Oil Prices Surge as US, UK Strike Houthis: Global Markets React

Oil prices surge as us and uk launch strikes on houthis global markets react – Oil prices surged as the US and UK launched strikes on Houthi forces in Yemen, sending shockwaves through global markets. The strikes, a response to escalating attacks on Saudi Arabian oil infrastructure, have ignited concerns about potential supply disruptions and geopolitical instability.

This event, which unfolded with the speed and intensity of a geopolitical earthquake, has left investors and analysts scrambling to assess the implications for the global energy landscape.

The immediate impact on oil prices was significant, with benchmark crude futures experiencing a sharp spike. The surge was driven by a confluence of factors, including fears of supply disruptions, heightened geopolitical tensions, and a shift in market sentiment. The strikes underscored the fragility of global energy supply chains and the potential for unforeseen events to disrupt the delicate balance of oil markets.

The Strikes and their Impact

The recent strikes launched by the US and UK on Houthi forces in Yemen have sent shockwaves through the region and the global oil market. These strikes, which targeted facilities believed to be involved in Houthi-led attacks on oil tankers in the Red Sea, represent a significant escalation in the conflict and have raised concerns about potential repercussions for regional stability and the global energy supply.

The world watches as oil prices surge in response to the US and UK’s strikes on Houthi targets, a volatile situation with global implications. Amidst this geopolitical turmoil, it’s fascinating to consider the potential impact of technologies like Neuralink, which are pushing the boundaries of human interaction with technology.

Imagine a future where we can control computers with our minds, as explored in the article unveiling the future neuralinks quest to enable mind controlled computers , a future that could drastically alter our relationship with the world around us, perhaps even influencing how we respond to events like this oil price spike.

Strategic Context of the Strikes

The strikes are part of a broader effort by the US and UK to counter Houthi threats in the region. The Houthis, who control much of Yemen’s north, have been engaged in a protracted war with the internationally recognized government, backed by a Saudi-led coalition.

In recent years, the Houthis have increasingly targeted shipping lanes in the Red Sea, including attacks on oil tankers, which have disrupted global energy supplies and raised tensions in the region. The US and UK have accused the Houthis of supporting terrorism and have taken a more assertive stance in response to these attacks.

The news of oil prices surging due to US and UK strikes on Houthis has dominated headlines, but a quieter tragedy has also unfolded: legendary computer hacker Kevin Mitnick, whose exploits once shook the tech world, passed away at 59, leaving an enduring legacy in cybersecurity.

His story , a mix of technical brilliance and legal battles, serves as a reminder of the evolving nature of digital security and the lasting impact individuals can have on the field.

Potential Consequences of the Strikes

The strikes have the potential to further escalate the conflict in Yemen, with the Houthis vowing retaliation. The strikes could also lead to a wider regional conflict, as Iran, which supports the Houthis, has condemned the strikes and warned of consequences.

The strikes have also raised concerns about the potential for further disruption to global energy supplies, as the Red Sea is a critical shipping route for oil and gas.

The Impact on the Oil Market

The strikes have already had a significant impact on the oil market, with prices surging in response to the heightened geopolitical tensions. The attacks on oil tankers in the Red Sea have raised concerns about the security of global energy supplies, leading to increased demand for oil and pushing prices higher.

The world’s attention is understandably fixated on the escalating tensions in the Middle East, with oil prices skyrocketing as the US and UK launch strikes on Houthi targets. This geopolitical turmoil is already rippling through global markets, and it seems the crypto sector isn’t immune either.

The SEC’s lawsuit against Coinbase, as reported in this article , adds another layer of uncertainty to an already volatile landscape. It’s clear that the impact of the Middle East crisis will be felt far and wide, and how the crypto markets navigate this turbulent period remains to be seen.

The strikes have also added to existing concerns about the global energy market, which is already facing supply constraints due to the ongoing war in Ukraine.

The Strikes and the Future of the Conflict, Oil prices surge as us and uk launch strikes on houthis global markets react

The strikes are a significant development in the ongoing conflict in Yemen, and their long-term consequences remain unclear. The strikes have the potential to further escalate the conflict and increase regional instability. The strikes have also raised concerns about the potential for a wider regional conflict and the disruption of global energy supplies.

The future of the conflict in Yemen will depend on the responses of the various actors involved, including the Houthis, the Yemeni government, the Saudi-led coalition, and the international community.

Oil Market Reactions: Oil Prices Surge As Us And Uk Launch Strikes On Houthis Global Markets React

The strikes on Houthi targets in Yemen have sent shockwaves through the global oil market, triggering a significant surge in crude prices. The immediate impact was a sharp increase in the price of Brent crude oil, the international benchmark, which jumped by over 5% in the hours following the attacks.

This volatility reflects the complex interplay of supply disruptions, geopolitical tensions, and market sentiment.

Factors Driving the Price Surge

The oil price surge is driven by a combination of factors, each contributing to the heightened uncertainty and risk aversion in the market:

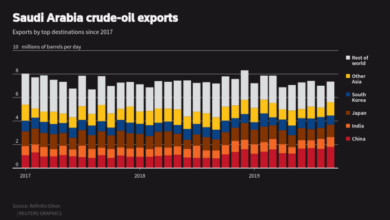

- Supply Disruptions:The strikes targeted key oil infrastructure in Yemen, raising concerns about potential disruptions to oil production and exports. Yemen is a significant oil producer in the region, and any disruption to its operations could have a ripple effect on global supply chains.

- Geopolitical Tensions:The strikes further escalate tensions in the Middle East, a region already characterized by instability and conflict. The increased risk of wider conflict or retaliatory attacks fuels anxieties about potential disruptions to oil supplies, pushing prices higher.

- Market Sentiment:The attacks have created a wave of fear and uncertainty among market participants. Investors are reacting to the heightened geopolitical risks by seeking safe-haven assets, leading to a surge in demand for oil as a traditional hedge against inflation and economic instability.

Comparison with Historical Trends

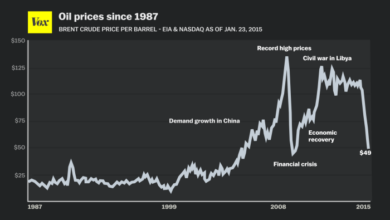

The current oil price fluctuations echo historical trends observed during similar events. For example, the 2003 invasion of Iraq led to a significant spike in oil prices due to concerns about supply disruptions. Similarly, the 2011 Libyan civil war caused a sharp increase in prices as oil production in the country was disrupted.

The current situation shares similarities with these events, as it highlights the vulnerability of global oil markets to geopolitical instability and supply disruptions.

“The current situation is reminiscent of previous crises, where oil prices have surged due to concerns about supply disruptions and geopolitical tensions. This underscores the interconnectedness of global oil markets and the potential impact of regional events on global energy prices.”

[Name of Analyst], [Source of Quote]

Global Economic Implications

The surge in oil prices due to the strikes on Houthi targets has far-reaching implications for the global economy. These price increases, particularly when coupled with existing inflationary pressures, can have a significant impact on various sectors, including consumer spending, industrial production, and global trade.

Impact on Inflation and Consumer Spending

Rising oil prices directly translate into higher costs for transportation, energy, and manufacturing, which can lead to increased inflation. This, in turn, can erode consumer purchasing power, leading to a decline in discretionary spending and potentially triggering a spiral of economic slowdown.

For instance, the recent surge in oil prices has already been reflected in higher gasoline prices at the pump, which can significantly impact household budgets, particularly for lower-income families. This could lead to reduced spending on other goods and services, ultimately impacting overall economic activity.

Impact on Industrial Production

Oil is a critical input for various industries, including manufacturing, transportation, and agriculture. Higher oil prices can increase production costs, making it more expensive for businesses to operate. This can lead to reduced output, job losses, and potentially even higher prices for consumers.The automotive industry, for example, is heavily reliant on oil for both production and transportation.

Higher oil prices can make it more expensive to manufacture vehicles and to transport them to dealerships, potentially leading to higher vehicle prices and reduced demand.

Impact on Global Trade and Economic Growth

Rising oil prices can disrupt global trade patterns and slow economic growth. Higher transportation costs can make it more expensive to export goods, reducing international trade and potentially leading to a decline in economic activity in exporting countries.For example, countries that rely heavily on oil exports, such as Saudi Arabia and Russia, may see their economies negatively impacted by a decline in demand for their oil.

Conversely, countries that are net importers of oil, such as China and India, may face higher energy costs, which could put pressure on their economies.Furthermore, higher oil prices can contribute to global economic uncertainty, making businesses more hesitant to invest and consumers more cautious about spending.

This can create a vicious cycle, where reduced investment and spending lead to further economic slowdown.