Forex Dollar Falls as Market Awaits Fridays US Inflation Report

Forex dollar falls as market awaits fridays us inflation report – Forex Dollar Falls as Market Awaits Friday’s US Inflation Report: The forex market is holding its breath as we head into Friday, eagerly anticipating the release of the US inflation report. This report, a key economic indicator, is expected to have a significant impact on the value of the US dollar, potentially influencing trading strategies and market sentiment.

The report’s significance stems from its ability to provide insights into the current state of the US economy and the Federal Reserve’s future monetary policy decisions. Traders closely watch for any signs of inflation easing or escalating, as these trends directly influence the US dollar’s value.

The report’s release is often accompanied by heightened volatility in the forex market, as traders react to the data and adjust their positions accordingly.

Market Context

The forex market is currently experiencing heightened volatility as investors closely monitor the upcoming US inflation report scheduled for Friday. The dollar’s recent performance has been heavily influenced by a combination of factors, including interest rate expectations, economic data releases, and geopolitical events.

The forex dollar took a dip today as investors anxiously await Friday’s US inflation report, hoping for signs of cooling price pressures. This cautious sentiment also spilled over into the stock market, which opened lower amid concerns about China’s economic slowdown.

However, positive US retail sales data provided some support, suggesting consumer spending remains resilient. For a deeper dive into these market dynamics, check out this insightful analysis on stock market updates and economic trends stocks open lower amid china economic concerns positive us retail sales.

The upcoming inflation report is sure to be a major market mover, with investors hoping for signs that the Fed’s aggressive rate hikes are starting to have the desired effect.

Impact of Inflation Reports on the Dollar

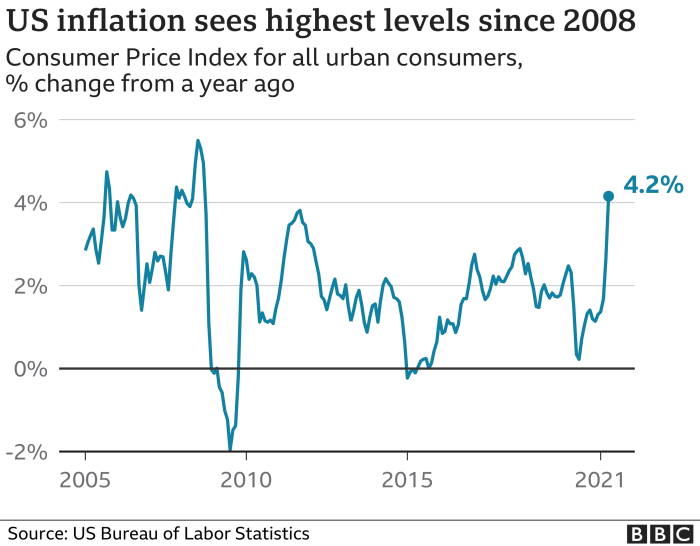

Inflation reports play a crucial role in shaping market sentiment and influencing the dollar’s value. Historically, the dollar has tended to strengthen when inflation data comes in lower than expected, suggesting that the Federal Reserve may be less likely to raise interest rates aggressively.

Conversely, higher-than-expected inflation readings often lead to a weakening of the dollar as investors anticipate more aggressive monetary tightening.

- In recent months, the dollar has experienced periods of both strength and weakness in response to inflation data. For instance, in June 2023, the dollar rallied after the release of a lower-than-expected inflation report, suggesting that the Fed might be nearing the end of its rate hike cycle.

The forex dollar is taking a tumble as the market eagerly awaits Friday’s US inflation report. While the financial world is glued to this data, it’s worth noting that the EU just imposed a record billion-euro fine on Meta for data privacy violations.

This hefty penalty serves as a stark reminder of the growing importance of data security and privacy, even as we grapple with economic uncertainty.

However, subsequent inflation reports have shown a more persistent level of inflation, leading to renewed concerns about the Fed’s policy path and putting downward pressure on the dollar.

Inflation Report’s Significance: Forex Dollar Falls As Market Awaits Fridays Us Inflation Report

The US inflation report is a key economic indicator that holds significant weight in the forex market. It provides valuable insights into the health of the US economy and can influence the Federal Reserve’s monetary policy decisions, ultimately impacting the value of the US dollar.

Impact on the US Dollar

The inflation report’s impact on the US dollar is multifaceted. When inflation is higher than expected, it typically leads to a weakening of the US dollar. This is because higher inflation erodes the purchasing power of the dollar, making it less attractive to foreign investors.

Conversely, when inflation is lower than expected, it can strengthen the US dollar as investors perceive it as a safe-haven asset.

The forex dollar is taking a tumble as investors anxiously await Friday’s US inflation report. This economic data could significantly impact the dollar’s trajectory, but it’s also interesting to note the growing interest in cryptocurrencies like Ethereum. While Bitcoin is often seen as digital gold, Ethereum is more than just a store of value; it’s a platform for decentralized applications and smart contracts, as explained in this insightful article: how ethereum is different from bitcoin.

Whether the dollar strengthens or weakens, the future of cryptocurrencies like Ethereum remains a fascinating watch.

Key Data Points

Traders closely monitor several key data points within the inflation report to gauge the direction of inflation and its potential impact on the US dollar. These include:

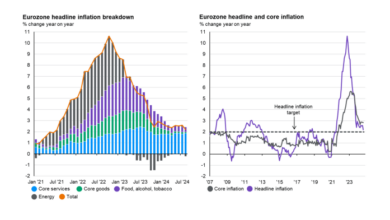

- Consumer Price Index (CPI):This measures the change in prices paid by urban consumers for a basket of goods and services. A higher CPI reading indicates higher inflation.

- Core CPI:This excludes volatile food and energy prices, providing a clearer picture of underlying inflation trends. A higher Core CPI reading suggests that inflation is becoming more entrenched in the economy.

- Producer Price Index (PPI):This measures the change in prices received by domestic producers for their output. A higher PPI reading suggests that businesses are passing on higher costs to consumers, potentially fueling inflation.

- Personal Consumption Expenditures (PCE) Price Index:This is the Fed’s preferred measure of inflation. It reflects the prices of goods and services purchased by consumers. A higher PCE reading indicates higher inflation.

Potential Outcomes of the Inflation Report

The upcoming inflation report is a crucial event for the forex market, potentially influencing the direction of the US dollar. Its impact will depend on how the data aligns with market expectations.

Potential Scenarios Based on Inflation Data

The inflation report could reveal a variety of outcomes, each with its own implications for the US dollar. Here’s a table summarizing these potential scenarios:

| Scenario | Inflation Rate | Expected Impact on Forex Dollar | Potential Market Reactions |

|---|---|---|---|

| Inflation Remains Elevated | Above 3.5% | Potential for a stronger US dollar |

|

| Inflation Shows Signs of Cooling | Between 2.5% and 3.5% | Potential for a weaker US dollar |

|

| Inflation Declines Significantly | Below 2.5% | Potential for a weaker US dollar |

|

Trading Strategies

Traders employ various strategies when anticipating significant economic releases like inflation reports, aiming to capitalize on potential market movements. Understanding these strategies and their historical effectiveness can help traders make informed decisions and manage risk effectively.

Trading Strategies for Inflation Reports

Traders use several strategies to profit from market volatility surrounding inflation reports.

- Scalping: This strategy involves entering and exiting trades quickly, aiming to profit from small price fluctuations. Scalpers typically use technical analysis and high leverage to maximize gains. They monitor price action closely, looking for opportunities to enter and exit trades within a short timeframe.

- News Trading: This strategy involves entering trades based on the anticipated impact of economic news releases. News traders analyze the potential impact of the inflation report on the currency pair and position themselves accordingly. For instance, if the inflation report is expected to be higher than anticipated, they might buy the USD.

- Trend Trading: This strategy involves identifying and trading in the direction of an established trend. Trend traders often use technical indicators to identify the trend and wait for confirmation before entering trades. They may choose to buy the USD if the trend is upward or sell it if the trend is downward.

- Breakout Trading: This strategy involves entering trades when a price breaks through a specific support or resistance level. Breakout traders believe that a breakout signals a new trend, and they position themselves accordingly. If the inflation report is unexpectedly high, the USD might break through a resistance level, triggering a buy signal.

Effectiveness of Different Strategies

The effectiveness of these strategies depends on various factors, including the market conditions, the trader’s experience, and the specific trading strategy employed.

- Scalping: Scalping can be highly profitable during volatile periods, but it requires significant skill and discipline. Scalpers must be able to identify and capitalize on small price fluctuations quickly.

- News Trading: News trading can be effective if the trader accurately predicts the market’s reaction to the news. However, news trading can also be risky, as the market’s reaction to news releases can be unpredictable.

- Trend Trading: Trend trading can be a profitable strategy, but it requires patience and discipline. Trend traders must wait for clear signals before entering trades and avoid chasing the market.

- Breakout Trading: Breakout trading can be profitable, but it is also risky. Breakout traders must be able to identify false breakouts and manage their risk effectively.

Risk Management Techniques

Risk management is crucial for forex traders, especially during volatile periods like those surrounding inflation reports.

- Stop-Loss Orders: Stop-loss orders automatically close a trade when the price reaches a predetermined level, limiting potential losses.

- Position Sizing: Position sizing involves determining the appropriate amount of capital to allocate to a trade based on risk tolerance and account balance.

- Diversification: Diversification involves spreading trades across different currency pairs or asset classes to reduce risk.

- Risk-Reward Ratio: This ratio compares the potential profit of a trade to the potential loss. Traders aim for a favorable risk-reward ratio, ensuring potential profits outweigh potential losses.

Expert Opinions

The anticipation surrounding the upcoming US inflation report has spurred a flurry of commentary from market analysts and economists. While the general consensus points towards a potential decline in inflation, the magnitude and implications for the forex market remain a subject of debate.

Experts offer diverse perspectives, ranging from cautious optimism to more reserved predictions, reflecting the inherent uncertainties surrounding the economic landscape.

Expert Opinions on the Inflation Report’s Impact, Forex dollar falls as market awaits fridays us inflation report

The potential impact of the inflation report on the forex market is a topic of considerable interest among financial experts. Here’s a summary of key perspectives: