[ad_1]

Financial institutions, including banks, could pool their resources to ensure cash access is maintained, Reserve Bank governor Michele Bullock has said.

Speaking at a payments summit on Tuesday morning, Ms Bullock said the central bank was focussed on ensuring individuals and business could continue accessing physical notes and coins, as distribution services become increasingly financially unviable, and the share of payments made in cash plummets.

“The RBA places a high priority on the community continuing to have reasonable access to cash withdrawal and deposit services,” Ms Bullock said.

“These discussions are ongoing, and industry, regulators and government will need to continue to work together to put in place sustainable arrangements for cash distribution.”

Governor Bullock said a utility model, where multiple entities like banks, could combine to provide wholesale cash distribution services was one possible solution.

“It may be worth exploring the merits of a cooperative model in Australia,” she said.

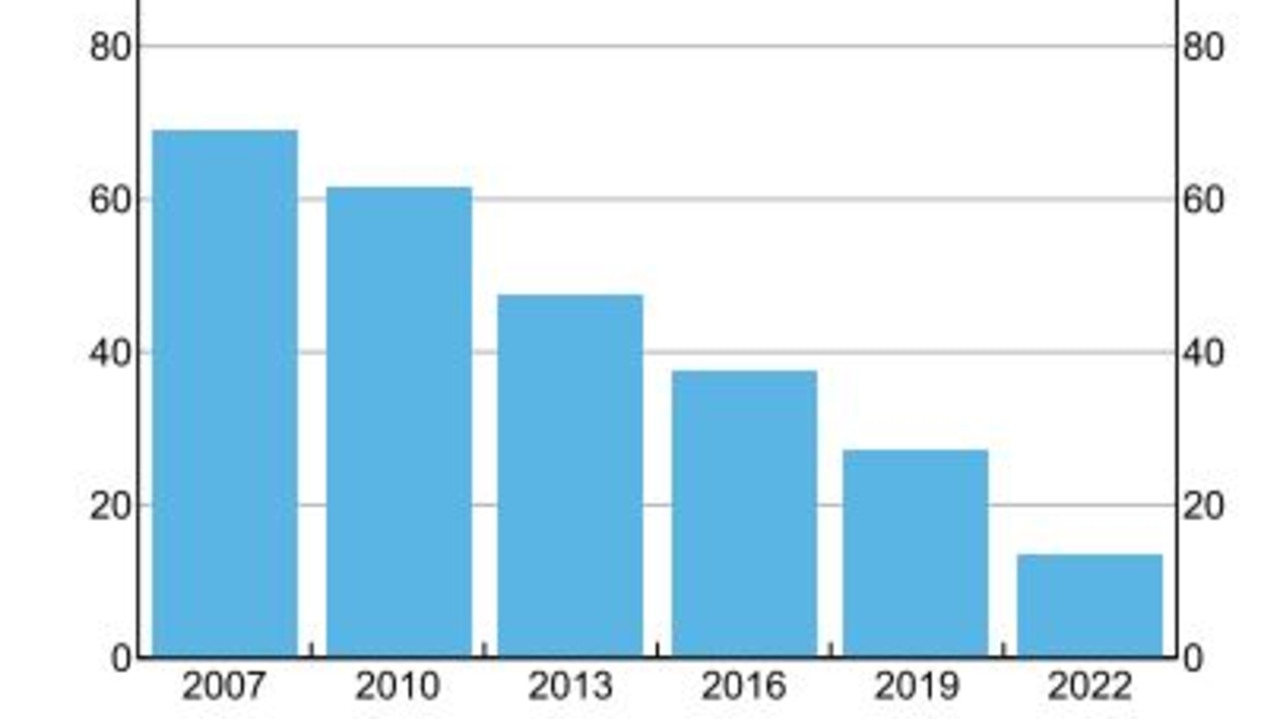

Recent analysis authored by central bank officials found that cash usage had halved in the past three years, with its decline accelerated by the Covid-19 pandemic.

In 2019, the share of consumers’ transactions paid in cash was 27 per cent, but by 2019, this figure had fallen to just 13 per cent.

Across all demographic groups, cash use had fallen, the analysis showed, although declines were most pronounced among those who traditionally use cash more frequently, including the elderly, those in regional areas and people on low incomes.

The continued decline in the use of cash is also reducing the number of access points available for consumers to withdraw it.

Figures released by the Australian Prudential Regulation Authority show the number of ATMs across Australia fell from 13,814 in 2017 to 6412 in June 2022.

The significant financial losses faced by the nation’s largest cash distributor, Armaguard, has brought the challenges of maintaining cash access into sharp focus in recent months.

Despite enjoying near-monopolistic conditions in the industry after it merged with its former rival Prosegur earlier this year, Armaguard has struggled to remain financially viable and has sought a $50 million capital injection to ensure it maintains its operations.

“Despite the merger having taken place as proposed, Linfox Armaguard is now indicating that its cash-in-transit business continues to be unsustainable,” Ms Bullock told the summit.

Armaguard is accumulating significant losses and is forecasting a $190 million cash deficit in the next three years.

In late November, the Australian Banking Association separately filed an urgent application to the competition watchdog to enable the banks to negotiate on a joint resolution to the growing challenges of distributing tender around the country.

Ms Bullock said the RBA had recently convened a roundtable of stakeholders and industry participants, however its work is ongoing.

The RBA also wants the finance industry to ensure “a broad coverage of ATMs at reasonable prices, particularly in regional and remote areas,” Ms Bullock said.

A Senate committee probing rural banking closures is currently examining cash accessibility in regional areas.

“We will continue to engage with industry participants to determine whether any changes are required to the RBA’s regulation of the ATM industry to facilitate this,” she said.

[ad_2]