Economist Predicts Housing Market Rally as New Home Sales Surge

Economist predicts potential rally in housing market as new home sales surge – Economist Predicts Housing Market Rally as New Home Sales Surge: Amidst a backdrop of rising interest rates and inflation, a glimmer of hope has emerged in the housing market. Recent data shows a surge in new home sales, prompting some economists to predict a potential rally in the coming months.

This unexpected surge could signal a shift in market dynamics, offering both challenges and opportunities for buyers and sellers alike.

The surge in new home sales can be attributed to a confluence of factors, including pent-up demand, a desire for more space, and the allure of new construction. However, the impact of this trend on the overall housing market remains to be seen.

Will this surge translate into a sustained rally, or will it be short-lived?

Housing Market Overview

The housing market is currently in a state of flux, with a complex interplay of factors influencing its trajectory. Recent trends suggest a potential shift towards a more balanced market, with some signs of a potential rally emerging.

Home Prices and Sales Volume

The housing market has experienced a period of rapid price appreciation in recent years, fueled by low interest rates and strong demand. However, this upward trend has begun to moderate as interest rates have risen, making homeownership more expensive. This has resulted in a slowdown in sales volume, as buyers become more cautious in their purchasing decisions.

Inventory Levels

Inventory levels remain relatively low, contributing to continued upward pressure on home prices. This scarcity of available homes stems from several factors, including limited new construction and a reluctance among homeowners to sell in a rising interest rate environment.

Factors Driving Housing Market Trends

Several factors are influencing the current state of the housing market, including:

- Interest Rates:Rising interest rates have made mortgages more expensive, reducing affordability for potential buyers and slowing down demand.

- Inflation:High inflation has eroded purchasing power, leading to increased borrowing costs and making it more challenging for individuals to save for a down payment.

- Economic Growth:The strength of the economy plays a crucial role in housing market activity. A robust economy typically supports job growth and higher incomes, boosting demand for housing.

Impact of New Home Sales Surge

The recent surge in new home sales is a positive indicator for the overall housing market. This increase suggests that builders are responding to the demand for new homes, which could help alleviate the inventory shortage and potentially moderate price growth.

Economist’s Predictions

The recent surge in new home sales has sparked optimism among economists, leading some to predict a potential rally in the housing market. This optimism is fueled by a confluence of factors that suggest a shift in market dynamics, potentially signaling a rebound from the recent slowdown.

Reasons for Optimism

Several factors contribute to the economists’ positive outlook. The surge in new home sales is a key indicator of renewed demand, suggesting that buyers are becoming more confident in the market. This confidence is further supported by the decline in mortgage rates, which has made homeownership more affordable for many.

Additionally, the strong job market and steady economic growth provide a solid foundation for sustained demand in the housing sector.

Potential Challenges

While the outlook appears positive, several challenges could hinder a full-fledged rally in the housing market. The ongoing inflation and rising interest rates, although somewhat moderated, continue to exert pressure on affordability. Moreover, the existing inventory of homes remains relatively low, which could limit the pace of price increases and potentially lead to bidding wars.

Additionally, the ongoing uncertainty surrounding the global economy and potential economic shocks could impact consumer confidence and dampen housing demand.

“While the recent surge in new home sales is encouraging, it’s important to remember that the housing market is complex and subject to a range of factors,” said [Name of Economist], a leading economist at [Name of Institution]. “It’s too early to declare a full-fledged rally, and we need to closely monitor the evolving economic landscape.”

Impact of New Home Sales Surge

The recent surge in new home sales is a significant indicator of a potential shift in the housing market. This trend suggests a renewed interest in homeownership, potentially fueled by factors such as low interest rates, pent-up demand, and the desire for more space.

The recent surge in new home sales has economists predicting a potential rally in the housing market. While this news might make some investors nervous, remember the words of Warren Buffett, the Oracle of Omaha, who famously said, “Be fearful when others are greedy, and greedy when others are fearful.” Unleashing the Oracle of Omaha’s Success: The Journey of Warren Buffett provides a fascinating look into his investment philosophy, which could offer valuable insights for navigating this volatile market.

If the recent data is any indication, now might be the time to consider investing in the housing market, just as Buffett would advise.

This surge could have substantial implications for the housing market, impacting price changes, inventory levels, and buyer demand.

Potential Implications for the Housing Market, Economist predicts potential rally in housing market as new home sales surge

The surge in new home sales could influence the housing market in various ways.

Price Changes

The increased demand for new homes could lead to price increases. As builders struggle to keep up with the demand, they may be able to charge higher prices for their homes. This could, in turn, lead to an overall increase in home prices, especially in areas where new construction is concentrated.

Inventory Levels

The surge in new home sales could also lead to a decrease in inventory levels. If builders cannot keep up with the demand, the number of available new homes for sale could decline. This could further drive up prices, as buyers compete for a limited number of homes.

The recent surge in new home sales has economists predicting a potential rally in the housing market. This upswing could be fueled by a number of factors, including pent-up demand and a growing economy. It’s interesting to consider how this trend might mirror the success of Netflix in adapting to social and political issues, as outlined in this insightful article.

Just as Netflix has demonstrated the ability to navigate complex social and political landscapes, the housing market might also be poised for a period of growth and adaptation.

Buyer Demand

The surge in new home sales is a strong indicator of increased buyer demand. This demand is likely fueled by factors such as low interest rates, pent-up demand, and the desire for more space. As more buyers enter the market, it could lead to more competition and potentially higher prices.

Contribution to the Predicted Rally

The surge in new home sales is a key factor contributing to the predicted rally in the housing market. The increased demand for new homes suggests that the housing market is recovering from the recent slowdown. This recovery could lead to a more balanced market with increased buyer activity and potentially higher prices.

Market Dynamics and Factors: Economist Predicts Potential Rally In Housing Market As New Home Sales Surge

The recent surge in new home sales signals a potential shift in the housing market, but understanding the underlying dynamics is crucial to accurately predict its future trajectory. Several key factors, including supply and demand, affordability, and consumer confidence, are shaping the current landscape.

These dynamics are further influenced by external factors such as interest rates, inflation, and economic growth. Additionally, government policies and regulations play a significant role in shaping the housing market.

Impact of Interest Rates

Interest rates are a major determinant of housing affordability. Higher interest rates increase the cost of borrowing, making mortgages more expensive and reducing the purchasing power of potential homebuyers. Conversely, lower interest rates make mortgages more affordable, stimulating demand and potentially leading to a surge in home sales.

The Federal Reserve’s recent interest rate hikes, aimed at controlling inflation, have already had a noticeable impact on the housing market, leading to a slowdown in home sales and price growth. However, if interest rates stabilize or decline, it could reignite demand and contribute to a potential rally in the housing market.

For example, in the 2000s, a period of historically low interest rates fueled a housing boom, which ultimately led to the financial crisis of 2008.

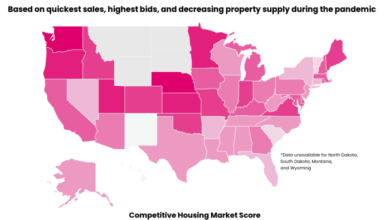

Regional Variations

The housing market, like many other economic sectors, exhibits significant regional variations. While the recent surge in new home sales suggests a potential nationwide rally, the intensity and timing of this recovery may differ considerably across different parts of the country.

Factors such as local economic conditions, housing supply, and demographics play a crucial role in shaping these regional differences.

Regional Economic Diversification

The strength of the local economy is a key driver of housing market performance. Regions with robust and diversified economies, particularly those less reliant on specific industries, tend to experience more resilient housing markets. For instance, areas with thriving tech sectors, like the San Francisco Bay Area or Austin, Texas, have shown greater resilience during economic downturns, leading to a faster recovery in housing demand.

Conversely, regions heavily dependent on specific industries, such as oil and gas extraction, might face more prolonged downturns, impacting their housing markets.

The news of a potential rally in the housing market, driven by a surge in new home sales, is certainly encouraging. However, it’s a stark reminder that not everyone is experiencing such positive economic trends. A recent case in Massachusetts, where a father and son were sentenced to prison for a $20 million lottery scam massachusetts father and son receive prison sentences for 20 million lottery scam , highlights the darker side of financial realities.

Despite the positive housing market indicators, it’s crucial to remember that economic challenges persist, and stories like this serve as a sobering reminder.

Housing Supply and Affordability

The balance between housing supply and demand is a major factor influencing regional housing market dynamics. Areas with limited housing supply, particularly in desirable locations, tend to experience higher prices and greater appreciation. This is evident in coastal cities like Los Angeles and New York City, where limited land availability and high demand have driven up housing costs.

Conversely, regions with ample housing supply, often found in less densely populated areas, might experience slower price growth and even price declines during periods of economic slowdown.

Demographic Trends

Population growth and shifts in demographics significantly impact regional housing markets. Areas experiencing rapid population growth, often driven by factors like job creation and a desirable lifestyle, typically see strong housing demand and price appreciation. For example, cities like Phoenix, Arizona, and Atlanta, Georgia, have experienced substantial population growth in recent years, leading to a robust housing market.

Conversely, regions with declining populations or an aging demographic profile might face slower housing demand and price growth.

Examples of Regional Variations

- Sunbelt States:States like Arizona, Florida, and Texas have experienced strong population growth and robust housing markets in recent years. These regions benefit from favorable climate, job opportunities, and relatively affordable housing compared to coastal areas. The predicted rally in the housing market is likely to be more pronounced in these regions, driven by continued population growth and strong economic fundamentals.

- Northeast and Midwest:These regions have experienced slower population growth and more moderate housing market performance in recent years. The predicted rally in the housing market might be less pronounced in these areas, particularly in regions facing economic challenges or population decline.

Implications for Buyers and Sellers

The predicted rally in the housing market presents both opportunities and challenges for buyers and sellers. As prices are expected to rise, navigating this dynamic landscape requires a strategic approach to maximize potential gains and minimize risks. Understanding the market dynamics and their impact on purchasing decisions and negotiation strategies is crucial for success in this evolving environment.

Impact on Purchasing Decisions

The anticipated surge in home prices might prompt buyers to accelerate their purchase decisions to capitalize on potential appreciation. However, it is essential to weigh the financial implications and consider the long-term affordability of a higher-priced home. A comprehensive financial assessment, including mortgage affordability, is vital to ensure a sustainable purchase.

- Increased Competition:The rising demand could lead to increased competition among buyers, potentially pushing prices higher and requiring more aggressive offers.

- Limited Inventory:The surge in demand might not be immediately met by an equal increase in inventory, potentially leading to a limited selection of available homes and a more competitive market.

- Shifting Affordability:As prices rise, affordability might become a significant concern for potential buyers, particularly for first-time homebuyers or those with limited budgets.

Negotiation Strategies

The changing market dynamics necessitate a shift in negotiation strategies for both buyers and sellers. Buyers may need to be more aggressive in their offers, while sellers might have more leverage in setting asking prices.

- Pre-Approval:Buyers should obtain pre-approval for a mortgage to demonstrate their financial readiness and strengthen their negotiating position.

- Competitive Offers:Buyers may need to offer above asking price or consider including contingencies to secure a winning bid in a competitive market.

- Market Research:Both buyers and sellers should thoroughly research comparable properties and recent sales data to inform their pricing strategies and negotiation tactics.

Market Activity

The predicted rally could stimulate overall market activity, leading to increased sales volume and faster turnover times. However, it is crucial to remember that the market is not always predictable, and fluctuations are expected.

- Increased Sales Volume:The surge in demand is likely to translate into higher sales volume, potentially driving prices further upward.

- Faster Turnover Times:The increased demand and limited inventory might lead to shorter time frames for homes to sell, requiring sellers to be prepared to act quickly.

- Market Volatility:The housing market is inherently cyclical, and the predicted rally might not be sustained. Fluctuations in interest rates, economic conditions, and other factors can influence market trends.

Future Outlook

The recent surge in new home sales, coupled with the economist’s prediction of a potential housing market rally, paints a promising picture for the future. However, the trajectory of this rally will be influenced by a complex interplay of factors, making it crucial to consider various aspects of the market.

Factors Influencing the Future of the Housing Market

The future of the housing market is expected to be shaped by several key factors, including:

- Interest Rates:Interest rates play a crucial role in affordability and demand. A continued rise in interest rates could dampen buyer enthusiasm, leading to a slowdown in price growth. Conversely, a stabilization or decline in rates could fuel further demand and price appreciation.

- Inflation:High inflation erodes purchasing power and can impact housing affordability. If inflation remains elevated, it could put pressure on home prices, potentially leading to a correction.

- Economic Growth:A strong economy typically supports a healthy housing market. If economic growth weakens, job losses and reduced consumer confidence could negatively impact demand for housing.

- Inventory Levels:The availability of homes for sale is a key driver of market dynamics. A tight inventory can lead to bidding wars and price escalation. Increased inventory could moderate price growth and favor buyers.

- Demographics:Changing demographics, such as population growth and migration patterns, can influence housing demand in specific regions. For instance, areas with growing populations are likely to experience higher demand for housing.

- Government Policies:Government policies, such as tax incentives for homebuyers or regulations on housing construction, can significantly impact the housing market. Changes in these policies could influence affordability, supply, and demand.

Potential Trajectory of Home Prices, Sales Volume, and Inventory Levels

Based on current trends and expert predictions, the following scenarios are possible for the housing market:

- Home Prices:While some analysts predict continued price growth in the near term, the pace of appreciation is likely to moderate. The combination of rising interest rates, potential economic slowdown, and increased inventory could lead to a stabilization or even a slight decline in home prices in certain markets.

- Sales Volume:Sales volume is expected to remain relatively stable or show a slight decline in the coming months. Higher interest rates and affordability concerns may dampen buyer activity, potentially leading to a cooling of the market.

- Inventory Levels:Inventory levels are expected to gradually increase as more homes come onto the market. This increase in supply could provide more choices for buyers and potentially moderate price growth.

“The housing market is cyclical, and we are likely to see a period of slower growth or even a slight correction in the coming months. However, the long-term outlook for the housing market remains positive, driven by strong underlying fundamentals such as population growth and limited housing supply.” [Name of Economist or Real Estate Expert]