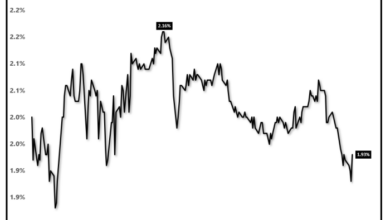

Mortgage Rates May Hit 8% as Home Sales Disappoint

Warning mortgage rates may hit 8 as home sales disappoint – Warning: mortgage rates may hit 8% as home sales disappoint. This isn’t just a headline; it’s a stark reality facing the housing market. The combination of rising interest rates and cooling buyer demand is creating a perfect storm that could significantly impact both homebuyers and sellers.

The Federal Reserve’s aggressive interest rate hikes, aimed at taming inflation, are directly impacting mortgage rates. These rates are climbing at a pace not seen in decades, making homeownership increasingly expensive for many. Meanwhile, buyers are pulling back, hesitant to commit to a mortgage in this volatile environment.

This decline in demand is further pushing down home sales, creating a cycle that could continue for some time.

Impact on Homebuyers

The prospect of mortgage rates hitting 8% is a significant challenge for homebuyers, especially those who are already facing affordability concerns and intense competition in the market. The rising cost of borrowing adds another layer of complexity to an already challenging process.

Navigating Affordability Challenges

Rising mortgage rates directly impact affordability. A higher interest rate translates to a larger monthly mortgage payment, reducing the amount of money a buyer can spend on a home. This can force buyers to reconsider their initial plans, potentially needing to lower their price range or compromise on features they had initially hoped for.

The news of potential mortgage rates hitting 8% coupled with disappointing home sales figures has sent a chill through the real estate market. It’s definitely a time to keep an eye on the broader economic picture, and that includes checking in on the stock market, especially with the Federal Reserve meeting on the horizon.

For insights into today’s market activity, including Instacart’s Nasdaq debut, head over to this blog for a comprehensive rundown. With the economy in flux, it’s more important than ever to stay informed and make smart financial decisions, especially when it comes to buying or selling a home.

- Budget Reassessment:It is crucial for potential homebuyers to carefully reassess their budget, considering the impact of higher mortgage rates on their monthly payments. Using online mortgage calculators can help determine the affordability range based on current rates.

- Consider Down Payment:Increasing the down payment can help lower the loan amount and, consequently, the monthly mortgage payment. A larger down payment can also improve the buyer’s chances of securing a loan, especially in a competitive market.

- Explore Alternative Loan Options:Buyers can explore different loan options, such as adjustable-rate mortgages (ARMs) or FHA loans, which may offer lower initial rates. However, it’s essential to understand the long-term implications of each loan type and ensure they align with the buyer’s financial goals.

Strategies for Navigating Competition

The current housing market remains competitive, even with rising interest rates. To stand out, homebuyers may need to employ strategies to increase their chances of securing a property.

- Pre-Approval for a Mortgage:Having a pre-approval letter from a lender demonstrates to sellers that the buyer is financially qualified and ready to purchase. This can strengthen their offer and increase their competitiveness.

- Flexibility in Location and Features:Buyers may need to be flexible in their search criteria, considering locations or features that were initially outside their preferred range. This can expand their options and potentially lead to a more competitive offer.

- Consider a Home Inspection Waiver:Waiving the home inspection contingency can make an offer more attractive to sellers, as it eliminates the potential for a deal to fall through due to inspection issues. However, buyers should be aware of the risks associated with this decision and may want to consult with a real estate attorney.

Managing Expectations and Making Informed Decisions

Navigating a volatile market requires realistic expectations and informed decision-making.

- Work with a Trusted Real Estate Agent:A knowledgeable real estate agent can provide valuable insights into market trends, pricing strategies, and negotiation tactics. They can help buyers navigate the complexities of the market and make informed decisions.

- Avoid Emotional Decisions:The pressure of finding a home can lead to emotional decisions, but it’s essential to stay objective and prioritize financial stability. Buyers should carefully consider the long-term implications of their purchase and avoid making decisions based solely on emotions.

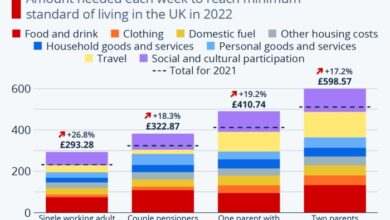

The news of mortgage rates potentially hitting 8% is a serious blow to the housing market, with sales already disappointing. This economic uncertainty is further compounded by the ongoing war in Ukraine, which is impacting global food security. The conflict has put Ukraine’s grain exports in peril, as Russia continues to attack vital infrastructure and disrupt shipping routes.

This ongoing crisis has created a ripple effect, raising concerns about food shortages and price increases, which could further dampen consumer confidence and impact the housing market.

- Be Prepared to Walk Away:In a competitive market, it’s important to remember that not every offer will be accepted. Buyers should be prepared to walk away from a deal if the terms are not favorable or if they feel pressured to make an offer they are not comfortable with.

Market Outlook and Predictions

The possibility of mortgage rates reaching 8% has sent shockwaves through the housing market, and it’s crucial to understand the potential trajectory of rates and home sales in the near future. Analyzing key economic indicators and market trends can shed light on the factors that will shape the housing market landscape.

Impact of Economic Indicators on Mortgage Rates

The Federal Reserve’s aggressive interest rate hikes have been the primary driver of rising mortgage rates. The Fed’s aim is to curb inflation, but this has a direct impact on borrowing costs, including mortgages.

- Inflation:Persistent inflation, fueled by factors like supply chain disruptions and strong consumer demand, has prompted the Fed to raise rates more aggressively. If inflation remains elevated, the Fed is likely to continue its rate hikes, potentially pushing mortgage rates higher.

The news of warning mortgage rates potentially hitting 8% and disappointing home sales is definitely a downer, but there’s a glimmer of hope in the tech sector. Tech stocks are surging as Meta shines and Fed rate hike hopes soar today , suggesting a possible shift in investor sentiment.

Of course, the housing market remains a significant concern, but it’s encouraging to see some positive signs elsewhere in the economy.

- Economic Growth:The pace of economic growth is closely tied to interest rates. If the economy slows down significantly, the Fed might become less aggressive with rate hikes, potentially providing some relief for mortgage rates. However, a slowdown could also lead to job losses and reduced consumer confidence, which could negatively impact home sales.

- Job Market:A strong job market, with low unemployment and robust wage growth, supports a healthy housing market. However, if the job market weakens, it could lead to a decline in homebuyer demand and a further slowdown in sales.

Financial Considerations: Warning Mortgage Rates May Hit 8 As Home Sales Disappoint

Rising mortgage rates have significant financial implications for both homebuyers and sellers, impacting affordability, monthly payments, and overall market dynamics. Understanding these implications is crucial for navigating the current real estate landscape and making informed financial decisions.

Impact on Monthly Payments and Affordability

Higher interest rates directly translate into increased monthly mortgage payments. For example, a 30-year fixed-rate mortgage of $300,000 at 5% would have a monthly payment of $1,610. However, if the interest rate rises to 8%, the monthly payment jumps to $2,200, a difference of $590 per month.

This substantial increase in monthly payments can significantly impact a buyer’s affordability and purchasing power.

A 3% increase in interest rates can lead to a 20% increase in monthly mortgage payments.

To illustrate, let’s consider a homebuyer with a $70,000 annual income. With a 5% mortgage rate, they could afford a $300,000 home. However, if the interest rate rises to 8%, their affordability drops to $250,000. This decrease in affordability can limit a buyer’s options and make it more challenging to find a suitable home within their budget.

Strategies for Managing Mortgage Costs

Given the rising interest rate environment, buyers and sellers need to implement strategies to manage mortgage costs and maintain financial stability.

- Negotiate a Lower Interest Rate:Buyers should actively negotiate with lenders to secure the lowest possible interest rate. This may involve shopping around for different loan options and comparing interest rates from multiple lenders.

- Consider a Shorter Loan Term:A shorter loan term, such as a 15-year mortgage, will result in lower interest payments over the life of the loan. While monthly payments will be higher, the overall interest cost will be significantly lower.

- Increase Down Payment:A larger down payment will reduce the amount of money borrowed, thereby reducing the total interest paid.

- Explore Refinancing Options:For existing homeowners, refinancing to a lower interest rate can help reduce monthly payments and save money over the long term. However, refinancing comes with associated costs, so it’s essential to carefully evaluate the potential savings against the costs involved.

Alternative Housing Options

The current housing market, with rising mortgage rates and cooling home sales, presents a significant challenge for potential homebuyers. If you’re facing affordability issues, exploring alternative housing options could be a strategic move. Let’s delve into some alternatives that might suit your circumstances.

Renting

Renting can offer flexibility and affordability compared to homeownership.

- Lower upfront costs:Renting typically requires a security deposit and first month’s rent, significantly lower than a down payment for a home.

- Flexibility:Renting provides the freedom to move without the hassle of selling a property. This is particularly beneficial for those with unpredictable job situations or lifestyle changes.

- Lower maintenance costs:Landlords are generally responsible for major repairs and maintenance, relieving you of these expenses.

However, renting also has drawbacks:

- Rent increases:Renters face the risk of rent increases, potentially eroding their budget over time.

- Limited customization:Renting often restricts your ability to make significant changes to the property, limiting your ability to personalize your living space.

- Lack of equity building:Rent payments don’t build equity like mortgage payments do, meaning you don’t gain ownership of the property.

Buying a Smaller Home, Warning mortgage rates may hit 8 as home sales disappoint

Downsizing your home can be a practical solution to affordability challenges.

- Lower purchase price:Smaller homes generally have lower purchase prices, requiring a smaller down payment and potentially leading to lower monthly mortgage payments.

- Lower maintenance costs:Smaller homes often require less maintenance, saving you money on upkeep and repairs.

- More manageable living:A smaller home can be easier to maintain and clean, reducing your overall workload.

However, downsizing can also present challenges:

- Limited space:A smaller home may not accommodate all your belongings or provide enough space for your needs, particularly if you have a large family.

- Potential resale value:Smaller homes may have lower resale value compared to larger homes, potentially impacting your future investment.

Alternative Financing Options

Exploring alternative financing options can help you navigate the current market.

- FHA loans:These loans require a lower down payment (as low as 3.5%) and have more lenient credit score requirements, making them more accessible to first-time homebuyers and those with less-than-perfect credit.

- USDA loans:These loans are available for rural properties and often have low interest rates and no down payment requirements, making them attractive for those seeking affordable homes in rural areas.

- VA loans:These loans are available to eligible veterans, active-duty military personnel, and surviving spouses, offering benefits like no down payment requirements and competitive interest rates.

However, it’s important to understand the specific terms and conditions of each program, as they can vary in eligibility requirements, interest rates, and closing costs.