Cryptocurrency Regulations Around the World: A Guide & Analysis

Cryptocurrency regulations around the world guide analysis – The cryptocurrency landscape is rapidly evolving, with governments and regulators around the world scrambling to keep up. This guide provides a comprehensive analysis of cryptocurrency regulations across the globe, exploring the diverse approaches taken by different jurisdictions and the impact these regulations have on the industry.

We’ll delve into the classification of cryptocurrencies, anti-money laundering and know your customer requirements, taxation, licensing, and more. Whether you’re an individual investor, a business owner, or simply curious about the future of crypto, understanding these regulations is crucial.

This guide aims to provide clarity and insight into the complex world of cryptocurrency regulation, offering a roadmap for navigating the legal and regulatory landscape. We’ll examine the challenges and opportunities presented by these regulations, exploring their impact on innovation, investment, and the overall adoption of cryptocurrencies.

By understanding the current regulatory environment and anticipating future trends, we can better navigate the exciting and ever-changing world of crypto.

Introduction

The global cryptocurrency landscape is rapidly evolving, characterized by a surge in the adoption of digital assets and decentralized technologies. This growth has brought about a diverse range of cryptocurrencies, blockchain platforms, and decentralized finance (DeFi) applications. However, this burgeoning industry has also attracted significant attention from regulators worldwide.

Cryptocurrency regulations are becoming increasingly crucial to ensure consumer protection, financial stability, and the responsible development of this nascent sector. Understanding these regulations is essential for individuals and businesses alike, as they shape the legal and operational framework for crypto activities.

The Importance of Cryptocurrency Regulations

Cryptocurrency regulations aim to address various concerns associated with the crypto ecosystem, including:* Consumer Protection:Protecting investors from fraud, scams, and market manipulation.

Financial Stability Mitigating risks to the broader financial system posed by cryptocurrencies.

Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) Preventing the use of cryptocurrencies for illicit activities.

Tax Compliance Ensuring that crypto transactions are subject to appropriate taxation.

Market Integrity

Navigating the complex world of cryptocurrency regulations across different countries can be a daunting task. It’s a constantly evolving landscape, and recent events like the bank turmoil resulting in a $72 billion loss of deposits for First Republic have only added to the uncertainty.

This highlights the need for clear and consistent regulatory frameworks to foster responsible innovation and protect investors within the cryptocurrency space.

For businesses, navigating these regulations is crucial for operating legally, managing compliance obligations, and accessing financial services.

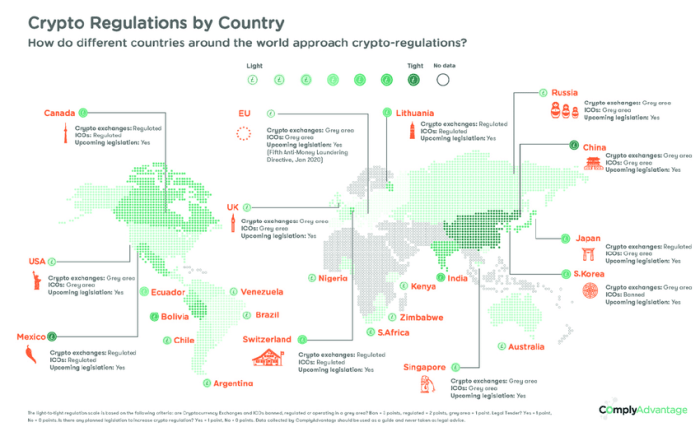

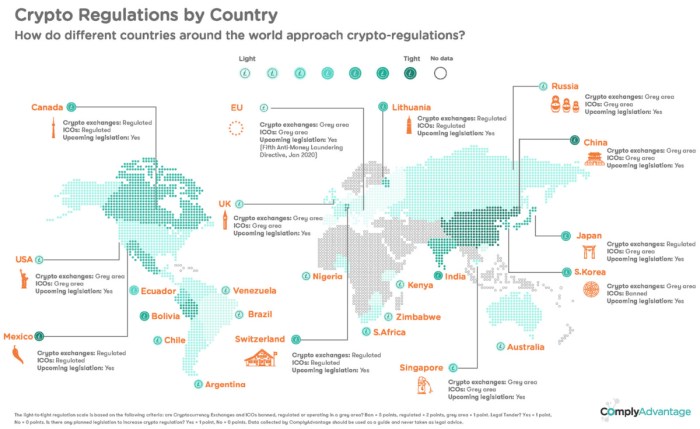

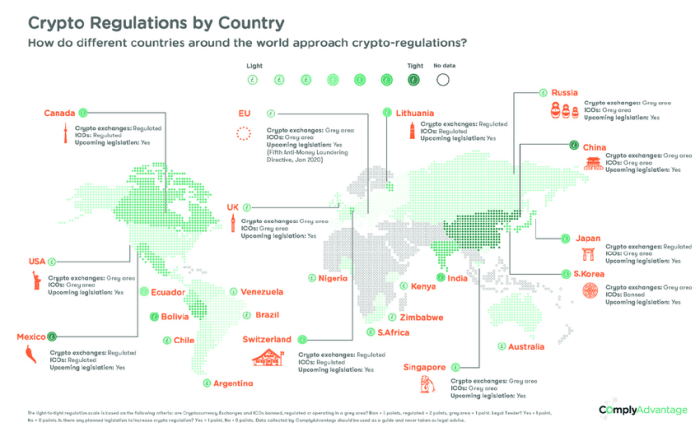

Regulatory Approaches Around the World

Cryptocurrency regulations are evolving rapidly, and governments worldwide are grappling with how to best manage this new asset class. This section will delve into the diverse regulatory approaches adopted by various countries, comparing and contrasting their frameworks and highlighting key trends.

Regulatory Landscape

Different countries have adopted diverse approaches to regulating cryptocurrencies, with frameworks ranging from comprehensive legislation to more lenient guidelines. Here’s a snapshot of the regulatory landscape in some key jurisdictions:

| Country | Regulatory Body | Key Regulations | Status |

|---|---|---|---|

| United States | Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC) | SEC’s focus on securities laws, CFTC’s focus on commodity laws, Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements for exchanges | Enacted |

| European Union | European Securities and Markets Authority (ESMA), European Banking Authority (EBA) | Markets in Financial Instruments Regulation (MiFIR), Anti-Money Laundering Directive (AMLD), General Data Protection Regulation (GDPR) | Enacted |

| Japan | Financial Services Agency (FSA) | Payment Services Act, Financial Instruments and Exchange Act, AML/KYC regulations | Enacted |

| Singapore | Monetary Authority of Singapore (MAS) | Payment Services Act, AML/KYC regulations, licensing requirements for cryptocurrency exchanges | Enacted |

| China | People’s Bank of China (PBOC) | Prohibition of Initial Coin Offerings (ICOs), restrictions on cryptocurrency exchanges, AML/KYC regulations | Enacted |

| India | Reserve Bank of India (RBI) | Ban on cryptocurrency transactions by banks, proposed cryptocurrency bill | Under Review |

Key Considerations in Regulatory Frameworks

The regulatory frameworks for cryptocurrencies often address the following key considerations:

Classification of Cryptocurrencies

One of the most debated aspects of cryptocurrency regulation is their classification. Different jurisdictions classify cryptocurrencies differently, with implications for applicable laws and regulations.

- Securities:In the US, the SEC has classified some cryptocurrencies as securities, subject to securities laws and regulations.

- Commodities:The CFTC in the US has classified some cryptocurrencies as commodities, subject to commodity laws and regulations.

- Digital Assets:Some jurisdictions, like Singapore, have adopted a more general “digital asset” classification, providing flexibility in regulating various types of cryptocurrencies.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

AML/KYC requirements are crucial for preventing the use of cryptocurrencies for illicit activities. Many jurisdictions have implemented AML/KYC regulations for cryptocurrency exchanges and businesses.

- Customer Due Diligence:Exchanges are required to verify the identities of their customers and monitor their transactions for suspicious activity.

- Reporting Obligations:Exchanges are often obligated to report suspicious transactions to financial intelligence units (FIUs).

Taxation of Cryptocurrency Transactions

Taxation of cryptocurrency transactions is another complex area. Some jurisdictions treat cryptocurrency transactions as capital gains or losses, while others have specific tax regimes for cryptocurrency activities.

- Capital Gains Tax:In some jurisdictions, profits from cryptocurrency trading are taxed as capital gains.

- Value-Added Tax (VAT):Some countries may impose VAT on cryptocurrency transactions.

- Specific Cryptocurrency Tax Regimes:Some jurisdictions have introduced specific tax regimes for cryptocurrency activities, such as mining or staking.

Licensing and Registration Requirements

Many jurisdictions require cryptocurrency exchanges and businesses to obtain licenses or register with relevant authorities. These requirements aim to ensure compliance with regulatory standards and protect investors.

- Exchange Licensing:Cryptocurrency exchanges may need to obtain licenses to operate in specific jurisdictions.

- Business Registration:Cryptocurrency businesses may need to register with relevant authorities to comply with regulatory requirements.

Evolution of Regulatory Approaches

Regulatory approaches to cryptocurrencies are constantly evolving. Some key trends include:

- Increased Regulatory Scrutiny:Governments are increasingly focusing on regulating cryptocurrencies due to concerns about financial stability, consumer protection, and illicit activities.

- International Cooperation:International organizations like the Financial Action Task Force on Money Laundering (FATF) are promoting global standards for regulating cryptocurrencies.

- Sandboxes and Pilot Programs:Some jurisdictions are establishing regulatory sandboxes or pilot programs to experiment with different approaches to regulating cryptocurrencies.

Impact of Regulations on the Cryptocurrency Industry

Cryptocurrency regulations are a double-edged sword. While they aim to provide consumer protection and financial stability, they can also stifle innovation and hinder adoption. This section delves into the complex interplay between regulations and the cryptocurrency industry, exploring their impact on various aspects of the ecosystem.

Impact on Cryptocurrency Adoption

Regulations can significantly influence the rate of cryptocurrency adoption by shaping public perception, investor confidence, and accessibility.

- Increased Legitimacy and Trust:Clear regulations can legitimize the cryptocurrency industry in the eyes of investors, businesses, and the general public. This can foster trust and encourage wider adoption, as individuals feel more confident in the security and stability of the market.

- Reduced Risk Perception:Regulations can help mitigate risks associated with cryptocurrency, such as money laundering, fraud, and market manipulation. This can attract more risk-averse investors who might have been hesitant to enter the market previously.

- Improved Accessibility:Regulatory frameworks can create a more accessible environment for cryptocurrency adoption by simplifying KYC/AML procedures, establishing clear legal frameworks for exchanges, and facilitating integration with traditional financial systems.

Impact on Cryptocurrency Innovation

While regulations can promote stability, they can also pose challenges to innovation in the cryptocurrency industry.

- Increased Compliance Costs:Compliance with complex regulations can impose significant costs on cryptocurrency businesses, diverting resources away from research and development. This can hinder innovation, especially for startups and smaller companies.

- Stifled Experimentation:Stringent regulations can discourage experimentation with new technologies and business models, potentially limiting the emergence of disruptive innovations in the cryptocurrency space.

- Uncertainty and Legal Ambiguity:Lack of clear regulatory frameworks can create uncertainty for businesses, making them hesitant to invest in innovative projects due to the risk of legal challenges or regulatory changes.

Impact on Cryptocurrency Investment

Regulations can influence investment patterns in the cryptocurrency industry, impacting both institutional and individual investors.

- Increased Institutional Investment:Clear regulations can encourage institutional investors, such as hedge funds and pension funds, to allocate capital to cryptocurrencies. This can lead to increased liquidity and price stability in the market.

- Enhanced Investor Protection:Regulations can protect investors from scams and fraud, creating a more secure and transparent environment for investment. This can attract a broader range of investors, including those with lower risk tolerance.

- Potential for Market Fragmentation:Different regulatory approaches across jurisdictions can lead to market fragmentation, creating challenges for cross-border transactions and investments.

Examples of Regulations Shaping the Cryptocurrency Industry

Several countries have implemented regulations that have significantly impacted the cryptocurrency industry.

- China:China’s strict regulations on cryptocurrency trading and mining have led to a significant decline in the country’s involvement in the industry. The ban on cryptocurrency exchanges in 2017 and subsequent crackdown on mining activities have significantly impacted the global market.

Navigating the complex world of cryptocurrency regulations across different countries can be daunting, especially with the ever-changing landscape. Understanding the impact of these regulations on the value and accessibility of cryptocurrencies is crucial, especially when considering the broader economic picture.

It’s also essential to factor in the influence of inflation, which can significantly impact your investment decisions. For valuable insights on how to navigate the challenges of rising prices, check out the inflation guide tips to understand and manage rising prices.

By understanding both the regulatory environment and the economic forces at play, you can make informed decisions about your cryptocurrency investments and navigate the volatility of the market with greater confidence.

- United States:The US has adopted a more fragmented approach to cryptocurrency regulation, with different agencies overseeing different aspects of the industry. The SEC has issued guidance on token offerings, while the CFTC has regulated derivatives markets. The US approach has led to uncertainty for businesses operating in the space.

- European Union:The EU has adopted a more comprehensive approach to cryptocurrency regulation, with the MiCA (Markets in Crypto-Assets) regulation aiming to provide a harmonized framework for the industry. The MiCA regulation covers a wide range of aspects, including licensing, investor protection, and anti-money laundering.

Key Regulatory Concerns: Cryptocurrency Regulations Around The World Guide Analysis

The rapid rise of cryptocurrencies has brought with it a multitude of regulatory challenges. Governments and financial institutions worldwide are grappling with how to regulate this nascent industry, balancing innovation with the need to protect consumers and maintain financial stability.

Navigating the complex world of cryptocurrency regulations around the globe can feel like a wild ride, especially with the ever-changing landscape. Understanding the nuances of each country’s approach is crucial for both investors and businesses, and it’s vital to be informed about the potential risks and opportunities.

It’s also important to remember that managing your finances responsibly is key, and learning about effective credit debt management tips strategies examples can help you avoid unnecessary financial burdens. With a solid understanding of both cryptocurrency regulations and personal finance, you can navigate the world of digital assets with greater confidence.

This section delves into some of the key regulatory concerns surrounding cryptocurrencies.

Consumer Protection and Investor Fraud

The decentralized nature of cryptocurrencies and the lack of traditional regulatory oversight can create vulnerabilities for consumers. Crypto markets are susceptible to scams, pump-and-dump schemes, and other forms of fraud. This can lead to significant financial losses for unsuspecting investors.

- Lack of Transparency:The anonymity associated with cryptocurrency transactions can make it difficult to track and trace fraudulent activities.

- Sophisticated Scams:Crypto scams are becoming increasingly sophisticated, often involving fake exchanges, cloned websites, and social engineering tactics.

- Limited Investor Protection:Many cryptocurrency platforms operate outside traditional regulatory frameworks, leaving investors with limited recourse in case of fraud or losses.

Market Manipulation and Price Volatility

Cryptocurrency markets are known for their extreme volatility, which can be exacerbated by market manipulation. This can lead to significant price swings and potential losses for investors.

- Wash Trading:This involves artificially inflating trading volume by creating fake trades, giving the impression of higher demand and driving up prices.

- Spoofing:This involves placing large orders to manipulate the market price and then canceling them before they are executed, creating false signals and influencing other traders.

- Pump-and-Dump Schemes:These involve coordinated efforts to artificially inflate the price of a cryptocurrency before dumping their holdings, leaving unsuspecting investors with significant losses.

Money Laundering and Terrorism Financing

The anonymity and cross-border nature of cryptocurrency transactions pose challenges for preventing money laundering and terrorism financing.

- Pseudonymous Transactions:Cryptocurrencies are often traded under pseudonyms, making it difficult to track the origin and destination of funds.

- Decentralized Exchanges:Decentralized exchanges (DEXs) operate without centralized control, making it harder to monitor and regulate transactions.

- Limited KYC/AML Compliance:Many cryptocurrency platforms have limited Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance measures, increasing the risk of illicit activities.

Data Privacy and Cybersecurity

Cryptocurrency exchanges and wallets store sensitive user data, making them targets for cyberattacks. Data breaches can lead to the theft of personal information, financial assets, and even the compromise of entire networks.

- Phishing Attacks:Hackers often use phishing emails and websites to trick users into revealing their login credentials and private keys.

- Malware Infections:Malicious software can be used to steal cryptocurrency from wallets and exchanges, or to manipulate trading activities.

- Exchange Hacks:Cryptocurrency exchanges have been the target of numerous high-profile hacks, resulting in significant financial losses for users and investors.

Environmental Impact of Cryptocurrency Mining

The energy-intensive process of cryptocurrency mining has raised concerns about its environmental impact, particularly in terms of carbon emissions.

- High Energy Consumption:Cryptocurrency mining requires significant computing power, which translates to high energy consumption.

- Carbon Footprint:The energy used for mining often comes from fossil fuels, contributing to greenhouse gas emissions.

- Environmental Concerns:The environmental impact of cryptocurrency mining has raised concerns about its contribution to climate change and resource depletion.

Future of Cryptocurrency Regulations

The future of cryptocurrency regulations is a dynamic and evolving landscape, shaped by a confluence of technological advancements, global economic trends, and evolving societal attitudes. Regulatory bodies around the world are actively working to adapt and refine their frameworks to effectively address the unique challenges and opportunities presented by cryptocurrencies.

Emerging Trends and Potential Future Developments

The rapid pace of innovation within the cryptocurrency ecosystem necessitates continuous adaptation and refinement of regulatory frameworks. Emerging trends and potential future developments are likely to shape the direction of cryptocurrency regulation in the years to come.

- Increased Focus on Decentralized Finance (DeFi):DeFi protocols are increasingly attracting attention from regulators, particularly due to their ability to offer financial services outside traditional institutions. Expect regulatory scrutiny to focus on aspects like transparency, consumer protection, and the potential for market manipulation.

- Stablecoin Regulation:Stablecoins, which aim to maintain a stable value pegged to a fiat currency, are gaining traction. Regulators are examining their potential impact on financial stability and are likely to introduce specific regulations to address concerns related to their issuance, redemption, and risk management.

- Non-Fungible Tokens (NFTs):NFTs are gaining popularity in various sectors, including art, gaming, and collectibles. While they are not inherently financial instruments, their use cases raise regulatory considerations regarding consumer protection, intellectual property rights, and potential market manipulation.

- Cross-Border Cooperation:As cryptocurrencies operate on a global scale, international cooperation is crucial to ensure regulatory consistency and prevent regulatory arbitrage. Expect increased collaboration among regulatory bodies to establish common standards and best practices.

Impact of International Cooperation and Standardization Efforts

International cooperation and standardization efforts are critical to achieving a cohesive and effective regulatory landscape for cryptocurrencies.

- Harmonized Regulations:International collaboration can help create a more harmonized regulatory environment, reducing regulatory fragmentation and fostering cross-border innovation. This can be achieved through the development of common principles, guidelines, and best practices.

- Reduced Regulatory Arbitrage:Standardized regulations can help mitigate the risk of regulatory arbitrage, where businesses relocate to jurisdictions with more lenient regulations. This ensures a level playing field for all players in the cryptocurrency ecosystem.

- Enhanced Consumer Protection:International cooperation can strengthen consumer protection measures by sharing best practices and coordinating efforts to address cross-border scams and fraud.

Role of Technology and Innovation in Shaping Future Regulations

Technology plays a crucial role in shaping the future of cryptocurrency regulation.

- RegTech Solutions:RegTech solutions can enhance regulatory efficiency and effectiveness by leveraging technologies such as artificial intelligence (AI), blockchain, and data analytics. These solutions can automate compliance processes, improve risk assessment, and enhance surveillance capabilities.

- Smart Contracts and Decentralized Governance:Smart contracts and decentralized governance models are increasingly prevalent in the cryptocurrency ecosystem. Regulators are exploring ways to incorporate these technologies into their frameworks, addressing issues like transparency, accountability, and enforcement.

- Regulatory Sandbox:Regulatory sandboxes provide a controlled environment for testing innovative crypto-related products and services. These sandboxes allow regulators to gain valuable insights into the practical implications of new technologies and develop appropriate regulatory approaches.

Best Practices for Compliance

Navigating the complex world of cryptocurrency regulations can be challenging, but understanding and implementing best practices for compliance is crucial for individuals and businesses alike. This section delves into practical tips and strategies to ensure you’re operating within the boundaries of the law and protecting yourself from potential risks.

Best Practices for Individuals

Understanding the regulatory landscape is essential for individuals engaging in cryptocurrency activities. The following checklist provides a framework for navigating compliance:

- Know Your Jurisdiction’s Regulations:Research and understand the specific laws and regulations governing cryptocurrency in your country or region. Different jurisdictions have varying rules regarding cryptocurrency trading, taxation, and KYC/AML requirements.

- Choose Reputable Platforms:Opt for cryptocurrency exchanges and wallets that are licensed and regulated in your jurisdiction. Reputable platforms prioritize security and compliance, reducing the risk of fraud or unauthorized access.

- Maintain Proper Records:Keep detailed records of all cryptocurrency transactions, including dates, amounts, and counterparties. This documentation can be invaluable for tax purposes and potential audits.

- Understand Tax Implications:Cryptocurrency transactions are often subject to taxation. Consult with a tax professional to understand the specific tax rules in your region and ensure you’re filing accurate tax returns.

- Be Aware of KYC/AML Requirements:Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are designed to prevent financial crime. Be prepared to provide identification and other documentation when required by cryptocurrency platforms or exchanges.

Best Practices for Businesses

Businesses operating in the cryptocurrency space face a higher level of scrutiny and regulatory requirements. The following best practices can help ensure compliance:

- Develop a Robust Compliance Program:Establish a comprehensive compliance program that encompasses KYC/AML, data security, and regulatory reporting. This program should be regularly reviewed and updated to reflect evolving regulations.

- Implement Strong Security Measures:Protect customer data and cryptocurrency assets with robust security protocols, including multi-factor authentication, encryption, and regular security audits.

- Conduct Due Diligence on Counterparties:Thoroughly vet all business partners and counterparties to ensure they are compliant with relevant regulations and pose no reputational or legal risks.

- Seek Professional Legal and Financial Advice:Engage legal and financial professionals with expertise in cryptocurrency to navigate complex regulatory landscapes, ensure compliance, and mitigate potential legal risks.

- Stay Informed of Regulatory Updates:The cryptocurrency regulatory environment is constantly evolving. Stay informed about new laws, regulations, and guidance through industry publications, regulatory websites, and professional networks.

Navigating Regulatory Requirements in Different Jurisdictions, Cryptocurrency regulations around the world guide analysis

Cryptocurrency regulations vary widely across different jurisdictions. Understanding the specific requirements in each region is crucial for businesses operating internationally.

- Conduct Thorough Due Diligence:Before expanding into a new jurisdiction, conduct thorough research on the applicable cryptocurrency laws and regulations. This includes understanding licensing requirements, KYC/AML rules, tax obligations, and any specific regulations for particular cryptocurrency activities.

- Seek Local Legal Counsel:Engage local legal counsel with expertise in cryptocurrency to provide guidance on navigating the specific regulatory landscape in that jurisdiction. Local counsel can also assist with compliance audits and legal risk assessments.

- Consider a Multi-Jurisdictional Approach:For businesses operating globally, consider adopting a multi-jurisdictional approach to compliance. This may involve establishing legal entities in different jurisdictions to ensure adherence to local laws and regulations.

The Importance of Seeking Professional Legal and Financial Advice

Navigating the complex world of cryptocurrency regulations can be daunting, especially for businesses operating in a rapidly evolving industry. Seeking professional legal and financial advice is essential for several reasons:

- Specialized Expertise:Legal and financial professionals with expertise in cryptocurrency can provide valuable insights and guidance on compliance, risk management, and navigating complex regulatory landscapes.

- Proactive Risk Management:Early engagement with legal and financial advisors can help identify potential legal risks and develop proactive strategies to mitigate them.

- Cost-Effective Compliance:Seeking professional advice can help businesses avoid costly legal penalties and reputational damage associated with non-compliance.