Considerations: Decoding Crypto Prices Understanding How Cryptocurrencies Are Valued

The cryptocurrency market, while still relatively young, is increasingly subject to government regulation and legal frameworks. These regulations aim to balance the potential benefits of cryptocurrencies with the need to protect investors, prevent financial crime, and ensure market stability.

Impact of Regulations on Cryptocurrency Valuations

Regulations can have a significant impact on cryptocurrency valuations. For example, a country’s decision to ban or restrict cryptocurrency trading can lead to a decline in the price of cryptocurrencies. Conversely, the introduction of clear and favorable regulations can boost investor confidence and drive up prices.

- Increased Transparency and Trust:Clear regulations can enhance transparency and trust in the cryptocurrency market, attracting more institutional investors and driving up valuations.

- Reduced Risk and Volatility:Regulations can help to reduce risk and volatility in the market, making it more attractive to risk-averse investors and leading to greater price stability.

- Improved Access to Capital:Regulations can facilitate access to capital for cryptocurrency businesses, leading to innovation and growth, which can positively impact valuations.

Key Legal Considerations for Investors and Traders

There are several key legal considerations for investors and traders in the cryptocurrency space:

- Taxation:Cryptocurrency transactions are subject to taxation in many jurisdictions. Investors need to understand the tax implications of buying, selling, and holding cryptocurrencies to avoid potential penalties.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations:Cryptocurrency exchanges and platforms are increasingly subject to AML and KYC regulations. Investors need to be aware of these requirements and comply with them to avoid legal issues.

- Security and Privacy:Investors need to be mindful of security risks associated with storing and trading cryptocurrencies. They should choose reputable platforms and implement strong security measures to protect their assets.

- Legal Status of Cryptocurrencies:The legal status of cryptocurrencies varies across jurisdictions. Investors need to be aware of the legal framework in their region to avoid any legal issues.

Cryptocurrency Adoption and Use Cases

The adoption of cryptocurrencies is a key driver of price appreciation. As more people and businesses use cryptocurrencies, demand increases, which can lead to higher prices. Conversely, low adoption can result in stagnant or declining prices. Understanding the relationship between adoption and price appreciation is crucial for investors and those seeking to understand the future of cryptocurrencies.

Impact of Emerging Use Cases

The emergence of new use cases for cryptocurrencies is a significant factor in their valuation. These use cases expand the potential applications of cryptocurrencies, increasing their utility and attracting new users and investors. DeFi, NFTs, and the metaverse are prominent examples of emerging use cases that are driving cryptocurrency adoption and influencing prices.

Cryptocurrency Use Cases and Their Potential Influence on Prices

The following table showcases different cryptocurrency use cases and their potential influence on prices:

| Use Case | Potential Influence on Prices |

|---|---|

| Decentralized Finance (DeFi) | DeFi applications, such as lending, borrowing, and trading, increase the demand for cryptocurrencies, potentially driving up prices. |

| Non-Fungible Tokens (NFTs) | NFTs are used to represent unique digital assets, including art, music, and collectibles. Their growing popularity can boost the demand for cryptocurrencies used to create and trade NFTs, potentially influencing prices. |

| Metaverse | The metaverse, a virtual reality world, relies heavily on cryptocurrencies for transactions and asset ownership. As the metaverse grows, the demand for cryptocurrencies within this ecosystem can drive price appreciation. |

| Payments | Cryptocurrencies are increasingly used for payments, particularly for cross-border transactions. Wider adoption of cryptocurrencies as a payment method can increase demand and potentially drive up prices. |

| Store of Value | Cryptocurrencies can serve as a store of value, similar to gold. Increased adoption as a store of value can lead to price appreciation, as investors seek to preserve their wealth. |

Risks and Challenges in Crypto Investing

Cryptocurrencies, while offering exciting investment opportunities, come with inherent risks and challenges. Understanding these risks is crucial for making informed investment decisions and mitigating potential losses. This section will delve into the key risks associated with crypto investing, including market volatility, hacking, and regulatory uncertainty.

We will also explore strategies for managing these risks and protecting your investments.

Market Volatility

Cryptocurrency markets are known for their extreme volatility. Prices can fluctuate dramatically in short periods, often driven by news events, market sentiment, and speculation. This volatility can create both opportunities and risks for investors.

- Rapid Price Fluctuations:Cryptocurrencies can experience significant price swings within a single day, making it challenging to predict future price movements.

- Market Manipulation:The relatively small market capitalization of some cryptocurrencies makes them susceptible to manipulation by large investors or coordinated groups.

- Fear, Uncertainty, and Doubt (FUD):Negative news, rumors, or events can quickly spread in the crypto space, leading to panic selling and price crashes.

Hacking and Security Risks

The decentralized nature of cryptocurrencies makes them vulnerable to hacking and security breaches.

- Exchange Hacks:Cryptocurrency exchanges, where users buy and sell digital assets, have been targeted by hackers in the past, resulting in significant losses for investors.

- Wallet Security:Private keys, which are used to access cryptocurrency wallets, are susceptible to theft or loss. If a private key is compromised, the associated cryptocurrency can be stolen.

- Smart Contract Vulnerabilities:Smart contracts, which are automated agreements stored on blockchains, can contain vulnerabilities that hackers can exploit.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is constantly evolving and varies widely across different jurisdictions. This uncertainty can create challenges for investors.

- Lack of Clear Regulations:The absence of clear and consistent regulations can lead to confusion and ambiguity, making it difficult for investors to understand their legal obligations and rights.

- Regulatory Crackdowns:Governments around the world are still grappling with how to regulate cryptocurrencies. Sudden regulatory crackdowns can have a significant impact on cryptocurrency prices.

- Tax Implications:The tax treatment of cryptocurrency investments can vary significantly from country to country, adding complexity for investors.

Future Trends and Predictions

Predicting the future of cryptocurrency is inherently challenging, but understanding current trends and emerging technologies can offer valuable insights into potential future scenarios. This section explores key factors that may shape the cryptocurrency market in the years to come, examining the potential impact of technological advancements and broader societal shifts.

Adoption and Integration

The widespread adoption of cryptocurrency is crucial for its long-term success. Increased adoption leads to greater liquidity, market stability, and price appreciation. Several factors contribute to this:

- Growing Institutional Interest:More institutional investors, including hedge funds and corporations, are entering the cryptocurrency market, bringing significant capital and credibility. This trend suggests a shift from speculative trading to a more mature investment approach.

- Increased Regulatory Clarity:Clearer regulatory frameworks around cryptocurrency in major economies will encourage more institutional and retail participation. This will enhance trust and transparency, making it easier for investors to participate.

- Expanding Use Cases:Beyond trading, cryptocurrency is being used for payments, decentralized finance (DeFi), non-fungible tokens (NFTs), and other applications. As these use cases expand, the demand for cryptocurrency will grow.

Technological Advancements

The cryptocurrency landscape is constantly evolving with new technologies and innovations. These advancements can significantly impact the valuation and future of cryptocurrencies:

- Layer-2 Scaling Solutions:Solutions like Lightning Network and Polygon aim to increase the transaction speed and efficiency of blockchains, making them more suitable for mainstream adoption.

- Interoperability:Cross-chain bridges and protocols enable communication and asset transfer between different blockchains, fostering greater interoperability and collaboration within the ecosystem.

- Decentralized Autonomous Organizations (DAOs):DAOs empower communities to make collective decisions and manage assets without centralized authority, potentially transforming how businesses and organizations operate.

- Artificial Intelligence (AI) and Machine Learning:AI and machine learning can enhance security, fraud detection, and risk management within the cryptocurrency space, potentially improving market efficiency and stability.

Potential Future Scenarios

Based on current trends and technological advancements, several possible scenarios for the future of cryptocurrency can be considered:

- Mainstream Adoption and Integration:Cryptocurrency could become a widely accepted form of payment, competing with traditional financial systems and offering a more efficient and accessible alternative.

- Decentralized Finance (DeFi) Revolution:DeFi platforms could disrupt traditional financial institutions by providing access to financial services like lending, borrowing, and trading without intermediaries.

- Rise of the Metaverse:Cryptocurrency could play a vital role in the development and operation of virtual worlds, enabling digital ownership, commerce, and governance within the metaverse.

- Regulation and Compliance:Governments and regulatory bodies may adopt more comprehensive frameworks for cryptocurrency, fostering a more secure and stable environment for investment and growth.