Wall Street Retreats as Investors Anticipate Nvidia Results and Fed Minutes

Wall Street retreats as investors anticipate Nvidia results and Fed minutes, setting the stage for a week of market uncertainty. The tech giant’s earnings report, expected to reveal insights into the AI chip market’s health, is hanging over investor sentiment.

Meanwhile, the release of the Federal Reserve’s minutes will offer clues about the future direction of monetary policy, potentially influencing interest rates and economic growth. This delicate balance of factors has led to a cautious market, with investors weighing the potential for both gains and losses.

The market’s retreat reflects the current state of investor anxiety, driven by a confluence of economic and geopolitical concerns. Inflation remains a persistent issue, and the Fed’s ongoing efforts to tame it through interest rate hikes have created a sense of unease.

Furthermore, the ongoing conflict in Ukraine and its impact on global energy markets add to the uncertainty. The upcoming earnings report from Nvidia, a key player in the rapidly growing AI sector, has become a focal point for investors.

Its performance will be closely scrutinized as a barometer of the broader tech industry’s health and potential for future growth.

Market Retreat

Wall Street has taken a step back this week, with investors exhibiting caution in the face of a confluence of factors. The market’s recent retreat can be attributed to a combination of influences, including investor anticipation for Nvidia’s earnings report, the upcoming release of the Federal Reserve’s minutes, and broader economic concerns.

Wall Street is taking a breather today, with investors anxiously awaiting Nvidia’s earnings report and the release of the Federal Reserve’s meeting minutes. This cautious mood is likely fueled by recent news that SoftBank has acquired a stake in its Vision Fund’s Arm unit for a whopping $64 billion, according to sources.

This significant deal, which signals SoftBank’s renewed commitment to its Vision Fund, could have ripple effects across the tech industry and might just be what Wall Street needs to shake off its current hesitation.

Nvidia’s Earnings Report

Nvidia’s upcoming earnings report holds significant weight for the tech sector and the broader market. Investors are eagerly awaiting the company’s financial performance, particularly in light of the recent surge in demand for its AI chips. Positive earnings could provide a much-needed boost to market sentiment, while disappointing results could exacerbate existing concerns about the tech sector’s growth prospects.

Impact of Fed Minutes

The upcoming release of the Federal Reserve’s minutes from its July meeting is another crucial event for investors to watch. These minutes will offer insights into the Fed’s thinking on monetary policy and provide clues about the potential for future interest rate hikes.

Investors will be particularly attentive to any hints about the Fed’s outlook on inflation and the economy’s trajectory.

Nvidia’s Earnings Expectations

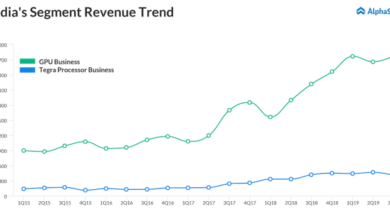

Nvidia, the leading graphics processing unit (GPU) maker, is set to report its second-quarter earnings on August 23, 2023. Investors are eagerly awaiting the results, as they hold significant implications for the tech sector and the broader market. The company’s performance is expected to provide insights into the health of the artificial intelligence (AI) and gaming industries, two key growth drivers for Nvidia.

Wall Street is holding its breath as investors anticipate the release of Nvidia’s earnings report and the minutes from the Federal Reserve’s latest meeting. While these events will likely dominate the financial news cycle, it’s also a good time to remember the importance of safeguarding your personal finances.

A recent Gallup survey highlighted the need for strong bank account security measures, with many individuals unaware of basic protection strategies. For tips on securing your accounts and protecting your hard-earned money, check out this informative article on bank account security tips protecting finances recent survey of gallup.

After all, even with Wall Street in a holding pattern, your financial well-being is always a priority.

Key Factors Influencing Earnings Expectations

Investors will be closely scrutinizing several key factors in Nvidia’s earnings report, including:

- Revenue Growth:Analysts are expecting Nvidia to report strong revenue growth, driven by the continued demand for its GPUs in data centers, gaming, and automotive markets. The company’s data center business, which caters to AI workloads, is anticipated to be a significant contributor to revenue growth.

- Gross Margins:Investors will be looking for stability in Nvidia’s gross margins, which have been under pressure due to the global chip shortage and rising component costs. Any signs of improvement in margins would be welcomed by investors.

- Guidance:Nvidia’s guidance for the third quarter will be closely watched, as it will provide insights into the company’s outlook for the remainder of the year. Investors will be looking for any indications of continued strong demand and growth prospects.

Potential Impact on the Tech Sector and Broader Market

Nvidia’s earnings report is likely to have a significant impact on the tech sector and the broader market. Strong results could boost investor sentiment and lead to gains in tech stocks, while disappointing results could trigger a sell-off. The company’s performance is seen as a bellwether for the AI and gaming industries, and its results could provide valuable insights into the overall health of these sectors.

Nvidia’s Growth Prospects, Wall street retreats as investors anticipate nvidia results and fed minutes

Nvidia is well-positioned for continued growth in the years to come. The company’s GPUs are at the forefront of the AI revolution, and its products are used in a wide range of applications, including self-driving cars, medical imaging, and financial modeling.

Nvidia’s gaming business remains strong, and the company is also expanding into new markets, such as the metaverse and cloud gaming.

Nvidia’s CEO, Jensen Huang, has stated that the company is “at the beginning of a new era of computing,” driven by AI and the metaverse.

Nvidia’s growth prospects are supported by several factors, including:

- Strong Demand for GPUs:The demand for GPUs is expected to continue to grow as AI and gaming continue to evolve. Nvidia’s products are well-positioned to benefit from this growth.

- Expanding Market Share:Nvidia is gaining market share in the GPU market, both in data centers and gaming. The company’s dominance in the AI market is also growing.

- Innovation:Nvidia is a leader in innovation, constantly developing new products and technologies. This commitment to innovation is crucial for maintaining its competitive edge.

Federal Reserve’s Monetary Policy

The Federal Reserve’s (Fed) monetary policy decisions have a significant impact on the financial markets and the overall economy. The Fed’s minutes, released after each meeting of the Federal Open Market Committee (FOMC), provide insights into the Fed’s thinking and future policy direction.

Investors closely analyze these minutes to gauge the Fed’s stance on interest rates, inflation, and economic growth.

Potential Implications of Fed Minutes for Interest Rates and Economic Growth

The Fed minutes can offer clues about the likelihood of future interest rate changes. If the minutes suggest that the Fed is concerned about inflation, it could signal a potential increase in interest rates. Conversely, if the minutes indicate that the Fed is worried about slowing economic growth, it might suggest that interest rates are likely to remain unchanged or even be lowered.

For example, if the minutes highlight concerns about persistent inflation, investors might anticipate a more hawkish stance from the Fed, potentially leading to expectations of higher interest rates in the near future. This could impact borrowing costs for businesses and consumers, potentially slowing down economic activity.

Conversely, if the minutes signal a shift towards a more dovish stance, emphasizing concerns about economic growth, investors might expect lower interest rates, which could stimulate borrowing and investment, potentially boosting economic growth.

Investor Sentiment and Market Volatility

Investor sentiment is a key driver of market volatility. It reflects the overall mood of investors towards the market and their expectations for future returns. When sentiment is positive, investors are more likely to be bullish, leading to higher stock prices and lower volatility.

Conversely, negative sentiment can lead to selling pressure and increased market fluctuations.

Investor Confidence and Risk Appetite

Investor confidence and risk appetite are influenced by a range of factors, including economic indicators, market news, and geopolitical events. Positive economic data, such as strong employment numbers or rising corporate profits, can boost investor confidence and increase their willingness to take on risk.

Conversely, negative news, such as rising inflation or geopolitical tensions, can lead to increased uncertainty and a decline in risk appetite.

Wall Street took a breather this week, with investors holding their breath for Nvidia’s earnings report and the Fed’s minutes. While the market is cautious, it’s not entirely gloomy. In fact, sentiment has improved slightly as stocks make gradual advances, likely fueled by the hope that inflation figures will show further cooling, as discussed in this article market sentiment improves as stocks make gradual advances awaiting crucial inflation figures.

This week’s events will likely be a key indicator for the rest of the year, shaping Wall Street’s trajectory as investors grapple with the potential impact of Nvidia’s performance and the Fed’s future course of action.

Factors Influencing Market Volatility

Several factors can contribute to market volatility, including:

- Economic Data Releases:Surprises in economic data releases, such as unexpected changes in inflation or interest rates, can trigger market reactions and increase volatility.

- Corporate Earnings Reports:Companies’ earnings reports can significantly impact their stock prices and the overall market. Strong earnings reports can boost investor confidence and reduce volatility, while weak earnings can lead to selling pressure and increased market fluctuations.

- Geopolitical Events:Geopolitical events, such as wars, trade disputes, or political instability, can create uncertainty and increase market volatility.

- Monetary Policy Decisions:Central bank decisions on interest rates and other monetary policy measures can have a significant impact on market sentiment and volatility. For example, a rate hike can increase borrowing costs for businesses and consumers, potentially leading to slower economic growth and lower stock prices.

Key Market Indicators: Wall Street Retreats As Investors Anticipate Nvidia Results And Fed Minutes

Wall Street is buzzing with anticipation as investors brace for Nvidia’s earnings report and the release of the Federal Reserve’s minutes. These events are expected to provide valuable insights into the health of the technology sector and the future trajectory of monetary policy.

However, it’s also crucial to monitor key market indicators to gauge the overall sentiment and potential direction of the market.

Major Stock Market Indices

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite are the three major stock market indices that provide a comprehensive overview of the U.S. stock market. They represent different sectors and market capitalization, offering a diverse perspective on market performance.

- Dow Jones Industrial Average (DJIA): The DJIA tracks the performance of 30 large-cap companies, primarily in the industrial sector. It is a price-weighted index, meaning that companies with higher stock prices have a greater influence on the index’s overall value.

- S&P 500: This broad-based index represents 500 large-cap companies across various sectors. It is a market-capitalization-weighted index, meaning that companies with larger market capitalizations have a greater influence on the index’s value.

- Nasdaq Composite: The Nasdaq Composite tracks the performance of over 3,000 companies listed on the Nasdaq Stock Market, with a strong focus on technology companies. It is a market-capitalization-weighted index.

Recent Performance and Implications

The performance of these indices can provide insights into the overall market sentiment and potential future direction. For example, a sustained upward trend in the Nasdaq Composite could indicate investor confidence in the technology sector, while a decline in the DJIA could suggest concerns about the industrial sector.

- Dow Jones Industrial Average: The DJIA has been relatively flat in recent weeks, indicating a period of consolidation. However, the index remains above its 50-day moving average, suggesting potential for further upside.

- S&P 500: The S&P 500 has also been consolidating in recent weeks, but it remains near its all-time highs. This suggests that the broader market is still relatively strong, but investors may be taking a cautious approach.

- Nasdaq Composite: The Nasdaq Composite has been more volatile in recent weeks, reflecting concerns about rising interest rates and potential slowing economic growth. However, the index remains above its 200-day moving average, suggesting a long-term bullish trend.

Impact of Economic Data and Market Events

Recent economic data and market events have played a significant role in shaping the performance of these indices. For instance, the release of strong employment data could boost investor confidence and lead to higher stock prices, while a decline in consumer spending could have the opposite effect.

- Inflation Data: The recent release of inflation data has been a key driver of market volatility. Inflation remains stubbornly high, raising concerns about the Federal Reserve’s future interest rate hikes.

- Interest Rate Decisions: The Federal Reserve’s decisions on interest rates have a significant impact on the stock market. Higher interest rates can make borrowing more expensive for companies, potentially slowing economic growth and leading to lower stock prices.

- Geopolitical Events: Global events, such as the ongoing war in Ukraine, can also influence market sentiment. These events can create uncertainty and volatility, making investors more cautious.

Impact on Different Sectors

The Wall Street retreat, driven by investor anticipation of Nvidia’s earnings and the release of the Federal Reserve’s minutes, is likely to have a significant impact on various sectors of the economy. The performance of the tech sector, energy sector, and financial sector will be closely watched as investors assess the implications of these events for their portfolios.

Tech Sector Performance

The tech sector is expected to be a focal point of investor attention, particularly with Nvidia’s earnings report looming. Nvidia, a leading manufacturer of graphics processing units (GPUs) used in artificial intelligence (AI) and gaming, is expected to report strong revenue growth, driven by the surging demand for AI chips.

If Nvidia delivers positive results, it could boost investor sentiment towards the tech sector, potentially leading to a rally in tech stocks. However, if the results fall short of expectations, it could trigger a sell-off, dragging down the broader tech sector.

Energy Sector Outlook

The energy sector’s performance will be influenced by the Federal Reserve’s monetary policy stance. The Fed’s minutes are expected to provide insights into the central bank’s future interest rate trajectory. If the minutes suggest that the Fed is likely to maintain its aggressive rate hikes to combat inflation, it could put downward pressure on energy prices, as higher interest rates tend to dampen economic activity and reduce demand for oil and gas.

Conversely, if the minutes signal a more dovish stance, it could lead to higher energy prices.

Financial Sector Response

The financial sector is likely to be sensitive to both the tech sector’s performance and the Fed’s monetary policy decisions. If the tech sector experiences a surge due to Nvidia’s strong earnings, it could benefit financial institutions that hold significant investments in tech companies.

However, if the tech sector weakens, it could negatively impact financial institutions’ earnings. Additionally, the Fed’s monetary policy stance will have a direct impact on the financial sector, as higher interest rates can squeeze bank margins and affect lending activity.

Investor Portfolio Shifts

The market outlook following the Wall Street retreat could lead to significant portfolio shifts by investors. If the tech sector outperforms, investors may allocate more capital to tech stocks, seeking to capitalize on the sector’s growth potential. Conversely, if the tech sector underperforms, investors may shift their portfolios away from tech and towards other sectors, such as energy or financials, that are perceived as less risky.

The Fed’s monetary policy decisions will also play a crucial role in shaping investor sentiment and portfolio allocations. Investors may adjust their holdings based on the Fed’s stance on interest rates, inflation, and economic growth.

Future Market Outlook

The recent market volatility, driven by Nvidia’s upcoming earnings report and the Federal Reserve’s minutes, has left investors pondering the future direction of the market. While short-term uncertainty persists, several factors suggest a potential for both rebound and continued decline.

Analyzing these factors will help investors understand the current market landscape and navigate potential opportunities.

Factors Influencing Market Performance

The market’s future trajectory hinges on a confluence of economic and financial factors.

- Inflation and Interest Rates:The Federal Reserve’s continued efforts to combat inflation through interest rate hikes remain a key driver of market sentiment. While recent data suggests inflation is cooling, the Fed’s future actions will be crucial. If the Fed signals a more aggressive stance, it could lead to further market declines.

Conversely, a more dovish approach could support a market rebound.

- Economic Growth:Global economic growth prospects are another critical factor. Recessions in major economies like the United States or Europe could dampen investor confidence and lead to further market declines. However, strong economic growth could support market gains.

- Corporate Earnings:Corporate earnings are a key driver of stock prices. If companies report strong earnings, it could boost investor confidence and lead to a market rebound. Conversely, weak earnings could trigger further market declines.

- Geopolitical Risks:Geopolitical tensions, such as the ongoing conflict in Ukraine and rising tensions between the United States and China, can create uncertainty and volatility in the market.

Capitalizing on Market Opportunities

Despite the uncertainty, investors can capitalize on market opportunities by adopting a strategic approach.

- Diversification:Diversifying across asset classes, such as stocks, bonds, and real estate, can help mitigate risk and potentially generate returns even in a volatile market.

- Value Investing:Focusing on undervalued companies with strong fundamentals can provide opportunities for long-term growth. Value investors often seek companies with solid earnings, strong balance sheets, and attractive valuations.

- Active Management:Working with a financial advisor or actively managing your portfolio can help you adjust your investment strategy based on changing market conditions. This involves monitoring market trends, analyzing company performance, and making informed investment decisions.