Stocks on Pause as Fear Gauge Hits Historic Low: Market Insight

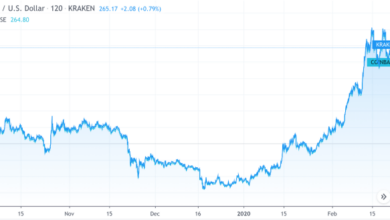

Market insight stocks on pause as fear gauge hits historic low – Stocks on Pause as Fear Gauge Hits Historic Low: Market Insight sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The market is exhibiting a curious phenomenon – a historic low in the fear gauge, an indicator of investor sentiment, while stocks are simultaneously taking a pause.

This unexpected combination is raising eyebrows and sparking debate among market analysts and investors alike. What does this unusual situation mean for the future of the market?

The fear gauge, often used as a barometer of market sentiment, has dropped to an all-time low, suggesting a high degree of confidence among investors. This contrasts sharply with the typical market behavior where a low fear gauge is often associated with bullish sentiment and rising stock prices.

However, the current market is not mirroring this historical pattern, with stocks seemingly hesitant to make any significant moves.

Market Sentiment and Fear Gauge

The recent dip in stock prices, despite a historically low fear gauge, has left many investors scratching their heads. This seemingly paradoxical situation raises questions about the true state of market sentiment and its implications for future market direction.

Significance of a Historic Low Fear Gauge

A low fear gauge, often measured by the CBOE Volatility Index (VIX), indicates a period of low market anxiety and uncertainty. When the VIX is low, investors are generally optimistic and comfortable with risk. This is a significant departure from the typical market behavior, where higher volatility and fear are often associated with market downturns.

The market seems to be taking a breather, with stocks on pause as the fear gauge hits a historic low. This might be a sign of a shift in investor sentiment, with a focus on growth rather than safety. It’s interesting to see how Gen Z investors are driving this trend, with companies like Nvidia, Tesla, and Lennar emerging as top stock picks, as highlighted in this article gen z investors seek growth nvidia tesla and lennar emerge as top stock picks.

Whether this is a temporary pause or a longer-term trend remains to be seen, but it’s clear that the market is adapting to new realities.

Contrasting Low Fear Gauge with Market Behavior

The current situation presents a unique scenario where a historically low fear gauge is juxtaposed with a decline in stock prices. This discrepancy suggests that factors beyond investor fear are driving the market.

Implications of a Low Fear Gauge on Investor Sentiment and Market Direction

A low fear gauge, despite the market downturn, could have several implications:

- Overconfidence and complacency:Investors may be overly confident in the market’s ability to rebound, leading to a lack of caution and potential overvaluation of assets.

- Delayed reaction to underlying risks:The low fear gauge might be masking underlying economic or geopolitical risks that investors have yet to fully acknowledge.

- Potential for a sudden shift in sentiment:A low fear gauge can be a fragile indicator, and any unforeseen event could trigger a rapid shift in investor sentiment, leading to a sharp market correction.

Stocks on Pause

While the fear gauge might be at historic lows, the stock market isn’t exactly booming. Instead, we’re seeing a period of “pause” where stocks are trading sideways, lacking the strong upward momentum we witnessed earlier this year. This pause, however, isn’t necessarily a cause for alarm, but rather a reflection of several factors that are influencing investor sentiment and market direction.

Reasons for the Stock Market Pause

Several factors are contributing to the current market pause, each playing a role in shaping investor sentiment and market direction.

While market insight suggests stocks are on pause as the fear gauge hits a historic low, it’s important to remember that global events can quickly shift sentiment. Take, for instance, the recent decision by Iraq to block the Telegram app, as reported in this article , citing concerns over personal data violations and national security.

This kind of action, even if it’s a response to legitimate concerns, can impact investor confidence and potentially disrupt the market’s current trajectory.

- Elevated Interest Rates:The Federal Reserve’s aggressive interest rate hikes have significantly impacted the cost of borrowing for businesses and consumers, impacting economic growth and corporate profitability. This has made investors more cautious about investing in stocks, leading to a slowdown in market activity.

- Inflation Concerns:Persistent inflation remains a key concern for investors, as it erodes purchasing power and increases the cost of doing business. The uncertainty surrounding inflation’s trajectory and the Fed’s response further contributes to market volatility.

- Geopolitical Tensions:Ongoing geopolitical tensions, particularly the war in Ukraine, contribute to market uncertainty. These conflicts disrupt global supply chains, impact energy prices, and create economic instability, making investors hesitant to commit to long-term investments.

- Profitability Concerns:With the economic outlook uncertain, investors are closely watching corporate earnings reports for signs of slowing growth and profit margins. This heightened scrutiny can lead to market volatility as investors adjust their positions based on individual company performance.

Impact on the Market Outlook

The implications of this market pause are multifaceted and can be categorized into short-term and long-term perspectives.

Short-Term Outlook

The short-term market outlook is characterized by increased volatility and uncertainty. As investors navigate the complex interplay of factors influencing market direction, we can expect to see more frequent price swings and potentially even short-term corrections. This volatility might present opportunities for savvy investors to capitalize on price dips, but it also necessitates a cautious approach.

Long-Term Outlook

While the short-term outlook might be uncertain, the long-term market outlook remains positive for many analysts. The underlying fundamentals of the US economy, such as a strong labor market and robust consumer spending, remain supportive of long-term growth. However, the path to sustained growth is likely to be uneven, with periods of consolidation and volatility interspersed with periods of market gains.

While the market seems to be taking a breather with the fear gauge hitting a historic low, it’s interesting to see how global events are still influencing investor sentiment. Elon Musk’s recent announcement that Tesla is interested in investing in India after meeting with PM Modi elon musk announces teslas interest in investing in india after meeting with pm modi could potentially be a major catalyst for the Indian economy, and that could ripple out globally.

It’s a reminder that even with a calm market, there’s always something brewing just beneath the surface.

Historical Comparisons

This market pause is not unprecedented. Historically, the stock market has experienced similar periods of consolidation and sideways trading after periods of strong growth. For example, in 2018, the market experienced a significant correction following a period of robust gains.

This correction was attributed to factors such as rising interest rates, trade tensions, and concerns about slowing economic growth. However, the market ultimately recovered and continued its upward trajectory.

Market Insight and Potential Opportunities: Market Insight Stocks On Pause As Fear Gauge Hits Historic Low

The current market environment, characterized by a historically low fear gauge, presents both intriguing insights and potential opportunities for investors. This subdued fear sentiment, while potentially indicating a period of calm and optimism, also raises questions about the sustainability of this trend and the potential for hidden risks.

Identifying Potential Opportunities

The low fear gauge can be interpreted as a signal of investor confidence, which can lead to increased risk appetite and potentially higher valuations for stocks. This presents an opportunity for investors to consider adding exposure to equities, particularly in sectors that are expected to benefit from a strong economic outlook.

Here are some potential opportunities to consider:

- Growth Stocks:Companies with high growth potential and strong earnings prospects are likely to be attractive in a market with low risk aversion. Investors may consider adding exposure to sectors such as technology, healthcare, and consumer discretionary.

- Emerging Markets:Emerging markets often benefit from a global economic recovery and can offer higher growth potential compared to developed markets. Investors may consider diversifying their portfolios with exposure to emerging market equities.

- Value Stocks:Value stocks, which are typically undervalued by the market, can become more attractive in a low-fear environment. Investors may consider exploring opportunities in sectors such as financials, energy, and industrials.

Market Volatility and Risk Assessment

While the current market sentiment might seem optimistic, it’s crucial to remember that market volatility is a constant factor. The recent decline in the “fear gauge” doesn’t guarantee a smooth ride ahead. A sudden shift in sentiment, triggered by unexpected economic data, geopolitical events, or changes in monetary policy, could easily lead to increased market volatility.

Managing Risk in a Volatile Market

Understanding and managing risk is paramount, especially in times of potential volatility. A well-defined risk management strategy can help investors navigate market fluctuations and protect their investments. Here are some key strategies:

- Diversification:Spreading investments across different asset classes, sectors, and geographies reduces the impact of any single asset’s performance on the overall portfolio. For example, investing in a mix of stocks, bonds, real estate, and commodities can help mitigate risk.

- Rebalancing:Regularly adjusting portfolio allocations to maintain the desired asset mix helps ensure that investments are not overly concentrated in any one asset class. Rebalancing involves selling assets that have performed well and buying those that have underperformed, helping to maintain a balanced portfolio.

- Dollar-Cost Averaging:Investing a fixed amount of money at regular intervals, regardless of market conditions, helps reduce the impact of market volatility. This strategy averages out the cost of investments over time, potentially reducing the overall risk.

- Defensive Strategies:Consider investing in assets that are considered more defensive, such as high-quality bonds or dividend-paying stocks. These assets tend to be less volatile than growth stocks and may provide a degree of stability in a turbulent market.

Investment Strategies for Different Risk Appetites, Market insight stocks on pause as fear gauge hits historic low

The appropriate investment strategy depends on an individual’s risk tolerance and financial goals. Here’s a table comparing different investment strategies and their suitability for various risk appetites:

| Investment Strategy | Risk Tolerance | Potential Returns | Suitability |

|---|---|---|---|

| Growth Stocks | High | High | Suitable for investors with a long-term horizon and a high tolerance for volatility. |

| Value Stocks | Moderate | Moderate | Suitable for investors seeking a balance between growth and value. |

| Bonds | Low | Low | Suitable for investors seeking income and stability. |

| Real Estate | Moderate | Moderate | Suitable for investors seeking long-term growth and potential appreciation. |

| Commodities | High | High | Suitable for investors seeking exposure to inflation-sensitive assets. |

Economic Factors and Market Outlook

The current economic landscape is a complex interplay of factors, including inflation, interest rates, and geopolitical events. These factors can significantly impact the stock market, creating both opportunities and risks for investors. Understanding the current economic climate and its potential implications for the stock market is crucial for making informed investment decisions.

Key Economic Indicators

Understanding the current economic landscape and its potential implications for the stock market is crucial for making informed investment decisions. Several key economic indicators provide insights into the health of the economy and its future trajectory.

- Inflation:Inflation measures the rate at which prices for goods and services rise over time. High inflation can erode purchasing power and reduce corporate profits, leading to stock market volatility. The Federal Reserve closely monitors inflation and adjusts interest rates accordingly to control its rate.

- Interest Rates:Interest rates represent the cost of borrowing money. The Federal Reserve sets the benchmark interest rate, which influences borrowing costs for businesses and consumers. Higher interest rates can slow economic growth and make it more expensive for companies to borrow money, potentially impacting stock prices.

- Gross Domestic Product (GDP):GDP measures the total value of goods and services produced in a country. Strong GDP growth indicates a healthy economy, which can support stock market performance. However, slow or negative GDP growth can signal economic weakness, potentially leading to market declines.

- Unemployment Rate:The unemployment rate measures the percentage of the labor force that is unemployed. A low unemployment rate indicates a strong economy, as businesses are hiring and consumers are spending. Conversely, a high unemployment rate can signal economic weakness, potentially impacting stock market sentiment.

Geopolitical Events

Geopolitical events can significantly impact the stock market, creating uncertainty and volatility. These events can range from international conflicts to trade disputes and political instability.

- International Conflicts:Conflicts such as wars or military tensions can disrupt global trade and investment, leading to market declines. For example, the Russia-Ukraine war has significantly impacted energy prices and global supply chains, creating volatility in the stock market.

- Trade Disputes:Trade disputes between countries can disrupt global trade flows and increase uncertainty for businesses, potentially impacting stock prices. The ongoing trade tensions between the United States and China have created volatility in the stock market.

- Political Instability:Political instability in major economies can create uncertainty for investors and impact stock market performance. For example, political turmoil in a country can lead to currency fluctuations, economic instability, and disruptions in business operations.