Forex USD Strengthens as US Economy Leads, Japan Yen Hits 10-Month Low

Forex usd strengthens as us economy leads japan yen hits 10 month low – The US dollar has been on a tear lately, reaching new heights as the US economy continues to outperform. This surge in the dollar has come at the expense of the Japanese yen, which has hit a 10-month low. This dynamic is a fascinating interplay of economic forces, with the US economic performance driving the dollar higher and a combination of factors, including the Bank of Japan’s monetary policy, contributing to the yen’s decline.

The strengthening of the US dollar has a ripple effect on the global economy. It makes US goods and services more expensive for buyers in other countries, which could impact trade. It also affects the value of investments held in other currencies.

The weakness of the yen, meanwhile, could impact Japan’s exports, which are a crucial part of its economy.

US Dollar Strength

The US dollar has been on a strengthening trajectory recently, reaching multi-year highs against major currencies like the Japanese yen. This surge in the dollar’s value is driven by a combination of factors, including the robust US economy, the Federal Reserve’s aggressive interest rate hikes, and a flight to safety amid global economic uncertainty.

Factors Contributing to US Dollar Strength

The recent strengthening of the US dollar is a result of several interconnected factors:

- Strong US Economic Performance:The US economy has demonstrated resilience, with robust job growth, low unemployment rates, and steady consumer spending. This economic strength attracts foreign investors, leading to increased demand for US dollars.

- Federal Reserve’s Monetary Policy:The Federal Reserve has been aggressively raising interest rates to combat inflation. Higher interest rates make US dollar-denominated assets more attractive to foreign investors, as they offer higher returns. This increased demand further strengthens the dollar.

- Global Economic Uncertainty:The global economy is facing headwinds, including the ongoing war in Ukraine, rising inflation, and potential recessionary pressures. In times of uncertainty, investors tend to seek safe haven assets, such as the US dollar, which is perceived as a stable and reliable currency.

The US dollar is strengthening against the Japanese yen, hitting a 10-month low as the US economy continues to outperform. This is partly due to rising interest rates in the US, making the dollar more attractive to investors. Meanwhile, Iraq has taken drastic action by blocking the Telegram app, citing concerns over personal data violations and national security, as detailed in this article iraq takes drastic action telegram app blocked over personal data violations and national security concerns.

This move highlights the growing global concern over data privacy and the potential for misuse of messaging platforms. As the US dollar continues to strengthen, it will be interesting to see how these global events impact the overall economic landscape.

Implications of a Strong US Dollar

A strong US dollar has significant implications for the global economy:

- Impact on Emerging Markets:Emerging market economies, which often have substantial dollar-denominated debt, can face challenges as a strong dollar makes it more expensive to service their debt. This can lead to currency depreciation and economic instability.

- Impact on Exports:A strong dollar makes US exports more expensive in foreign markets, potentially reducing demand and impacting US businesses that rely on international trade.

- Impact on Commodity Prices:Commodity prices, which are often denominated in US dollars, can fall when the dollar strengthens, as buyers need to pay more in their local currencies. This can benefit consumers but may hurt producers.

Examples of US Dollar Strength’s Impact on Other Currencies

The US dollar’s strength has had a noticeable impact on other currencies:

- Japanese Yen:The Japanese yen has depreciated significantly against the US dollar, reaching a 10-month low. This weakness is partly attributed to the Bank of Japan’s accommodative monetary policy, which contrasts with the Federal Reserve’s hawkish stance.

- Euro:The euro has also weakened against the US dollar, influenced by the energy crisis in Europe, concerns about economic growth, and the European Central Bank’s more cautious approach to interest rate hikes.

Japanese Yen Weakness

The Japanese yen has been weakening against the US dollar, reaching a 10-month low. This decline is driven by a confluence of factors, including the divergence in monetary policy between Japan and the US, Japan’s dependence on imports, and the country’s weak economic growth.

The Bank of Japan’s Monetary Policy

The Bank of Japan (BOJ) has maintained an ultra-loose monetary policy, keeping interest rates near zero and engaging in quantitative easing. This policy aims to stimulate the Japanese economy, but it also weakens the yen. When interest rates are low, investors are less inclined to hold yen-denominated assets, as they can earn higher returns in other currencies.

The BOJ’s policy is also contributing to the yen’s weakness by increasing the supply of yen in the market.

The US dollar continues its upward climb as the US economy outperforms, pushing the Japanese yen to a 10-month low. This strength in the dollar comes as a stark contrast to the news of the passing of legendary computer hacker Kevin Mitnick, who passed away at 59, leaving behind an enduring legacy in cybersecurity.

Mitnick’s story serves as a reminder of the evolving landscape of cybersecurity and the need for constant vigilance in a world increasingly reliant on digital technology. The strengthening dollar, however, suggests a continued confidence in the US economy, potentially impacting global trade and investment decisions.

The Impact of Yen Weakness on Japan’s Economy, Forex usd strengthens as us economy leads japan yen hits 10 month low

The yen’s weakness can have both positive and negative impacts on Japan’s economy. On the positive side, a weaker yen makes Japanese exports more competitive in global markets. This can boost Japan’s economic growth by increasing demand for its products.

However, a weaker yen also makes imports more expensive. This can lead to higher inflation and erode consumer purchasing power.

Japan’s Dependence on Imports

Japan is a net importer of energy and raw materials, making it vulnerable to fluctuations in global commodity prices. A weaker yen makes these imports more expensive, which can strain Japan’s trade balance and contribute to inflation.

The US dollar’s recent strength against the Japanese yen, hitting a 10-month low, reflects a strong US economy. This comes amidst growing regulatory pressure on the cryptocurrency sector, as evidenced by the recent SEC lawsuit against Coinbase. The regulatory landscape is evolving, and its impact on the crypto market could ripple out to traditional financial markets, potentially influencing currency fluctuations in the future.

US Economic Performance: Forex Usd Strengthens As Us Economy Leads Japan Yen Hits 10 Month Low

The recent strengthening of the US dollar can be largely attributed to the robust performance of the US economy. While other major economies grapple with various challenges, the US economy has demonstrated resilience and a strong growth trajectory.

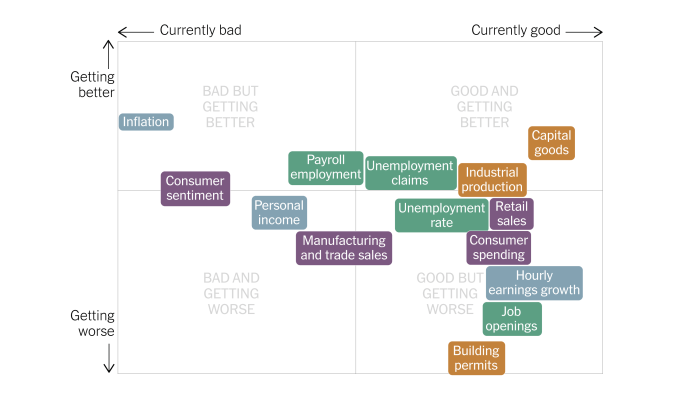

Key Economic Indicators Driving US Dollar Strength

Several key economic indicators are contributing to the US dollar’s strength. These indicators reflect the health and dynamism of the US economy, making it an attractive destination for investment and boosting demand for the US dollar.

- Strong Job Market:The US labor market remains robust, with low unemployment rates and steady job growth. This indicates a healthy economy with ample consumer spending power, supporting economic growth and bolstering demand for the US dollar.

- Resilient Consumer Spending:Despite rising inflation, US consumer spending has remained resilient, indicating strong consumer confidence and a healthy economy. This robust consumer spending fuels economic growth and supports demand for the US dollar.

- Aggressive Monetary Policy:The Federal Reserve’s aggressive monetary policy, including interest rate hikes, has attracted foreign investment into the US, increasing demand for the US dollar. Higher interest rates make US assets more attractive to foreign investors, leading to increased demand for the US dollar.

- Strong Corporate Earnings:US corporations continue to report strong earnings, indicating a healthy business environment and strong economic fundamentals. These strong corporate earnings attract investment and boost demand for the US dollar.

Comparison to Other Major Economies

The US economy is outperforming other major economies, leading to a widening gap in economic performance.

- Europe:The European economy is facing headwinds from the ongoing war in Ukraine, rising energy prices, and supply chain disruptions. This has led to slower economic growth and higher inflation in Europe, compared to the US.

- Japan:The Japanese economy is struggling with deflation and a weak yen. The Bank of Japan’s ultra-loose monetary policy has resulted in a weaker yen, making the US dollar relatively stronger.

- China:The Chinese economy is facing challenges from the ongoing COVID-19 pandemic, strict lockdowns, and a slowing property market. This has led to slower economic growth in China, compared to the US.

Recent US Economic Data

The following table showcases recent economic data for the US, including GDP growth, inflation, and unemployment rates:

| Indicator | Value | Period |

|---|---|---|

| GDP Growth (Annualized) | 2.9% | Q2 2023 |

| Inflation (CPI) | 3.2% | July 2023 |

| Unemployment Rate | 3.8% | August 2023 |

Global Currency Markets

The recent surge in the US dollar has had a significant impact on global currency markets, influencing exchange rates and investment flows. As the world’s reserve currency, the dollar’s strength often reflects the health of the US economy and investor sentiment towards it.

Impact on Global Trade and Investment

The strengthening dollar can make US exports more expensive and imports cheaper, potentially impacting trade balances. For example, a stronger dollar could make US goods less competitive in markets like Europe and Asia, leading to reduced exports. Conversely, it could make imported goods from those regions more affordable for US consumers, potentially increasing imports.A stronger dollar can also influence global investment flows.

Investors may be drawn to US assets, such as stocks and bonds, due to their perceived safety and higher returns. This can lead to increased capital inflows into the US, further strengthening the dollar. However, it can also make it more expensive for US companies to invest abroad.

Key Currency Pairs Affected

The recent dollar surge has significantly impacted several major currency pairs, particularly those involving the Japanese yen. The USD/JPY pair has been one of the most volatile, with the yen weakening to a 10-month low against the dollar. This weakness can be attributed to the Bank of Japan’s ultra-loose monetary policy, which has kept interest rates low and weakened the yen.Other currency pairs that have been affected include:

- USD/EUR: The euro has weakened against the dollar as the European Central Bank (ECB) has taken a more cautious approach to raising interest rates compared to the Federal Reserve.

- USD/GBP: The British pound has also weakened against the dollar, partly due to concerns about the UK economy and the ongoing Brexit negotiations.

- USD/CHF: The Swiss franc has generally held its value against the dollar, as it is often considered a safe-haven currency.

Outlook for the Yen and US Dollar

The recent strengthening of the US dollar against the Japanese yen has sparked discussions about the future trajectory of these two major currencies. While the US economy continues to show resilience, Japan faces unique challenges, including persistent deflation and a weak yen.

This raises questions about the potential for further yen depreciation and the sustainability of the US dollar’s strength.

Factors Influencing Future Movements

Several factors will influence the future movements of the yen and US dollar.

- US Monetary Policy:The Federal Reserve’s aggressive interest rate hikes have been a major driver of the US dollar’s strength. As long as the Fed maintains its hawkish stance, the dollar is likely to remain supported. However, if the Fed signals a pivot towards a more dovish stance, the dollar could weaken.

- Japanese Monetary Policy:The Bank of Japan (BOJ) continues to maintain its ultra-loose monetary policy, keeping interest rates near zero. This policy divergence between the US and Japan is a key factor driving the yen’s weakness. If the BOJ were to shift towards a more hawkish stance, it could lead to yen appreciation.

- Economic Growth:The US economy is expected to continue growing, albeit at a slower pace. Conversely, Japan’s economy is facing headwinds from weak consumer spending and a global slowdown. If the US economy outperforms, it could further strengthen the dollar.

- Geopolitical Risks:The ongoing war in Ukraine and rising geopolitical tensions in Asia could create uncertainty and volatility in global currency markets.

Expert Opinions

Experts have differing views on the potential impact of upcoming economic events on the yen and US dollar. Some believe that the yen will continue to depreciate, citing the widening interest rate differential between the US and Japan. Others argue that the yen’s weakness is unsustainable and that it will eventually rebound.

“The yen is likely to remain under pressure in the near term, as the BOJ is unlikely to change its monetary policy stance anytime soon,” said [Expert Name], a currency strategist at [Financial Institution].

“The US dollar’s strength is not sustainable in the long term, as it is driven by short-term factors such as the Fed’s aggressive rate hikes,” said [Expert Name], an economist at [Research Firm].