Chinas Economic Slowdown Weighs on Global Markets

Chinas economic slowdown weighs on global markets stocks and bonds show drift – China’s economic slowdown weighs on global markets, stocks and bonds show drift, casting a shadow over the world’s financial landscape. The slowdown, fueled by a confluence of domestic and global factors, has sent ripples across international markets, impacting supply chains, commodity prices, and investor sentiment.

As China grapples with these challenges, businesses worldwide are forced to adapt, navigating a complex web of risks and opportunities.

The slowdown’s impact on global markets is undeniable. Stock markets have witnessed volatility, particularly in sectors heavily reliant on Chinese demand. Bond markets have also shown signs of caution, with investors seeking safer havens. This economic turbulence has prompted businesses to rethink their strategies, seeking to mitigate the potential fallout while exploring avenues for growth in a changing environment.

China’s Economic Slowdown

China’s economic growth has slowed significantly in recent years, raising concerns about the global economic outlook. The slowdown is attributed to a combination of domestic and global factors, impacting global markets, supply chains, and commodity prices.

Domestic Factors Contributing to China’s Economic Slowdown

The Chinese economy faces several domestic challenges contributing to its slowdown.

- The zero-COVID policy: China’s stringent zero-COVID policy, while initially successful in containing the virus, has disrupted economic activity, particularly in manufacturing and services. Lockdowns and travel restrictions have hampered production, supply chains, and consumer spending.

- Real estate sector slowdown: The Chinese real estate sector, a significant contributor to economic growth, has experienced a slowdown due to excessive debt levels, government regulations, and declining property prices. This has impacted construction activity, employment, and consumer confidence.

- Declining investment: Investment in fixed assets, such as infrastructure and manufacturing, has slowed due to uncertainty about future economic growth and the government’s focus on reducing debt levels. This has dampened economic activity and job creation.

- Aging population: China’s rapidly aging population is putting pressure on social security systems and reducing the size of the workforce, impacting economic growth and consumption.

Global Factors Contributing to China’s Economic Slowdown

External factors also play a role in China’s economic slowdown.

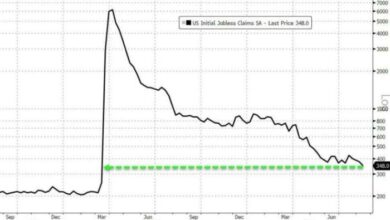

China’s economic slowdown continues to cast a shadow over global markets, with stocks and bonds exhibiting a disconcerting drift. This uncertainty is amplified by the recent market decline witnessed on Wall Street, as detailed in this article , which highlights concerns surrounding labor data and potential rate hikes.

The confluence of these factors suggests a period of volatility ahead, with investors closely monitoring both China’s economic trajectory and the Federal Reserve’s monetary policy decisions.

- Global trade tensions: The ongoing trade war between the United States and China has disrupted global supply chains and increased uncertainty for businesses. This has impacted Chinese exports and investment.

- Global economic slowdown: The global economy has experienced a slowdown due to factors such as rising inflation, supply chain disruptions, and the war in Ukraine. This has reduced demand for Chinese goods and services.

- Rising interest rates: The Federal Reserve’s aggressive interest rate hikes have strengthened the US dollar and made it more expensive for Chinese companies to borrow money. This has dampened investment and economic activity.

Impact of China’s Slowdown on Global Markets

China’s economic slowdown has had a significant impact on global markets, particularly in terms of supply chains and commodity prices.

- Supply chain disruptions: China’s slowdown has disrupted global supply chains, as many companies rely on China for manufacturing and sourcing. This has led to delays, shortages, and higher prices for goods.

- Commodity price fluctuations: China’s demand for commodities, such as oil, metals, and agricultural products, has declined due to the slowdown. This has led to price fluctuations and volatility in global commodity markets.

Comparison with Previous Slowdowns

The current economic slowdown in China differs from previous periods in several ways.

China’s economic slowdown is casting a shadow over global markets, with stocks and bonds exhibiting a cautious drift. While we navigate these uncertain times, it’s crucial to remember the importance of balancing your finances and health , as a strong foundation in both areas can help us weather any storm.

As investors assess the impact of China’s economic performance, maintaining a balanced approach to our own well-being is key to navigating the volatility and making informed decisions.

- The zero-COVID policy: The current slowdown is significantly impacted by the zero-COVID policy, which was not a factor in previous slowdowns. The policy has had a more severe impact on economic activity than previous economic shocks.

- Real estate sector: The current slowdown is characterized by a significant decline in the real estate sector, which has not been seen in previous slowdowns. The government’s efforts to curb excessive debt levels and speculation in the real estate market have contributed to this decline.

China’s economic slowdown is casting a long shadow over global markets, with stocks and bonds showing a distinct lack of direction. The uncertainty surrounding China’s economic trajectory is further compounded by the escalating crisis in Russia, as Wagner leader Yevgeny Prigozhin openly defies President Putin’s authority.

This unfolding power struggle adds another layer of volatility to an already fragile global economic landscape, making it difficult for investors to find clear paths for growth and stability.

- Global economic environment: The current slowdown is occurring in a more challenging global economic environment, with rising inflation, supply chain disruptions, and geopolitical tensions. These factors have exacerbated the impact of China’s slowdown on global markets.

Global Market Reactions: Chinas Economic Slowdown Weighs On Global Markets Stocks And Bonds Show Drift

China’s economic slowdown has sent ripples across global markets, impacting both stocks and bonds. Investors worldwide are grappling with the implications of this slowdown, which has led to increased volatility and uncertainty.

Impact on Global Stock Markets

The slowdown in China’s economy has had a significant impact on global stock markets, particularly in sectors and regions heavily reliant on Chinese demand.

- Commodities:The demand for raw materials such as iron ore, copper, and oil has declined due to China’s weaker economic growth. This has resulted in lower prices for these commodities, affecting companies involved in their production and trading.

- Luxury Goods:Chinese consumers are a significant driver of demand for luxury goods. The slowdown in China’s economy has led to reduced spending on luxury items, impacting companies in the luxury sector.

- Technology:China is a major market for technology companies, and the slowdown has impacted the growth prospects of these companies. However, some technology companies, particularly those involved in cloud computing and artificial intelligence, have continued to perform well due to the growing adoption of these technologies in China.

Performance of Global Bond Markets

The slowdown in China’s economy has also influenced global bond markets. Investors have become more risk-averse, leading to a flight to safety. This has resulted in lower yields on government bonds, particularly in developed economies like the United States and Japan.

“The slowdown in China’s economy has led to a flight to safety in global bond markets, resulting in lower yields on government bonds.”

Investor Strategies

Investors are adopting various strategies to navigate the volatility caused by China’s economic slowdown. Some are reducing their exposure to Chinese assets, while others are seeking opportunities in sectors less affected by the slowdown.

- Diversification:Investors are diversifying their portfolios to reduce exposure to any single sector or region. This involves investing in a mix of assets, including stocks, bonds, and real estate, across different countries and industries.

- Value Investing:Some investors are focusing on value investing, seeking companies with strong fundamentals and undervalued assets. This strategy aims to capitalize on potential growth opportunities as the Chinese economy recovers.

- Defensive Sectors:Investors are also seeking opportunities in defensive sectors, such as healthcare and consumer staples, which are less susceptible to economic downturns.

Implications for Businesses

China’s economic slowdown has far-reaching implications for businesses operating within its borders or with significant exposure to the Chinese market. Companies are adapting to the changing landscape, navigating both risks and opportunities presented by this evolving economic environment.

Strategies for Adapting to the Slowdown

Businesses are implementing a range of strategies to mitigate the impact of China’s economic slowdown. These strategies often involve diversifying revenue streams, optimizing operations, and exploring new market opportunities.

- Diversification:Companies are seeking to reduce their dependence on the Chinese market by expanding into other regions or diversifying their product offerings. For example, multinational corporations like Apple are increasing production in countries like India to lessen their reliance on China.

- Cost Optimization:Businesses are streamlining operations and seeking ways to reduce costs, such as renegotiating contracts with suppliers, implementing lean manufacturing techniques, and automating processes. This helps to maintain profitability amidst reduced demand.

- Market Expansion:Companies are actively exploring new markets outside of China, particularly in emerging economies with high growth potential. This includes expanding into Southeast Asia, Africa, and Latin America.

- Focus on Domestic Consumption:Businesses are increasingly targeting the domestic Chinese market, as consumer spending remains a significant driver of growth. This involves developing products and services tailored to the needs and preferences of Chinese consumers.

Risks and Opportunities

The slowdown in China’s economy presents both risks and opportunities for businesses in various sectors.

- Manufacturing:Companies in the manufacturing sector face challenges due to decreased demand, rising labor costs, and potential supply chain disruptions. However, opportunities exist in areas like automation and robotics, as businesses seek to improve efficiency and reduce labor dependence.

- Retail:The retail sector is impacted by changing consumer behavior and a shift towards online shopping. Companies need to adapt their strategies to meet the evolving needs of consumers, including investing in e-commerce platforms and developing digital marketing campaigns.

- Technology:The technology sector is experiencing a slowdown in growth, but opportunities remain in areas like artificial intelligence, cloud computing, and big data. Companies in this sector need to focus on innovation and developing solutions that meet the needs of a rapidly evolving digital economy.

- Financial Services:The financial services sector is facing challenges due to a slowing economy and increased regulatory scrutiny. However, opportunities exist in areas like wealth management, insurance, and digital banking, as Chinese consumers become increasingly sophisticated in their financial needs.

Policy Responses

Facing the economic slowdown, the Chinese government has implemented a range of policy measures to stimulate growth and stabilize the market. These policies can be categorized into monetary and fiscal measures, each aiming to address specific aspects of the economic challenges.

Monetary Policy Measures

The People’s Bank of China (PBOC), the central bank, has taken several steps to loosen monetary policy and inject liquidity into the economy. These measures include:

- Interest Rate Cuts:The PBOC has reduced benchmark interest rates, including the Loan Prime Rate (LPR) and the reserve requirement ratio (RRR), to lower borrowing costs for businesses and consumers, encouraging investment and consumption.

- Quantitative Easing (QE):The PBOC has injected liquidity into the banking system through open market operations, providing banks with more funds to lend and stimulate credit growth.

- Targeted Credit Support:The PBOC has directed banks to provide preferential lending terms to specific sectors, such as small and medium enterprises (SMEs) and infrastructure projects, aimed at supporting key industries and job creation.

Fiscal Policy Measures

The Chinese government has also implemented fiscal measures to stimulate demand and support economic activity. These measures include:

- Tax Cuts and Rebates:The government has reduced taxes for businesses and individuals, particularly for SMEs and those in industries impacted by the slowdown, to boost their profitability and spending.

- Increased Government Spending:The government has increased spending on infrastructure projects, such as roads, railways, and airports, to create jobs and stimulate economic activity.

- Targeted Fiscal Support:The government has provided financial assistance to specific sectors, such as agriculture and tourism, to help them overcome the challenges posed by the slowdown.

Effectiveness of Policy Measures

The effectiveness of these policies in stimulating economic growth and stabilizing the market has been mixed. While some measures, such as interest rate cuts and increased government spending, have shown positive results, others, such as targeted credit support, have faced challenges in reaching their intended beneficiaries.

The effectiveness of these policies has been further hampered by external factors, such as the ongoing trade war with the United States and the global economic slowdown. These factors have created uncertainties in the global economy and dampened investor confidence, making it challenging for China to achieve its economic growth targets.

Long-Term Implications of Policy Measures, Chinas economic slowdown weighs on global markets stocks and bonds show drift

The long-term implications of these policies for the Chinese economy remain uncertain. While the policies have provided short-term support to the economy, their sustainability and potential impact on long-term growth require further analysis.Some economists argue that the government’s focus on short-term stimulus measures may lead to increased debt levels and financial risks.

Others argue that the policies have provided a necessary buffer against the economic slowdown and have laid the foundation for future growth.The long-term implications of these policies will depend on various factors, including the effectiveness of structural reforms, the pace of technological innovation, and the global economic environment.

The Chinese government will need to carefully monitor the impact of these policies and adjust them as needed to ensure sustainable and inclusive economic growth in the long term.

Outlook for the Future

The current economic slowdown in China has sparked concerns about its potential impact on the global economy. While the short-term implications are evident, the long-term outlook remains uncertain. Experts and analysts are closely monitoring the situation, offering various perspectives on the duration and severity of the slowdown and its broader implications.

The Duration and Severity of China’s Economic Slowdown

The duration and severity of China’s economic slowdown depend on various factors, including the effectiveness of government policies, global economic conditions, and the trajectory of the pandemic. Experts offer a range of forecasts, with some suggesting a short-term dip followed by a rebound, while others predict a more protracted slowdown.

- Short-term dip followed by rebound:This view emphasizes the Chinese government’s ability to stimulate the economy through targeted policies, including infrastructure spending, tax cuts, and easing monetary policy. The argument also highlights the inherent resilience of the Chinese economy, driven by strong domestic demand and a robust manufacturing sector.

For instance, China’s recent economic data, particularly industrial production and retail sales, show signs of improvement, indicating a potential rebound in the coming months.

- Protracted slowdown:This perspective highlights the structural challenges facing the Chinese economy, including an aging population, rising debt levels, and a slowdown in productivity growth. Furthermore, the global economic environment, marked by rising inflation and geopolitical tensions, adds further uncertainty. This view suggests that a sustained recovery may be more challenging, requiring fundamental reforms to address these structural issues.

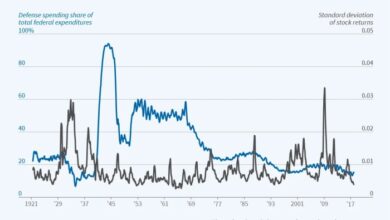

Impact on the Global Economic Outlook

China’s economic performance has a significant impact on the global economy. The country is a major trading partner for many nations, and its slowdown could dampen global demand, particularly for commodities and manufactured goods. The impact could be felt across various sectors, from energy and agriculture to manufacturing and services.

- Reduced demand for commodities:China is a major importer of commodities, including oil, iron ore, and copper. A slowdown in its economy could lead to reduced demand for these commodities, impacting prices and the profitability of commodity-producing nations.

- Slower growth in global trade:China’s economic slowdown could lead to a decline in global trade, as businesses reduce their exports to China and global supply chains adjust to the new reality. This could have a negative impact on countries that rely heavily on exports to China.

- Financial market volatility:China’s economic slowdown could lead to increased volatility in global financial markets, as investors reassess their exposure to Chinese assets and adjust their portfolios. This could impact the value of currencies, stocks, and bonds.

Key Factors Influencing China’s Economic Recovery

The trajectory of China’s economic recovery will be influenced by a range of factors, including government policies, global economic conditions, and the evolution of the pandemic. Understanding these factors is crucial for predicting the future course of the Chinese economy.

- Government policies:The effectiveness of government policies, particularly in stimulating domestic demand and supporting key industries, will play a crucial role in shaping the recovery. The government’s ability to manage debt levels and address structural issues will also be important.

- Global economic conditions:The global economic environment will also have a significant impact on China’s recovery. A strong global economy would provide a supportive backdrop for Chinese growth, while a weakening global economy could pose further challenges.

- The pandemic:The course of the pandemic, including the emergence of new variants and the effectiveness of vaccination efforts, will continue to influence economic activity in China and globally.