Warren Buffetts Smart Solution to Fix Americas Debt

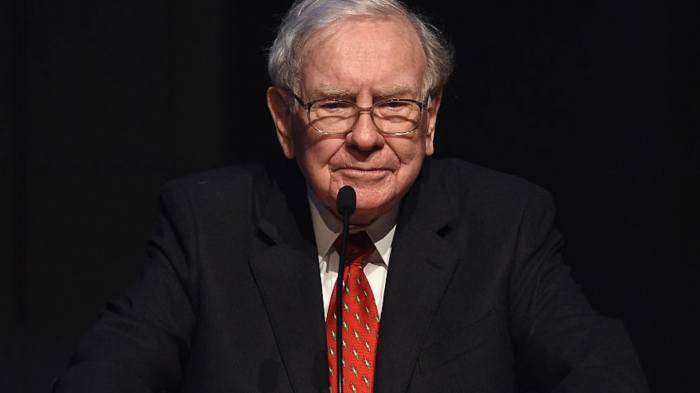

Warren buffett smart solution how he wants to quickly fix americas debt – Warren Buffett’s Smart Solution to Fix America’s Debt is a topic that has captured the attention of many, as the legendary investor shares his insights on how to tackle the nation’s growing debt burden. With a keen eye for value and a long-term perspective, Buffett proposes practical solutions that aim to address the root causes of the problem, emphasizing the importance of fiscal responsibility and sustainable economic growth.

Buffett’s approach is rooted in his belief that responsible financial management is crucial, not just for individuals but for nations as well. He argues that unchecked debt can lead to economic instability and hinder future prosperity. His solutions are designed to promote fiscal discipline and foster a more balanced economic landscape, aiming to create a brighter future for generations to come.

Warren Buffett’s Perspective on America’s Debt

Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has repeatedly expressed his concerns about the ever-growing national debt in the United States. He believes that the current trajectory of the debt poses significant risks to the nation’s economic future and its ability to maintain its global standing.

Warren Buffett’s Concerns about the Long-Term Implications of the Debt

Buffett’s primary concern is that the escalating national debt will ultimately lead to a decline in the value of the U.S. dollar, eroding the purchasing power of Americans and making it more expensive to borrow money. He argues that the debt burden will eventually become unsustainable, forcing the government to make difficult choices, such as raising taxes or cutting essential programs, which could have negative repercussions on the economy and society.

Warren Buffett’s Proposed Solutions for Addressing the Debt

Buffett advocates for a multi-pronged approach to address the national debt. He emphasizes the importance of fiscal discipline, urging the government to prioritize spending on essential services and reduce unnecessary expenditures. He also believes that tax reform is crucial, advocating for a more progressive tax system that ensures fair contributions from all income levels.

Additionally, Buffett supports investment in education and infrastructure, believing that these long-term investments will enhance productivity and economic growth, ultimately contributing to a stronger and more sustainable economy.

The Feasibility and Potential Impact of Warren Buffett’s Solutions

Buffett’s proposed solutions have been met with mixed reactions. Some argue that his approach is too simplistic and ignores the complexities of the national debt. Others, however, believe that his focus on fiscal responsibility and long-term investment is essential for addressing the issue effectively.

The feasibility of his solutions depends on political will and the willingness of policymakers to implement tough but necessary measures.

“The national debt is the most serious problem we face, and it’s getting worse every day. We’re borrowing money from our children and grandchildren, and we’re not leaving them a very good legacy.”

Warren Buffett

The impact of his proposed solutions would likely be significant, potentially leading to a more stable and prosperous economy in the long run. However, it is important to note that the implementation of these solutions would require significant political and social changes, which could be challenging to achieve in the current political climate.

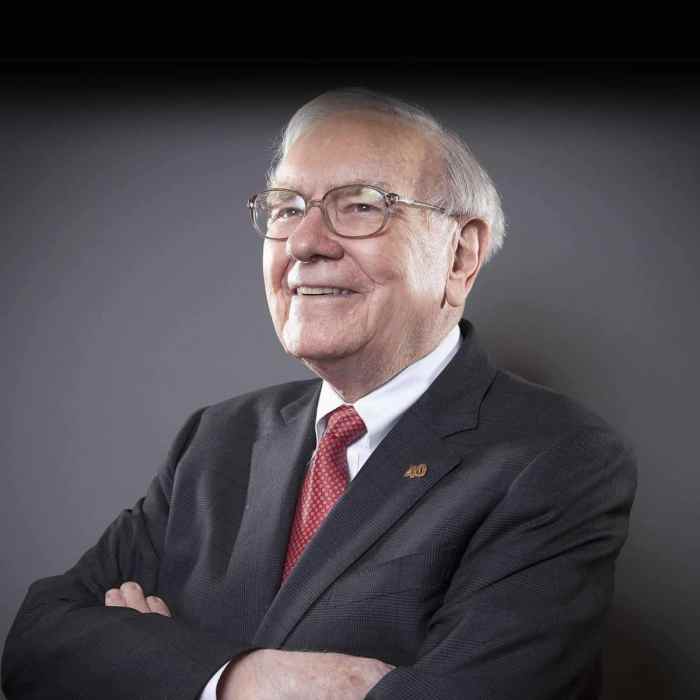

The Importance of Fiscal Responsibility

Warren Buffett, renowned for his investment acumen and wisdom, emphasizes the significance of fiscal responsibility, not just in personal finance but also in business management and on a national level. His perspective on fiscal responsibility is rooted in the belief that responsible financial practices are essential for long-term success and stability.

Fiscal Responsibility in Personal Finance

Warren Buffett consistently advocates for responsible financial practices in personal finance, emphasizing the importance of saving, investing, and avoiding excessive debt. He highlights the power of compounding, where small amounts saved consistently over time can generate significant wealth.

“The single most important decision in your life is who you marry. The second most important is what you do with your money.”

Warren Buffett

Buffett emphasizes the importance of budgeting and living within one’s means. He advocates for prioritizing needs over wants and avoiding unnecessary spending.

Fiscal Responsibility in Business Management

Buffett applies the principles of fiscal responsibility to business management, emphasizing the importance of long-term value creation over short-term profits. He believes that businesses should invest in their core competencies, manage their capital efficiently, and prioritize long-term growth.

“Our favorite holding period is forever.”

Warren Buffett’s solution to America’s debt problem might be a simple one: raise taxes. While it’s a controversial move, it’s one that could have a significant impact. Meanwhile, Wall Street is looking ahead to the Jackson Hole Symposium, where the Federal Reserve will be discussing its monetary policy.

The event is expected to be a positive start for the market , with Nvidia’s earnings report also drawing attention. Whether Buffett’s solution will gain traction remains to be seen, but it’s a topic that’s sure to spark debate.

Warren Buffett

Buffett emphasizes the importance of responsible debt management in businesses. He believes that debt can be a valuable tool for growth, but it should be used strategically and with careful consideration.

Fiscal Responsibility on a National Level

Buffett’s perspective on fiscal responsibility extends to the national level, where he believes that responsible government spending and debt management are crucial for long-term economic stability. He advocates for prioritizing essential government services and avoiding excessive spending on non-essential programs.

Warren Buffett’s proposed solution to America’s debt crisis – a one-time wealth tax – might seem radical, but it’s a bold move to address a pressing issue. It’s interesting to consider how a similar approach might be applied to the situation in Israel, where israel confronts financial strain amid ongoing conflict.

Perhaps a temporary, targeted tax on the wealthy could help alleviate the pressure on the Israeli economy, similar to Buffett’s vision for the US. It’s a thought-provoking idea that could potentially offer a path forward for both nations.

“It’s better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Warren Buffett

Buffett highlights the potential consequences of neglecting fiscal responsibility on a national level, including higher interest rates, increased inflation, and a weakened economy. He believes that responsible fiscal policies are essential for creating a strong and sustainable economy.

Addressing the Debt

Warren Buffett, a renowned investor and business leader, has repeatedly expressed concern about the growing national debt in the United States. He believes that unchecked debt poses a significant risk to the long-term economic health of the country. While he acknowledges the complexities of addressing this issue, he advocates for a multi-faceted approach that involves both spending restraint and revenue generation.

Warren Buffett’s Proposed Solutions for Reducing the National Debt

Buffett’s proposed solutions for tackling the national debt are not just about cutting spending or raising taxes. He believes in a comprehensive strategy that involves various aspects of the economy, aiming for a balanced approach.

Warren Buffett’s solution to America’s debt is a simple one: invest in the future. While his focus might be on traditional industries, the government could learn a thing or two from companies like Amazon, who are investing in space exploration.

Amazon’s $120 million investment in a satellite processing hub at NASA’s Kennedy Space Center in Florida is a testament to the potential of space exploration, and the government should consider investing in similar projects to stimulate innovation and economic growth, ultimately helping to pay down the national debt.

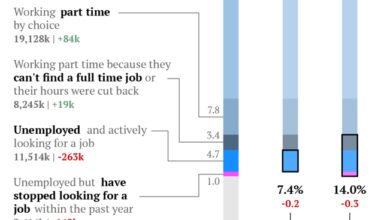

| Solution | Description | Potential Impact | Challenges |

|---|---|---|---|

| Tax Reform | Buffett advocates for a tax system that is fairer and more efficient. He believes that the wealthy should pay their fair share, and that loopholes and deductions that benefit the affluent should be eliminated. He also supports simplifying the tax code to reduce complexity and compliance costs. | Increased tax revenue could help reduce the deficit. A fairer system could boost public confidence and reduce inequality. | Political opposition to tax increases, especially from wealthy individuals and corporations. Designing a fair and efficient tax system that doesn’t stifle economic growth is challenging. |

| Spending Restraint | Buffett argues for prioritizing essential government programs and eliminating wasteful spending. He believes that the government should focus on investments in infrastructure, education, and research, while reducing spending on non-essential programs. | Reduced government spending could contribute to a lower deficit. Shifting resources to key areas could boost economic growth and productivity. | Political pressure to maintain or expand existing programs. Determining which programs are truly essential and which are wasteful can be subjective. |

| Social Security Reform | Buffett acknowledges the importance of Social Security for millions of Americans. He believes that the program needs to be reformed to ensure its long-term sustainability. This could involve raising the retirement age, adjusting benefits based on income, or increasing contributions. | A sustainable Social Security system would protect the benefits of current and future retirees. | Political opposition to changes that could impact current beneficiaries. Finding a balance between ensuring sustainability and protecting benefits for current retirees is difficult. |

| Healthcare Reform | Buffett believes that healthcare costs are a major driver of the national debt. He advocates for a system that is more efficient and affordable, potentially involving a single-payer system or other reforms that reduce administrative costs and negotiate lower drug prices. | Reduced healthcare costs could significantly contribute to a lower deficit. A more efficient system could improve access to care and lower out-of-pocket expenses. | Political opposition to changes to the current healthcare system. Finding a solution that balances cost containment with access to quality care is challenging. |

The Role of Government Spending and Taxation: Warren Buffett Smart Solution How He Wants To Quickly Fix Americas Debt

Addressing the national debt requires a careful consideration of government spending and taxation. While these tools are crucial for providing essential services and stimulating economic growth, they also contribute to the debt burden. Warren Buffett, known for his fiscal responsibility, believes that a balanced approach is necessary to ensure a sustainable future for the United States.

Warren Buffett’s Views on Government Spending

Warren Buffett, a renowned investor and philanthropist, has consistently advocated for responsible government spending. He argues that while government spending can be essential for infrastructure, education, and healthcare, it should be carefully managed to avoid excessive debt accumulation. He believes that prioritizing spending on areas that yield the highest return on investment is crucial.

For example, investing in education and infrastructure can lead to long-term economic growth and increased productivity.

Comparing and Contrasting Buffett’s Views with Other Economists

While Warren Buffett emphasizes fiscal responsibility, other economists hold diverse perspectives on the role of government spending. Some, like Keynesian economists, advocate for increased government spending during economic downturns to stimulate demand and create jobs. They argue that government intervention can help stabilize the economy and prevent recessions.

Conversely, some economists, like classical economists, prioritize reducing government spending and debt to promote long-term economic growth. They argue that government intervention can distort markets and discourage investment.

Trade-offs Between Reducing the Debt and Maintaining Essential Government Services

Reducing the national debt requires a delicate balance between fiscal discipline and maintaining essential government services. Cutting spending can reduce the debt burden but may lead to cuts in crucial programs like education, healthcare, and infrastructure. Increasing taxes can generate revenue to reduce the debt but may stifle economic growth and discourage investment.

Finding the right balance between these competing priorities is essential for ensuring a sustainable and prosperous future for the United States.

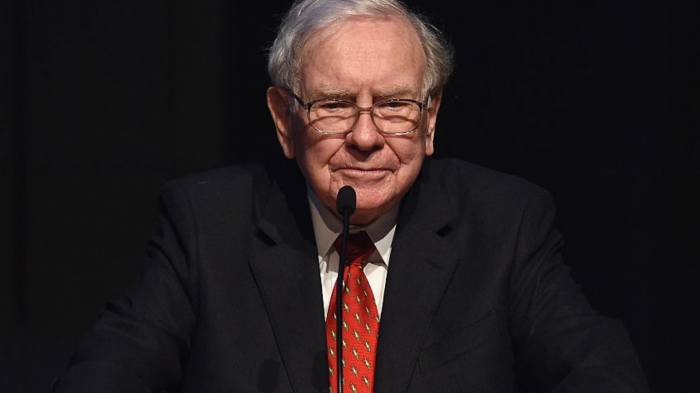

Long-Term Economic Outlook

Warren Buffett, known for his insightful observations and long-term investment strategies, has expressed serious concerns about the long-term economic outlook if the national debt remains unaddressed. He believes that unchecked debt poses significant risks to the future of the US economy and could have far-reaching consequences for future generations.

Potential Impact of High Debt Levels on Future Generations, Warren buffett smart solution how he wants to quickly fix americas debt

The burden of a large national debt falls disproportionately on future generations. Here’s why:

- Higher Interest Payments:As the debt grows, so do the interest payments required to service it. This means less money available for essential public services like education, healthcare, and infrastructure.

- Increased Taxes:To manage the debt, future generations may face higher taxes to cover interest payments and debt reduction efforts. This can stifle economic growth and reduce individual disposable income.

- Reduced Investment Opportunities:A high national debt can crowd out private investment, as investors may become less willing to invest in a country with a high debt burden. This can hinder innovation and economic growth.

- Slower Economic Growth:High debt levels can lead to slower economic growth, as the government may be forced to prioritize debt payments over investments in education, infrastructure, and research and development.

The Role of Responsible Fiscal Policies

Responsible fiscal policies are crucial to ensuring a sustainable economic future. These policies aim to balance government spending with revenue collection to minimize the growth of the national debt.

- Spending Control:Governments need to prioritize spending on essential services and avoid unnecessary expenditures. This involves carefully evaluating the effectiveness of government programs and making necessary adjustments to ensure efficient use of taxpayer funds.

- Tax Reform:A well-designed tax system should be fair, efficient, and encourage economic growth. It should ensure that all taxpayers contribute their fair share and avoid loopholes that allow wealthy individuals and corporations to avoid paying their due taxes.

- Long-Term Planning:Governments need to adopt a long-term perspective on fiscal policy, taking into account future economic challenges and demographic changes. This involves making responsible decisions today to avoid burdening future generations with unsustainable debt levels.

“If you’re not willing to own a stock for ten years, don’t even think about owning it for ten minutes.”Warren Buffett