Morgan Stanley Strategist Predicts Further Stock Market Declines

Morgan Stanley strategist predicts further stock market declines due to recession fears and high interest rates, a warning that has sent ripples through the financial world. The strategist’s prediction, based on a confluence of economic headwinds, suggests that investors brace themselves for a turbulent period ahead.

The warning comes as the global economy grapples with a complex mix of challenges. Inflation remains stubbornly high, supply chains are still disrupted, and geopolitical tensions continue to escalate. These factors have fueled concerns about a potential recession, a scenario that could significantly impact the stock market.

Furthermore, the Federal Reserve’s aggressive interest rate hikes, aimed at taming inflation, are adding to the pressure on businesses and consumers. Rising interest rates make borrowing more expensive, potentially slowing economic growth and impacting corporate earnings.

Morgan Stanley’s Prediction: Morgan Stanley Strategist Predicts Further Stock Market Declines Due To Recession Fears And High Interest Rates

Morgan Stanley, a prominent investment bank, has issued a warning regarding the stock market, predicting further declines in the near future. The strategist’s prediction is rooted in concerns about a potential recession and the impact of rising interest rates on the economy.

Recession Fears

Recession fears are a major driving force behind Morgan Stanley’s bearish outlook. The bank’s economists believe that the US economy is on the brink of a recession, citing several indicators.

- Inflation:Persistent high inflation, despite recent easing, continues to put pressure on consumer spending and businesses, hindering economic growth.

- Interest Rates:The Federal Reserve’s aggressive interest rate hikes, aimed at curbing inflation, are increasing borrowing costs for businesses and consumers, potentially leading to a slowdown in economic activity.

- Consumer Confidence:Consumer confidence remains fragile, with households facing rising prices and economic uncertainty, which could further dampen spending and impact economic growth.

High Interest Rates

Morgan Stanley’s prediction also emphasizes the impact of high interest rates on the stock market. Rising interest rates, a consequence of the Fed’s tightening monetary policy, increase the cost of borrowing for companies, making it more expensive to finance operations and investments.

This can lead to reduced corporate earnings, which in turn can negatively impact stock prices.

- Valuation:Higher interest rates can lead to lower valuations for stocks, as investors demand higher returns in a higher-interest rate environment.

- Growth:Higher borrowing costs can slow down economic growth, potentially leading to lower corporate profits and reduced stock market performance.

- Bond Yields:Rising bond yields, which are closely tied to interest rates, can make bonds more attractive to investors, potentially leading to capital outflows from the stock market.

Recession Fears

The recent prediction by Morgan Stanley strategists about potential stock market declines has ignited concerns about a looming recession. This fear is fueled by a confluence of factors, including persistent inflation, ongoing supply chain disruptions, and escalating geopolitical tensions.

Impact of Inflation on Stock Market

Inflation has been a major concern for investors, eroding purchasing power and increasing the cost of doing business. As companies grapple with rising input costs, they are forced to raise prices, potentially leading to a decline in consumer demand.

With Morgan Stanley strategists predicting further stock market declines due to recession fears and high interest rates, it’s more crucial than ever to understand the impact of inflation on your finances. The good news is, you can equip yourself with the knowledge and strategies to navigate this challenging economic landscape.

Check out the inflation guide tips to understand and manage rising prices for practical advice on budgeting, saving, and investing in times of rising prices. This could be the key to weathering the storm and even coming out ahead, even as Morgan Stanley’s predictions loom large.

This can negatively impact corporate profits and, in turn, stock market valuations.

It’s tough to see the market taking a hit, especially with Morgan Stanley’s strategist predicting further declines due to recession fears and high interest rates. But even amidst the economic uncertainty, it’s important to remember the basics of online security.

Knowing what is a privacy policy and why is it important can help protect your personal information, which is especially crucial during times of economic instability. After all, while we’re watching the stock market, it’s equally important to watch out for potential online threats.

Supply Chain Disruptions and Their Impact

The ongoing global supply chain disruptions, exacerbated by the COVID-19 pandemic and geopolitical events, have contributed to inflation and hampered economic growth. These disruptions have created bottlenecks in production and distribution, leading to shortages of essential goods and rising prices.

As businesses struggle to navigate these challenges, their profitability and stock prices may suffer.

Geopolitical Tensions and Their Impact

Geopolitical tensions, such as the ongoing war in Ukraine, have created uncertainty and volatility in global markets. These tensions can disrupt trade, increase energy prices, and lead to sanctions, all of which can negatively impact economic growth and stock market performance.

Historical Examples of Recessions and Stock Market Performance, Morgan stanley strategist predicts further stock market declines due to recession fears and high interest rates

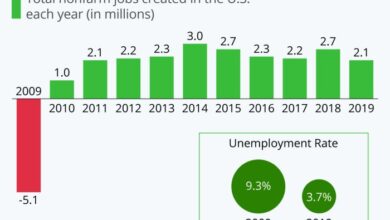

History provides numerous examples of how recessions have affected stock market performance. During the 2008 financial crisis, the S&P 500 index plummeted by nearly 57% from its peak. The 2001 recession, triggered by the dot-com bubble burst, saw the S&P 500 index decline by over 49%.

These examples highlight the potential impact of economic downturns on stock market valuations.

High Interest Rates

High interest rates represent a significant headwind for both businesses and consumers, potentially dampening economic growth and impacting stock market performance. As the Federal Reserve continues to raise interest rates to combat inflation, it’s crucial to understand how these changes influence various aspects of the economy and the stock market.

Impact on Businesses and Consumers

Rising interest rates directly impact businesses and consumers by increasing borrowing costs. This can lead to:* Reduced Investment:Businesses may postpone or cancel expansion plans, acquisitions, or new product development due to higher borrowing costs.

Slower Economic Growth Reduced investment and consumer spending can lead to a slowdown in economic growth, potentially triggering a recession.

Increased Debt Burden Existing borrowers face higher monthly payments, reducing their disposable income and potentially leading to financial distress.

Lower Consumer Spending

It’s a tough time for investors as the Morgan Stanley strategist’s prediction of further stock market declines due to recession fears and high interest rates hangs heavy. But amidst the storm, it’s worth remembering the timeless wisdom of Warren Buffett, who navigated many market cycles.

His journey, chronicled in unleashing the oracle of omahas success the journey of warren buffett , reminds us that long-term investing requires patience, discipline, and a focus on value. While the current market turbulence might be unsettling, history shows that even during difficult periods, opportunities for growth eventually emerge.

Influence on Corporate Earnings and Valuations

Rising interest rates can significantly impact corporate earnings and valuations:* Increased Cost of Capital:Higher interest rates increase the cost of borrowing for companies, impacting their profitability.

Lower Profit Margins Increased borrowing costs can reduce profit margins, especially for companies with high debt levels.

Reduced Valuations Higher interest rates can lead to lower valuations for companies, as investors demand a higher return on their investment due to the increased risk.

Historical Impact on the Stock Market

Historically, rising interest rates have often been associated with stock market declines. For example:* The 1980s:The Federal Reserve’s aggressive interest rate hikes to combat inflation led to a significant decline in the stock market.

The 2000s The Federal Reserve’s interest rate increases in the early 2000s contributed to the bursting of the dot-com bubble.

The 2022-2023 Period The Federal Reserve’s recent interest rate hikes have already impacted the stock market, leading to a decline in major indices.

Market Outlook

Morgan Stanley’s prediction of further stock market declines due to recession fears and high interest rates presents a challenging landscape for investors. While the firm’s outlook is not universally accepted, it’s crucial to consider its potential implications for different sectors and asset classes, and how current market conditions compare to historical periods of uncertainty.

Potential Implications for Different Sectors and Asset Classes

The potential impact of Morgan Stanley’s prediction varies significantly across different sectors and asset classes.

| Sector/Asset Class | Potential Impact |

|---|---|

| Technology | Growth stocks, particularly in the tech sector, are often highly sensitive to interest rate changes. Rising rates could lead to a further decline in valuations as investors shift towards more defensive sectors. |

| Consumer Discretionary | Companies in the consumer discretionary sector, which rely on consumer spending, could be impacted by a potential recession. Reduced consumer confidence and spending could lead to lower sales and earnings. |

| Energy | The energy sector could benefit from rising inflation and potential supply constraints. However, a recession could dampen demand, leading to price volatility. |

| Fixed Income | Rising interest rates typically lead to declining bond prices. Investors may face losses in their bond portfolios, particularly those with longer maturities. |

| Gold | Gold is often seen as a safe haven asset during times of economic uncertainty. Increased demand for gold could lead to price appreciation. |

Comparison to Historical Periods of Uncertainty

It’s essential to understand how current market conditions compare to historical periods of economic uncertainty and market volatility. This analysis can provide valuable insights into potential outcomes and investor behavior.

| Historical Period | Key Characteristics | Similarities to Current Market | Differences to Current Market |

|---|---|---|---|

| 2008 Financial Crisis | Subprime mortgage crisis, systemic banking failures, global recession. | High inflation, rising interest rates, economic uncertainty. | Current crisis is driven by supply chain disruptions and geopolitical tensions, not a housing bubble. |

| 1970s Stagflation | High inflation, slow economic growth, rising unemployment. | High inflation, potential for economic slowdown. | Current situation is not as severe as the 1970s, with lower unemployment and stronger corporate balance sheets. |

Potential Strategies for Investors

Investors considering the predicted market declines have several strategies to navigate this challenging environment.

| Strategy | Description |

|---|---|

| Diversification | Spreading investments across different asset classes and sectors can help mitigate risk. |

| Value Investing | Focusing on undervalued companies with strong fundamentals can offer potential for outperformance during market downturns. |

| Defensive Sectors | Investing in sectors less sensitive to economic cycles, such as healthcare and utilities, can provide some stability during a recession. |

| Short-Term Cash Position | Maintaining a higher cash position allows for flexibility to buy stocks at lower prices during market declines. |

Investor Considerations

In the face of Morgan Stanley’s prediction of further stock market declines, investors must prioritize risk management and portfolio diversification. These strategies can help mitigate potential losses and position portfolios for long-term growth.

Strategies for Navigating Market Volatility

Understanding the potential benefits and drawbacks of different investment strategies is crucial for investors navigating a volatile market. Here’s a breakdown of popular approaches:

- Holding Cash:This strategy offers safety and liquidity, allowing investors to wait for market dips or better entry points. However, it comes with the risk of missing out on potential gains during market rallies. Holding cash can also lead to a loss of purchasing power due to inflation.

- Investing in Defensive Sectors:Sectors like healthcare, consumer staples, and utilities tend to be less volatile during economic downturns, as they provide essential goods and services. While they may offer stability, their growth potential might be limited compared to more cyclical sectors.

- Buying on Dips:This strategy involves purchasing stocks or other assets when the market experiences a downturn. It relies on the assumption that the market will eventually rebound, offering an opportunity to buy at lower prices. However, it requires a strong conviction in the underlying assets and the ability to tolerate short-term volatility.

Guidance for Informed Investment Decisions

Navigating the current market environment requires a balanced approach, considering both risk and reward. Investors should:

- Review and Rebalance Portfolios:Regularly assess asset allocation, adjusting it based on changing market conditions and individual risk tolerance. Consider rebalancing portfolios to ensure they align with long-term goals and risk appetite.

- Focus on Long-Term Investments:Avoid making impulsive decisions based on short-term market fluctuations. Instead, prioritize investments in companies with strong fundamentals and long-term growth potential.

- Seek Professional Advice:Consult with a financial advisor to develop a personalized investment plan that aligns with individual financial goals and risk tolerance. They can provide valuable insights and guidance based on market trends and individual circumstances.