Wall Street Slides as Tesla Impact Weighs, Economic Data Awaited

Wall street slides as tesla impact weighs economic data awaited – Wall Street Slides as Tesla Impact Weighs, Economic Data Awaited: The stock market experienced a downturn, with Wall Street taking a hit as investors grappled with the weight of Tesla’s recent performance and eagerly awaited crucial economic data releases.

This confluence of factors created a volatile environment, leaving many wondering about the future trajectory of the market.

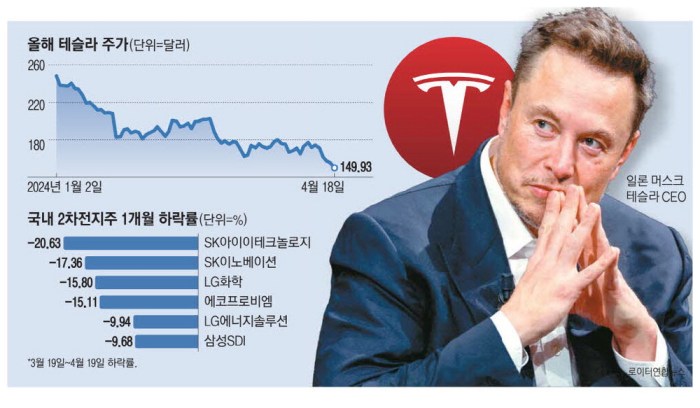

Tesla’s performance, or lack thereof, has been a major focal point, influencing broader market sentiment. The electric vehicle giant’s recent events and announcements have sparked debate about its impact on the tech sector and the broader economy. Meanwhile, investors are closely watching for key economic data releases, hoping to gain insights into the health of the economy and potential future market direction.

This data could shed light on inflation, employment, and consumer spending, all of which play a crucial role in shaping investor confidence and market trends.

Tesla’s Impact

Tesla, the electric vehicle (EV) giant, has become a significant force in the stock market, influencing not just the automotive sector but also broader market sentiment. Its volatile stock price and ambitious growth plans have attracted investors and analysts alike, making Tesla a topic of constant discussion on Wall Street.

Tesla’s Influence on Market Sentiment, Wall street slides as tesla impact weighs economic data awaited

Tesla’s performance, or lack thereof, can significantly impact broader market sentiment. The company’s stock price has been known to move in dramatic swings, often driven by Elon Musk’s pronouncements, product launches, and regulatory developments. When Tesla performs well, it can boost investor confidence in the broader tech sector and the future of EVs.

Conversely, negative news about Tesla can trigger sell-offs and a sense of uncertainty in the market.

“Tesla’s stock price has been known to move in dramatic swings, often driven by Elon Musk’s pronouncements, product launches, and regulatory developments.”

Tesla’s Influence Compared to Other Tech Giants

While Tesla’s influence on Wall Street is undeniable, it’s important to compare it to other major tech companies. Tesla’s market capitalization and stock price volatility are significantly higher than companies like Apple, Microsoft, and Google. This suggests that Tesla’s influence on market sentiment might be more pronounced, particularly within the EV and clean energy sectors.

- Tesla’s stock price movements are often more volatilethan other tech giants, leading to greater market swings when Tesla’s performance fluctuates.

- Tesla’s growth trajectory is perceived as more uncertainthan established tech giants, making its impact on the market more unpredictable.

- Tesla’s influence on the EV and clean energy sectors is arguably greaterthan other tech companies, as it is a leading player in these emerging markets.

Events and Announcements Influencing Tesla’s Stock

Tesla’s stock price has been influenced by various events and announcements, including:

- Product launches and production updates: New vehicle models, production ramp-ups, and delivery figures are closely watched by investors, as they reflect Tesla’s growth potential.

- Elon Musk’s tweets and pronouncements: Musk’s public statements often have a significant impact on Tesla’s stock price, even if they are not directly related to the company’s core business.

- Regulatory developments: Government policies on EVs, subsidies, and tax incentives can significantly impact Tesla’s profitability and growth prospects.

- Financial performance: Tesla’s quarterly earnings reports and financial forecasts are closely scrutinized by investors, as they provide insights into the company’s financial health and future prospects.

Future Outlook: Wall Street Slides As Tesla Impact Weighs Economic Data Awaited

Predicting Wall Street’s trajectory is an intricate endeavor, influenced by a complex interplay of economic, geopolitical, and market-specific factors. The short-term outlook is often volatile, while the long-term picture hinges on fundamental economic drivers and global trends.

Factors Influencing Wall Street’s Trajectory

Several key factors will shape the future of Wall Street, impacting both short-term and long-term performance.

- Economic Growth and Inflation:The pace of economic growth and inflation will be crucial determinants of market direction. Robust economic growth, coupled with controlled inflation, generally supports stock market gains. Conversely, sluggish growth or high inflation can lead to market volatility and potential declines.

- Interest Rates:The Federal Reserve’s monetary policy, particularly interest rate adjustments, significantly influences market sentiment. Rising interest rates typically increase borrowing costs for businesses and consumers, potentially dampening economic activity and leading to stock market corrections. Conversely, lower interest rates can stimulate investment and economic growth, supporting stock market performance.

- Geopolitical Events:Global events, such as wars, trade tensions, and political instability, can have a profound impact on markets. These events introduce uncertainty and risk, potentially leading to market volatility and corrections. For instance, the ongoing Russia-Ukraine conflict has created significant market volatility, with investors seeking safe haven assets.

- Corporate Earnings:Company earnings are a fundamental driver of stock prices. Strong earnings growth indicates healthy businesses and a positive outlook for the economy, supporting stock market gains. Conversely, weak earnings growth can signal economic weakness and lead to market declines.

- Technological Advancements:Technological innovations, such as artificial intelligence, cloud computing, and renewable energy, can create new industries and investment opportunities.

These advancements can drive economic growth and support stock market performance.

Potential Scenarios for the Market

Given the numerous factors influencing Wall Street, several potential scenarios for the market can be envisioned.

- Bullish Scenario:A bullish scenario assumes a robust economic recovery, with continued corporate earnings growth, controlled inflation, and stable geopolitical conditions. This scenario would likely lead to sustained stock market gains, driven by investor confidence and strong economic fundamentals. For example, the period following the 2008 financial crisis witnessed a strong bull market driven by accommodative monetary policy, economic recovery, and technological innovation.

- Bearish Scenario:A bearish scenario suggests economic weakness, high inflation, rising interest rates, and geopolitical uncertainty. This scenario could lead to market declines, as investors become risk-averse and seek safe haven assets. For instance, the dot-com bubble burst in the early 2000s was driven by overvaluation, economic slowdown, and investor panic.

- Neutral Scenario:A neutral scenario implies a balanced market with modest growth, moderate inflation, and limited geopolitical risks. This scenario could lead to sideways trading with limited gains or losses, as investors remain cautious and wait for more clarity on economic and geopolitical developments.

For example, the market performance during the early stages of the COVID-19 pandemic, characterized by significant volatility and uncertainty, can be considered a neutral scenario.

Navigating Market Volatility

The future of Wall Street remains uncertain, with various factors influencing its trajectory. Investors must carefully consider their investment goals, risk tolerance, and the potential impact of economic and geopolitical events. Diversification, long-term investing, and professional financial advice can help mitigate risk and navigate market volatility.

Wall Street is in a holding pattern, with Tesla’s performance weighing heavily on the market’s mood. While everyone awaits crucial economic data, it’s important to remember the bedrock of online security: a strong privacy policy. Understanding what is a privacy policy and why is it important is essential in this digital age, especially as investors navigate the volatile landscape of the stock market.

Wall Street took a tumble today, with Tesla’s impact on the market weighing heavily on investor sentiment. The economic data we’re all waiting for is adding to the uncertainty, but there’s some good news coming from China, where new realty initiatives are expected to boost demand for base metals.

This, combined with a weaker dollar, has sent gold prices soaring. It’s a mixed bag for investors, but hopefully the economic data will shed some light on the way forward. Read more about the Chinese realty initiatives and gold’s surge and how it could impact the broader market.

For now, we’ll just have to keep a close eye on those economic indicators.

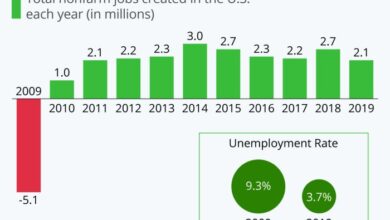

Wall Street took a tumble today as investors digested the impact of Tesla’s recent earnings report, anxiously awaiting key economic data. However, a surprising twist emerged with the release of the April jobs report, which revealed a robust addition of 253,000 jobs and a drop in the unemployment rate to 3.4%, a sign of continued resilience in the US economy, as reported in this article.

This unexpected strength could provide some relief for Wall Street, but the market remains cautiously optimistic, balancing the positive jobs data with concerns about inflation and interest rates.