COVID-19s Impact on the US Economy: Past, Present, and Future

The impact of covid 19 on the us economy an analysis of the past present and future – COVID-19’s impact on the US economy: an analysis of the past, present, and future, is a story of both devastation and resilience. The pandemic, which began in early 2020, brought the world to a standstill, forcing businesses to close, workers to stay home, and economies to shudder.

The US, a global economic powerhouse, was not immune to these shocks.

From the initial lockdowns and supply chain disruptions to the subsequent economic stimulus packages and shifts in consumer behavior, the pandemic has fundamentally altered the US economic landscape. This analysis delves into the profound impact of COVID-19, exploring the economic landscape before the pandemic, the immediate consequences, government responses, sector-specific impacts, labor market changes, and the evolving consumer behavior.

It also looks ahead to the long-term implications for the US economy, highlighting potential growth opportunities and challenges in the post-pandemic era.

The Economic Landscape Before COVID-19

The years leading up to the COVID-19 pandemic saw a period of relative economic stability and growth in the United States. While not without its challenges, the economy exhibited several positive indicators, creating a sense of optimism and prosperity.The US economy was characterized by steady growth in GDP, low unemployment rates, and relatively low inflation.

The COVID-19 pandemic drastically impacted the US economy, with initial lockdowns causing widespread economic shutdowns. As we move forward, the effects are still being felt, with inflation and rising interest rates creating a challenging environment for businesses and consumers alike.

This is particularly relevant for the housing market, where experts warn homebuyers of red flags beyond climbing interest rates. Navigating these challenges will be key to understanding the future trajectory of the US economy and its ability to recover fully from the pandemic’s impact.

These key economic indicators painted a picture of a robust and resilient economy.

Key Economic Indicators

The period leading up to the pandemic witnessed a gradual but consistent expansion of the US economy. This growth was reflected in the GDP, which serves as a comprehensive measure of the total value of goods and services produced in a country.

The unemployment rate, a measure of the percentage of the labor force actively seeking employment but unable to find it, remained relatively low. This indicated a healthy job market with ample opportunities for workers.Inflation, the rate at which prices for goods and services rise over time, was also relatively low during this period.

This stability in prices contributed to consumer confidence and encouraged spending.

Major Industries and Sectors

Several industries and sectors were thriving in the years preceding the pandemic. These included:

- Technology:The tech sector continued its explosive growth, driven by innovation, rising consumer demand for digital products and services, and the increasing adoption of cloud computing.

- Healthcare:The healthcare sector experienced steady growth, fueled by an aging population, advances in medical technology, and rising healthcare expenditures.

- Financial Services:The financial services sector benefited from a robust stock market, low interest rates, and increased demand for financial products and services.

- Energy:The energy sector saw growth in both traditional fossil fuels and renewable energy sources, driven by increasing global demand for energy.

“The US economy was on a solid footing before the pandemic, with strong GDP growth, low unemployment, and low inflation. However, the pandemic’s impact on the economy was unprecedented, causing a sharp economic downturn.”

The Immediate Impact of COVID-19

The COVID-19 pandemic had a profound and immediate impact on the U.S. economy, leading to widespread business closures, job losses, and a sharp decline in economic activity. The pandemic’s effects were felt across all sectors of the economy, with some industries being hit harder than others.

Business Closures and Job Losses

The pandemic’s impact on businesses was immediate and severe. Businesses were forced to close their doors due to government-mandated lockdowns, social distancing measures, and the fear of spreading the virus. This led to widespread job losses, as businesses were unable to operate and could not afford to keep their employees on payroll.

The Bureau of Labor Statistics reported that the U.S. economy lost over 20 million jobs in April 2020 alone, the largest monthly decline in employment on record.

Impact of Lockdowns and Social Distancing Measures

Lockdowns and social distancing measures were implemented to slow the spread of the virus. While these measures were necessary to protect public health, they also had a significant impact on economic activity. Businesses were forced to close or operate at reduced capacity, and consumers were discouraged from spending money on non-essential goods and services.

This led to a sharp decline in consumer spending, which is a major driver of economic growth.

Industries Particularly Hard-Hit

The pandemic had a disproportionate impact on certain industries. For example, the tourism and hospitality industries were particularly hard-hit, as travel and leisure activities were severely restricted. The restaurant industry also suffered significant losses, as dine-in services were limited or prohibited in many areas.

The COVID-19 pandemic had a profound impact on the US economy, leaving a trail of economic uncertainty in its wake. Many individuals and families faced financial hardship, with some struggling to make ends meet. Navigating this turbulent landscape requires a solid understanding of personal finance, particularly when it comes to managing credit debt.

Fortunately, there are resources available to help, like the credit debt management tips strategies examples found on The Venom Blog, which can provide valuable insights into effective debt reduction strategies. As the US economy continues to recover, understanding and implementing these strategies can help individuals regain financial stability and build a brighter future.

The COVID-19 pandemic had a devastating impact on the U.S. economy, leading to a sharp decline in economic activity, widespread business closures, and significant job losses.

Government Responses and Economic Policies

The US government implemented a series of unprecedented economic stimulus packages to mitigate the economic fallout of the COVID-19 pandemic. These measures aimed to provide financial relief to individuals, businesses, and industries, with the goal of preventing a deeper economic downturn.

The CARES Act and Subsequent Stimulus Measures

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law in March 2020, was the first and most significant stimulus package. It included a wide range of provisions, such as:

- Direct payments to individuals: The act provided one-time payments of up to $1,200 per adult and $500 per child, depending on income levels.

- Expanded unemployment benefits: The act increased the duration of unemployment benefits and provided an additional $600 weekly payment to eligible recipients.

- Loans and grants for businesses: The act established the Paycheck Protection Program (PPP) to provide forgivable loans to small businesses to cover payroll and other expenses. It also provided grants to businesses and non-profits.

- Support for healthcare providers: The act provided funding to hospitals, health care providers, and state and local governments to address the pandemic.

Following the CARES Act, the government enacted several additional stimulus measures, including the Coronavirus Response and Relief Supplemental Appropriations Act (CRRSAA) in December 2020 and the American Rescue Plan Act (ARPA) in March 2021. These acts extended and expanded some of the provisions of the CARES Act, such as unemployment benefits and direct payments, and provided additional funding for various programs.

Effectiveness of Government Interventions

The effectiveness of these economic policies in mitigating the economic impact of the pandemic is a subject of ongoing debate. Some argue that the stimulus measures prevented a deeper recession and helped to support the recovery. Others argue that the policies were too costly and may have contributed to inflation.

- Economic impact: The stimulus measures undoubtedly had a significant impact on the economy. They helped to support household incomes, maintain business operations, and prevent a deeper recession. The unemployment rate, which peaked at 14.7% in April 2020, has since fallen back to pre-pandemic levels.

The COVID-19 pandemic had a profound impact on the US economy, leading to a sharp recession in 2020. While the economy has since recovered, the effects of the pandemic are still being felt, particularly in the financial sector. The recent bankruptcy filing of Genesis crypto lending is a stark reminder of the ongoing economic fragility, highlighting the vulnerabilities of the crypto market and its potential impact on broader financial stability.

Looking ahead, the US economy faces a number of challenges, including rising inflation, supply chain disruptions, and a potential recession.

- Inflation: However, the massive influx of government spending also contributed to rising inflation. The Consumer Price Index (CPI) rose by 7% in 2021, the highest annual increase since 1982. This inflation has eroded the purchasing power of consumers and has put pressure on businesses.

- Long-term effects: The long-term effects of the stimulus measures are still uncertain. Some argue that the policies may have created a dependency on government support and may have discouraged workers from returning to the labor force. Others argue that the policies were necessary to prevent a more severe economic downturn and that the economy will eventually adjust.

Comparison of Government Interventions

The government implemented a variety of interventions to address the economic crisis, each with its own advantages and disadvantages.

- Unemployment benefits: Unemployment benefits provided a lifeline to millions of workers who lost their jobs due to the pandemic. However, the extended duration and generous payments of the benefits may have discouraged some workers from seeking new employment.

- Loan programs: The PPP and other loan programs helped businesses to stay afloat during the pandemic. However, some argue that these programs were too generous and that some businesses may have used the funds for purposes other than payroll and expenses.

The Pandemic’s Impact on Different Sectors

The COVID-19 pandemic had a profound and multifaceted impact on various sectors of the U.S. economy. From healthcare and technology to tourism and manufacturing, the pandemic disrupted established trends and forced businesses to adapt to unprecedented challenges. This section explores the specific effects of the pandemic on different sectors, highlighting the pre-pandemic trends, the immediate impact, and the post-pandemic outlook.

The Pandemic’s Impact on Different Sectors

The following table provides a concise overview of the pandemic’s impact on different sectors of the U.S. economy:

| Sector | Pre-Pandemic Trends | Pandemic Impact | Post-Pandemic Outlook |

|---|---|---|---|

| Healthcare | Steady growth in healthcare spending, increasing demand for specialized services, and a growing emphasis on technology integration. | Surge in demand for COVID-19-related services, strained healthcare systems, supply chain disruptions for medical equipment, and workforce shortages. | Continued demand for telehealth services, focus on public health preparedness, investment in digital infrastructure, and a potential shift towards value-based care models. |

| Technology | Rapid technological advancements, increasing adoption of cloud computing and digital platforms, and a growing reliance on e-commerce. | Accelerated adoption of remote work technologies, increased demand for digital services, and growth in e-commerce platforms. | Continued growth in technology sectors, with a focus on cybersecurity, artificial intelligence, and the development of new digital tools. |

| Tourism | Strong growth in domestic and international travel, driven by increasing disposable incomes and a growing demand for leisure experiences. | Sharp decline in travel and tourism activity, with travel restrictions, lockdowns, and safety concerns leading to a significant drop in demand. | Gradual recovery in travel and tourism, with a focus on domestic travel and the adoption of new safety protocols. |

| Manufacturing | Steady growth in manufacturing output, driven by technological advancements and increased global demand. | Supply chain disruptions, factory closures, and labor shortages, leading to production delays and increased costs. | Reshoring of manufacturing operations, investment in automation and robotics, and a focus on supply chain resilience. |

The Labor Market and Workforce Dynamics: The Impact Of Covid 19 On The Us Economy An Analysis Of The Past Present And Future

The COVID-19 pandemic had a profound impact on the US labor market, causing unprecedented disruptions and reshaping the way people work. This section delves into the significant changes in unemployment rates, employment patterns, and workforce dynamics during the pandemic. It also examines the impact of remote work and automation on the labor market and explores the challenges faced by workers in adapting to the new economic realities.

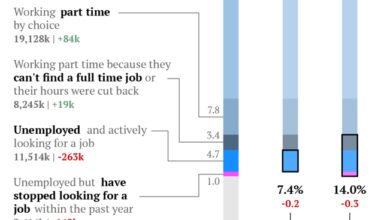

Unemployment Rates and Employment Patterns, The impact of covid 19 on the us economy an analysis of the past present and future

The pandemic triggered a sharp rise in unemployment rates, with millions of Americans losing their jobs due to business closures, reduced demand, and health concerns. The unemployment rate reached a peak of 14.7% in April 2020, the highest level since the Great Depression.

The labor market recovery has been uneven, with some sectors experiencing significant job losses while others have seen growth. For instance, the leisure and hospitality industry, heavily impacted by lockdowns and travel restrictions, experienced a steep decline in employment, while sectors like healthcare and technology saw more resilience.

- Initial Job Losses:The initial impact of the pandemic was felt most acutely in sectors like leisure and hospitality, retail, and transportation, which were forced to close or significantly reduce operations. The Bureau of Labor Statistics reported that in April 2020, the leisure and hospitality sector alone lost 7.7 million jobs, representing a staggering 47% decline in employment.

- Uneven Recovery:While the unemployment rate has since declined, the recovery has been uneven across different sectors. Some industries, like manufacturing and construction, have seen a relatively quick rebound, while others, like travel and tourism, have been slower to recover. The pandemic also accelerated the trend of job polarization, with low-wage jobs experiencing greater losses than high-wage jobs.

- Long-Term Unemployment:The pandemic also led to an increase in long-term unemployment, defined as individuals who have been out of work for 27 weeks or more. This group faced significant challenges in re-entering the workforce, as their skills may have become outdated or their job prospects diminished due to prolonged unemployment.

Remote Work and Automation

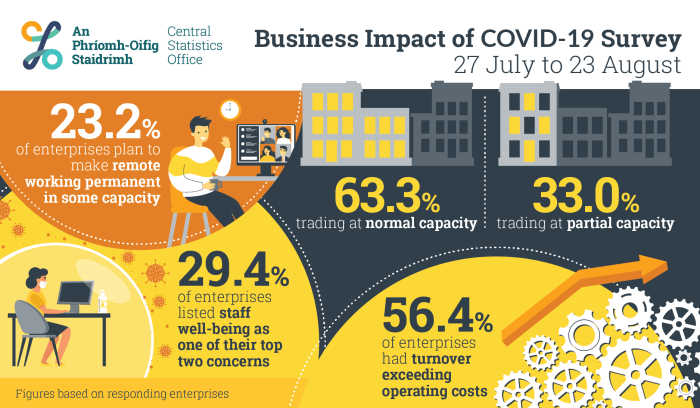

The pandemic accelerated the adoption of remote work, with many companies transitioning to virtual work environments. While remote work has offered flexibility and work-life balance for some employees, it has also raised concerns about job security, social isolation, and the potential for automation to displace jobs.

- Increased Adoption of Remote Work:The pandemic forced many companies to adopt remote work arrangements, leading to a surge in the use of virtual meeting platforms, collaboration tools, and cloud-based software. This shift has the potential to permanently alter the way work is organized, with many companies exploring hybrid work models that combine in-office and remote work.

- Automation and Job Displacement:The pandemic has also accelerated the adoption of automation in various industries. Companies have increasingly turned to robots and artificial intelligence to perform tasks that were previously done by humans, leading to concerns about job displacement. The impact of automation is expected to vary across industries, with some sectors experiencing greater job losses than others.

- Upskilling and Reskilling:The changing nature of work requires workers to adapt and acquire new skills. The pandemic has highlighted the importance of upskilling and reskilling programs to help workers transition to in-demand roles. Government and private sector initiatives aimed at providing training and support for workers affected by automation and the shift to remote work will be crucial for a successful labor market transition.

Challenges Faced by Workers

Workers have faced numerous challenges in adapting to the new economic realities created by the pandemic. These challenges include job insecurity, income instability, and the need to acquire new skills.

- Job Insecurity:The pandemic has led to widespread job insecurity, with many workers facing layoffs, reduced hours, or temporary furloughs. This uncertainty has created anxiety and financial stress for many households.

- Income Instability:The pandemic has also caused income instability for many workers, with some experiencing significant pay cuts or job losses. This has led to increased reliance on government assistance programs, such as unemployment benefits and food stamps.

- Skills Gap:The pandemic has highlighted the importance of skills and the need for workers to adapt to changing job requirements. The shift to remote work and the increasing adoption of automation have created a skills gap, requiring workers to acquire new skills to remain competitive in the labor market.

Consumer Behavior and Spending Patterns

The COVID-19 pandemic dramatically altered consumer behavior and spending patterns, leading to significant shifts in the retail landscape. As lockdowns and social distancing measures became the norm, consumers adapted to new ways of shopping and spending, impacting various industries and businesses.

The pandemic’s impact on consumer spending was multifaceted, driven by factors such as economic uncertainty, changing priorities, and government interventions. The sudden shift to remote work and the closure of non-essential businesses significantly impacted spending habits. Consumers began prioritizing essential goods and services, while discretionary spending declined.

This shift in priorities led to a surge in demand for items like groceries, household supplies, and healthcare services, while spending on travel, entertainment, and dining out decreased. The pandemic also forced many consumers to adapt to online shopping, leading to a significant rise in e-commerce and a decline in brick-and-mortar retail.

The Rise of Online Shopping

The pandemic accelerated the shift toward online shopping, as consumers sought safe and convenient ways to acquire goods and services. E-commerce platforms experienced a surge in demand, with many businesses adapting their operations to meet the growing online market.

The rise of online shopping was driven by several factors:

- Convenience:Online shopping offered consumers a convenient and contactless way to purchase goods, particularly during lockdowns and social distancing measures.

- Safety:Consumers sought safer alternatives to in-store shopping, reducing the risk of exposure to the virus.

- Wider Selection:Online retailers often offer a wider selection of products than brick-and-mortar stores, providing consumers with greater choice and flexibility.

- Competitive Pricing:Online retailers frequently offer competitive pricing, attracting price-sensitive consumers.

The Decline of Brick-and-Mortar Retail

The pandemic significantly impacted brick-and-mortar retail, leading to closures, reduced foot traffic, and financial challenges. The decline in physical retail was driven by several factors:

- Shift to Online Shopping:The rise of online shopping diverted consumer spending away from brick-and-mortar stores.

- Lockdowns and Restrictions:Government-imposed lockdowns and restrictions limited consumer mobility, reducing foot traffic in physical stores.

- Social Distancing Measures:Social distancing guidelines discouraged in-store shopping, leading to reduced customer engagement.

- Economic Uncertainty:The economic uncertainty caused by the pandemic led to reduced consumer spending, impacting retail sales.

The Impact of Government Stimulus Checks

Government stimulus checks, distributed to individuals and families during the pandemic, aimed to mitigate the economic impact and support consumer spending. The stimulus checks provided a temporary boost to consumer spending, helping to offset job losses and income reductions.

The impact of the stimulus checks on consumer spending was evident in increased purchases of essential goods and services, as well as discretionary items like electronics and home appliances.

However, the impact of the stimulus checks on consumer spending was temporary, and their long-term effects remain under debate. Some argue that the stimulus checks helped to stabilize the economy during the pandemic, while others contend that they contributed to inflation.

The overall impact of the stimulus checks on consumer spending is a complex issue, with varying perspectives and interpretations.

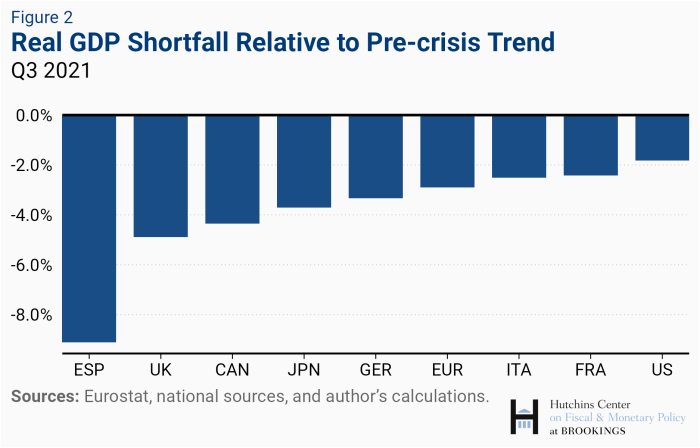

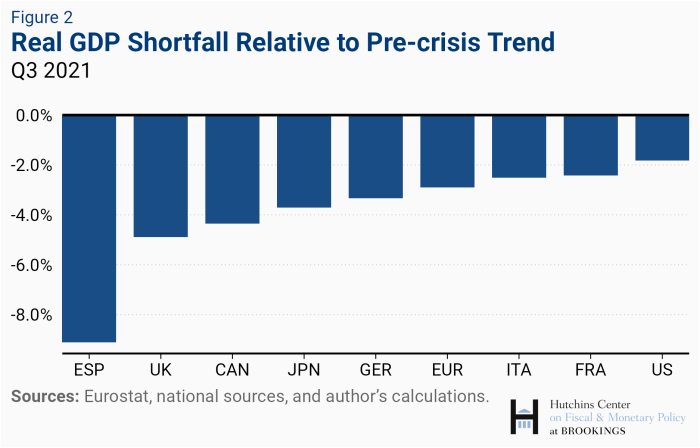

The Future of the US Economy

The COVID-19 pandemic has left an indelible mark on the US economy, disrupting industries, altering consumer behavior, and forcing businesses to adapt. While the immediate impact was characterized by widespread economic contraction, the long-term implications are still unfolding. As we navigate the post-pandemic era, it is crucial to understand the potential growth opportunities and challenges that lie ahead.

This analysis will delve into the future of the US economy, exploring the role of innovation, technology, and government policy in shaping the economic landscape.

The Long-Term Economic Implications of the Pandemic

The COVID-19 pandemic has triggered a series of long-term economic implications, some of which are still being understood. The pandemic has accelerated the adoption of technology, leading to a shift towards remote work, online shopping, and digital payments. This has resulted in the growth of e-commerce and digital services, while traditional brick-and-mortar businesses have faced challenges.

The pandemic has also highlighted the importance of supply chain resilience and the need for greater diversification. The disruption of global supply chains due to lockdowns and travel restrictions has led to shortages and price increases, underscoring the need for more robust and adaptable supply chains.