Futures Hold Steady Ahead of Fed, Tesla Dips Pre-Market

Futures hold steady ahead of fed decision tesla faces pre market slip – Futures Hold Steady Ahead of Fed, Tesla Dips Pre-Market – the market is holding its breath as we await the Federal Reserve’s decision on interest rates, with futures markets remaining relatively stable. Meanwhile, Tesla’s stock is experiencing a pre-market decline, sparking questions about the company’s future performance.

This dynamic interplay between economic policy and individual company performance offers a glimpse into the intricate workings of the financial world.

The upcoming Fed decision has the potential to significantly impact the market, with investors closely watching for any indication of the central bank’s future monetary policy direction. The Fed’s decision will likely influence inflation expectations and economic growth projections, potentially affecting the trajectory of both equities and futures markets.

Meanwhile, Tesla’s pre-market decline might be attributed to a combination of factors, including recent news developments, investor sentiment, and competitive pressures. Understanding the interplay between these factors is crucial for navigating the complexities of the current market landscape.

Futures Market Stability

Futures markets are exhibiting a sense of calm ahead of the Federal Reserve’s interest rate decision. This relative stability suggests that investors are cautiously optimistic, anticipating a balanced approach from the Fed. While the market is aware of the potential for volatility, current conditions indicate a level of confidence in the direction of monetary policy.

Factors Contributing to Futures Market Stability

The stability of futures markets can be attributed to several factors.

- Investor Sentiment:Recent economic data, such as the strong labor market and resilient consumer spending, has bolstered investor confidence. This positive sentiment has contributed to a more stable market environment.

- Economic Indicators:While inflation remains a concern, recent data suggests that it may be cooling down, providing some relief for investors. This trend, coupled with the strong labor market, has instilled a sense of optimism about the overall economic outlook.

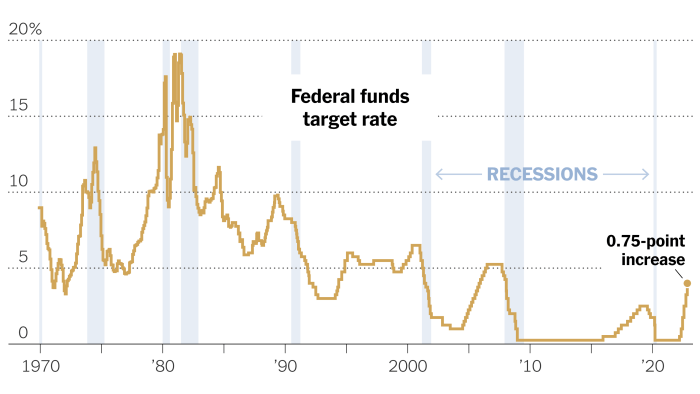

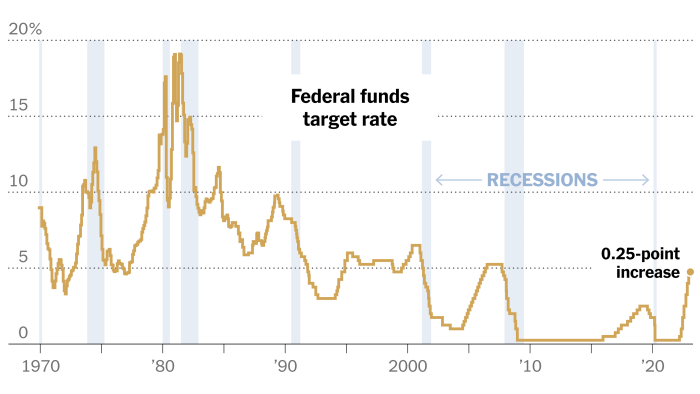

- Market Expectations:The market is anticipating a smaller rate hike from the Fed, potentially a quarter-point increase, as opposed to the larger half-point increases seen earlier this year. This expectation has helped to reduce uncertainty and stabilize the market.

Comparison to Previous Fed Decisions

The current market conditions leading up to the Fed decision are somewhat different from previous periods. In the past, anticipation of Fed announcements has often led to increased volatility in futures markets. However, the current environment seems to be characterized by a more measured response, likely due to the factors mentioned above.

Federal Reserve Decision Impact

The Federal Reserve’s upcoming decision on interest rates and monetary policy is a pivotal event for financial markets, particularly futures markets. The Fed’s actions have a direct impact on inflation expectations, economic growth projections, and the overall direction of asset prices.

Potential Scenarios and Market Effects

The Fed’s decision on interest rates can have a significant impact on futures markets. The following scenarios illustrate the potential effects:* Interest Rate Hike:An increase in interest rates can lead to a rise in borrowing costs for businesses and consumers, potentially slowing economic growth.

In this scenario, futures markets may experience a downward trend, reflecting the potential for reduced economic activity.

Interest Rate Hold If the Fed maintains current interest rates, it signals a cautious approach to inflation and economic growth. This could lead to a period of market stability, as investors remain uncertain about the future direction of monetary policy.

Interest Rate Cut A decrease in interest rates can stimulate economic activity by making borrowing cheaper. In this scenario, futures markets might experience an upward trend, reflecting the potential for increased economic growth and corporate earnings.

The markets seem to be holding their breath ahead of the Fed’s decision, with Tesla facing a pre-market slip. It’s a reminder that even in times of uncertainty, companies need to adapt to changing circumstances. Netflix, for example, has shown impressive agility in navigating social and political issues, as detailed in this insightful article netflix success in adapting to social and political issues insights from a corporate board veteran.

Whether the Fed raises rates or not, companies like Tesla will need to learn from examples like Netflix to stay ahead of the curve and keep investors confident.

Influence on Inflation Expectations and Economic Growth Projections

The Fed’s decision on interest rates directly influences inflation expectations and economic growth projections. * Inflation:Higher interest rates can help curb inflation by reducing consumer spending and business investment. However, excessive rate hikes can also stifle economic growth.

Economic Growth The Fed’s decision on interest rates plays a crucial role in managing economic growth. A balanced approach aims to stimulate growth without triggering excessive inflation.

The Fed’s decision on interest rates is a complex one, balancing the need to control inflation with the desire to support economic growth.

Tesla’s Pre-Market Decline

Tesla’s stock experienced a pre-market decline, prompting investors to examine the factors contributing to this downward trend. The decline comes amidst a broader market sentiment influenced by the upcoming Federal Reserve decision and concerns about the company’s future prospects.

Futures held steady ahead of the Fed’s decision, but Tesla faced a pre-market slip. The dollar stumbled as investors braced for inflation data, while the yuan weakened following a rate cut in China. This dynamic reflects the interconnectedness of global markets, with each currency’s movement often influenced by broader economic trends and central bank policies.

As the dollar stumbles ahead of inflation data and the yuan slips on rate cut , investors are keeping a close eye on how the Fed’s decision will impact the market landscape.

Recent News and Developments

Several recent news events and developments have potentially impacted Tesla’s stock price. The company recently announced a price reduction for its electric vehicles in China, aiming to boost sales in a competitive market. This move, however, could signal concerns about demand and profitability, especially in the face of rising competition from Chinese EV manufacturers.

Additionally, CEO Elon Musk’s involvement in Twitter has raised concerns among some investors about his focus on Tesla. While Musk has repeatedly emphasized his commitment to Tesla, some investors may be apprehensive about the potential for distractions and the allocation of resources.

Futures held steady ahead of the Fed decision, with Tesla facing a pre-market slip, while the global chip war took a dramatic turn as China imposed export controls on gallium and germanium, critical metals used in semiconductor production. This move has the potential to further disrupt supply chains and escalate tensions between the US and China, potentially impacting the broader market outlook as well.

Tesla’s Performance Compared to Historical Trends and Market Expectations

Tesla’s stock has been volatile in recent months, reflecting the company’s growth trajectory and the broader market dynamics. While Tesla has experienced impressive growth in recent years, its valuation has come under scrutiny, with some analysts suggesting that the stock is overvalued.

The current decline could be attributed to a correction in Tesla’s stock price, aligning with market expectations for a more measured growth rate in the coming quarters. Tesla’s performance is also influenced by factors such as production ramp-up, supply chain challenges, and regulatory scrutiny.

Factors Influencing Tesla’s Stock Price

Tesla’s stock price is influenced by a complex interplay of factors, including:

- Investor Confidence:Tesla’s stock price is heavily reliant on investor sentiment. Positive news and announcements tend to boost investor confidence, leading to price increases. Conversely, negative news or concerns about the company’s future prospects can erode investor confidence, resulting in stock declines.

- Competition:The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants aggressively entering the space. Tesla’s ability to maintain its market share and competitive advantage will be crucial in determining its future performance.

- Company-Specific Announcements:Tesla’s stock price can fluctuate significantly based on company-specific announcements, such as production updates, sales figures, and new product launches. Investors closely monitor these announcements for insights into the company’s growth trajectory and profitability.

Interplay of Market Factors: Futures Hold Steady Ahead Of Fed Decision Tesla Faces Pre Market Slip

The pre-market dip in Tesla’s share price, coupled with the anticipation of the Federal Reserve’s interest rate decision, has created a complex interplay of market factors. Understanding how these events might influence each other and broader market sentiment is crucial for investors.

Relationship between Fed Decision and Tesla’s Decline

The potential connection between the Fed’s decision and Tesla’s pre-market decline can be examined through several lenses. A hawkish stance from the Fed, signaling higher interest rates, could potentially impact Tesla negatively due to several factors. First, higher interest rates could increase borrowing costs for Tesla, making it more expensive to finance its operations and expansion plans.

Second, a rising interest rate environment might incentivize investors to shift their capital from growth stocks like Tesla to more conservative investments, leading to a sell-off.

Investor Sentiment and Market Volatility

The combined impact of the Fed’s decision and Tesla’s performance on investor sentiment and market volatility is multifaceted. A hawkish Fed stance, coupled with Tesla’s decline, could create a negative sentiment, potentially leading to increased market volatility. Conversely, a dovish Fed decision, combined with a positive performance from Tesla, could boost investor confidence and contribute to market stability.

Impact on Different Market Sectors

| Sector | Potential Impact of Fed Decision | Potential Impact of Tesla Performance |

|---|---|---|

| Technology | Higher interest rates could negatively impact growth-oriented tech companies like Tesla, potentially leading to a decline in their valuations. | Tesla’s performance could act as a bellwether for the broader technology sector, influencing investor sentiment and investment decisions. |

| Financial Services | A hawkish Fed stance could benefit financial institutions, as higher interest rates typically lead to increased lending profitability. | Tesla’s performance could have a limited direct impact on the financial services sector, but its overall market sentiment influence might indirectly affect this sector. |

| Energy | The Fed’s decision is unlikely to have a direct impact on the energy sector, but the overall economic outlook influenced by the decision could affect energy demand and prices. | Tesla’s performance, as a leader in electric vehicle production, could influence investor sentiment towards the renewable energy sector, potentially driving investment in this area. |

Market Outlook and Potential Trends

The current market landscape is poised for a period of volatility, with several key events and factors expected to influence investor sentiment and asset prices in the coming days.

Timeline of Potential Market Events

The upcoming days will see a confluence of events that could significantly impact the market.

- Federal Reserve Interest Rate Decision (July 26th):The Fed’s decision on interest rates will be a major catalyst for market movements. A larger-than-expected rate hike could trigger a sell-off in equities and a surge in bond yields, while a smaller increase or pause could lead to a rally in risk assets.

- Earnings Season:Several major companies, including Apple, Amazon, and Microsoft, are scheduled to release their earnings reports in the coming weeks. Strong earnings reports could boost investor confidence and support stock prices, while disappointing results could lead to declines.

- Economic Data Releases:Key economic indicators, such as GDP growth, inflation, and unemployment, will be released throughout the week. These data points will provide insights into the health of the economy and could influence market sentiment.

- Geopolitical Developments:Ongoing geopolitical tensions, such as the war in Ukraine and the US-China trade dispute, continue to pose risks to global markets. Any escalation of these conflicts could lead to market volatility.

Visual Representation of Potential Market Trajectory, Futures hold steady ahead of fed decision tesla faces pre market slip

[ Insert a visual representation of the potential market trajectory.] A hypothetical chart or graph depicting the potential movement of futures markets and Tesla’s stock price.X-axis:Time (Days) Y-axis:Price (Index points or Dollars) Futures Market Trajectory:

Scenario 1 (Bullish) A steady upward trend, with a potential surge following the Fed’s rate decision if it is less hawkish than expected.

Scenario 2 (Bearish) A downward trend, with potential dips following negative economic data releases or a more aggressive rate hike by the Fed.

Scenario 3 (Neutral) A range-bound movement, with limited gains or losses, reflecting uncertainty and cautious investor sentiment. Tesla’s Stock Price Trajectory:

Scenario 1 (Bullish) A strong upward trend, driven by positive news about its electric vehicle production, sales, and autonomous driving technology.

Scenario 2 (Bearish) A downward trend, influenced by concerns about competition, regulatory challenges, or negative news about its manufacturing operations.

Scenario 3 (Neutral) A range-bound movement, with limited fluctuations, reflecting investor indecision and a wait-and-see approach.

Key Factors Influencing Market Sentiment and Volatility

- Inflation and Interest Rates:The Fed’s stance on inflation and interest rates will continue to be a dominant factor in market sentiment. Investors will closely monitor the Fed’s communication and assess its potential impact on economic growth and corporate earnings.

- Economic Growth Outlook:The outlook for economic growth, both domestically and globally, will influence investor confidence. Concerns about a potential recession or slowing economic growth could lead to market volatility.

- Geopolitical Risks:Ongoing geopolitical tensions, such as the war in Ukraine and the US-China trade dispute, continue to pose risks to global markets. Any escalation of these conflicts could lead to market volatility.

- Corporate Earnings:Strong corporate earnings reports could boost investor confidence and support stock prices, while disappointing results could lead to declines.

- Investor Sentiment:Overall investor sentiment, driven by factors such as news headlines, economic data, and market performance, will play a role in market volatility.