Forex Dollar Dips, Yuan Slides: Market Moves After PBOC Surprise & Fed Rate Cut Bets

Forex dollar dips yuan slides market moves after pboc surprise and fed rate cut bets – Forex Dollar Dips, Yuan Slides: Market Moves After PBOC Surprise & Fed Rate Cut Bets – this headline captures the recent volatility in the global currency markets. The unexpected move by the People’s Bank of China (PBOC) to cut interest rates, coupled with growing expectations for a Fed rate cut, has sent shockwaves through the financial world.

The US dollar has weakened against major currencies, while the Chinese yuan has also slipped, reflecting the uncertainty surrounding global economic prospects. This unexpected turn of events has left market participants scrambling to adjust their positions and anticipate the next move.

The PBOC’s surprise rate cut, aimed at stimulating the Chinese economy, has raised questions about the country’s growth trajectory and its impact on global demand. Meanwhile, the anticipation of a Fed rate cut, driven by concerns about slowing economic growth and inflation, has fueled speculation about the future direction of US monetary policy.

The interplay of these factors has created a complex and dynamic environment for currency trading, with significant implications for investors and businesses alike.

Fed Rate Cut Bets

The market is buzzing with speculation about a potential Fed rate cut, and its impact on the US dollar is a major point of discussion. This anticipation is fueled by a combination of economic indicators, inflation concerns, and the Federal Reserve’s recent communication.

The Impact of a Fed Rate Cut on the US Dollar, Forex dollar dips yuan slides market moves after pboc surprise and fed rate cut bets

A rate cut by the Fed would likely weaken the US dollar relative to other currencies. This is because a lower interest rate environment makes it less attractive for investors to hold US dollar assets, as they would earn lower returns.

Conversely, a rate cut could make other currencies, like the yuan, more appealing to investors seeking higher yields.

Factors Driving Rate Cut Expectations

Several factors are driving the anticipation of a Fed rate cut:* Economic Data:Recent economic data has shown signs of slowing growth in the US economy. For instance, the latest GDP figures revealed a slowdown in the second quarter of 2023, indicating a potential recessionary risk.

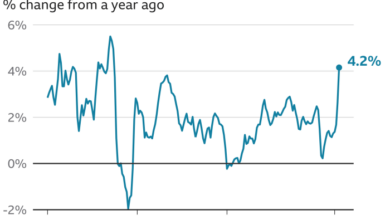

Inflation While inflation has cooled somewhat, it remains elevated above the Fed’s target of 2%. This persistent inflationary pressure could prompt the Fed to act more aggressively to bring inflation under control, potentially through rate cuts.

Fed Communication The Fed’s recent communication has hinted at the possibility of rate cuts in the near future. In their latest statement, Fed officials emphasized their commitment to achieving price stability, suggesting that they are open to using all available tools, including rate cuts, to reach their inflation target.

Potential Scenarios of a Fed Rate Cut

The following table Artikels the potential scenarios of a Fed rate cut and its impact on the dollar and yuan:| Scenario | Fed Action | Dollar Impact | Yuan Impact ||—|—|—|—|| Scenario 1: Aggressive Rate Cut| The Fed cuts interest rates by 50 basis points or more.

| Dollar weakens significantly against other currencies, including the yuan. | Yuan strengthens against the dollar. || Scenario 2: Moderate Rate Cut| The Fed cuts interest rates by 25 basis points. | Dollar weakens modestly against other currencies, including the yuan. | Yuan strengthens moderately against the dollar.

|| Scenario 3: No Rate Cut| The Fed maintains its current interest rate policy. | Dollar remains relatively stable against other currencies, including the yuan. | Yuan remains relatively stable against the dollar. |

It is important to note that these are just potential scenarios, and the actual impact of a Fed rate cut on the dollar and yuan could vary depending on various factors, including global economic conditions, investor sentiment, and the response of other central banks.

Forex Dollar Dips Yuan Slides: Forex Dollar Dips Yuan Slides Market Moves After Pboc Surprise And Fed Rate Cut Bets

The US dollar experienced a decline against major currencies, while the yuan also weakened following the People’s Bank of China’s (PBOC) surprise rate cut and heightened expectations of a Federal Reserve (Fed) interest rate cut. This move sparked volatility in the forex market, prompting investors to re-evaluate their positions.

Dollar Weakness and Yuan Slide

The US dollar weakened against major currencies like the euro, Japanese yen, and British pound, reflecting a shift in market sentiment. This was primarily driven by the anticipation of a Fed rate cut, which would make the dollar less attractive to investors seeking higher returns.

The yuan, on the other hand, slid against the dollar, primarily due to the PBOC’s unexpected rate cut, which signaled a loosening of monetary policy in China. This move was interpreted as a sign of weakness in the Chinese economy, leading to a decline in the yuan’s value.

Correlation and Divergence

While both the dollar and yuan experienced weakness, their movements were driven by distinct factors. The dollar’s decline was fueled by the anticipation of a Fed rate cut, while the yuan’s slide was primarily attributed to the PBOC’s surprise rate cut.

This suggests that the two currencies are not always perfectly correlated and can move independently based on their respective economic conditions and policy decisions.

Contributing Factors

Several factors contributed to the dollar’s decline and the yuan’s slide, including:

- Market Sentiment:The anticipation of a Fed rate cut, coupled with the PBOC’s surprise rate cut, fueled a risk-on sentiment in the market, which favored currencies like the euro and Japanese yen over the dollar and yuan.

- Economic Data:Weak economic data in both the US and China, including slowing growth and inflation, contributed to the decline in both currencies. This data reinforced concerns about the global economic outlook, prompting investors to seek safe-haven assets.

- Geopolitical Events:Ongoing geopolitical tensions, such as the trade war between the US and China, added to market volatility and contributed to the weakening of both currencies. These uncertainties created a sense of risk aversion among investors, leading to a flight to safety.

Exchange Rate Changes

The following table showcases the changes in exchange rates for the US dollar and yuan against major currencies:

The forex market is in a frenzy today, with the dollar dipping and the yuan sliding after the PBOC’s surprise rate cut and growing bets on a Fed rate cut. It’s a wild ride, and it’s hard to keep up with all the news! Meanwhile, the Hunter Biden federal tax case just took a dramatic turn, with the president’s son indicted on 9 criminal charges – you can read more about it here.

I’m not sure if this will have any impact on the forex market, but it’s definitely something to keep an eye on.

The forex market was in a frenzy today, with the dollar dipping and the yuan sliding after the PBOC surprised everyone with its latest move. Meanwhile, speculation about a Fed rate cut is driving investors to reassess their positions.

All this action reminds me of the importance of a solid privacy policy, especially when it comes to sensitive financial data. After all, understanding what is a privacy policy and why is it important is crucial for protecting your information in a volatile market like this.

So, as we watch the forex market gyrate, let’s also remember to safeguard our personal information with a strong privacy policy.

The forex market is in a frenzy right now, with the dollar dipping and the yuan sliding after the PBOC’s surprise move and bets on a Fed rate cut. Amidst all this volatility, it’s worth remembering the role of gold as a safe investment as a hedge against inflation and economic uncertainty.

While the dollar’s weakness might be temporary, gold’s long-term appeal as a safe haven asset remains strong, particularly during times like these when market sentiment is shaky.