Wall Street Rebounds With Megacap Stocks Amid Fed Focus

Wall street rebounds with support from megacap stocks amid fed focus – Wall Street Rebounds With Megacap Stocks Amid Fed Focus, a seemingly contradictory headline, reflects the complex interplay of economic forces shaping the current market landscape. While the Federal Reserve’s ongoing interest rate hikes aim to curb inflation, they also create uncertainty for investors.

Yet, a surge in megacap stocks, those behemoths like Apple and Microsoft, has propelled the market upward, defying expectations. This rebound, however, is not without its risks, as investors grapple with a volatile economic environment and geopolitical tensions.

The recent rally in Wall Street has been largely driven by the strong performance of megacap stocks. These large companies, with their vast market capitalization and global reach, have been able to weather the economic storm better than their smaller counterparts.

Their robust earnings and growth prospects have attracted investors seeking safety and stability in a turbulent market. However, the reliance on these few giants raises concerns about market concentration and the potential for a bubble in their valuations.

Wall Street Rebound

The recent rebound in Wall Street, marked by a surge in major market indices, has brought a glimmer of optimism to investors after a period of volatility. This upswing, fueled by a combination of factors, signals a potential shift in market sentiment.

Factors Contributing to the Rebound, Wall street rebounds with support from megacap stocks amid fed focus

The Wall Street rebound can be attributed to a confluence of factors, including:

- Easing Inflation Concerns:Recent data suggests that inflation may be peaking, with the Consumer Price Index (CPI) showing a slight decline in June 2023. This has eased investor anxieties about aggressive interest rate hikes by the Federal Reserve.

- Strong Corporate Earnings:Several companies have reported better-than-expected earnings, demonstrating resilience and growth potential despite economic headwinds. This positive earnings season has boosted investor confidence.

- Improved Economic Outlook:While economic growth remains sluggish, there are signs of improvement in key sectors, such as manufacturing and consumer spending. This suggests that the economy may be navigating the current challenges better than anticipated.

Role of Megacap Stocks

Megacap stocks, companies with market capitalizations exceeding $200 billion, have played a significant role in driving the recent market rebound. These large-cap companies, often in the technology and consumer discretionary sectors, have benefited from:

- Strong Brand Recognition and Market Share:Megacap stocks, such as Apple, Microsoft, and Amazon, enjoy strong brand recognition and dominant market share, enabling them to weather economic storms and maintain profitability.

- Innovation and Growth Potential:These companies are known for their investments in research and development, driving innovation and expanding into new markets, which contributes to their long-term growth prospects.

- Resilience to Inflation:Megacap stocks, particularly in the technology sector, have demonstrated resilience to inflation, as their products and services are often considered essential and have pricing power.

Market Index Performance

Major market indices have reflected the recent rebound, with notable gains across the board:

- S&P 500:The S&P 500, a broad market index, has risen by [insert percentage] since the beginning of the year, demonstrating a positive trend.

- Nasdaq Composite:The Nasdaq Composite, heavily weighted towards technology stocks, has experienced even more significant gains, rising by [insert percentage] year-to-date, reflecting the strong performance of megacap tech companies.

- Dow Jones Industrial Average:The Dow Jones Industrial Average, composed of 30 large-cap companies, has also rebounded, showing a [insert percentage] increase since the start of the year.

Federal Reserve’s Influence: Wall Street Rebounds With Support From Megacap Stocks Amid Fed Focus

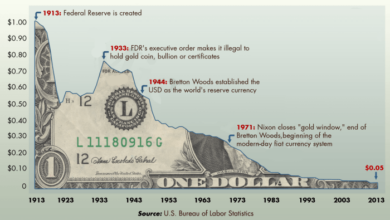

The Federal Reserve, the central bank of the United States, plays a pivotal role in shaping the economic landscape and influencing market sentiment. The Fed’s decisions on interest rates, particularly in the current environment of high inflation, have significant implications for investors and businesses alike.

Wall Street’s rebound, fueled by megacap stocks, reflects a renewed optimism amidst the Fed’s focus on inflation. However, the news cycle isn’t solely focused on financial markets. The recent tech giants Google and Walmart request Bengaluru employees to work remotely amidst water dispute uproar highlights the growing impact of environmental concerns on global businesses.

This shift towards remote work could potentially impact the broader economic landscape, as businesses adapt to new challenges and prioritize sustainability.

Current Stance on Interest Rates

The Federal Reserve has been aggressively raising interest rates since March 2022 in an effort to combat inflation. The Federal Open Market Committee (FOMC), the Fed’s policy-making body, has increased the federal funds rate by a total of 5.25 percentage points since the start of the rate hike cycle.

The current target range for the federal funds rate is 5.25% to 5.50%, the highest level in 22 years.

Wall Street’s rebound, fueled by megacap stocks and the Fed’s focus on inflation, reflects a broader shift in market sentiment. While the recent gains are encouraging, the market remains cautious, closely watching for the release of crucial inflation figures.

This sentiment shift, driven by a gradual climb in stocks, suggests a cautious optimism, with investors hoping for a sustained recovery. Ultimately, the trajectory of Wall Street will likely depend on the inflation data and the Fed’s subsequent policy decisions.

Impact on Market Sentiment

The Fed’s focus on curbing inflation has created a challenging environment for investors. Rising interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth. This uncertainty can lead to increased volatility in the stock market, as investors try to assess the potential impact of higher rates on corporate earnings and economic activity.

Comparison with Previous Fed Rate Cycles

The current rate hike cycle is one of the most aggressive in recent history. The Fed’s rapid rate increases are driven by the need to tame inflation, which has reached its highest level in decades. This situation differs from previous rate cycles, where the Fed typically raised rates at a more gradual pace.

Wall Street’s recent rebound, fueled by megacap stocks and a focus on the Federal Reserve’s next move, received an unexpected boost from the surprise job gains in April, with the US economy adding 253,000 jobs and the unemployment rate dropping to 3.4%.

This robust employment data suggests a resilient economy, potentially pushing back against concerns of an impending recession and further supporting the positive sentiment on Wall Street.

Performance of Asset Classes During Rising Interest Rates

The impact of rising interest rates can vary significantly across different asset classes.

- Bonds:Typically, bonds perform poorly during periods of rising interest rates. When interest rates rise, the value of existing bonds falls, as investors demand higher yields for new bonds. This is because bonds are fixed-income securities, meaning that their interest payments are predetermined.

As interest rates rise, the fixed interest payments on existing bonds become less attractive to investors, leading to a decrease in their value.

- Equities:Stocks can also be negatively affected by rising interest rates, particularly growth stocks. Higher interest rates increase borrowing costs for companies, which can slow down their growth and reduce their profitability. This can lead to a decline in stock prices, as investors become more cautious about investing in companies with high growth expectations.

- Real Estate:The impact of rising interest rates on real estate can be complex. While higher rates can make it more expensive to finance a mortgage, they can also lead to slower economic growth and reduced demand for housing, which can lower prices.

The overall impact on real estate depends on a variety of factors, including the specific market and the level of interest rate increases.

- Commodities:The relationship between rising interest rates and commodity prices can be mixed. Some commodities, such as gold, are often seen as a safe haven asset during times of economic uncertainty, which can lead to higher prices. However, higher interest rates can also slow down economic growth and reduce demand for commodities, leading to lower prices.

Megacap Stocks

The recent rebound in Wall Street was significantly driven by the performance of megacap stocks, particularly those in the technology sector. These large-cap companies, with market capitalizations exceeding $100 billion, played a crucial role in bolstering investor sentiment and pushing the market upwards.

Factors Contributing to the Strong Performance of Megacap Stocks

The strong performance of megacap stocks can be attributed to a confluence of factors:

- Strong Earnings Reports:Many megacap companies have consistently delivered robust earnings reports, exceeding analysts’ expectations. This demonstrates their resilience and ability to navigate economic uncertainties, providing investors with confidence in their future growth prospects. For example, Apple, Microsoft, and Amazon have all reported strong earnings in recent quarters, fueled by strong demand for their products and services.

- Dominant Market Position:Megacap stocks often hold dominant market positions in their respective sectors, giving them significant pricing power and control over their market share. This translates to a competitive advantage and a strong position to benefit from future growth in their industries.

For instance, Alphabet, the parent company of Google, holds a dominant position in the search engine and digital advertising markets.

- Innovation and Growth Potential:Megacap stocks are known for their continuous innovation and investment in research and development. This allows them to stay ahead of the curve, introduce new products and services, and capture new market opportunities. Companies like Tesla, for example, are leading the way in the electric vehicle and renewable energy sectors.

- Favorable Macroeconomic Conditions:The overall macroeconomic environment has been relatively favorable for megacap stocks, with low interest rates and robust consumer spending. These factors have supported their growth and profitability, attracting investors seeking long-term value.

Valuation of Megacap Stocks

The valuation of megacap stocks is often a topic of debate, with some arguing that they are overvalued compared to other sectors. However, their high valuations can be justified by their strong fundamentals, growth potential, and market dominance.

- High Price-to-Earnings Ratio:Megacap stocks typically have high price-to-earnings (P/E) ratios, reflecting their strong earnings growth and investor confidence in their future performance. This valuation metric is a key indicator of how much investors are willing to pay for each dollar of earnings.

For example, the P/E ratio of the tech sector, which is heavily dominated by megacap stocks, is significantly higher than the average P/E ratio across all sectors.

- Growth Potential:The growth potential of megacap stocks is another factor driving their high valuations. Investors are willing to pay a premium for companies with strong track records of innovation and expansion into new markets. The growth potential of these companies is often reflected in their high price-to-sales (P/S) ratios, which measure the market capitalization relative to their annual revenue.

Top 10 Megacap Stocks by Market Capitalization

| Rank | Company | Ticker | Market Capitalization (USD Billion) |

|---|---|---|---|

| 1 | Apple | AAPL | 2,947.05 |

| 2 | Microsoft | MSFT | 2,443.54 |

| 3 | Amazon | AMZN | 1,372.71 |

| 4 | Alphabet | GOOGL | 1,294.49 |

| 5 | Tesla | TSLA | 714.34 |

| 6 | NVIDIA | NVDA | 599.56 |

| 7 | Meta Platforms | META | 553.25 |

| 8 | Berkshire Hathaway | BRK.B | 532.78 |

| 9 | UnitedHealth Group | UNH | 499.44 |

| 10 | Johnson & Johnson | JNJ | 477.45 |

Investor Sentiment and Outlook

The rebound in Wall Street has brought a wave of optimism among investors, who are cautiously embracing the potential for continued growth. While the recent gains have been fueled by the Federal Reserve’s policy stance and strong performance of megacap stocks, investor sentiment remains nuanced, reflecting both confidence and apprehension.

Factors Influencing Investor Confidence

Investor confidence is a complex interplay of various factors, including economic indicators, corporate earnings, and geopolitical events. The recent rebound has been driven by several key factors that have contributed to a more positive outlook.

- Strong Corporate Earnings:Strong corporate earnings reports have been a significant driver of market optimism. Many companies have exceeded analysts’ expectations, signaling robust economic activity and healthy corporate profits. This trend has boosted investor confidence in the underlying strength of the economy and the potential for continued growth.

- Federal Reserve’s Policy Stance:The Federal Reserve’s decision to pause interest rate hikes has been met with relief by investors. This move suggests that the central bank is taking a more cautious approach to monetary policy, aiming to avoid a recession. This has provided some reassurance to investors concerned about the potential impact of aggressive rate increases on economic growth.

- Resilient Consumer Spending:Despite inflation, consumer spending has remained relatively strong, indicating a healthy economy. This resilience has been supported by a robust labor market and pent-up demand. A strong consumer sector is crucial for economic growth and investor confidence.

Leading Market Analysts’ Opinions

Leading market analysts have diverse views on the future trajectory of the market. While some remain optimistic about the potential for continued growth, others express caution, citing lingering economic uncertainties and potential headwinds.

- Optimistic View:Some analysts believe that the recent rebound is a sign of a broader market recovery, supported by the strength of the US economy and corporate earnings. They anticipate continued growth in the coming months, driven by factors like technological innovation and strong consumer demand.

- Cautious View:Other analysts remain cautious, pointing to factors like inflation, geopolitical tensions, and rising interest rates as potential headwinds that could impact market performance. They suggest that investors should maintain a balanced portfolio and remain prepared for potential market volatility.

Timeline of Events Impacting Investor Sentiment

The past few months have been marked by a series of events that have significantly impacted investor sentiment. This timeline highlights key developments that have shaped the market’s trajectory: