Steady Stocks, Inflation, and the Fed: Latest Market Update

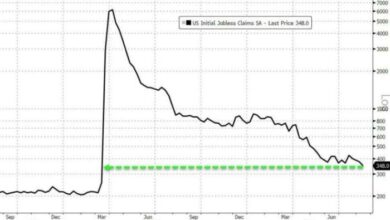

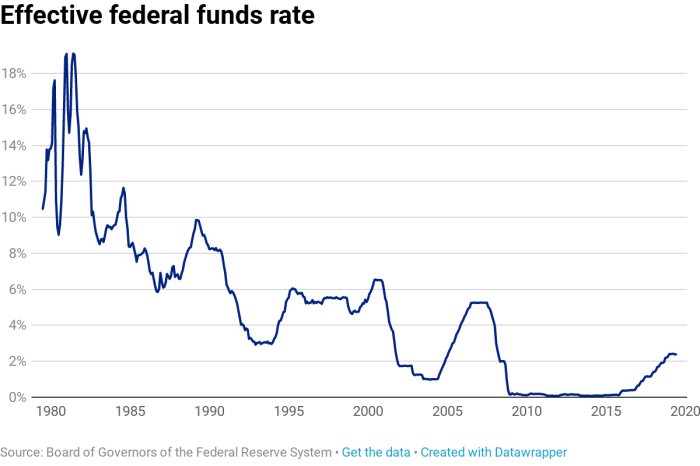

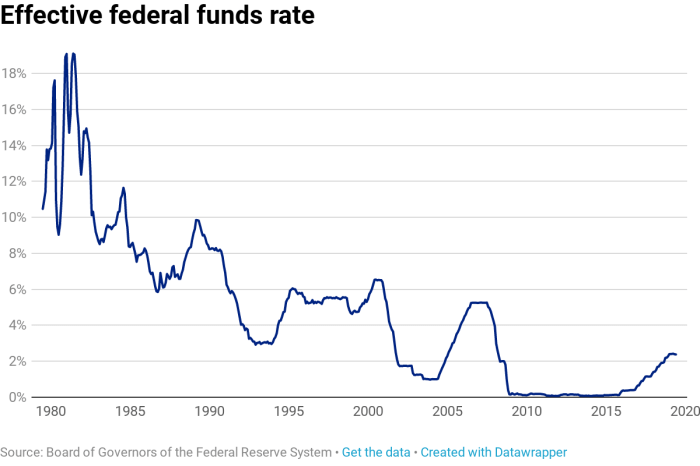

Steady stocks and inflation how fed rates might react latest stock market update: These are the questions on everyone’s mind as we navigate a volatile market. The Federal Reserve is walking a tightrope, trying to tame inflation without sending the economy into a tailspin.

This delicate balancing act has significant implications for investors, particularly those seeking steady returns in a turbulent environment.

This post delves into the complex interplay between inflation, interest rates, and stock market performance. We’ll explore historical trends, analyze the Fed’s current stance, and discuss strategies for navigating these challenging times. Get ready to gain valuable insights into how you can position your portfolio for success.

Understanding Steady Stocks in an Inflationary Environment: Steady Stocks And Inflation How Fed Rates Might React Latest Stock Market Update

Inflation is a significant economic factor that can impact the stock market, making it crucial for investors to understand its relationship with stock market stability. While inflation can lead to increased volatility and uncertainty, certain stocks tend to perform well in such environments.

This analysis delves into the intricacies of steady stocks in an inflationary environment, examining historical trends and identifying sectors that typically thrive during periods of high inflation.

The Relationship Between Stock Market Stability and Inflation

Inflation erodes the purchasing power of money, making it more expensive for businesses to operate and consumers to spend. This can lead to a decline in corporate profits, ultimately affecting stock prices. However, the impact of inflation on the stock market is not uniform.

Some sectors and industries are more resilient to inflation than others, and certain stocks tend to outperform during inflationary periods.

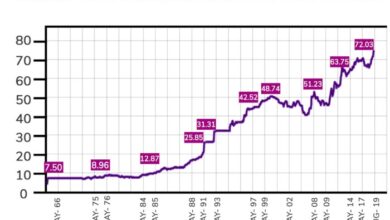

Historical Trends of Stock Performance During High Inflation

Historical data reveals that stock performance during periods of high inflation has been mixed. While some studies suggest that stocks generally underperform during inflationary periods, others indicate that certain sectors, such as energy and materials, tend to outperform. It’s important to note that the impact of inflation on stock prices is complex and influenced by various factors, including the level of inflation, the duration of the inflationary period, and the overall economic environment.

Examples of Sectors That Perform Well in Inflationary Environments, Steady stocks and inflation how fed rates might react latest stock market update

Several sectors and industries tend to perform well during inflationary periods. These include:

- Energy:As inflation rises, the demand for energy often increases, leading to higher energy prices and increased profits for energy companies. This is particularly true for oil and gas producers, as their products are essential commodities that experience price increases during inflationary periods.

- Materials:The materials sector includes companies that produce raw materials, such as metals, chemicals, and construction materials. These companies benefit from inflation as the demand for their products increases and prices rise. For example, during periods of high inflation, demand for steel and copper often rises, leading to higher prices for these materials and increased profits for producers.

- Financials:Financial institutions, such as banks and insurance companies, tend to benefit from inflation due to higher interest rates. As interest rates rise, banks can charge higher interest on loans, increasing their profitability. Similarly, insurance companies can charge higher premiums, as the cost of claims increases due to inflation.

- Consumer Staples:Companies that produce essential goods, such as food, beverages, and household products, are often considered defensive stocks and tend to perform well during inflationary periods. This is because consumers continue to purchase these essential goods regardless of economic conditions. For example, companies that produce packaged food, personal care products, and other non-durable goods tend to see stable demand even during inflationary periods.

The market’s been holding steady despite inflation, but with the Fed’s next rate hike looming, things could get interesting. Meanwhile, in the world of tech, daniel baldwin joins ishook 202879 is a move that could shake things up. Whether it’s a positive shake or not remains to be seen, but it’s definitely something to keep an eye on as we navigate this volatile market.

It’s a balancing act, isn’t it? Keeping inflation in check while trying to maintain steady stock growth. The Fed’s recent signals about interest rates have sent ripples through the market, and while some investors are concerned about the potential impact, it’s encouraging to see signs of recovery.

Check out this recent stock market update that suggests the market might be weathering the storm. Only time will tell how the Fed’s actions will ultimately affect the markets, but for now, there’s a glimmer of hope that we might be heading towards calmer waters.

It’s been a wild ride for the stock market lately, with inflation still a major concern and the Fed’s rate decisions hanging in the balance. But amidst all the economic chatter, it’s important to remember that even in times of uncertainty, there are always individuals looking to take advantage of the system.

Take for instance, the recent case of a Massachusetts father and son who were sentenced to prison for a whopping $20 million lottery scam – read the full story here. It’s a stark reminder that while the market can be volatile, there are always individuals out there trying to manipulate it for personal gain, and we need to be aware of these risks as we navigate the current economic landscape.