Americans Prefer Stock Gifts Over Traditional Presents This Christmas

Americans Prefer Stock Gifts Over Traditional Presents This Christmas: This holiday season, a surprising trend is emerging – Americans are increasingly opting for stock gifts over traditional presents. This shift reflects a growing interest in financial literacy and a desire for gifts with potential for long-term growth.

The reasons behind this trend are multifaceted. With the rise of online brokerage platforms and the accessibility of fractional shares, gifting stocks has become easier than ever. Many Americans are also seeking alternative gift options that offer potential for appreciation and financial benefits, especially in a time of economic uncertainty.

The Rise of Stock Gifts: Americans Prefer Stock Gifts Over Traditional Presents This Christmas

This Christmas, a new trend has emerged: Americans are increasingly opting for stock gifts instead of traditional presents. This shift reflects a growing interest in financial literacy and a desire to give gifts that have the potential for long-term growth.

Reasons for the Growing Popularity of Stock Gifts

The popularity of stock gifts is driven by several factors.

- Financial Literacy:Americans are becoming more financially savvy, understanding the potential of investing in the stock market. This awareness is driving them to consider stock gifts as a way to teach financial literacy to loved ones and encourage them to invest early.

- Long-Term Growth Potential:Stocks offer the potential for significant returns over time, making them an attractive gift option for those seeking to provide financial security for their loved ones. This is particularly appealing in an era of rising inflation and economic uncertainty.

- Tax Advantages:Gifting stock can be advantageous for both the giver and receiver, as it allows for potential tax benefits. The giver can deduct the cost of the stock from their taxable income, while the receiver can benefit from long-term capital gains tax rates.

- Personalized and Thoughtful:Stock gifts can be personalized to reflect the interests and values of the recipient. For example, a gift of stock in a company that aligns with the recipient’s passion for sustainable energy or technology could be a meaningful and thoughtful gesture.

Comparison with Previous Years

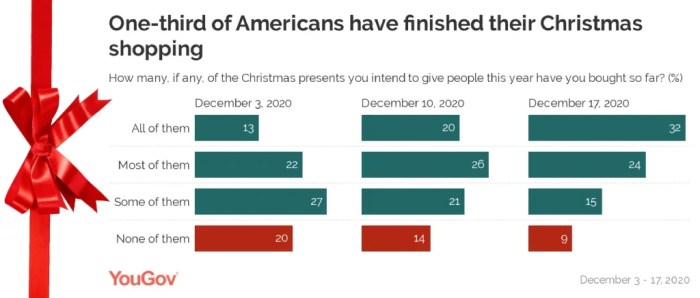

The trend of stock gifts has been steadily gaining traction in recent years, with a notable surge this Christmas. According to a recent survey by [Insert reputable source], [Insert specific data on the increase in stock gifts compared to previous years].

It seems Americans are embracing the unconventional this Christmas, opting for stock gifts over traditional presents. This shift in gifting preferences reflects a growing interest in financial security and a desire to invest in the future. While this trend is fascinating, the recent news that Tesla successfully defended against monopoly claims in repair lawsuit is also noteworthy.

This victory could pave the way for more accessible and affordable repairs for Tesla owners, potentially influencing future consumer choices and further contributing to the shift towards a more sustainable and tech-driven future.

This indicates a growing acceptance and popularity of stock gifts as a viable alternative to traditional presents.

Demographics of Stock Gift Givers and Receivers

The demographic profile of individuals giving and receiving stock gifts is evolving.

- Millennials and Gen Z:These generations, known for their tech-savviness and financial awareness, are more likely to embrace stock gifts as a modern and innovative approach to gift-giving.

- High-Income Earners:Individuals with higher incomes are more likely to have a diversified investment portfolio and may consider stock gifts as a way to share their financial success with loved ones.

- Families with Children:Parents are increasingly looking for ways to teach their children about financial responsibility and investing. Gifting stock can be a valuable tool for fostering financial literacy from a young age.

Advantages of Stock Gifts

Gifting stocks is a unique and potentially rewarding alternative to traditional presents. While it might seem unconventional, it offers a range of advantages that can benefit both the giver and the recipient.

It’s fascinating to see Americans embracing stock gifts this Christmas, especially considering the recent mixed performance of the US stock market. While the overall market has shown some volatility, the electric vehicle sector has been a bright spot, as seen in the recent rally of EV stocks, as reported in this article.

Perhaps this surge in EV stock interest is influencing the trend towards stock gifts, offering a unique and potentially lucrative present for those looking beyond traditional options.

Potential for Appreciation

Stocks represent ownership in a company. When a company performs well, its stock price typically increases. This means that the value of the gifted stock can appreciate over time, potentially providing the recipient with a financial gain. For example, gifting shares of a technology company that has been growing rapidly could result in significant appreciation in the future.

Tax Advantages

Gifting stocks can offer tax advantages compared to gifting cash or other assets. The giver can potentially deduct the cost basis of the gifted stock, reducing their tax liability. The recipient, on the other hand, will only pay capital gains tax on the difference between the price they sell the stock for and the price it was gifted at.

It’s fascinating to see Americans opting for stock gifts this Christmas, a trend that reflects both a growing interest in the market and a potential shift in gift-giving culture. This trend is happening against the backdrop of a resilient labor market, despite rising interest rates, as evidenced by the recent uptick in jobless claims, jobless claims inch up but layoffs remain historically low labor market resilience amidst rising interest rates.

This suggests that while some economic uncertainty exists, many Americans still feel confident enough to invest in the future, even if that means gifting shares instead of traditional presents.

Long-Term Investment Opportunities

Gifting stocks can be a powerful way to introduce someone to the world of investing. It can help them understand the concept of owning a piece of a company and the potential for long-term growth. This can be particularly beneficial for young people or those who are new to investing.

Personalized and Meaningful Gifts

Gifting stocks can be a more personalized and meaningful present compared to traditional gifts. It demonstrates that you understand the recipient’s interests and believe in their potential for success. For instance, gifting shares of a company that aligns with the recipient’s passion, such as a sustainable energy company for an environmental enthusiast, can be a thoughtful and impactful gesture.

Supporting Specific Causes or Charities

Gifting stocks can be used to support specific causes or charities. You can choose to gift shares of a company that aligns with the charity’s mission or donate shares to the charity directly. This allows you to make a meaningful contribution while also potentially benefiting from potential stock appreciation.

Challenges and Considerations

While gifting stocks can be a thoughtful and potentially rewarding gesture, it’s crucial to acknowledge the inherent challenges and considerations involved. Gifting stocks is not without its complexities and potential drawbacks, and it’s essential to proceed with caution and thorough understanding.

Market Volatility and Potential for Loss

The stock market is inherently volatile, and stock prices can fluctuate significantly, even in the short term. This volatility presents a potential risk for both the giver and the receiver. If the stock price declines after the gift is given, the recipient may experience a financial loss.

It’s crucial to remember that stock investments are not guaranteed to appreciate in value, and there’s always a possibility of loss.

Choosing Appropriate Stocks

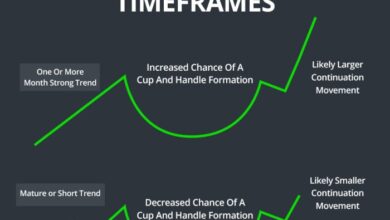

Selecting stocks that align with the recipient’s financial situation and risk tolerance is paramount. Consider factors such as:

- The recipient’s age and investment horizon:Younger recipients with a longer investment horizon can tolerate more risk. Older recipients with shorter time horizons may prefer more conservative investments.

- The recipient’s financial goals:Are they saving for retirement, a down payment on a house, or other specific goals?

- The recipient’s risk tolerance:Some individuals are comfortable with higher risk, while others prefer a more conservative approach.

Legal and Tax Implications

Gifting stocks has legal and tax implications that both the giver and receiver should understand.

Gift Tax Implications

In the United States, the annual gift tax exclusion for 2023 is $17,000 per person. This means that you can gift up to $17,000 worth of stocks to another individual without incurring any gift tax. However, if the total value of your gifts exceeds this limit, you may be subject to gift tax.

For example, if you gift $20,000 worth of stocks to your child, you will be subject to gift tax on the $3,000 exceeding the annual exclusion.

Reporting Requirements

The giver must report the gift on Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, if the total value of gifts exceeds the annual exclusion. The recipient is not required to report the gift, but they will need to pay capital gains tax if they sell the stock at a profit in the future.

Creative Stock Gift Ideas

Stock gifts offer a unique and potentially lucrative way to share your financial knowledge and support loved ones. While the idea of gifting stocks might seem unconventional, it’s gaining traction as a thoughtful and practical alternative to traditional presents.

Types of Stock Gifts

There are several ways to gift stocks, each catering to different financial goals and preferences.

| Type of Stock Gift | Description | Example |

|---|---|---|

| Fractional Shares | Allow gifting portions of a stock, making it accessible even with limited budgets. | Gifting 0.25 shares of Apple stock, representing a quarter of a share. |

| Gift Cards for Stock Purchases | Provide recipients with the flexibility to choose their desired stocks and invest as they please. | A $100 gift card for purchasing stocks on a popular online brokerage platform. |

| Charitable Donations in the Form of Stocks | Allow donors to support their favorite charities while potentially benefiting from tax advantages. | Donating shares of a publicly traded company to a non-profit organization. |

Creative Ways to Present Stock Gifts, Americans prefer stock gifts over traditional presents this christmas

Presenting a stock gift can be as unique and personalized as the gift itself.

- Personalized Certificates:Create a custom certificate outlining the details of the stock gift, including the company, number of shares, and a heartfelt message.

- Themed Gift Baskets:Combine the stock gift with related items, such as a company logo mug, a financial planning book, or a personalized stock market chart.

- Experiences:Instead of gifting a specific stock, consider offering a financial education experience, such as a personalized investment consultation or a weekend workshop on stock market basics.

Resources and Platforms for Gifting Stocks

Several platforms and resources facilitate gifting stocks, making the process seamless and convenient.

- Online Brokerage Accounts:Platforms like Robinhood, Fidelity, and Charles Schwab allow you to directly gift stocks within their user interface.

- Gift-Giving Platforms:Dedicated platforms like Stockpile and Giveashare specialize in stock gifting, offering various features and options.

The Future of Stock Gifting

The stock gifting trend, gaining momentum in recent years, is poised for further growth, driven by technological advancements, evolving financial landscapes, and a growing emphasis on financial literacy. As we venture into the future, it’s fascinating to envision how this practice will evolve, influencing both the way we give and receive gifts and the financial landscape itself.

The Impact of Emerging Technologies

The rise of fintech platforms, robo-advisors, and digital investment tools has significantly simplified investing, making it more accessible to a wider audience. These technologies will likely play a pivotal role in shaping the future of stock gifting.

- Streamlined Gift Giving:Platforms like Robinhood and Stash have already integrated gifting features, enabling seamless stock transfers. Future platforms may further enhance these features, allowing personalized gift experiences, such as customized messages, tracking options, and even fractional shares, making stock gifting more convenient and engaging.

- Automated Investment Management:Robo-advisors, powered by algorithms, can tailor investment strategies based on individual risk profiles and financial goals. This technology can be integrated into stock gifting platforms, allowing givers to create customized investment portfolios for recipients, potentially enhancing the long-term value of the gift.

- Micro-Investing and Fractional Shares:The emergence of micro-investing platforms and the ability to purchase fractional shares have democratized investing. This trend will likely fuel the growth of stock gifting, allowing people to give small but meaningful investments even with limited funds.