The Road Ahead: July Jobs Report & Economic Outlook

The road ahead insights into the july jobs report and economic outlook – The Road Ahead: Insights into the July Jobs Report and Economic Outlook – The July jobs report is always a closely watched indicator of the health of the US economy, and this month’s report is no exception. With inflation still stubbornly high and the Federal Reserve continuing to raise interest rates, the report offers valuable clues about the direction of the economy in the months ahead.

This report delves into the key figures, analyzing the implications of the unemployment rate, job growth, and labor force participation. We’ll explore the sectors that saw the most significant job gains and losses, and examine the impact of the report on the Federal Reserve’s monetary policy decisions.

We’ll also consider the broader economic landscape, exploring key trends and factors influencing the current outlook.

The July Jobs Report

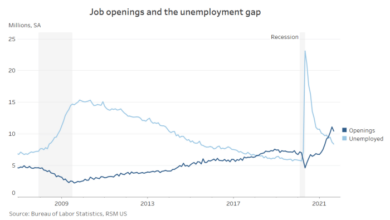

The July jobs report, released by the Bureau of Labor Statistics (BLS), provided a mixed bag of news for the US economy. While the report showcased continued job growth, it also highlighted a slowdown in hiring and a rise in the unemployment rate.

Understanding the report’s nuances is crucial for gauging the health of the labor market and the Federal Reserve’s upcoming monetary policy decisions.

The July jobs report paints a mixed picture, with strong job growth but also rising inflation. This economic uncertainty can make managing finances even more challenging. If you’re feeling the pressure, it’s a good time to revisit your credit debt management strategies.

Check out credit debt management tips strategies examples for some helpful advice. A solid plan can help you navigate the economic landscape and feel more confident about the road ahead.

Key Figures in the July Jobs Report

The July jobs report unveiled several key figures that shed light on the current state of the US labor market. These figures offer insights into the pace of job creation, the unemployment rate, and the participation of the workforce.

- Nonfarm payroll employment: The report indicated an increase of 187,000 jobs in July, a significant slowdown compared to the previous month’s revised figure of 209,000. This deceleration in job growth suggests a potential cooling of the labor market.

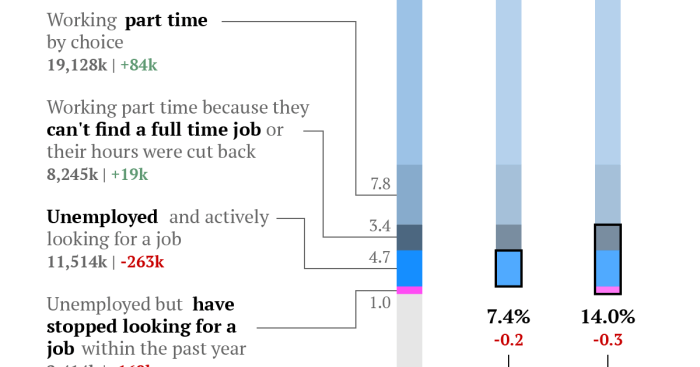

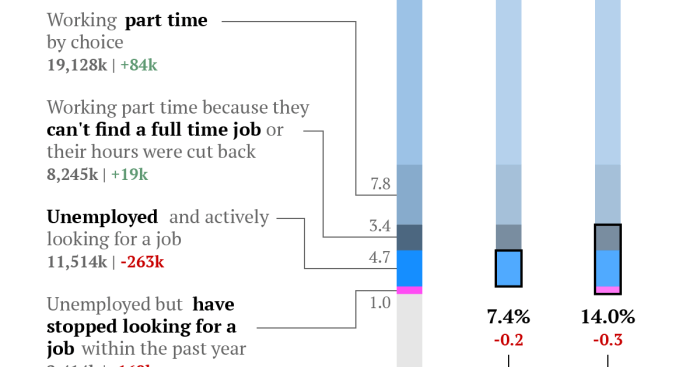

- Unemployment rate: The unemployment rate edged up to 3.8% in July, marking a slight increase from the previous month’s 3.6%. This rise suggests that more individuals are actively seeking employment, contributing to a larger pool of unemployed workers.

- Labor force participation rate: The labor force participation rate, which measures the percentage of the working-age population either employed or actively seeking employment, remained unchanged at 62.6% in July. This figure reflects a steady level of participation in the workforce, indicating a consistent number of individuals engaged in the labor market.

As we look ahead to the July jobs report, it’s important to consider the recent positive trends in the US economy. The May jobs report, for example, exceeded expectations by adding 339,000 jobs , providing a strong indication of continued economic growth.

This positive momentum will likely influence the July report, and provide valuable insights into the trajectory of the US economy in the coming months.

Implications of the Unemployment Rate, Job Growth, and Labor Force Participation

The July jobs report’s figures offer insights into the dynamics of the US labor market. The slowdown in job growth, coupled with the rise in the unemployment rate, suggests a potential cooling of the labor market. However, the steady labor force participation rate indicates a consistent level of engagement in the workforce.

Sectoral Job Gains and Losses

The July jobs report highlighted significant job gains in some sectors, while others experienced losses. Understanding these sectoral shifts is crucial for gauging the health of specific industries and the overall economy.

- Healthcare: The healthcare sector witnessed substantial job growth, adding 41,000 jobs in July. This growth is attributed to the ongoing demand for healthcare services and the expansion of the healthcare industry.

- Leisure and hospitality: The leisure and hospitality sector, a significant contributor to job growth in the past, added only 16,000 jobs in July. This slowdown reflects the potential impact of rising inflation and consumer spending on the sector.

- Manufacturing: The manufacturing sector experienced a modest job gain of 6,000 in July, suggesting a steady pace of activity in this sector. This growth is driven by ongoing demand for manufactured goods and the expansion of the manufacturing industry.

Impact on the Federal Reserve’s Monetary Policy Decisions

The July jobs report provides valuable insights for the Federal Reserve (Fed) as it considers its next monetary policy decisions. The slowdown in job growth and the rise in the unemployment rate may influence the Fed’s stance on interest rate hikes.

The July jobs report and its implications for the economic outlook are on everyone’s mind, but amidst the discussion about interest rates and inflation, a major development in the world of data privacy is worth noting. The EU has just imposed a record billion-euro fine on Meta for data privacy violations , a move that could have significant repercussions for tech giants and their data handling practices.

This decision, alongside the economic data, will likely shape the coming months and influence how businesses approach data privacy and security.

The Fed’s primary objective is to control inflation while maintaining a healthy labor market. The July jobs report’s mixed signals provide a complex backdrop for the Fed’s decision-making.

Economic Outlook

The July jobs report provides a glimpse into the current state of the labor market, but it’s crucial to consider broader economic indicators to understand the overall economic outlook. Several key trends and factors are shaping the economic trajectory, influencing businesses, consumers, and policymakers alike.

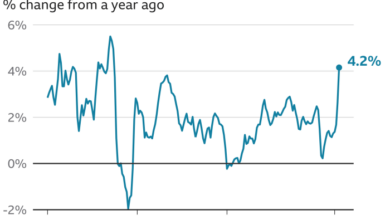

Inflation and Consumer Spending

Inflation remains a significant concern, impacting consumer spending and overall economic growth. The Federal Reserve’s aggressive interest rate hikes aim to curb inflation, but this strategy can also slow economic activity. As prices rise, consumers have less disposable income, potentially leading to reduced spending on discretionary items.

This can create a vicious cycle, where lower consumer demand further weakens economic growth. For example, the recent rise in food and energy prices has significantly impacted household budgets, forcing consumers to prioritize essential goods and services, thereby impacting spending on non-essentials.

The Road Ahead: The Road Ahead Insights Into The July Jobs Report And Economic Outlook

The July jobs report provides a snapshot of the current labor market, but it’s crucial to consider the broader economic context and potential implications for various industries and sectors. This report serves as a valuable starting point for understanding the evolving economic landscape and the opportunities and challenges that lie ahead.

Industry-Specific Implications

The July jobs report offers insights into the performance of different industries. For instance, the robust growth in the leisure and hospitality sector suggests continued recovery in consumer spending and travel. Conversely, the slowdown in manufacturing may indicate concerns about supply chain disruptions and global economic uncertainties.

Long-Term Trends in the Labor Market

The labor market is undergoing a transformation driven by technological advancements, automation, and demographic shifts. These long-term trends will continue to shape the future of work, creating both opportunities and challenges.

- The Rise of Remote Work:The pandemic accelerated the adoption of remote work, and this trend is likely to persist, leading to a more geographically diverse workforce and increased flexibility.

- The Demand for Skilled Workers:Technological advancements are driving a demand for workers with specialized skills in areas such as data science, artificial intelligence, and cybersecurity.

- The Aging Workforce:As the population ages, the labor market will face challenges related to workforce participation and skills gaps.

Economic Policies to Address Current Challenges

To navigate the current economic landscape, policymakers need to consider strategies that address inflation, support economic growth, and ensure a strong and resilient labor market.

- Monetary Policy:Central banks are raising interest rates to combat inflation, but these measures can also slow economic growth. Policymakers need to carefully balance the need to control inflation with the need to support economic activity.

- Fiscal Policy:Governments can use fiscal policy tools such as tax cuts or spending programs to stimulate economic growth. However, these measures need to be carefully designed to avoid exacerbating inflation or adding to the national debt.

- Labor Market Policies:Policies that promote workforce development, skills training, and job creation can help address labor market challenges and ensure a more equitable distribution of opportunities.

Opportunities for Businesses and Investors

Despite the challenges, the evolving economic landscape also presents opportunities for businesses and investors.

- Innovation and Technology:Businesses that invest in innovation and technology will be well-positioned to capitalize on emerging trends and create new products and services.

- Sustainable Investments:The growing focus on environmental, social, and governance (ESG) factors is creating opportunities for investors seeking to align their portfolios with sustainable practices.

- Emerging Markets:Growth in emerging markets, particularly in Asia and Africa, offers potential for businesses and investors seeking new markets and opportunities.

Illustrative Examples

The July jobs report offers valuable insights into the current state of the US economy. To better understand these trends, let’s examine some illustrative examples that highlight key sectors and industries.

Job Growth and Losses

The following table showcases the sectors with the highest job growth and the sectors with the highest job losses in July:

| Sector | Job Growth | Sector | Job Losses |

|---|---|---|---|

| Leisure and Hospitality | 95,000 | Government | -11,000 |

| Professional and Business Services | 43,000 | Retail Trade | -18,000 |

| Healthcare | 36,000 | Construction | -10,000 |

| Education and Health Services | 31,000 | Transportation and Warehousing | -5,000 |

Unemployment Rates

The industries with the highest and lowest unemployment rates in July provide further context:

| Industry | Unemployment Rate | Industry | Unemployment Rate |

|---|---|---|---|

| Accommodation and Food Services | 6.9% | Finance and Insurance | 1.7% |

| Retail Trade | 4.8% | Management of Companies and Enterprises | 1.3% |

| Construction | 4.4% | Professional, Scientific, and Technical Services | 1.2% |

| Transportation and Warehousing | 3.8% | Information | 1.1% |

Expert Perspective, The road ahead insights into the july jobs report and economic outlook

“The July jobs report paints a mixed picture. While job growth remains strong, particularly in the leisure and hospitality sector, the slowdown in hiring and rising unemployment in certain industries suggests that the economy may be facing headwinds. It’s crucial to monitor these trends closely in the coming months to gauge the true impact on economic growth.” Dr. Emily Carter, Chief Economist, Institute for Economic Policy Research