Asian Stock Markets: Mixed Performance Amid US Inflation and Chinas Data

Asian stock markets mixed performance amid us inflation and chinas economic data – Asian stock markets experienced a mixed performance recently, navigating a complex landscape of rising US inflation, fluctuating interest rates, and mixed economic signals from China. This dynamic environment presents both opportunities and challenges for investors seeking exposure to the region.

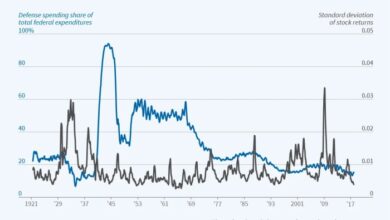

The global economic backdrop has been marked by volatility, with the US Federal Reserve aggressively raising interest rates to combat inflation. This has had a ripple effect on Asian markets, impacting currency valuations and investor sentiment. Meanwhile, China’s economic data has shown signs of weakness, raising concerns about the country’s growth trajectory.

The interplay of these factors has created a challenging environment for investors to assess.

Global Market Context

The global economic environment is currently characterized by a complex interplay of factors, including persistent inflation, rising interest rates, and geopolitical tensions. These forces are shaping market sentiment and influencing investment decisions across the globe.

Asian stock markets are experiencing a mixed performance today, grappling with the ongoing impact of US inflation and China’s economic data. Adding to the uncertainty is the news that gas prices are surging again , impacting consumers and economic sentiment.

This could further dampen investor confidence, as rising energy costs put pressure on household budgets and businesses alike. The overall picture remains volatile, with investors closely monitoring these developments and their potential impact on global growth prospects.

Impact of US Inflation on Global Markets

US inflation has remained stubbornly high, exceeding expectations and prompting the Federal Reserve to aggressively raise interest rates. This has a significant impact on global markets, as investors grapple with the implications of higher borrowing costs and potential economic slowdown.

- Higher Borrowing Costs:Rising interest rates increase the cost of borrowing for businesses and consumers, potentially dampening economic activity and corporate earnings.

- Stronger Dollar:As the Fed raises interest rates, the US dollar tends to appreciate, making it more expensive for companies in other countries to repay their dollar-denominated debts and potentially impacting their profitability.

- Market Volatility:The uncertainty surrounding inflation and interest rate hikes can lead to increased market volatility, as investors adjust their portfolios to navigate the changing economic landscape.

Impact of Rising US Interest Rates on Asian Markets

The rise in US interest rates has a direct impact on Asian markets, as investors seek higher returns in the US, leading to capital outflows from the region.

- Capital Outflows:Investors may shift their funds from Asian markets to US markets, seeking higher returns on US Treasury bonds or other assets.

- Currency Depreciation:As capital flows out of Asian markets, their currencies may depreciate against the US dollar, potentially impacting the competitiveness of local businesses and eroding the purchasing power of consumers.

- Economic Growth Concerns:Higher interest rates in the US can slow down economic growth in Asia, as businesses face higher borrowing costs and consumer spending may be affected.

Asian Stock Market Performance

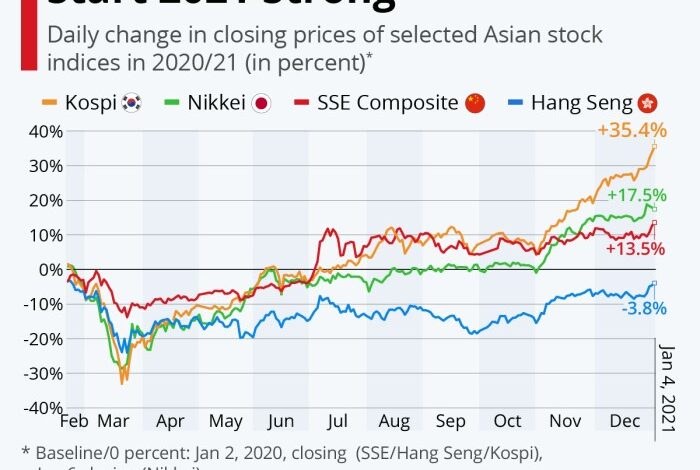

Asian stock markets exhibited a mixed performance this week, reflecting a complex interplay of global economic uncertainties and regional factors. While some markets experienced gains, others saw declines, underscoring the diverse dynamics at play across the region.

Performance of Major Asian Markets

The performance of major Asian markets varied significantly, with China and India emerging as the standout performers.

- China:The Shanghai Composite Index gained over 2% this week, buoyed by positive economic data, including a strong rebound in industrial production and retail sales. The government’s continued support for the property sector also contributed to investor optimism.

- India:The benchmark Nifty 50 index climbed over 1% this week, driven by robust corporate earnings and positive investor sentiment. The Indian economy continues to demonstrate resilience, with strong growth prospects in the coming quarters.

- Japan:The Nikkei 225 index closed slightly lower this week, weighed down by a stronger yen and concerns about slowing global economic growth. However, the Japanese market remains relatively resilient, supported by the Bank of Japan’s accommodative monetary policy.

- South Korea:The Kospi index ended the week with a modest decline, impacted by rising inflation and geopolitical tensions. The semiconductor sector, a key driver of the South Korean economy, faced headwinds from slowing global demand.

Key Sectors Driving Performance

Several sectors played a significant role in shaping the performance of Asian markets this week.

- Technology:The technology sector experienced mixed performance, with some companies benefiting from the continued adoption of artificial intelligence and cloud computing, while others faced headwinds from slowing global demand.

- Consumer Discretionary:The consumer discretionary sector, which includes retailers and travel companies, showed signs of recovery, driven by the reopening of economies and increased consumer spending.

- Energy:The energy sector remained strong, benefiting from elevated oil prices and the global energy crisis.

- Financials:The financial sector exhibited mixed performance, with some banks benefiting from rising interest rates, while others faced challenges from economic uncertainty.

China’s Economic Data

China’s economic data continues to be a key driver of sentiment in Asian markets. Recent releases have provided mixed signals, with some indicators suggesting resilience while others point to ongoing challenges.

Asian stock markets are showing a mixed performance today, with investors grappling with the latest US inflation data and China’s economic reports. While the global economic outlook remains uncertain, there’s a fascinating parallel in the world of sports, where the Indian Premier League (IPL) is a powerhouse of financial success.

The money game of Indian cricket, how IPL scores big in finances , demonstrates how a well-managed and exciting sporting event can generate significant revenue. The IPL’s success, much like the performance of Asian stock markets, depends on a delicate balance of factors – strong brand appeal, a passionate audience, and smart financial management.

GDP Growth, Asian stock markets mixed performance amid us inflation and chinas economic data

China’s GDP growth in the second quarter of 2023 came in at 6.3%, exceeding expectations. This robust growth was driven by a rebound in consumer spending and investment activity. However, it’s important to note that this growth rate is still lower than the pre-pandemic levels.

- The services sector, which accounts for a significant portion of the Chinese economy, grew at a faster pace than the industrial sector, reflecting a shift in consumer spending patterns.

- Investment activity also showed signs of improvement, driven by government infrastructure projects and private sector investment in areas such as renewable energy.

Inflation

China’s inflation rate remains relatively low, with the consumer price index (CPI) rising by 2.5% in July 2023. This low inflation rate provides some breathing room for the central bank to maintain a supportive monetary policy.

- However, there are concerns that food prices could rise in the coming months due to extreme weather events and supply chain disruptions.

- The producer price index (PPI), which measures inflation at the factory gate, has been declining for several months, indicating weak demand in the manufacturing sector.

Trade Figures

China’s trade surplus narrowed in July 2023, reflecting weaker global demand and a slowdown in exports. While imports also declined, the rate of decline was less pronounced than that of exports.

- This suggests that domestic demand remains relatively strong, despite the challenging global economic environment.

- However, the slowdown in exports raises concerns about the sustainability of China’s economic growth, particularly as global demand weakens.

Impact on Asian Markets

China’s economic performance has a significant impact on Asian markets, given its role as the region’s largest economy. Strong economic growth in China typically leads to higher demand for goods and services from other Asian countries, boosting their exports and supporting their economies.

Asian stock markets are navigating a choppy sea of mixed performance, caught between the waves of US inflation and China’s economic data. The uncertainty surrounding the global economy is further amplified by the recent revelations about the US Federal Reserve’s covert stress testing and the impact of Bidenomics, as detailed in this article.

These developments, along with the evolving geopolitical landscape, add another layer of complexity to the already volatile market conditions, making it difficult to predict the future trajectory of Asian equities.

- However, the recent slowdown in China’s exports has raised concerns about the potential for spillover effects on other Asian economies.

- The ongoing zero-COVID policy continues to weigh on sentiment in Asian markets, as it creates uncertainty about the future trajectory of China’s economy.

Impact of Zero-COVID Policy

China’s zero-COVID policy has had a significant impact on its economy and markets. The strict lockdowns and travel restrictions have disrupted supply chains, weighed on consumer spending, and slowed down economic activity.

- While the government has eased some restrictions in recent months, the policy remains in place, creating uncertainty for businesses and investors.

- The ongoing lockdowns and travel restrictions are also a major source of concern for foreign investors, who are hesitant to invest in China due to the unpredictable nature of the policy.

Investor Sentiment and Market Outlook

Investor sentiment towards Asian markets remains cautious, reflecting a complex interplay of global economic uncertainties and regional growth prospects. While some investors are optimistic about the long-term growth potential of the region, others remain concerned about the near-term headwinds.

Factors Influencing Investor Decisions

Investor decisions are driven by a combination of factors, including risk appetite, market expectations, and macroeconomic data.

- Risk Appetite: Investors’ willingness to take on risk is influenced by global economic conditions, geopolitical tensions, and market volatility. A heightened risk aversion can lead to capital outflows from emerging markets, including Asia. Conversely, a strong risk appetite can attract investments to the region.

- Market Expectations: Investors’ expectations about future economic growth, corporate earnings, and interest rate policies play a crucial role in their investment decisions. Positive expectations can drive stock prices higher, while negative expectations can lead to market declines.

- Macroeconomic Data: Economic indicators such as inflation, GDP growth, and unemployment rates provide insights into the health of economies and influence investor sentiment. Strong economic data can boost investor confidence, while weak data can dampen sentiment.

Outlook for Asian Stock Markets

The outlook for Asian stock markets is mixed, with both short-term and long-term considerations influencing investor sentiment.

- Short-Term Outlook: In the short term, Asian stock markets face headwinds from global inflation, rising interest rates, and geopolitical uncertainty. However, some sectors, such as technology and consumer discretionary, may benefit from the region’s growing middle class and digitalization. For example, the rise of e-commerce in Southeast Asia has driven strong growth in tech companies, attracting significant investment.

- Long-Term Outlook: In the long term, Asia’s strong economic growth potential, growing middle class, and increasing urbanization present significant opportunities for investors. The region’s long-term growth story is supported by factors such as demographic trends, rising incomes, and government infrastructure investments.

For instance, China’s Belt and Road Initiative has stimulated infrastructure development across Asia, creating opportunities for businesses and investors.

Key Market Drivers and Challenges: Asian Stock Markets Mixed Performance Amid Us Inflation And Chinas Economic Data

The performance of Asian stock markets is influenced by a complex interplay of economic, political, and global factors. While robust economic growth and corporate earnings drive positive sentiment, challenges like inflation, supply chain disruptions, and geopolitical tensions pose significant risks.

Understanding these drivers and challenges is crucial for investors seeking to navigate the Asian markets effectively.

Economic Growth and Corporate Earnings

Economic growth is a key driver of stock market performance. When economies grow, businesses tend to perform better, leading to higher earnings and stock valuations. Asian economies have historically shown strong growth, driven by factors such as a large and growing middle class, increasing urbanization, and rising investment in infrastructure.

However, recent global economic slowdown and rising inflation have slowed down economic growth in the region.

- China, the world’s second-largest economy, has been a major driver of Asian growth. However, its economic growth has slowed in recent years due to factors such as the COVID-19 pandemic, a property market slowdown, and government policies aimed at reducing debt levels.

- India, on the other hand, has emerged as a bright spot in the region, with strong growth driven by its large and young population, increasing consumption, and government reforms.

- Southeast Asiahas also seen strong economic growth, driven by rising exports and domestic consumption. However, the region is facing challenges from the global economic slowdown and rising inflation.

Corporate earnings are another key driver of stock market performance. When companies generate strong earnings, investors are more likely to invest in their stocks, driving up prices. Asian companies have generally been able to maintain strong earnings growth in recent years, but rising inflation and supply chain disruptions are posing challenges to future earnings growth.

Inflation and Supply Chain Disruptions

Inflation is a major challenge facing Asian markets. Rising prices for goods and services can erode corporate profits and reduce consumer spending, leading to slower economic growth. The ongoing global supply chain disruptions have exacerbated inflation, as businesses struggle to obtain raw materials and components at reasonable prices.

- China’s zero-COVID policyhas disrupted global supply chains, as lockdowns and travel restrictions have hampered production and transportation.

- The war in Ukrainehas also disrupted supply chains, particularly for energy and food.

- Rising energy priceshave also added to inflationary pressures.

The impact of inflation on Asian markets is significant. For example, the rising cost of raw materials and energy has led to higher prices for consumers in India, which has slowed down consumer spending and impacted economic growth.

Geopolitical Tensions

Geopolitical tensions are another significant challenge facing Asian markets. The ongoing trade war between the US and China, the territorial disputes in the South China Sea, and the growing tensions between North Korea and the US all pose risks to economic stability and investor confidence.

- The US-China trade warhas led to tariffs on goods traded between the two countries, disrupting supply chains and increasing costs for businesses.

- The territorial disputes in the South China Seahave raised concerns about potential military conflict, which could disrupt trade and investment in the region.

- North Korea’s nuclear programhas also been a source of geopolitical instability in the region, raising concerns about the potential for conflict.

Geopolitical tensions can lead to increased market volatility and make investors hesitant to invest in Asian markets.