Dollar Plunges: 5-Month Low vs Euro Amid Fed Rate Cut Talk

Year end twist dollar hits 5 month low against euro amid fed rate cut expectations – Dollar Plunges: 5-Month Low vs Euro Amid Fed Rate Cut Talk sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The US dollar has been on a downward trajectory recently, hitting a five-month low against the euro.

This decline is fueled by growing expectations that the Federal Reserve will cut interest rates soon. The euro, on the other hand, is gaining strength due to a robust European economy and a hawkish stance from the European Central Bank.

This dynamic is creating a volatile market environment as investors grapple with the implications of a weakening dollar and the possibility of a global economic slowdown.

The dollar’s weakness can be attributed to several factors, including the recent decline in US economic growth, the Fed’s dovish monetary policy, and the ongoing trade war between the US and China. The euro, on the other hand, is being supported by strong economic growth in the Eurozone, the European Central Bank’s hawkish stance on monetary policy, and the recent weakness of the British pound.

The current dollar-euro exchange rate is a significant departure from historical trends, and its impact on global markets is already being felt.

Dollar Weakness and Euro Strength

The recent decline of the US dollar against the euro, reaching a 5-month low, signifies a shift in market sentiment and reflects several key economic factors. This move suggests a potential change in the global currency landscape and raises questions about the future direction of these two major currencies.

The year-end twist of the dollar hitting a 5-month low against the euro amid expectations of Fed rate cuts has investors looking for growth opportunities. This has led to a surge in interest from Gen Z investors, who are seeking out companies like Nvidia, Tesla, and Lennar, which are known for their potential for rapid growth.

Gen Z investors seek growth Nvidia Tesla and Lennar emerge as top stock picks. As the dollar continues to weaken, these stocks are likely to remain popular choices for investors seeking to capitalize on the changing economic landscape.

Factors Driving Euro Strength

The euro’s recent strength can be attributed to a combination of factors, including the European Central Bank’s (ECB) hawkish stance on interest rates, a robust Eurozone economy, and a weakening US dollar.

- ECB’s Hawkish Stance:The ECB has indicated its commitment to combatting inflation, signaling potential future interest rate hikes. This aggressive approach to monetary policy has boosted investor confidence in the euro, making it more attractive to hold.

- Strong Eurozone Economy:The Eurozone economy has demonstrated resilience, with recent data showing strong economic growth and a robust labor market. This positive economic outlook supports the euro’s value as investors seek exposure to a growing economy.

- Weakening US Dollar:The US dollar has been under pressure due to expectations of a Federal Reserve rate cut. These expectations stem from concerns about slowing US economic growth and the potential for a recession. As investors anticipate a less aggressive Fed, the dollar’s appeal as a safe-haven currency has diminished, leading to its decline.

Historical Comparison

The current dollar-euro exchange rate can be compared to historical trends to understand the significance of this recent move. For example, in 2014, the euro reached a peak against the dollar, trading at around 1.40. However, in recent years, the dollar has strengthened, reaching a high of around 1.10 in 2022.

The current decline to a 5-month low suggests a potential shift in the balance of power between these two currencies, indicating a potential return to a more favorable environment for the euro.

Fed Rate Cut Expectations: Year End Twist Dollar Hits 5 Month Low Against Euro Amid Fed Rate Cut Expectations

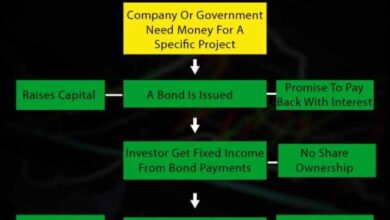

The recent decline in the US dollar against the euro has been driven by growing expectations of a Federal Reserve (Fed) rate cut in the coming months. The market is pricing in a significant probability of a rate reduction, which has put downward pressure on the dollar’s value.

Factors Influencing Rate Cut Expectations

The market’s expectations for a Fed rate cut are fueled by several economic factors:

- Slowing Economic Growth:The US economy has shown signs of slowing down, with weaker-than-expected GDP growth and declining consumer spending. This has raised concerns about the strength of the US economy and its ability to withstand further interest rate hikes.

- Inflation Concerns:While inflation has cooled down from its peak, it remains elevated, particularly in the service sector. This suggests that the Fed may be hesitant to raise interest rates further, as it could potentially stifle economic growth and exacerbate inflation.

- Banking Sector Instability:The recent banking sector turmoil, with the collapse of Silicon Valley Bank and Signature Bank, has raised concerns about financial stability and the potential for a credit crunch. This has further fueled expectations for a Fed rate cut, as it could help to alleviate pressure on banks and stimulate lending.

Impact of a Fed Rate Cut on the Dollar

A Fed rate cut would likely have a negative impact on the US dollar’s value. This is because lower interest rates would make the dollar less attractive to foreign investors, who would seek higher returns in other currencies.

“A rate cut would make US assets less attractive to foreign investors, leading to a decline in demand for the dollar.”

The year-end twist of the dollar hitting a five-month low against the euro amidst expectations of Fed rate cuts adds another layer of complexity to the financial landscape. While the Fed navigates these turbulent waters, it’s also taking strides towards a more modern financial system with the introduction of the FedNow instant payment system, a game-changer that promises to revolutionize money transfers.

This new system could potentially influence the dollar’s trajectory, especially if it attracts widespread adoption and fosters greater confidence in the US financial system.

For example, if the Fed cuts rates by 25 basis points, it could lead to a 1-2% depreciation of the dollar against the euro, depending on market conditions and investor sentiment.

The year-end twist of the dollar hitting a 5-month low against the euro amid expectations of Fed rate cuts is a wild ride, and the financial news keeps getting stranger. Now, Elon Musk is set to face a subpoena in the Virgin Islands’ lawsuit against JPMorgan over the Epstein case, adding another layer of intrigue to the already complex situation.

It’s hard to predict how these developments will affect the dollar’s trajectory, but one thing’s for sure – it’s going to be an interesting ride to watch.

Year-End Market Volatility

The year-end period is often characterized by heightened market volatility, as investors adjust their portfolios and prepare for the upcoming year. This volatility can manifest in various ways, including sharp price swings in stocks, bonds, and currencies.

Factors Contributing to Year-End Volatility, Year end twist dollar hits 5 month low against euro amid fed rate cut expectations

The year-end period presents a confluence of factors that can contribute to increased market volatility.

- Tax Loss Harvesting:Investors may engage in tax loss harvesting, selling losing investments to offset capital gains and reduce their tax liabilities. This selling pressure can drive down prices, particularly in the final weeks of the year.

- Year-End Portfolio Rebalancing:Many investors use the year-end as an opportunity to rebalance their portfolios, adjusting their asset allocation to align with their investment goals and risk tolerance. This rebalancing can involve buying and selling various assets, potentially leading to market fluctuations.

- Holiday Seasonality:The holiday season can see reduced trading activity as investors take time off. This reduced liquidity can amplify price swings as fewer participants are available to absorb market orders.

- End-of-Year Performance Chasing:Some investors may chase strong performers at year-end, hoping to boost their returns. This can lead to inflated prices and potentially create a bubble-like effect.

Dollar-Euro Situation’s Influence on Year-End Market Trends

The recent weakness in the US dollar against the euro, driven by expectations of Fed rate cuts, can influence year-end market trends in several ways.

- Increased Investment in Eurozone Assets:A weaker dollar makes eurozone assets more attractive to foreign investors, potentially leading to increased demand for European stocks and bonds. This could drive up prices and create a positive feedback loop.

- Impact on US Exports:A weaker dollar makes US exports more competitive in global markets, potentially boosting economic growth. This could lead to higher demand for US goods and services, benefiting US companies and the overall economy.

- Inflationary Pressures:A weaker dollar can contribute to inflationary pressures, as imported goods become more expensive. This could force the Fed to reconsider its rate cut plans, potentially impacting the direction of the dollar and the broader market.

Implications for Global Markets

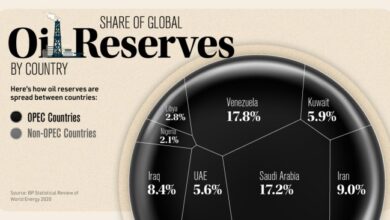

A weaker dollar can have significant implications for global markets, influencing commodity prices, international trade, and investment flows. Understanding these effects is crucial for investors and businesses operating in a globalized economy.

Impact on Commodity Prices

The dollar’s decline can lead to higher prices for commodities priced in dollars, such as oil, gold, and agricultural products. This is because a weaker dollar makes these commodities more expensive for buyers holding other currencies.

- For example, if the price of oil is $100 per barrel, a weakening dollar against the euro means that European buyers will need to pay more euros for the same amount of oil.

- This increased demand can push commodity prices higher, benefiting producers in countries with weaker currencies but potentially impacting consumers in countries with stronger currencies.

Consequences for International Trade

A weaker dollar can make US exports more competitive, potentially boosting US economic growth. However, it can also make imports more expensive for US consumers and businesses.

- A weaker dollar makes US goods and services cheaper for buyers holding other currencies, potentially increasing demand for US exports.

- However, it also makes imported goods and services more expensive for US buyers, potentially leading to higher inflation and a decrease in consumer spending.

Investor Strategies

Navigating the current market landscape requires a strategic approach. Investors should consider various factors, including the dollar’s weakness, the euro’s strength, and the potential for a Fed rate cut, to formulate their investment strategies. Understanding the potential benefits and risks associated with different approaches is crucial for making informed decisions.

Potential Investment Strategies

The following table Artikels potential investment strategies, considering the current market conditions: