Forex Dollar Slips as US Unemployment Rises, Wage Growth Slows

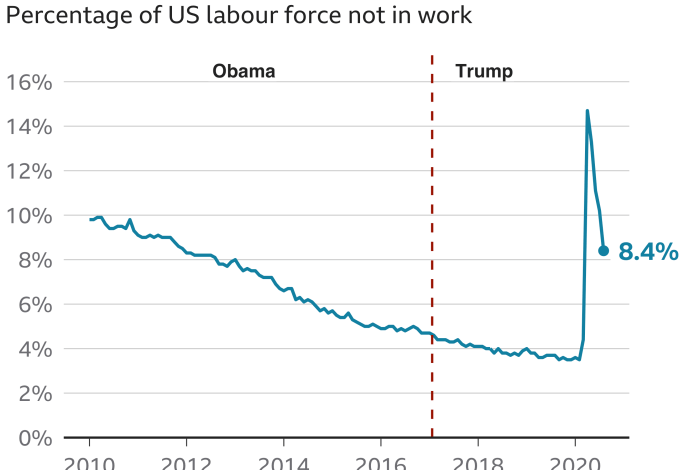

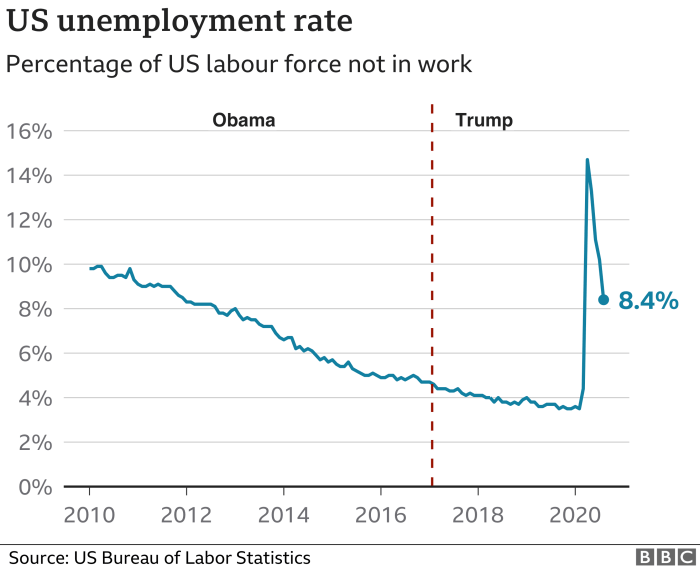

Forex dollar slips as US unemployment rate rises and wage growth slows in august, a trend that has sent ripples through the global financial markets. This unexpected combination of rising unemployment and slowing wage growth has cast a shadow over the US economy, raising concerns about the strength of the recovery and the Federal Reserve’s future monetary policy path.

The implications for the US dollar are significant, as investors grapple with the implications of this economic data on the currency’s value and the outlook for the US economy.

The rise in unemployment, coupled with slowing wage growth, has dampened investor sentiment towards the US dollar, as it signals a potential weakening in the US economy. This, in turn, has led to a decline in demand for the US dollar as a safe-haven currency.

The slowdown in wage growth has also raised concerns about inflation expectations, prompting some analysts to speculate that the Federal Reserve may need to maintain its current monetary policy stance for longer than anticipated. This uncertainty surrounding the Fed’s future actions has added to the pressure on the US dollar.

Impact of Rising Unemployment and Slowing Wage Growth on the Forex Dollar

The recent release of US economic data showing a rise in the unemployment rate and slowing wage growth has sent shockwaves through the forex market, causing the US dollar to weaken against its major counterparts. These developments raise concerns about the health of the US economy and its implications for the Federal Reserve’s monetary policy stance, impacting investor sentiment towards the US dollar.

Impact of Rising Unemployment on Investor Sentiment

A rise in the unemployment rate is a significant indicator of a weakening economy. When unemployment rises, it signals that businesses are cutting jobs, potentially due to declining demand or concerns about future economic prospects. This can lead to a decrease in consumer spending, further dampening economic growth.

Investors often view a rise in unemployment as a sign of economic weakness, making them less optimistic about the US dollar’s future prospects. Consequently, they may reduce their holdings of US dollar assets, leading to a depreciation of the currency.

Implications of Slowing Wage Growth on Inflation Expectations

Slowing wage growth has a direct impact on inflation expectations. Wage growth is a key component of consumer spending, which drives inflation. When wage growth slows, it suggests that consumers have less disposable income, potentially leading to a decrease in spending.

This can result in lower demand for goods and services, ultimately contributing to lower inflation. As inflation expectations decrease, investors may anticipate a less aggressive monetary policy stance from the Federal Reserve, which could lead to lower interest rates.

Lower interest rates can make the US dollar less attractive to foreign investors, potentially weakening the currency.

The forex dollar’s recent slip is a reflection of the economic anxieties gripping the US. The rise in unemployment and the slowdown in wage growth signal a potential recession, further fueled by the global food crisis. The war in Ukraine has disrupted grain exports, putting millions at risk of starvation.

The ongoing attacks on Ukraine’s grain infrastructure, as detailed in this article on Ukraine’s grain exports in peril amidst Russian attacks, shipping industry braces for challenges , highlight the fragility of global food security. These intertwined challenges add to the economic uncertainty and contribute to the dollar’s weakness.

Impact of Rising Unemployment and Slowing Wage Growth on the US Dollar’s Safe-Haven Appeal

The US dollar is often considered a safe-haven currency during periods of global uncertainty. Investors tend to flock to the US dollar when they perceive risk in other markets. However, the combination of rising unemployment and slowing wage growth can undermine the US dollar’s safe-haven appeal.

This is because these developments signal a weakening US economy, making it less attractive as a safe haven. Investors may seek alternative safe havens, such as the Japanese yen or Swiss franc, which are perceived as less risky in times of economic turmoil.

Market Reactions to the Economic Data: Forex Dollar Slips As Us Unemployment Rate Rises And Wage Growth Slows In August

The release of the US unemployment and wage growth data for August sent shockwaves through the forex market, prompting immediate and significant reactions from traders. The unexpected rise in unemployment and slowdown in wage growth painted a less-than-optimistic picture of the US economy, leading to a sell-off in the US dollar.The market’s response was driven by the perception that the data could influence the Federal Reserve’s monetary policy decisions.

With inflation still elevated, the data suggested that the Fed might have less room to maneuver in its efforts to tame inflation. This fueled concerns that the Fed might need to maintain its hawkish stance for longer, potentially leading to further economic slowdown.

Impact on Key Trading Pairs

The release of the data triggered notable price movements in several key forex trading pairs. The US dollar weakened against a basket of major currencies, with the euro, Japanese yen, and Swiss franc showing significant gains.

- EUR/USD: The euro surged against the US dollar, breaking above the 1.1000 level for the first time in several weeks. The move was fueled by the weaker dollar and the eurozone’s relatively stronger economic outlook.

- USD/JPY: The dollar weakened against the Japanese yen, dropping below the 145.00 level. The yen is often seen as a safe-haven currency during times of market uncertainty, and the economic data fueled demand for the yen.

- USD/CHF: The dollar also weakened against the Swiss franc, a currency known for its stability and low-interest rates. The data reinforced the perception that the Fed might need to keep interest rates higher for longer, making the US dollar less attractive compared to the Swiss franc.

The forex dollar took a dip as the US unemployment rate ticked up and wage growth slowed in August, highlighting economic uncertainties. While the US grapples with these economic headwinds, Binance is making moves to ensure smooth operations for its Belgian users by establishing a new Polish entity, as reported by The Venom Blog.

This move underscores the importance of navigating regulatory landscapes and adapting to evolving market conditions, just as the forex market reacts to economic indicators like unemployment and wage growth.

Short-Term Outlook for the US Dollar

The immediate reaction to the economic data suggests a short-term bearish outlook for the US dollar. The weakening dollar could continue if further economic data releases point to a slowdown in the US economy. However, the Fed’s stance on monetary policy remains crucial.

If the Fed signals a more dovish approach, the dollar could rebound.

The US dollar’s short-term outlook hinges on the interplay between economic data, market sentiment, and the Fed’s policy decisions.

Potential Implications for the US Economy

The recent rise in unemployment and slowing wage growth in the US paint a concerning picture for the nation’s economic outlook. These indicators, if sustained, could have significant implications for various facets of the US economy, potentially hindering future growth and prosperity.

Impact on Consumer Spending

Consumer spending is a crucial driver of economic growth in the US, accounting for a significant portion of GDP. Rising unemployment and slower wage growth could negatively impact consumer spending in several ways. * Reduced purchasing power:With stagnant wages and rising unemployment, households have less disposable income available for spending on goods and services.

This could lead to a decline in consumer demand, affecting various sectors like retail, hospitality, and entertainment.

The forex dollar is slipping as the US unemployment rate rises and wage growth slows, suggesting a potential slowdown in the economy. This economic uncertainty is compounded by news of a Massachusetts father and son receiving prison sentences for a $20 million lottery scam , highlighting the potential for financial instability even in seemingly secure areas like state lotteries.

With these factors in play, it’s likely the forex dollar will continue to experience volatility in the coming weeks.

Increased financial uncertainty The economic slowdown and job insecurity may prompt consumers to save more and spend less, fearing future economic instability. This could further dampen consumer spending, creating a vicious cycle of reduced demand and economic stagnation.

Potential for a decline in consumer confidence Rising unemployment and sluggish wage growth can erode consumer confidence, leading to a more pessimistic outlook on the economy. This can further discourage spending, as consumers may postpone major purchases or opt for cheaper alternatives.

Impact on Business Investment

Business investment is another crucial engine of economic growth, contributing to job creation, technological advancement, and productivity gains. Rising unemployment and slowing wage growth can negatively impact business investment by creating an environment of uncertainty and risk aversion. * Reduced demand for goods and services:With consumer spending declining due to unemployment and stagnant wages, businesses may face reduced demand for their products and services.

This can lead to lower profits, reduced investment, and potentially job losses.

Higher costs of labor Businesses may face higher labor costs due to rising wages or difficulty finding skilled workers in a tight labor market. This could discourage investment and expansion, especially for smaller businesses with limited resources.

Uncertainty about future economic prospects The economic slowdown and rising unemployment can create uncertainty about future economic prospects, making businesses hesitant to invest in new projects or expand operations. This can lead to a slowdown in economic growth and job creation.

Impact on Federal Reserve Policy

The Federal Reserve closely monitors economic indicators like unemployment and wage growth to guide its monetary policy decisions. The recent rise in unemployment and slowing wage growth could prompt the Fed to reconsider its current course of action and potentially take steps to stimulate economic growth.* Potential for interest rate cuts:The Fed may consider lowering interest rates to encourage borrowing and spending, thereby boosting economic activity.

This could help stimulate business investment and consumer spending, potentially mitigating the negative impact of rising unemployment and slowing wage growth.

Potential for additional quantitative easing The Fed may also consider implementing additional quantitative easing measures, such as purchasing government bonds or other assets, to inject liquidity into the financial system and lower borrowing costs. This could help stimulate economic activity and create a more favorable environment for business investment and job creation.

Potential for extended accommodative stance The Fed may maintain an accommodative monetary policy stance for an extended period to support economic growth and prevent a further downturn. This could involve keeping interest rates low and continuing asset purchases until the economy shows signs of sustained recovery.

Comparison with Other Major Currencies

The recent weakness in the US dollar has been a trend across multiple major currencies. While the rise in unemployment and the slowdown in wage growth are primary factors contributing to the dollar’s decline, the performance against other currencies offers a broader perspective on the global economic landscape.

Performance of the US Dollar Against Other Major Currencies

The performance of the US dollar against other major currencies provides insights into the relative strengths and weaknesses of different economies.

| Currency | Recent Performance | Key Trends |

|---|---|---|

| Euro (EUR/USD) | Appreciated against the US dollar | The euro has strengthened against the US dollar due to a more resilient European economy and the expectation of continued interest rate hikes by the European Central Bank. |

| Japanese Yen (JPY/USD) | Appreciated against the US dollar | The Japanese yen has gained against the US dollar due to safe-haven demand amidst global economic uncertainty. |

| British Pound (GBP/USD) | Appreciated against the US dollar | The British pound has strengthened against the US dollar, driven by a combination of factors, including the Bank of England’s hawkish stance on interest rates and a rebound in the UK economy. |

Relative Strengths and Weaknesses of Major Currencies

The recent economic data highlights the relative strengths and weaknesses of major currencies. The euro has been a strong performer, benefiting from a more resilient European economy and the expectation of continued interest rate hikes by the European Central Bank.

The Japanese yen has also gained strength, driven by safe-haven demand amidst global economic uncertainty. The British pound has strengthened against the US dollar, driven by a combination of factors, including the Bank of England’s hawkish stance on interest rates and a rebound in the UK economy.

The US dollar’s weakness can be attributed to several factors, including the rise in unemployment and the slowdown in wage growth. The recent economic data suggests that the US economy may be slowing down, which could lead to further depreciation of the US dollar.

Factors Influencing the Forex Dollar

While unemployment and wage growth are crucial indicators of the US economy’s health, they are not the sole determinants of the US dollar’s value in the forex market. Several other factors, both domestic and international, play a significant role in shaping the currency’s trajectory.

Global Risk Appetite

The global risk appetite, or investors’ willingness to take on risk, significantly influences the forex dollar. When global risk appetite is high, investors tend to seek out higher-yielding assets, often favoring emerging market currencies or riskier assets like stocks. This leads to a decline in demand for the US dollar, which is considered a safe-haven asset during times of uncertainty.

Conversely, during periods of heightened risk aversion, investors flock to safe-haven currencies like the US dollar, driving up its value.

Geopolitical Events, Forex dollar slips as us unemployment rate rises and wage growth slows in august

Geopolitical events can significantly impact the forex market. For instance, international tensions, wars, or political instability can create uncertainty and lead to a flight to safety, boosting the US dollar’s demand. Conversely, positive geopolitical developments, such as trade agreements or improved relations between nations, can reduce risk aversion and weaken the US dollar.

Central Bank Policies

Central bank policies, particularly the Federal Reserve’s monetary policy decisions, have a profound impact on the forex dollar. When the Federal Reserve raises interest rates, it makes the US dollar more attractive to foreign investors, as they can earn higher returns on their investments.

This increased demand for the US dollar strengthens its value. Conversely, interest rate cuts tend to weaken the US dollar as they make it less attractive to foreign investors.

Other Key Factors

- Economic Growth:A robust US economy with strong growth prospects tends to attract foreign investment, boosting demand for the US dollar. Conversely, weak economic growth can lead to a decline in the currency’s value.

- Inflation:High inflation erodes the purchasing power of a currency, making it less attractive to investors. Conversely, low inflation can support a currency’s value.

- Government Debt:High levels of government debt can raise concerns about a country’s long-term fiscal sustainability, potentially weakening its currency.

- Trade Balance:A persistent trade deficit can indicate a country’s dependence on foreign financing, potentially putting downward pressure on its currency.

- Political Stability:Political instability or uncertainty can create market volatility and weaken a currency’s value.

Impact of Key Factors on the Forex Dollar

| Factor | Impact on the Forex Dollar | Relative Importance |

|---|---|---|

| Global Risk Appetite | High risk appetite weakens the US dollar; low risk appetite strengthens the US dollar. | High |

| Geopolitical Events | Positive geopolitical events weaken the US dollar; negative geopolitical events strengthen the US dollar. | Medium |

| Central Bank Policies | Higher interest rates strengthen the US dollar; lower interest rates weaken the US dollar. | Very High |

| Economic Growth | Strong economic growth strengthens the US dollar; weak economic growth weakens the US dollar. | High |

| Inflation | High inflation weakens the US dollar; low inflation strengthens the US dollar. | High |

| Government Debt | High government debt weakens the US dollar; low government debt strengthens the US dollar. | Medium |

| Trade Balance | Trade deficit weakens the US dollar; trade surplus strengthens the US dollar. | Medium |

| Political Stability | Political stability strengthens the US dollar; political instability weakens the US dollar. | Medium |

Outlook for the US Dollar

The recent rise in the US unemployment rate and slowing wage growth has cast a shadow on the outlook for the US dollar. While the currency has been relatively strong in recent months, these economic indicators suggest that the greenback may face headwinds in the coming months.

Short-Term Outlook

The short-term outlook for the US dollar is uncertain. The Federal Reserve’s hawkish stance on interest rates has supported the dollar in recent months, but the recent economic data suggests that the Fed may be nearing the end of its rate-hiking cycle.

If the Fed does pivot to a more dovish stance, the dollar could weaken. However, if inflation remains stubbornly high, the Fed may be forced to continue raising rates, which could support the dollar.