May Jobs Report: 339,000 Jobs Added, Boosting US Economy

May jobs report exceeds expectations adding 339000 jobs and boosting us economy – The May jobs report exceeded expectations, adding a whopping 339,000 jobs and injecting a dose of optimism into the US economy. This robust job growth signals a resilient labor market and points to a continued economic expansion.

The report highlights the strength of the US economy, with key sectors like leisure and hospitality, healthcare, and professional and business services driving job creation. This surge in employment is not only boosting consumer confidence but also fueling spending and contributing to a healthy economic outlook.

Job Market Strength: May Jobs Report Exceeds Expectations Adding 339000 Jobs And Boosting Us Economy

The May jobs report exceeded expectations, adding a robust 339,000 jobs, demonstrating the continued resilience of the U.S. economy. This significant increase surpasses the 190,000 jobs projected by economists, signaling a strong labor market and a positive outlook for economic growth.This robust job growth marks a continuation of the positive trend observed in recent months.

The unemployment rate remained stable at 3.7%, highlighting the strength of the labor market. The previous month’s report also showed strong job gains, adding 294,000 jobs, indicating a sustained period of positive economic activity.

Sectors Contributing to Job Growth

The May jobs report revealed significant contributions from various sectors, driving the overall job growth.

The leisure and hospitality sector led the job gains, adding 292,000 jobs, demonstrating the ongoing recovery in the travel and tourism industry.

- The healthcare sector also experienced substantial growth, adding 44,000 jobs, indicating a continued demand for healthcare professionals.

- Professional and business services saw an increase of 34,000 jobs, reflecting the continued growth in these sectors.

- The construction industry added 22,000 jobs, indicating a positive outlook for the construction sector.

Economic Impact

The strong job report, exceeding expectations with 339,000 new jobs added, paints a positive picture for the US economy. This robust job growth suggests a healthy and resilient labor market, signaling a continuation of economic expansion.

Impact on Consumer Spending

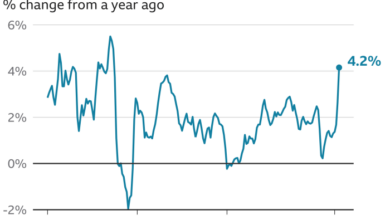

The positive job market has a direct impact on consumer spending. With increased employment and higher wages, consumers have more disposable income, leading to increased spending on goods and services. This rise in consumer spending fuels economic growth by stimulating demand across various sectors.

For example, the robust job market has likely contributed to the recent increase in retail sales, as consumers feel more confident about their financial situations.

The May jobs report came in strong, adding 339,000 jobs and further boosting the US economy. This positive news is a testament to the resilience of the workforce and the continued growth of the economy. However, it’s worth noting that HP CEO forecasts an AI-driven revolution in computers within two years , which could significantly impact the job market in the future.

Despite these potential changes, the strong jobs report is a positive sign for the economy, indicating continued growth and stability.

Impact on Inflation

While a strong job market is generally positive, it can also contribute to inflationary pressures. As wages rise, businesses may pass on those costs to consumers in the form of higher prices. The job report, however, suggests that inflation is currently under control, as wage growth has not outpaced productivity gains.

This indicates that businesses are able to absorb some of the rising labor costs without significantly impacting prices. However, it is important to monitor the situation closely, as persistent wage growth could eventually lead to higher inflation.

Impact on Interest Rates

The Federal Reserve closely monitors the labor market to assess the health of the economy and make decisions regarding interest rates. A strong job report, indicating a healthy economy, can lead to expectations of future interest rate hikes. The Fed might raise interest rates to curb inflation and prevent the economy from overheating.

However, the Fed’s actions will depend on a range of factors, including inflation trends, economic growth, and the overall state of the labor market.

Labor Market Dynamics

The latest jobs report paints a picture of a resilient labor market, with strong job growth and a steady unemployment rate. However, a deeper dive into the data reveals some nuances and potential challenges that could shape the labor market in the months ahead.

Unemployment Rate and Job Growth

The unemployment rate remained at 3.6% in May, reflecting a tight labor market where employers are still struggling to find enough workers to fill open positions. This stability in the unemployment rate despite the significant job growth underscores the continued strength of the labor market.

The relationship between job growth and the unemployment rate is complex, but in this case, it suggests that the economy is adding jobs at a pace that is keeping up with the growth in the labor force.

Labor Participation and Wage Growth

Labor force participation rates have been steadily increasing, suggesting that more people are entering or re-entering the workforce. This trend is partly driven by demographic shifts, as the baby boomer generation continues to age and retire, while younger generations enter the workforce.

However, it also reflects the growing demand for labor, which is encouraging some individuals who were previously out of the labor force to seek employment.Wage growth remains a key concern for many workers. While wages have been rising, the pace of growth has not kept pace with inflation.

The May jobs report blew past expectations, adding a whopping 339,000 jobs and giving the US economy a much-needed boost. It’s interesting to note that even with the positive news, Bloomberg’s Studio 10 recently featured Ethereum co-founder Vitalik Buterin discussing the potential impact of cryptocurrencies on the global financial system, highlighting the interconnectedness of traditional and emerging markets.

It’s exciting to see how these trends might play out in the coming months, with the strong jobs report likely fueling further growth and innovation across various sectors.

This disparity has led to concerns about the erosion of purchasing power for many households. However, there are some signs that wage growth may be starting to accelerate, particularly in sectors experiencing high demand for labor, such as healthcare and technology.

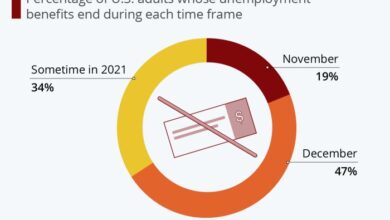

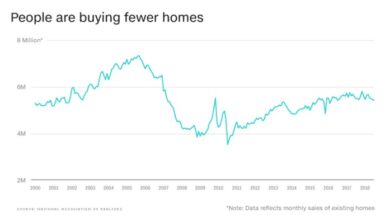

The May jobs report exceeded expectations, adding a whopping 339,000 jobs and providing a much-needed boost to the US economy. This positive news, however, shouldn’t overshadow the warnings from experts who are urging homebuyers to be cautious, especially with rising interest rates.

Experts warn homebuyers of red flags beyond climbing interest rates , emphasizing the need for thorough research and a balanced approach when making such a significant financial decision. With a strong job market and a positive economic outlook, it’s more important than ever to navigate the housing market wisely.

Challenges and Opportunities in the Labor Market

The labor market faces a number of challenges, including:

- The ongoing skills gap, which is a mismatch between the skills employers need and the skills workers possess. This gap is particularly pronounced in industries that are rapidly evolving, such as technology and healthcare.

- The rising cost of living, which is making it increasingly difficult for workers to make ends meet, particularly in high-cost areas. This can lead to a decline in labor force participation as workers choose to reduce their hours or leave the workforce altogether.

- The potential for a recession, which could lead to job losses and a slowdown in wage growth.

Despite these challenges, the labor market also presents a number of opportunities, including:

- The growing demand for skilled workers in industries such as technology, healthcare, and renewable energy. This presents opportunities for workers to upskill or reskill to take advantage of these growing fields.

- The increasing use of technology to automate tasks, which can free up workers to focus on higher-value activities. This can lead to increased productivity and wage growth.

- The growing importance of flexible work arrangements, which can allow workers to balance their work and personal lives. This can attract and retain talent, particularly among younger generations.

Policy Implications

The robust job report has significant implications for policymakers, particularly the Federal Reserve and the government. The strong economic indicators influence their decisions regarding monetary and fiscal policies, with potential ripple effects on social programs and the overall economy.

Federal Reserve’s Monetary Policy

The strong job report reinforces the Federal Reserve’s stance on combating inflation. The Fed’s primary mandate is to maintain price stability and full employment. The robust job growth, coupled with persistent inflation, suggests that the Fed may continue its aggressive monetary tightening strategy.

- Interest Rate Hikes:The Fed is likely to continue raising interest rates to cool down the economy and bring inflation under control. Higher interest rates make borrowing more expensive, potentially slowing down economic activity and reducing demand, which could help curb inflation.

- Quantitative Tightening:The Fed may also continue reducing its balance sheet by allowing bonds to mature without reinvesting the proceeds. This effectively reduces the money supply in circulation, further tightening monetary conditions.

Government Response to Economic News, May jobs report exceeds expectations adding 339000 jobs and boosting us economy

The positive economic news may encourage the government to maintain its current fiscal policies or even consider further stimulus measures. The strong job market and economic growth provide some leeway for the government to address pressing issues.

- Infrastructure Spending:The government might consider allocating more resources towards infrastructure projects, which can create jobs and stimulate economic growth in the long term. This could be a strategic move to address potential future economic challenges.

- Social Programs:The strong economy could provide an opportunity for the government to expand or enhance social programs, such as healthcare, education, and social safety nets. This could address social inequalities and improve the overall well-being of the population.

Fiscal Policy Implications

The positive economic news may lead to a reassessment of fiscal policy, particularly with regards to spending and taxation. The government might consider increasing spending on infrastructure or social programs, while also potentially adjusting tax policies to address income inequality or stimulate investment.

- Tax Cuts:The government might consider providing tax cuts for businesses or individuals to encourage investment and spending, thereby boosting economic growth. However, this could also increase the budget deficit.

- Increased Spending:The government might also consider increasing spending on social programs, infrastructure projects, or research and development. This could help address social issues and promote long-term economic growth. However, it could also lead to higher budget deficits.

Long-Term Outlook

The robust job growth reported in May offers a glimpse into the future of the US economy, but the path ahead is not without its challenges. Several factors will shape the trajectory of the job market and the economy in the coming months and years.

Potential Risks and Opportunities

The continued strength of the job market is a positive sign, but it’s essential to acknowledge the potential risks and opportunities that could impact sustained economic growth.

- Inflation:While inflation has shown signs of cooling, it remains a concern. If inflation persists at a high level, it could erode consumer purchasing power, leading to a slowdown in economic activity and job creation.

- Interest Rates:The Federal Reserve’s efforts to combat inflation through interest rate hikes could impact economic growth. Higher interest rates can make it more expensive for businesses to borrow money, potentially slowing down investment and hiring.

- Geopolitical Uncertainty:The ongoing war in Ukraine and geopolitical tensions around the world create uncertainty and volatility in the global economy. These events can disrupt supply chains, increase energy prices, and impact economic growth.

- Technological Advancements:Automation and artificial intelligence are transforming industries, creating both opportunities and challenges for the labor market. While these technologies can boost productivity and create new jobs, they can also lead to job displacement in certain sectors.