Market Watch Jobs Report Sparks Interest As Futures Dip

Market Watch Jobs Report Sparks Interest As Futures Experience a Minor Dip: The recent release of the Market Watch jobs report has sent ripples through the financial world, sparking a flurry of discussions and analyses. While the report revealed positive signs of job growth, a minor dip in futures markets has added a layer of complexity to the economic picture.

This unexpected twist has left investors and analysts pondering the implications for the future of the market.

The jobs report, which highlighted a strong increase in employment, initially fueled optimism among investors. However, the subsequent dip in futures markets, attributed to a combination of factors including concerns about inflation and geopolitical tensions, has tempered that enthusiasm. This seemingly contradictory scenario has prompted a closer examination of the relationship between the labor market and the futures market, and the potential impact on investor sentiment and market volatility.

Market Watch Jobs Report: Market Watch Jobs Report Sparks Interest As Futures Experience A Minor Dip

The latest Market Watch Jobs Report provides a comprehensive overview of the current state of the US labor market. The report analyzes key metrics such as job growth, unemployment rates, and labor market trends, offering insights into the health of the economy and the outlook for future employment.

Job Growth Trends, Market watch jobs report sparks interest as futures experience a minor dip

The report highlights the continued growth in job creation, indicating a robust economy. However, it also notes a slight slowdown in job growth compared to previous months, suggesting a potential shift in the labor market dynamics. The report analyzes the growth across various sectors, identifying industries experiencing the most significant gains and those facing challenges.

- The report reveals that the service sector continues to drive job growth, with notable increases in healthcare, hospitality, and leisure industries. These sectors are experiencing strong demand as the economy recovers from the pandemic and consumer spending rebounds.

- In contrast, the manufacturing sector has witnessed a more moderate pace of job growth, reflecting the ongoing supply chain disruptions and global economic uncertainties.

- The report also sheds light on the tech sector, which has experienced a slowdown in hiring due to factors such as rising inflation and interest rates. The tech industry is known for its cyclical nature, and recent trends suggest a potential shift in hiring patterns.

Unemployment Rates

The report provides an in-depth analysis of the unemployment rate, highlighting the current rate and its implications for the labor market. The report compares the unemployment rate to historical trends and analyzes its impact on various demographics, such as age, race, and education levels.

- The report indicates that the unemployment rate has remained relatively low, suggesting a strong labor market. However, it also notes that the unemployment rate for certain demographics, such as younger workers and minority groups, remains higher than the overall average.

The MarketWatch jobs report certainly sparked some interest today, even as futures dipped slightly. It seems like investors are closely watching the broader economic picture, especially with the upcoming Fed rate decision. You can get the latest news and analysis on Wall Street’s reaction to mixed earnings reports and the anticipated Fed move on this live news coverage.

Ultimately, the jobs report is just one piece of the puzzle, and the market will likely remain volatile until we see how the Fed responds to the current economic climate.

- The report examines the reasons behind these disparities, including factors such as educational attainment, access to job training, and geographic location.

- The report highlights the importance of addressing these disparities to ensure a more inclusive and equitable labor market.

Labor Market Trends

The report analyzes various labor market trends, including wage growth, labor participation rates, and the increasing demand for skilled workers. These trends provide valuable insights into the evolving dynamics of the labor market and their impact on businesses and workers.

The MarketWatch jobs report certainly caught everyone’s attention today, especially with futures dipping slightly. It seems the market is taking a cautious approach, mirroring the sentiment on Wall Street, where lingering concerns over interest rates have led to expectations of a slow start.

This article on The Venom Blog delves deeper into those concerns, providing valuable insights into the current market landscape. The jobs report and the cautious market mood are intertwined, painting a picture of uncertainty that investors are closely watching.

- The report notes that wage growth has been increasing, reflecting the tight labor market and the growing demand for workers. However, it also highlights that wage growth has not kept pace with inflation, leading to a decline in real wages for many workers.

- The report discusses the labor participation rate, which has been gradually increasing, suggesting that more people are returning to the workforce. This trend is driven by factors such as a strong economy, improved job opportunities, and a decline in COVID-19 cases.

- The report emphasizes the increasing demand for skilled workers, particularly in fields such as technology, healthcare, and engineering. This trend is driven by technological advancements, an aging population, and the growing need for specialized skills.

Comparison with Previous Reports

The report compares its findings with previous reports, highlighting any significant changes or patterns in the labor market. This analysis provides a historical context for the current trends and helps to identify any emerging patterns or shifts in the labor market.

- The report indicates that job growth has slowed slightly compared to previous months, suggesting a potential shift in the labor market dynamics. This slowdown could be attributed to factors such as rising inflation, interest rate hikes, and global economic uncertainties.

- The report also notes that wage growth has been increasing, but at a slower pace than in previous months. This trend suggests that employers are becoming more cautious about wage increases, potentially due to concerns about inflation and economic growth.

- The report emphasizes the importance of monitoring these trends closely to understand the potential implications for the labor market and the broader economy.

Futures Market Dip

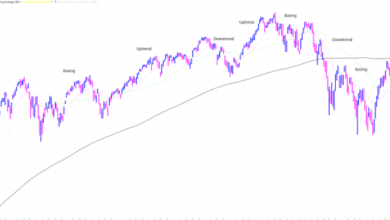

Following the release of the Market Watch Jobs Report, futures markets experienced a minor dip, indicating a potential shift in investor sentiment. This dip can be attributed to several factors, including the report’s data, broader market trends, and overall economic conditions.

Impact on Investor Sentiment and Market Volatility

The dip in futures markets can have a significant impact on investor sentiment and market volatility. When futures contracts decline, it often signals a bearish outlook, potentially causing investors to become more cautious and hesitant to invest. This can lead to increased market volatility, as investors react to the perceived risks and adjust their portfolios accordingly.

The degree of impact depends on the magnitude of the dip and the overall market conditions.

Relationship Between Jobs Report and Futures Market Dip

The jobs report and the futures market dip are interconnected, with potential correlations and discrepancies. A strong jobs report, for example, might typically be associated with a positive market reaction, driving futures prices higher. However, the recent dip suggests that other factors might have outweighed the positive impact of the jobs report.

The MarketWatch jobs report sparked a lot of interest this week, even as futures dipped slightly. It’s a reminder that the economy is constantly evolving, and the future of work is always in flux. This is especially true as we see the rapid development of technologies like brain-computer interfaces, which are already making waves in the medical field.

Imagine a future where you can control your computer with your mind! Unveiling the future Neuralink’s quest to enable mind-controlled computers is a fascinating read that dives into the possibilities of this technology. While we might be a ways away from that reality, it’s important to keep an eye on these emerging trends, especially as they could have a major impact on the job market in the years to come.

These factors could include concerns about inflation, rising interest rates, or geopolitical tensions.

Market Sentiment and Investor Behavior

The recent jobs report and subsequent dip in futures markets have sent ripples through the investment landscape, prompting investors to reassess their strategies and adjust their risk appetites. The report’s implications for inflation, interest rates, and economic growth are being carefully considered, shaping investor sentiment and driving market behavior.

Investor Confidence and Risk Appetite

The jobs report’s mixed signals have led to a shift in investor sentiment, with confidence levels wavering. While the strong employment figures initially fueled optimism, the accompanying rise in wages raised concerns about inflationary pressures. This uncertainty has prompted some investors to adopt a more cautious approach, reducing their risk appetite and seeking safe-haven assets like bonds.

Conversely, others remain optimistic about the economy’s resilience and view the market dip as a buying opportunity, potentially increasing their exposure to riskier assets like stocks.

Potential Investor Strategies

In response to the current market conditions, investors are likely to adopt a range of strategies, with their choices heavily influenced by their individual risk tolerance and investment goals. Some investors might:

- Increase their cash holdings:This strategy allows for greater flexibility in the face of market volatility, enabling investors to wait for a clearer picture to emerge before deploying capital.

- Shift their portfolio allocation:Investors may consider reallocating their assets towards more defensive sectors, such as consumer staples or healthcare, which are typically less sensitive to economic fluctuations.

- Seek out value opportunities:The market dip could create attractive entry points for investors seeking undervalued assets, particularly in sectors that are expected to benefit from long-term economic growth.

- Adopt a wait-and-see approach:Investors may choose to observe market developments closely before making significant investment decisions, hoping to gain a better understanding of the potential impact of the jobs report and futures market dip.

“The key is to remain disciplined and avoid making rash decisions based on short-term market movements. A well-defined investment strategy, aligned with individual risk tolerance and financial goals, should guide investment decisions.”

Economic Outlook and Predictions

The recent jobs report and futures market dip have sparked concerns about the overall economic outlook. While the jobs report showed positive signs of a strong labor market, the dip in futures suggests investor anxiety about potential economic headwinds.

Understanding the potential impact of these developments on key economic indicators is crucial for investors and policymakers alike.

Impact on GDP Growth

The jobs report, with its strong employment numbers, could point towards continued GDP growth. However, the futures market dip suggests that investors are concerned about factors that could hinder growth, such as rising inflation and interest rates. These factors could dampen consumer spending and business investment, ultimately impacting GDP growth.

Impact on Inflation

The jobs report could also influence inflation expectations. A tight labor market can push up wages, leading to higher consumer prices. However, the futures market dip suggests that investors are concerned about potential economic slowdowns, which could put downward pressure on inflation.

The interplay between these forces will determine the trajectory of inflation in the coming months.

Economic Analyst Predictions

A range of economic analysts have offered predictions about the potential impact of the jobs report and futures market dip on the overall economic outlook. These predictions highlight the uncertainty surrounding the economic landscape:

| Analyst | Prediction | Rationale |

|---|---|---|

| Goldman Sachs | GDP growth to moderate slightly in the coming quarters. | Continued strong consumer spending will be offset by rising interest rates and slowing business investment. |

| Morgan Stanley | Inflation to remain elevated in the short term, but ease in the latter half of the year. | Strong demand and supply chain constraints will continue to push up prices, but easing supply chain pressures and a potential economic slowdown could lead to a moderation in inflation. |

| JPMorgan Chase | The Federal Reserve will continue to raise interest rates to combat inflation, but the pace of rate hikes could slow in the coming months. | The Fed will remain focused on bringing inflation down to its 2% target, but the recent economic data could lead to a more cautious approach to rate hikes. |

“The economic outlook remains uncertain, with the potential for both growth and inflation to moderate in the coming months. The impact of the recent jobs report and futures market dip will depend on how these developments play out in the broader economic context.”

[Name of Economist, Affiliation]

Implications for Businesses and Industries

The recent jobs report and the dip in the futures market have sent ripples through the economic landscape, raising questions about the future trajectory of various industries and sectors. Understanding these implications is crucial for businesses to navigate the changing economic landscape and adapt their strategies accordingly.

Impact on Different Sectors

The impact of the jobs report and futures market dip will vary across different sectors. Some industries might experience a surge in demand, while others might face challenges.

- Consumer Discretionary Goods:The dip in the futures market could lead to a decrease in consumer confidence, potentially affecting spending on non-essential goods and services. Businesses in this sector may need to adjust their marketing strategies and offer promotions to attract customers.

- Technology:The technology sector might benefit from the continued growth in remote work and digitalization. Companies specializing in cloud computing, cybersecurity, and software development are likely to see increased demand.

- Healthcare:The healthcare sector is generally considered recession-resistant, as people continue to prioritize their health regardless of economic conditions. However, rising inflation and potential job losses could affect access to healthcare for some individuals.

- Energy:The energy sector is facing a complex situation. While demand for energy is likely to remain high, the volatility in the futures market could create challenges for energy producers and consumers.

Business Adaptation Strategies

In response to the changing economic landscape, businesses need to adopt a proactive approach and consider the following strategies:

- Cost Optimization:Businesses should focus on reducing unnecessary expenses and streamlining operations to improve efficiency and profitability. This might involve renegotiating contracts, automating tasks, and optimizing supply chains.

- Diversification:Expanding into new markets or product lines can help businesses mitigate risks and create new revenue streams. For example, a manufacturing company might consider entering the e-commerce market to reach a wider customer base.

- Enhanced Customer Service:Providing exceptional customer service is more crucial than ever in a competitive market. Businesses should prioritize customer satisfaction, build strong relationships, and foster loyalty.

- Innovation and Technology Adoption:Investing in technology and innovation can help businesses gain a competitive edge, improve efficiency, and develop new products or services.