Stocks Signal Resilient Bull Market, Optimism Takes Hold

Optimism takes hold as stocks signal a resilient bull market, a trend that has many investors wondering about the future of the market. While recent stock market performance suggests a strong bull market, understanding the factors driving this resilience and the potential challenges ahead is crucial.

This post delves into the reasons behind this optimism, exploring key market indicators, and analyzing potential challenges and opportunities that lie ahead.

The current bull market is characterized by a number of factors, including a robust economy, strong corporate earnings, and low interest rates. These factors have contributed to a positive investor sentiment, driving stock prices higher. However, it’s important to acknowledge that optimism can sometimes be excessive, leading to potential risks in the market.

The Bull Market’s Resilience

The stock market has been defying expectations, displaying a surprising resilience in the face of persistent economic headwinds. While many predicted a downturn, the market has continued to climb, showcasing a remarkable ability to weather challenges. This resilience, however, is not simply a result of blind optimism; it’s fueled by a confluence of factors, including strong economic indicators, positive investor sentiment, and solid market fundamentals.

Factors Contributing to the Bull Market’s Resilience

Several factors are contributing to the stock market’s resilience. These factors are interconnected and collectively drive the market’s positive performance.

The stock market’s recent surge is a beacon of optimism, suggesting a resilient bull market. It’s a reminder that even in uncertain times, there are still opportunities for growth. This resilience is crucial, especially when considering the importance of safeguarding personal data, which is why understanding what is a privacy policy and why is it important is more vital than ever.

As investors navigate this bullish landscape, protecting their information should be a top priority, ensuring they can confidently participate in the market’s growth.

Strong Economic Indicators

Despite global uncertainties, economic indicators continue to paint a positive picture. For example, the US unemployment rate remains low, consumer spending is robust, and corporate earnings are generally healthy. These indicators suggest a strong economy, which often translates into positive stock market performance.

Positive Investor Sentiment

Investor sentiment is playing a significant role in driving the bull market. Investors are optimistic about the future, driven by factors like low interest rates, strong corporate earnings, and the potential for continued economic growth. This optimism encourages investors to buy stocks, fueling the market’s upward trajectory.

Market Fundamentals

Market fundamentals also support the resilience of the bull market. Companies are generating strong profits, and many are investing in growth initiatives, which often leads to increased stock valuations. This positive trend suggests that the market is fundamentally sound, supporting the ongoing bull run.

It’s encouraging to see optimism taking hold as stocks signal a resilient bull market. This kind of confidence in the market is often fueled by companies like Netflix, who have shown remarkable adaptability to social and political issues, as explored in this insightful article netflix success in adapting to social and political issues insights from a corporate board veteran.

Their ability to navigate these complex landscapes is a testament to their forward-thinking approach, and it’s a good reminder that even in turbulent times, companies can thrive by embracing change. This adaptability, coupled with the current market trends, suggests a promising outlook for continued growth and stability.

Examples of Recent Stock Market Performance

Recent stock market performance provides compelling evidence of the bull market’s resilience. For instance, the S&P 500, a widely-followed benchmark index, has consistently reached new highs in recent months, defying predictions of a downturn. This positive performance reflects the market’s ability to absorb economic shocks and maintain its upward trajectory.

Other Factors

Beyond these core factors, other influences are also contributing to the bull market’s resilience. These include government policies, technological advancements, and global economic trends. These factors create a complex and dynamic environment that continues to support stock market growth.

Optimism’s Influence

The stock market, a complex ecosystem driven by a myriad of factors, is heavily influenced by the sentiment of its participants. Optimism, a potent force in the financial world, plays a pivotal role in shaping investor behavior and driving market trends.

The Role of Optimism

Optimism, characterized by a positive outlook and belief in future prosperity, acts as a catalyst for market growth. When investors are optimistic about the economy, corporate earnings, and the overall market outlook, they tend to be more willing to invest, leading to increased demand for stocks.

This increased demand pushes stock prices higher, creating a positive feedback loop that further fuels optimism.

Optimism’s Translation into Investor Behavior

Optimism manifests in several ways within the market:

- Increased Risk Appetite:Optimistic investors tend to be more comfortable taking on risk, as they believe the potential for gains outweighs the risk of losses. This leads to increased investment in higher-risk assets, such as growth stocks or emerging markets.

- Higher Investment Levels:Optimism encourages investors to allocate more of their capital to the market, believing that the returns will be favorable. This increased investment activity further contributes to rising stock prices.

- Reduced Selling Pressure:When investors are optimistic, they are less likely to sell their holdings, even in the face of minor market fluctuations. This reduces selling pressure and supports stock prices.

The Potential Risks of Excessive Optimism

While optimism is generally viewed as a positive force in the market, excessive optimism can lead to dangerous market bubbles.

- Irrational Exuberance:When optimism reaches a fever pitch, it can lead to irrational exuberance, where investors disregard fundamental valuations and invest based on emotion rather than sound financial analysis. This can result in asset prices becoming detached from reality, creating a bubble that is vulnerable to bursting.

- Market Volatility:Excessive optimism can create a market environment where prices are driven by speculation and hype, leading to increased volatility. This can create sudden and unpredictable price swings, making it difficult for investors to navigate the market effectively.

- Potential for Market Corrections:When optimism wanes and investors realize that asset prices have become inflated, it can lead to a sharp market correction. This can result in significant losses for investors who were caught up in the euphoria.

Key Market Indicators

The stock market is a complex system influenced by various factors, including economic conditions, investor sentiment, and global events. Analyzing key market indicators provides valuable insights into the current market situation and helps investors gauge its potential direction. These indicators serve as a compass, guiding investors towards informed decisions and helping them navigate the market’s fluctuating tides.

Stock Market Indices

Stock market indices, such as the S&P 500 and Nasdaq Composite, are widely used benchmarks to track the overall performance of the stock market. These indices represent a weighted average of the prices of a specific group of stocks, offering a comprehensive view of the market’s health.

- S&P 500:This index comprises 500 of the largest publicly traded companies in the United States, representing about 80% of the total market capitalization. A rising S&P 500 indicates a positive outlook for the overall market.

- Nasdaq Composite:This index tracks the performance of over 3,000 publicly traded companies, primarily focused on technology and growth sectors. Its performance often reflects the overall health of the tech industry.

Earnings Reports

Earnings reports, released by companies quarterly, provide insights into their financial performance. Strong earnings reports, exceeding analysts’ expectations, signal positive growth and profitability, often boosting investor confidence and driving stock prices higher.

It’s exciting to see optimism taking hold as stocks signal a resilient bull market. While the market’s upward trajectory is encouraging, it’s wise to remember that diversification is key, and understanding the role of gold as a safe investment can be a valuable part of any portfolio.

Gold’s historical stability during times of economic uncertainty provides a hedge against market volatility, allowing investors to weather potential storms while still enjoying the potential upside of a strong stock market.

- Revenue Growth:Companies with consistent revenue growth demonstrate strong market demand and a healthy business model.

- Profitability:High profit margins indicate efficient operations and strong financial health, which investors often favor.

Economic Indicators

Economic indicators provide insights into the overall health of the economy, which significantly impacts the stock market. Positive economic data often fuels optimism and encourages investment, while negative data can create uncertainty and volatility.

- Gross Domestic Product (GDP):GDP measures the total value of goods and services produced within a country. Strong GDP growth indicates a healthy economy, which can positively impact stock prices.

- Unemployment Rate:A low unemployment rate suggests a robust economy with strong consumer spending and job creation, contributing to a favorable market environment.

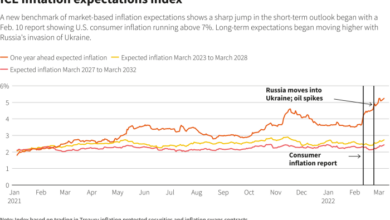

- Inflation Rate:Inflation measures the rate at which prices increase over time. Moderate inflation is generally considered healthy, but high inflation can erode purchasing power and negatively impact the market.

Interest Rates, Optimism takes hold as stocks signal a resilient bull market

Interest rates play a crucial role in the stock market. Lower interest rates encourage borrowing and investment, leading to increased economic activity and potentially higher stock prices. Conversely, higher interest rates can make borrowing more expensive and potentially dampen economic growth, impacting stock prices negatively.

- Federal Funds Rate:The Federal Reserve sets the federal funds rate, which is the target rate banks charge each other for overnight loans. Lower rates encourage borrowing and investment, while higher rates can make borrowing more expensive.

- Bond Yields:Bond yields move inversely to bond prices. When interest rates rise, bond prices fall, leading to higher yields. Conversely, when interest rates fall, bond prices rise, resulting in lower yields.

Investor Sentiment

Investor sentiment, often measured through surveys and market indicators, reflects the overall mood of investors towards the market. High investor confidence can drive prices higher, while pessimism can lead to market declines.

- Bullish vs. Bearish Sentiment:Bullish sentiment reflects optimism about the market’s future, while bearish sentiment indicates pessimism. Market sentiment surveys provide insights into investor expectations and can help gauge the market’s overall direction.

- Put/Call Ratio:This ratio compares the number of put options (bets on a decline in price) to call options (bets on a rise in price). A high put/call ratio indicates increased bearish sentiment, while a low ratio suggests bullish sentiment.

Potential Challenges and Opportunities: Optimism Takes Hold As Stocks Signal A Resilient Bull Market

While the bull market exhibits remarkable resilience, acknowledging potential challenges and emerging opportunities is crucial for investors to navigate the market effectively. Understanding these factors allows for informed decision-making and a proactive approach to portfolio management.

Potential Challenges and Opportunities

The current bull market’s resilience faces several challenges, alongside emerging opportunities that investors should consider. This table highlights these key factors:

| Challenges | Opportunities |

|---|---|

| Inflation and Interest Rates: Persistent inflation and rising interest rates pose a significant threat to the bull market. Higher borrowing costs can dampen corporate earnings and investor sentiment, potentially leading to market corrections. | Value Stocks: As interest rates rise, value stocks, which are often undervalued and have a history of strong dividend payments, become more attractive. Investors may seek out these companies for their potential for capital appreciation and income generation. |

| Geopolitical Uncertainty: Ongoing geopolitical tensions, such as the war in Ukraine and the escalating US-China rivalry, contribute to market volatility and uncertainty. These events can disrupt supply chains, impact global economic growth, and create investment risks. | Defensive Sectors: In times of uncertainty, investors often seek refuge in defensive sectors, such as healthcare and consumer staples. These sectors tend to be less cyclical and provide a degree of stability during market downturns. |

| Recession Concerns: The possibility of a recession in the US and other major economies remains a concern. A recession could significantly impact corporate profits and lead to a decline in stock prices. | Technology Innovation: The ongoing technological revolution continues to drive innovation and growth in sectors like artificial intelligence, cloud computing, and renewable energy. Investing in these sectors offers potential for long-term returns. |

The Future of the Bull Market

Predicting the future of the bull market is an intricate task, fraught with uncertainty. Numerous factors can influence the market’s trajectory, both positive and negative, making it a dynamic and unpredictable landscape. This section explores potential scenarios for the bull market’s future, incorporating different market conditions and events, to provide a balanced perspective on the market’s potential trajectory.

Factors Influencing the Bull Market’s Future

The future of the bull market is influenced by a complex interplay of economic, political, and social factors. Here are some of the key factors that could shape the market’s direction:

- Economic Growth:Strong economic growth is a major driver of stock market performance. Continued growth, fueled by factors such as consumer spending, business investment, and government spending, can support a healthy bull market. However, a slowdown in economic growth or a recession could dampen market sentiment and lead to a correction.

- Interest Rates:Interest rates play a crucial role in influencing stock valuations. Rising interest rates can make borrowing more expensive for companies, potentially slowing down economic growth and reducing the attractiveness of stocks. Conversely, low interest rates can stimulate economic activity and make stocks more appealing to investors.

- Inflation:High inflation can erode purchasing power and hurt corporate profits, leading to stock market volatility. However, moderate inflation is generally considered healthy for the economy and can support a bull market. The Federal Reserve’s ability to manage inflation is a key factor to watch.

- Geopolitical Events:Global events, such as wars, trade tensions, and political instability, can significantly impact market sentiment. These events can create uncertainty and volatility, potentially disrupting a bull market.

- Technological Advancements:Technological innovation can drive economic growth and create new investment opportunities. Emerging technologies such as artificial intelligence, blockchain, and renewable energy have the potential to fuel stock market gains.

Potential Scenarios for the Bull Market’s Future

Based on the factors discussed above, here are a few potential scenarios for the bull market’s future:

- Scenario 1: Continued Growth and Expansion:If the economy continues to grow at a healthy pace, inflation remains under control, and interest rates rise gradually, the bull market could continue for several more years. This scenario would likely be characterized by strong corporate earnings, rising stock prices, and positive investor sentiment.

This scenario is similar to the bull market that occurred in the late 1990s, fueled by technological advancements and robust economic growth.

- Scenario 2: Moderate Growth and Consolidation:If economic growth slows down but remains positive, inflation remains relatively low, and interest rates rise modestly, the bull market could continue but at a slower pace. This scenario might involve periods of market volatility and consolidation as investors adjust to a less favorable economic environment.

This scenario resembles the bull market of the early 2000s, which saw periods of consolidation and volatility amidst moderate economic growth.

- Scenario 3: Correction or Bear Market:If the economy enters a recession, inflation surges, or interest rates rise rapidly, the bull market could experience a correction or even a bear market. This scenario would be characterized by declining stock prices, negative investor sentiment, and potentially a significant drop in market valuations.

This scenario is similar to the bear market of 2008, which was triggered by the global financial crisis and resulted in a sharp decline in stock prices.

Timeline for Potential Scenarios

It is impossible to predict with certainty when or if any of these scenarios will occur. However, based on current economic conditions and historical trends, here is a possible timeline for the bull market’s future:

- Short Term (1-2 Years):The market could continue to experience moderate growth, driven by strong corporate earnings and a favorable economic environment. However, volatility is likely to remain elevated due to ongoing inflation and uncertainty about the Fed’s monetary policy.

- Medium Term (3-5 Years):The market could enter a period of consolidation, with slower growth and potentially some periods of correction. This period could be influenced by rising interest rates, geopolitical events, and a potential slowdown in economic growth.

- Long Term (5+ Years):The long-term outlook for the bull market is uncertain and depends heavily on the factors discussed above. If the economy continues to grow and inflation remains under control, the bull market could continue for several more years. However, if the economy experiences a recession or other major shocks, the bull market could end prematurely.