Upcoming Economic Indicators: Inflation and Jobs Data in Focus

Upcoming economic indicators inflation and jobs data in focus – The upcoming release of economic indicators, particularly inflation and jobs data, is a crucial event for investors and policymakers alike. This data will offer insights into the health of the economy, providing a snapshot of current trends and potential future direction.

With inflation still a concern and the labor market showing signs of change, these indicators will be closely scrutinized for clues about the future economic landscape.

The recent economic climate has been marked by volatility, with inflation remaining elevated despite some easing in recent months. The Federal Reserve has been aggressively raising interest rates to combat inflation, but the impact of these measures on the economy remains uncertain.

The upcoming jobs data will be crucial for gauging the strength of the labor market and its resilience to rising interest rates.

Economic Indicators Overview

The upcoming release of key economic indicators, particularly inflation and jobs data, will provide valuable insights into the current state of the US economy. These figures are closely watched by investors, policymakers, and businesses alike, as they offer crucial information about the health and direction of the economy.

Current Economic Climate and Recent Trends

The US economy has been navigating a complex landscape in recent months, marked by persistent inflation, rising interest rates, and ongoing geopolitical uncertainty. While the Federal Reserve has aggressively raised interest rates to combat inflation, the impact on economic growth remains a subject of debate.

Recent data has shown some signs of cooling in the economy, with consumer spending slowing and the housing market experiencing a downturn. However, the labor market remains robust, with low unemployment and strong job growth.

Expected Release Dates for Key Economic Indicators

The following table Artikels the expected release dates for key economic indicators in the coming weeks:

| Indicator | Release Date |

|---|---|

| Consumer Price Index (CPI) | [Insert Date] |

| Producer Price Index (PPI) | [Insert Date] |

| Nonfarm Payrolls | [Insert Date] |

| Unemployment Rate | [Insert Date] |

These indicators will provide valuable insights into the trajectory of inflation, the health of the labor market, and the overall direction of the US economy.

This week, investors will be glued to the latest economic indicators, with inflation and jobs data taking center stage. But while the macro picture is crucial, Wall Street is also anticipating a positive start to the week, fueled by optimism surrounding the upcoming Jackson Hole Symposium and the eagerly awaited Nvidia earnings report.

This article offers a deeper dive into these key catalysts, and how they could impact the market in the coming days. Of course, all eyes will remain on the inflation and jobs data, as those figures will ultimately dictate the direction of the broader economy.

Inflation Data Analysis

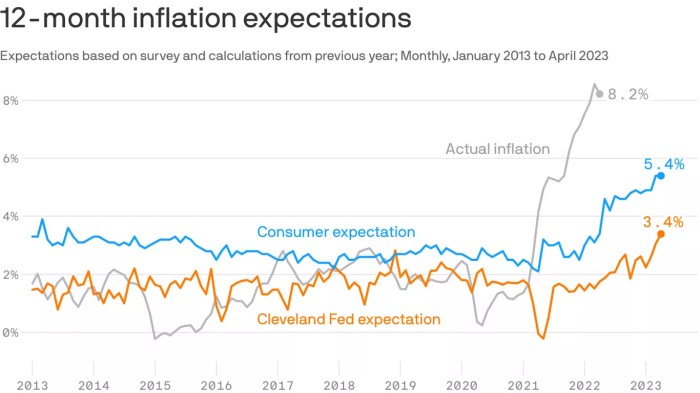

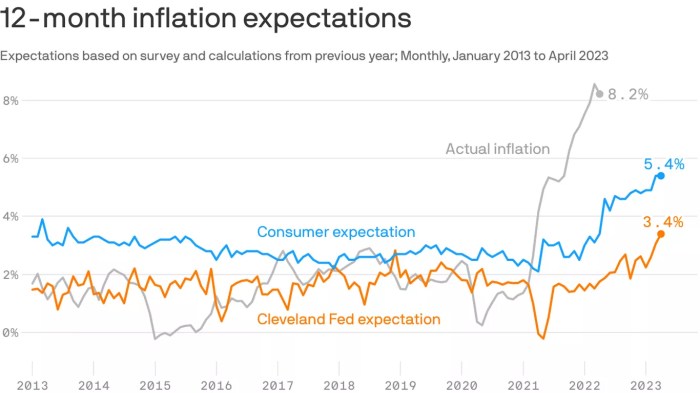

The upcoming inflation data release will be a key event for investors and economists alike, as it will provide insights into the current state of the economy and the Federal Reserve’s future monetary policy decisions. Market sentiment will be highly sensitive to the inflation figures, with any surprises likely to cause significant volatility in asset prices.

The upcoming economic indicators, like inflation and jobs data, are definitely keeping everyone on their toes. It’s a good time to think about ways to build resilience, and that’s where exploring profitable low investment business ideas unlocking high returns comes in.

Whether it’s a side hustle or a full-fledged venture, these ideas can help you weather the economic storm and potentially even capitalize on the changing landscape. Keeping a close eye on the economic indicators can help inform your decision-making, and ultimately, lead you to success.

Expected Inflation Figures

The expected inflation figures will be compared to previous releases and forecasts to assess the trajectory of inflation. Analysts will be closely watching for signs of a slowdown or acceleration in price growth. If inflation comes in higher than expected, it could raise concerns about the Fed’s ability to tame inflation and potentially lead to a more aggressive tightening of monetary policy.

Conversely, if inflation comes in lower than expected, it could ease pressure on the Fed to raise interest rates, potentially boosting market sentiment.

With the upcoming release of inflation and jobs data, the market is on edge. It’s crucial to keep an eye on these indicators as they can significantly impact our financial well-being. But before you dive into the numbers, make sure your own finances are secure.

If you’re a Wells Fargo customer and have been experiencing missing deposits, check out this article on how to address the issue and protect your finances. Knowing your financial situation will give you a better understanding of how the economic data might affect you personally.

Factors Influencing Inflation Trends

Several factors could influence inflation trends in the coming months, including:

- Supply Chain Disruptions:Ongoing supply chain disruptions continue to contribute to elevated inflation. As these disruptions ease, it could help moderate price growth.

- Consumer Demand:Consumer spending remains robust, but there are signs that it may be starting to slow down as inflation erodes purchasing power. A decline in consumer demand could help ease inflationary pressures.

- Energy Prices:Energy prices have been a major contributor to inflation. However, oil prices have recently declined, which could help moderate overall inflation.

- Wage Growth:Strong wage growth can contribute to inflationary pressures as businesses pass on higher labor costs to consumers. However, if wage growth slows down, it could help ease inflation.

Jobs Data Examination

The upcoming jobs report is a crucial indicator of the health of the U.S. economy. It provides insights into the labor market’s strength, offering a snapshot of employment trends, wage growth, and overall economic activity. This data is closely watched by policymakers, investors, and businesses alike, as it informs decisions on monetary policy, investment strategies, and hiring plans.

Unemployment Rate Changes

The unemployment rate is a key metric used to assess the overall health of the labor market. It measures the percentage of the labor force that is unemployed and actively seeking work. A declining unemployment rate generally signals a strong economy with ample job opportunities.

However, it is essential to consider the rate in conjunction with other economic indicators, such as wage growth and labor force participation, to obtain a comprehensive picture of the labor market.

Market Reactions and Implications

The release of economic indicators, particularly inflation and jobs data, can significantly impact market sentiment and investor behavior. These data points provide crucial insights into the health of the economy, influencing investment strategies and potentially affecting interest rates and economic growth.

Impact on Financial Markets

The market’s reaction to economic indicators is often swift and pronounced. For example, if inflation data comes in higher than expected, investors may anticipate a more aggressive stance from central banks, leading to increased interest rates. This can result in a sell-off in the stock market, as higher interest rates make borrowing more expensive for businesses, potentially hindering economic growth.

Conversely, if inflation data comes in lower than expected, it could signal a less hawkish monetary policy, potentially boosting stock prices.

- Bonds:Higher inflation typically leads to a decline in bond prices, as investors demand higher yields to compensate for the eroding purchasing power of their investments. Conversely, lower inflation can lead to an increase in bond prices.

- Currencies:Strong economic data can strengthen a currency, as investors become more confident in the country’s economic prospects. Conversely, weak economic data can weaken a currency.

- Commodities:Inflation can drive up commodity prices, as demand increases and supply struggles to keep pace. For example, rising oil prices can impact transportation costs and fuel inflation.

Investment Strategies

Investors often adjust their strategies based on economic indicators. For example, if inflation is expected to remain high, investors may shift their portfolios towards assets that are likely to outperform in an inflationary environment, such as commodities or real estate.

Conversely, if inflation is expected to moderate, investors may shift their portfolios towards assets that are more sensitive to economic growth, such as stocks.

Impact on Interest Rates

Central banks closely monitor economic indicators to gauge the health of the economy and make decisions about interest rates. If inflation is high and the economy is growing strongly, central banks may raise interest rates to cool down the economy and prevent inflation from spiraling out of control.

Conversely, if inflation is low and the economy is weak, central banks may lower interest rates to stimulate economic growth.

Impact on Economic Growth

Economic indicators can provide valuable insights into the trajectory of economic growth. For example, strong jobs data can indicate a healthy economy with strong consumer spending. Conversely, weak jobs data can signal a weakening economy and potentially lead to a recession.

Additional Considerations: Upcoming Economic Indicators Inflation And Jobs Data In Focus

Beyond the core inflation and jobs data, several other factors warrant consideration when assessing the economic landscape. These factors provide a broader context for understanding the current economic climate and its potential implications.

Historical Trends of Inflation and Jobs Data

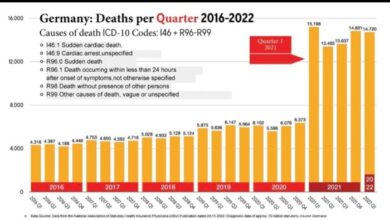

Understanding the historical trends of inflation and jobs data provides valuable insights into the current economic situation and its potential trajectory. Analyzing these trends allows for a more informed assessment of the current economic climate.

| Year | Inflation Rate (%) | Unemployment Rate (%) |

|---|---|---|

| 2010 | 1.6 | 9.6 |

| 2015 | 0.1 | 5.3 |

| 2020 | 1.2 | 8.1 |

| 2022 | 8.0 | 3.7 |

Key Economic Indicators to Be Released

The release of key economic indicators provides valuable insights into the current state of the economy and its future trajectory. These indicators are closely watched by economists, investors, and policymakers alike.

| Indicator | Release Date | Importance |

|---|---|---|

| Consumer Price Index (CPI) | [Date] | Measures inflation in consumer goods and services |

| Producer Price Index (PPI) | [Date] | Measures inflation in goods and services produced by domestic companies |

| Nonfarm Payrolls | [Date] | Measures the number of jobs created or lost in the economy |

| Unemployment Rate | [Date] | Measures the percentage of the labor force that is unemployed |

Comparing the Current Economic Situation to Previous Periods, Upcoming economic indicators inflation and jobs data in focus

Comparing the current economic situation to previous periods provides valuable context for understanding the current economic climate. This comparison allows for a more informed assessment of the current economic trends and their potential implications.