Affordable Insurance Options in Texas

Insurance is essential for everyone, and it is equally important to ensure that you have affordable options that fit your budget. Texas residents have access to a variety of affordable insurance options, including health, car, and home insurance.

One of the most significant concerns for Texans when it comes to insurance is the cost. However, there are many ways to ensure that you get the coverage you need without breaking the bank.

Let’s explore some affordable insurance options available in Texas:

Health Insurance

Health insurance is one of the most critical types of insurance you can have, as it offers protection against high medical bills, which can quickly pile up and lead to financial ruin. Here are a few affordable health insurance options in Texas:

Medicaid

Medicaid is a government-funded insurance program that provides free or low-cost coverage to low-income adults, children, pregnant women, and people with disabilities. In Texas, Medicaid is available to those with an income at or below 138% of the federal poverty level.

CHIP

The Children’s Health Insurance Program (CHIP) is designed to provide free or low-cost health coverage to children in families that earn too much to qualify for Medicaid but cannot afford private insurance. In Texas, CHIP is available to children up to age 19 from families with income up to 200% of the federal poverty level.

ACA Marketplace Plans

The Affordable Care Act (ACA) Marketplace offers a variety of health insurance plans to individuals and families. While the cost of these plans varies depending on your income and where you live, many Texans qualify for tax credits that can make health insurance more affordable.

Car Insurance

Car insurance is mandatory in Texas, and driving without it can result in hefty fines, legal charges, and even license suspension. However, car insurance does not have to cost a fortune, and there are affordable options available.

Liability Coverage

Liability coverage is the minimum required insurance in Texas, and it covers damages you may cause in an accident to other people’s property or injuries. This type of coverage is relatively cheap, and it is an excellent option for those on a tight budget.

Usage-based Insurance

Usage-based insurance programs track your driving and offer discounts based on your behavior, such as driving less or following traffic rules. This type of car insurance can be an excellent way to save money while still providing enough coverage for your needs.

Home Insurance

Home insurance can be a lifesaver if your home is damaged due to unforeseen circumstances such as natural disasters or burglaries. Luckily, there are affordable home insurance options available to Texans.

Bundle Insurance

Bundling insurance means buying two or more insurance policies from the same insurance company. Many insurers offer discounts for customers who bundle their home and car insurance, which can save you money in the long run.

Home Security Discounts

Some insurers offer discounts for homeowners who have home security systems or smoke detectors installed in their homes. These discounts can help reduce the cost of your home insurance premium.

Overall, Texas residents have access to numerous affordable insurance options. By doing some research and comparing different policies, you can find the right insurance for your needs and budget.

Factors that influence insurance rates in Texas

When it comes to car insurance rates in Texas, there are a lot of factors that can impact the amount you pay each month or year. Understanding these factors can help you make informed decisions when it comes to choosing an insurance policy, and also provide insight into what makes certain rates higher or lower than others. Here are some of the main factors that influence insurance rates in Texas:

1. Driving Record

Your driving record is one of the biggest factors that insurance companies look at when determining your rates. If you have a history of speeding tickets, accidents, and other driving violations, then you will likely be considered a higher risk for the insurance company and may end up paying more as a result. On the other hand, if you have a clean driving record with no accidents or tickets, then you may be eligible for discounts and lower rates.

2. Your Age, Gender, and Marital Status

Your demographic information can also play a role in determining your insurance rates. For example, young drivers under the age of 25 are generally considered higher risk and may have higher rates as a result. Similarly, male drivers are often considered higher risk than female drivers, and unmarried drivers may also face higher rates than those who are married. While you can’t necessarily change these factors, it’s important to be aware of them when shopping for insurance.

3. Type of Vehicle

The type of vehicle you drive can also impact your insurance rates. Sports cars and high-end luxury vehicles are generally considered to be higher risk and may have higher rates as a result. On the other hand, more practical cars like minivans and sedans may have lower rates. When buying a car, it’s a good idea to consider the impact it may have on your insurance rates before making a decision.

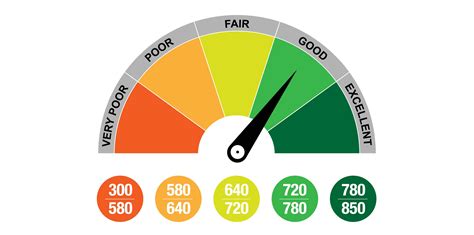

4. Credit Score

Believe it or not, your credit score can also play a role in your insurance rates. Studies have shown that people with better credit scores tend to file fewer insurance claims, which means they are seen as lower risk by insurance companies and may have lower rates as a result. If you have a poor credit score, you may end up paying more for insurance than someone with a higher score.

5. Location

Finally, where you live can also impact your insurance rates. If you live in an area with high crime rates or a lot of traffic accidents, then you may have higher rates as a result. Similarly, if you live in an area prone to natural disasters like hurricanes or tornadoes, then you may have higher rates to account for the added risk. When moving to a new area, it’s a good idea to research what the average insurance rates are to avoid any surprises.

By understanding these factors that influence insurance rates in Texas, you can make more informed decisions when it comes to choosing a policy and also take steps to potentially lower your rates. Whether it’s improving your driving record, shopping around for different policies, or choosing a different type of vehicle, there are a variety of ways you can save money on insurance in Texas.

Comparing insurance policies in Texas for affordability

When it comes to purchasing insurance policies in Texas, one of the most significant factors that need to be considered is affordability. While there may be numerous options available for insurance coverage, not all of them come at an affordable price.

Therefore, it is essential to compare the various insurance policies available in Texas concerning affordability and ensure that you are getting the best coverage at a reasonable cost. Here are some practical tips for comparing insurance policies in Texas for affordability:

1. Know What You Need:

The first thing you need to do is to determine what you need from your insurance policy. For example, if you have a car, you will need auto insurance, but how much coverage do you need? Likewise, if you own or rent a home, you will need homeowners or renters’ insurance. Understanding what you require from your insurance will help you look for policies that cater to your specific needs, making it easier to compare different insurance policies.

2. Determine Your Budget:

Once you have identified the insurance policies you need, you need to determine how much you can afford to pay. Every insurance policy comes with a monthly, quarterly, or yearly premium, and you should aim to find policies that fit within your budget. Analyzing your budget will allow you to make informed decisions and find insurance policies that offer the best value for your money.

3. Understand the Coverage:

While it is crucial to find affordable insurance policies, you also need to understand the coverage they offer. Some insurance policies may be more affordable than others, but their coverage may be limited or come with higher deductibles. Therefore, it’s essential to read and understand the fine print of every insurance policy and determine if they are worthwhile investments. Don’t just go for the cheapest option; instead, ensure that the policy offers the necessary coverage to cater to your needs.

4. Shop Around:

When it comes to purchasing affordable insurance policies in Texas, shopping around is a must. Insurance policies and their costs can vary from one provider to another, and it’s essential to do your research before settling on any policy. You can use online price comparison tools or seek guidance from an insurance broker to find policies that cater to your budget and insurance needs. It pays to take your time and explore all available options.

5. Look for Discounts:

Many insurance providers offer discounts if you meet specific criteria or if you bundle different policies. For example, some providers offer discounts for safe driving, while others provide discounts if you bundle your home and auto insurance policies. Before settling on any policy, check to see if you qualify for any discounts that can help reduce your premium costs.

With these tips, you’ll be able to compare different insurance policies in Texas for affordability and select one that offers the best coverage at an affordable price. Remember that the cheapest option may not always be the best, and it’s essential to prioritize the policies’ coverage over their cost.

Tips for finding the most affordable insurance in Texas

Everyone likes to save money whenever possible, especially when it comes to insurance. Finding affordable insurance in Texas can seem like a daunting task, but with the right knowledge it’s much easier than you think. Here are some tips for finding the most affordable insurance in Texas:

1. Shop Around

One of the most important things you can do to find affordable insurance in Texas is to shop around and compare rates from different insurance providers. Don’t just settle for the first provider you come across. Take the time to research and compare quotes from different companies to ensure you’re getting the best deal. You can even use online comparison tools to make it easier to find the most cost-effective option for you.

2. Opt for Higher Deductibles

Choosing a higher deductible can lower your insurance premiums significantly. The deductible is the amount of money you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you’re taking on more of the financial burden in case of a claim. However, if you do have to file a claim, you’ll end up paying less in premiums if you have a higher deductible.

3. Bundle Your Policies

Many providers offer discounts when you bundle multiple policies, such as combining your home and auto insurance. Bundling your policies is an easy way to save money on your insurance premiums, as providers often offer discounts for doing so. It’s important to do your research and compare bundled rates to individual policies to ensure you’re getting the best deal for you.

4. Improve Your Credit Score

Your credit score can have a huge impact on your insurance premiums. In fact, in many cases, having a good credit score can save you more money than having a perfect driving record. Insurance providers use your credit score as one factor to determine your risk level. The lower your credit score, the higher your risk level is, which translates to higher insurance premiums. By improving your credit score, you’re increasing your chances of getting lower rates on your insurance policies. Simple ways to improve your credit score include paying bills on time, keeping credit card balances low, and disputing any errors on your credit report.

5. Consider Usage-Based Insurance

Usage-based insurance, also known as telematics insurance, uses technology to track your driving habits, such as the distance you travel and how often you brake hard. Insurers use this information to calculate your premiums, which can lead to lower rates for safe drivers. If you’re a safe driver who doesn’t spend much time on the road, then usage-based insurance could be an affordable option for you.

Remember, finding affordable insurance in Texas is all about doing your research and comparing rates from different providers. By implementing these tips and taking the time to find the best rates, you can save money on your insurance premiums without sacrificing coverage.

Understanding the benefits of affordable Texas insurance policies

When it comes to insurance policies, it’s always better to have one than to not have any at all. Insurance policies protect you from unexpected expenses that may incur due to unforeseen accidents or disasters. While insurance policies may seem expensive, there are affordable options available for Texas residents.

One of the most significant benefits of affordable Texas insurance policies is that you can meet your legal obligations. For example, in Texas, car insurance is mandatory. If you get into an accident while driving without insurance, you could face significant legal consequences. However, with an affordable insurance policy, you can easily avoid any legal problems.

Moreover, affordable insurance policies offer individuals peace of mind. Knowing that you’re covered in case of an emergency is a feeling that cannot be quantified. You can have the assurance that if any unexpected events occur, you won’t have to bear the financial burden alone.

Affordable insurance policies come in a variety of forms, including health insurance, homeowners insurance, car insurance, and life insurance. The benefits of having these policies go beyond just financial security. For instance, with health insurance, you can regularly visit the doctor for preventative care and avoid costly medical bills. Homeowners insurance allows you to protect your property and belongings from theft or damage. With life insurance, you can take care of your loved ones even after you’re gone.

Another benefit of having affordable insurance policies is that they allow you to save money in the long run. Paying for an affordable insurance policy is a small expense compared to the potential costs you may incur in the future. For example, if you own a home and experience a natural disaster, homeowners insurance can help you rebuild and recover without having to start from scratch.

In summary, affordable insurance policies offer numerous benefits to Texas residents. These policies provide individuals with legal protection, financial security, and peace of mind. Insurance policies also come in various forms, including health, home, car, and life. By investing in affordable insurance policies, you can save yourself significant expenses in the long run and ensure that you’re always prepared for whatever the future may bring.