UPS Profit Drops After Teamsters Deal, Stock Takes a Hit

UPS projects profit decrease following teamsters agreement stock takes a hit, a scenario that has sent shockwaves through the financial world. The recent agreement between UPS and the Teamsters union, aimed at improving working conditions for employees, has come at a cost.

With increased labor costs and potential operational disruptions, the company faces a challenging future. This development has also triggered a negative reaction from investors, leading to a decline in UPS’s stock price.

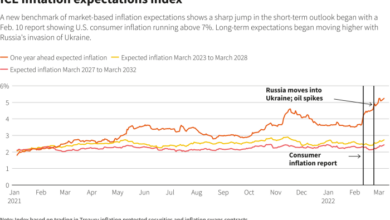

The impact of this agreement extends beyond UPS itself, affecting the broader shipping industry and potentially impacting consumer behavior. Rival shipping companies are watching closely, ready to capitalize on any potential vulnerabilities. With rising inflation and economic uncertainty already looming, this development adds another layer of complexity to the landscape.

Impact of the Teamsters Agreement on UPS

The recent agreement between UPS and the Teamsters union has significant implications for the company’s operations and financial performance. This agreement marks a pivotal moment for UPS, potentially influencing its future trajectory and its position within the competitive landscape of the shipping industry.

Key Provisions and Operational Impact

The agreement includes various provisions that directly impact UPS’s operations. The agreement guarantees higher wages for existing and new employees, introduces new benefits like improved healthcare coverage, and establishes stricter working conditions. These provisions aim to address concerns regarding employee compensation, work-life balance, and overall job satisfaction.

However, they also represent a significant increase in labor costs for UPS.

Financial Implications, Ups projects profit decrease following teamsters agreement stock takes a hit

The increased labor costs associated with the new agreement will undoubtedly impact UPS’s financial performance. The company will need to navigate this challenge by finding ways to offset the additional expenses, potentially through increased pricing, operational efficiency, or a combination of both.

The agreement’s impact on UPS’s profitability will be a key factor to watch in the coming months and years.

UPS’s recent profit decrease following the Teamsters agreement and subsequent stock hit is a major blow to the company. However, there’s a glimmer of hope on the horizon: breaking news gasoline natural gas and other energy sources witness significant price declines.

These lower fuel costs could potentially help offset some of the financial strain UPS is facing, allowing them to regain their footing in the long run.

Competitive Landscape

The agreement’s impact on UPS’s competitive landscape is multifaceted. The increased labor costs could potentially make UPS less competitive compared to its rivals, especially those with lower labor costs. However, the improved employee morale and working conditions could lead to increased productivity and customer satisfaction, potentially offsetting the cost disadvantage.

Additionally, the agreement could influence customer behavior, as some customers may prefer to utilize UPS’s services due to its commitment to employee well-being.

Stock Market Reaction to the Agreement

The announcement of the UPS Teamsters agreement sent shockwaves through the stock market, prompting a significant decline in UPS’s share price. Investors reacted negatively to the deal, raising concerns about the potential impact on UPS’s profitability and future growth.

Stock Performance Comparison

To understand the market’s reaction, it’s crucial to compare UPS’s stock performance to its competitors in the days following the agreement. While UPS shares experienced a decline, its competitors, such as FedEx and Amazon, saw relatively stable or even positive stock performance.

This suggests that the market viewed the agreement as a specific risk to UPS, rather than a broader industry-wide concern.

Factors Contributing to the Stock Decline

Several factors contributed to the decline in UPS’s stock price, including:

- Investor Sentiment:The agreement, with its focus on increased wages and benefits, raised concerns among investors about the potential impact on UPS’s profitability. The market anticipated higher labor costs and potential disruptions to operations, leading to a negative sentiment towards the company’s future prospects.

- Market Expectations:Prior to the agreement, the market had been expecting a more cost-effective deal for UPS. The agreement’s terms, which included higher wages and improved benefits, exceeded these expectations, causing a negative reaction from investors.

- Potential Future Risks:The agreement also highlighted potential future risks for UPS, including potential labor unrest, higher operating costs, and potential pressure from competitors. Investors reacted to these risks by lowering their valuation of UPS’s stock.

The market’s reaction to the UPS Teamsters agreement underscores the importance of labor relations in influencing investor sentiment and stock performance. The agreement’s terms, which were perceived as unfavorable for UPS, triggered a negative reaction from investors, leading to a decline in the company’s share price.

UPS’s recent profit decrease following the Teamsters agreement has sent their stock plummeting. With rising fuel costs, they’re undoubtedly looking at ways to cut expenses, and the decision to switch to electric vehicles is a hot topic. To understand the potential impact of this shift, it’s crucial to consider the financial implications of electric vehicles, which can be complex.

Read more about the pros and cons of gas vs. electric vehicles in this insightful article gas vs electric vehicles which is a better deal know the experts suggestions. Ultimately, the decision to go electric will depend on a variety of factors, including the long-term cost savings, the availability of charging infrastructure, and the overall environmental impact.

Only time will tell if UPS’s move to electric vehicles will help them recover from their recent financial setback.

UPS’s Financial Performance and Profitability

UPS has been a leading player in the global logistics industry for decades, known for its reliable delivery services and extensive network. However, the company has faced challenges in recent years, leading to a decline in profitability. This section delves into UPS’s recent financial performance, analyzing the key drivers of its profit decline and exploring the potential impact of the Teamsters agreement on its future financial performance.

Recent Financial Performance

UPS’s recent financial performance has been marked by a decline in profitability, driven by a combination of factors, including increased costs, competition, and market conditions.

The news of UPS’s profit decrease following the Teamsters agreement and the subsequent stock dip is certainly a blow. It’s a reminder that labor costs are a significant factor in any business, especially one as large and complex as UPS.

While we’re all trying to make sense of the market fluctuations, it’s important to keep in mind that the real estate sector can offer a different perspective. If you’re looking for a more stable investment, you might want to check out exploring real estate in united states state by state analysis residential commercial properties , which offers a comprehensive breakdown of the real estate market across the US.

Regardless of the ups and downs in the stock market, the need for housing and commercial spaces remains constant, making it a potentially lucrative investment.

- Revenue Growth:While UPS has continued to generate revenue growth, the rate of growth has slowed in recent years. In 2022, UPS’s revenue increased by 1.3% compared to the previous year, a significant slowdown from the double-digit growth rates seen in the years leading up to the pandemic.

- Profitability:UPS’s profitability has been under pressure, with operating margins declining in recent quarters. The company’s operating margin in the second quarter of 2023 was 10.4%, down from 13.5% in the same period last year.

- Key Financial Metrics:Several key financial metrics indicate a decline in UPS’s financial performance. For example, the company’s return on equity (ROE) has fallen below its historical average, suggesting a decrease in profitability.

Key Drivers of Profit Decline

The decline in UPS’s profitability can be attributed to several key drivers, including:

- Increased Costs:UPS has faced significant cost pressures in recent years, including higher labor costs, fuel prices, and operating expenses. The company’s labor costs have increased due to rising wages and benefits, while fuel prices have surged due to global supply chain disruptions and geopolitical tensions.

- Intensified Competition:The logistics industry has become increasingly competitive, with the emergence of new players and the expansion of existing competitors. This intensified competition has put pressure on UPS’s pricing and margins.

- Market Conditions:UPS’s business is sensitive to economic conditions, and the global economy has faced significant challenges in recent years, including inflation, supply chain disruptions, and geopolitical uncertainty. These factors have impacted consumer demand and business activity, affecting UPS’s revenue growth and profitability.

Impact of the Teamsters Agreement

The recent agreement with the Teamsters union will have a significant impact on UPS’s future financial performance. The agreement includes provisions for higher wages and benefits, which will increase UPS’s labor costs. However, the agreement also includes provisions that could help UPS improve efficiency and productivity, such as a new work-sharing program and a commitment to invest in technology.

The impact of the Teamsters agreement on UPS’s financial performance will depend on the company’s ability to manage costs, improve efficiency, and maintain its competitive position in the market.

Strategies for UPS to Address Profit Decline: Ups Projects Profit Decrease Following Teamsters Agreement Stock Takes A Hit

The Teamsters agreement, while securing labor peace, has undoubtedly impacted UPS’s profitability. To navigate this challenge, UPS needs to adopt a multi-pronged approach that focuses on cost optimization, operational efficiency, and revenue generation. These strategies are crucial to ensuring long-term success and maintaining UPS’s position as a leading logistics provider.

Cost Reduction Strategies

Cost reduction is a key strategy for UPS to offset the impact of the Teamsters agreement. The company can explore various avenues to streamline operations and minimize expenses.

- Automation and Technology:UPS can further invest in automation and technology to enhance efficiency and reduce labor costs. This could include deploying robots for tasks like sorting and loading, implementing advanced route optimization software, and using drones for deliveries in specific areas.

- Network Optimization:UPS can optimize its delivery network by consolidating facilities, reducing unnecessary routes, and streamlining delivery processes. This can involve analyzing delivery patterns, identifying areas for consolidation, and optimizing route planning to minimize mileage and fuel consumption.

- Outsourcing and Partnerships:UPS can consider outsourcing certain non-core functions, such as customer service or warehouse management, to specialized third-party providers.

This can help reduce overhead costs and free up internal resources to focus on core competencies. Strategic partnerships with other logistics companies can also provide access to new markets and technologies.

- Supply Chain Management:UPS can leverage its expertise in supply chain management to offer value-added services to its customers.

This can include providing inventory management, warehousing, and fulfillment services, which can generate additional revenue and enhance customer relationships.

Operational Efficiency Strategies

Improving operational efficiency is crucial for UPS to maintain profitability in a competitive market. By optimizing processes and workflows, the company can enhance productivity and reduce costs.

- Process Optimization:UPS can analyze its current processes and identify areas for improvement. This could involve streamlining workflows, eliminating unnecessary steps, and implementing lean management principles to minimize waste and improve efficiency.

- Employee Training and Development:Investing in employee training and development can enhance productivity and reduce errors.

UPS can implement programs to improve employee skills, knowledge, and efficiency, leading to better customer service and operational performance.

- Data Analytics:UPS can leverage data analytics to gain insights into its operations and identify areas for improvement. By analyzing data on delivery routes, customer behavior, and employee performance, the company can optimize processes, improve resource allocation, and enhance customer satisfaction.

Revenue Generation Strategies

To offset the impact of increased labor costs, UPS needs to explore strategies for generating additional revenue. Expanding into new markets and offering value-added services can drive growth and enhance profitability.

- Expanding into New Markets:UPS can explore new markets, both geographically and in terms of service offerings. This could involve expanding into emerging economies, developing new delivery services for specific industries, or offering specialized logistics solutions.

- Value-Added Services:UPS can enhance its service offerings by providing value-added services to its customers.

This could include offering customized logistics solutions, providing supply chain consulting, or developing innovative technologies that improve efficiency and customer experience.

- Pricing Optimization:UPS can carefully analyze its pricing strategies and identify opportunities for adjustments. This could involve implementing dynamic pricing models based on factors such as demand, distance, and delivery time, ensuring that prices reflect the value provided to customers.

Long-Term Outlook for UPS

The Teamsters agreement, while addressing immediate concerns, adds a layer of complexity to UPS’s long-term trajectory. Navigating the evolving landscape of e-commerce, technological advancements, and a fluctuating economic environment will be crucial for UPS’s future success.

Challenges and Opportunities

The agreement’s impact on labor costs and operational efficiency will be a key challenge for UPS. However, it also presents opportunities to streamline operations, invest in technology, and enhance customer service.

- Labor Cost Management:The agreement’s impact on labor costs will require UPS to focus on operational efficiency and automation to maintain profitability. This could involve optimizing delivery routes, investing in automated sorting systems, and exploring alternative delivery models.

- Technological Advancements:The rise of e-commerce and the increasing demand for faster and more efficient delivery have spurred technological advancements in the logistics industry. UPS needs to embrace these advancements, including autonomous vehicles, drones, and AI-powered route optimization, to maintain its competitive edge.

- Customer Service and Innovation:UPS needs to continue to invest in customer service and innovative delivery solutions. This could involve expanding its range of delivery options, offering personalized experiences, and leveraging technology to enhance customer communication and tracking.

Impact of Technological Advancements and Industry Trends

Technological advancements, particularly in automation and artificial intelligence, will continue to reshape the logistics industry. These trends present both challenges and opportunities for UPS.

- Automation:The adoption of automated systems, such as robots and drones, will increase efficiency and reduce labor costs. However, it will also require UPS to adapt its workforce and invest in training programs.

- E-commerce Growth:The continued growth of e-commerce will create new opportunities for UPS. However, it will also increase competition from other logistics providers, including Amazon and other e-commerce giants.

- Sustainability:Consumers are increasingly demanding sustainable delivery practices. UPS needs to prioritize sustainable solutions, such as electric vehicles and eco-friendly packaging, to meet these expectations and maintain its brand reputation.