4 Must-Read Books to Revolutionize Your Money Mindset for Investment

4 must read books to revolutionize your money mindset for investment – 4 Must-Read Books to Revolutionize Your Money Mindset for Investment – Ready to unlock the secrets of successful investing? It all starts with your mindset. This journey will delve into the crucial link between your beliefs and investment outcomes.

We’ll explore how to shift your perspective from fear and scarcity to confidence and abundance, empowering you to make smarter financial decisions and achieve long-term wealth.

You’ll discover the power of financial psychology, learn to identify and challenge limiting beliefs, and build a solid financial foundation. This isn’t just about investing; it’s about transforming your relationship with money and embracing a growth mindset that fuels your financial success.

The Power of Mindset in Investing: 4 Must Read Books To Revolutionize Your Money Mindset For Investment

Investing is not just about numbers and strategies; it’s deeply intertwined with your mindset. Your beliefs about money and risk play a crucial role in shaping your investment decisions and ultimately influencing your financial success.

The Connection Between Mindset and Investment Success, 4 must read books to revolutionize your money mindset for investment

A positive and growth-oriented mindset can empower you to make informed investment decisions, manage risk effectively, and navigate market fluctuations with resilience.

- Confidence:A strong belief in your ability to make sound investment choices fosters confidence, leading to proactive decision-making and a willingness to take calculated risks.

- Discipline:A disciplined mindset helps you stick to your investment plan, even when faced with market volatility or emotional impulses to deviate from your strategy.

- Long-term Perspective:A growth mindset encourages you to focus on the long-term potential of your investments rather than getting swayed by short-term market fluctuations. This allows for consistent growth and wealth accumulation over time.

Negative Financial Beliefs and Their Impact on Investment Decisions

Negative financial beliefs can act as roadblocks, hindering your ability to invest effectively and achieve your financial goals.

- Fear of Loss:The fear of losing money can paralyze you, preventing you from taking calculated risks that could lead to significant returns. This fear often leads to inaction or impulsive selling decisions during market downturns, potentially resulting in missed opportunities.

- Belief in Get-Rich-Quick Schemes:This belief can lead you to chase unrealistic returns, potentially exposing you to scams or high-risk investments that could result in significant losses.

- Lack of Trust in Financial Markets:A lack of trust in the financial system can make you hesitant to invest, hindering your ability to participate in the growth of the economy and build wealth.

Strategies for Cultivating a Positive and Growth-Oriented Mindset

Developing a positive and growth-oriented mindset requires conscious effort and practice.

- Educate Yourself:Understanding the fundamentals of investing, including risk management and asset allocation, can empower you to make informed decisions and overcome fear.

- Challenge Negative Beliefs:Identify and challenge negative financial beliefs that may be holding you back. Replace them with positive affirmations and focus on your ability to achieve your financial goals.

- Set Realistic Expectations:Avoid unrealistic expectations of quick riches. Understand that investing is a long-term journey that requires patience, discipline, and a focus on consistent growth.

- Seek Support:Surround yourself with positive and supportive individuals who share your financial goals and encourage your growth.

Embracing a Growth Mindset for Long-Term Success

In the dynamic world of investing, adopting a growth mindset is crucial for achieving long-term success. It involves viewing challenges as opportunities for learning and improvement, rather than as setbacks. This mindset allows investors to adapt to market changes, embrace risks, and consistently enhance their knowledge and skills.

The Importance of Continuous Learning

Continuous learning is essential for navigating the ever-evolving investment landscape. Market trends, economic conditions, and technological advancements constantly reshape the investment environment. To stay ahead of the curve, investors need to proactively seek new knowledge and insights.

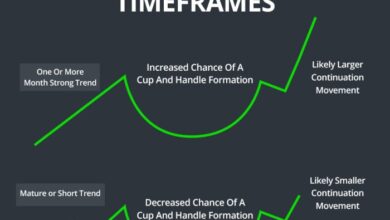

- Stay Updated with Market Trends:Regularly monitor economic indicators, industry news, and investment research to gain a comprehensive understanding of current market conditions.

- Expand Investment Knowledge:Explore different asset classes, investment strategies, and financial concepts to broaden your investment horizons.

- Attend Workshops and Conferences:Participate in industry events to learn from experts, network with other investors, and gain valuable insights.

Strategies for Developing a Resilient Approach

Developing a resilient and optimistic approach to investment risks and challenges is paramount for long-term success. A growth mindset empowers investors to view setbacks as learning opportunities and to persevere through market volatility.

- Embrace Risk as a Part of the Investment Process:Recognize that risk is inherent in investing and that it’s essential for potential growth. However, carefully assess and manage risks through diversification and due diligence.

- Maintain a Long-Term Perspective:Avoid short-term market fluctuations and focus on achieving long-term financial goals. Remember that investment returns are often cyclical and that market downturns are inevitable.

- Learn from Mistakes:Analyze investment decisions that did not yield the desired results to identify areas for improvement. This process helps refine your investment strategy and avoid repeating past errors.

Want to ditch the fear and finally take control of your finances? I’m a big believer in the power of knowledge, and these four books are my go-to recommendations for anyone wanting to revolutionize their money mindset for investment.

They’ve helped me understand the importance of long-term planning, and I’ve learned how to navigate the world of investing with confidence. It’s especially crucial for women to prioritize retirement savings, as we often face unique challenges when it comes to financial security.

Check out this article on empowering women’s retirement and closing the savings gap for a bright financial future for some valuable insights. After reading these books, I’m excited to build a strong financial future for myself, and I know you can too!

Reading books like “The Richest Man in Babylon” or “Think and Grow Rich” can seriously shift your perspective on money and investing. It’s a journey of self-discovery, and sometimes, events like the recent bank turmoil resulting in a 72 billion loss of deposits for First Republic serve as stark reminders of the importance of financial literacy.

These books can help you navigate the complexities of the financial world, empowering you to make informed decisions and build a secure future.

If you’re looking to shift your money mindset and make smarter investments, I highly recommend checking out these four books: “Rich Dad Poor Dad,” “The Psychology of Money,” “The Intelligent Investor,” and “Think and Grow Rich.” These books can provide valuable insights into financial literacy and help you build a solid foundation for investing.

It’s interesting to consider how the rapid advancements in AI, like those predicted by HP’s CEO in this article , might reshape the financial landscape and influence investment strategies in the future. With a strong understanding of money management principles, you’ll be better equipped to navigate these changes and make informed decisions about your investments.