Wall Street Prepares for Fed Meeting Amidst Easing Yields

Wall Street prepares for federal reserve meeting amidst easing yields takes center stage, as investors brace for the Federal Reserve’s upcoming interest rate decision. The market is buzzing with anticipation, with analysts closely watching the potential impact on stock prices and the broader economy.

This meeting comes at a time of easing yields, a trend that has sparked debate about its implications for future growth. As the Fed weighs its options, Wall Street is left to navigate a complex landscape of potential outcomes.

The Federal Reserve’s monetary policy decisions have always been a major driver of market sentiment, but this time, the stakes seem higher than ever. The recent easing of yields, a phenomenon that often signals economic uncertainty, has added another layer of complexity to the equation.

Investors are trying to decipher whether this easing is a sign of weakness or simply a temporary blip in the market. The Federal Reserve’s actions will likely have a significant impact on the direction of interest rates, inflation, and ultimately, the health of the economy.

This meeting could very well shape the trajectory of the market for months to come.

Wall Street’s Anticipation

Wall Street is on edge, eyes glued to the calendar, as the Federal Reserve’s next monetary policy meeting looms large. Investors are grappling with a complex mix of economic signals, and the upcoming decision on interest rates holds significant weight for the stock market’s trajectory.

Impact on Stock Market Performance

The Federal Reserve’s decisions on interest rates have a direct impact on the stock market. Higher interest rates typically lead to a decrease in stock prices, as they make borrowing more expensive for companies and can slow down economic growth.

Wall Street is on edge as the Federal Reserve meeting looms, with easing yields adding to the uncertainty. While the markets are focused on interest rates and inflation, it’s interesting to see Amazon’s big move into the space industry, investing 120 million in a satellite processing hub at NASA’s Kennedy Space Center in Florida.

This investment suggests a broader shift in the economy, and it’ll be interesting to see how it impacts the Federal Reserve’s decision-making.

Conversely, lower interest rates can stimulate borrowing and investment, leading to a potential rise in stock prices. The current anticipation revolves around the Fed’s stance on future rate hikes. Investors are trying to gauge whether the Fed will maintain its aggressive approach to combat inflation or shift towards a more dovish stance, potentially signaling a pause in rate increases.

Key Factors Wall Street is Watching

Wall Street is closely monitoring several key indicators in anticipation of the Federal Reserve meeting.

- Inflation Data:The latest inflation figures will be a crucial factor. If inflation shows signs of cooling, it could bolster the case for a less aggressive Fed. However, persistent inflation could signal the need for continued rate hikes.

- Economic Growth:The strength of the US economy is another key factor. If economic growth weakens, the Fed might be more cautious about raising rates, as it could risk pushing the economy into a recession.

- Labor Market Data:The job market remains robust, but recent data has shown some signs of cooling. The Fed will be watching closely to see if the labor market is softening, which could provide some breathing room for a less aggressive monetary policy.

Easing Yields

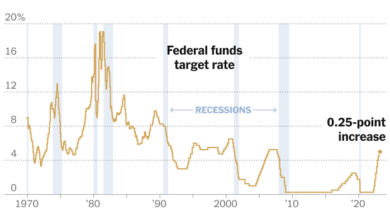

The recent trend of easing yields, a phenomenon observed in the bond market, has become a significant topic of discussion among investors and economists. Easing yields indicate a decline in the interest rates offered on bonds, which can have far-reaching implications for the economy.

Understanding the drivers behind this trend and its potential consequences is crucial for navigating the current market landscape.

Comparison with Previous Periods of Easing Yields

Easing yields are not a novel phenomenon in the financial world. Historically, periods of easing yields have often been associated with economic slowdowns or uncertainty. For example, during the 2008 financial crisis, the Federal Reserve (Fed) implemented a policy of quantitative easing (QE), which involved buying bonds to inject liquidity into the market and lower interest rates.

Wall Street is bracing for the Federal Reserve meeting, with easing yields adding another layer of complexity to the mix. While the Fed ponders its next move, across the globe, the Bank of Israel is exploring the potential of a digital shekel, a move aimed at streamlining payments and boosting financial inclusion.

This digital currency initiative could have implications for global financial markets, potentially influencing the Fed’s own considerations as it navigates the evolving economic landscape.

This resulted in a significant easing of yields, as investors sought safer havens for their money.The current easing yield environment, however, presents some notable differences compared to previous periods. One key distinction is the role of inflation. While easing yields during the 2008 crisis were primarily driven by concerns about economic contraction, the current easing is occurring amidst a backdrop of persistent inflation.

This creates a unique situation where investors are grappling with the conflicting forces of rising prices and declining yields.

Potential Drivers of Easing Yields

Several factors are contributing to the recent easing of yields.

Wall Street is bracing for the Federal Reserve meeting, with easing yields suggesting a potential shift in monetary policy. Meanwhile, the housing market continues to defy expectations, with US home building surging past expectations in July amidst high demand for new homes.

This robust growth in the housing sector could provide further fuel for the Fed’s deliberations, as they weigh the impact of interest rate hikes on the broader economy.

- Recessionary Fears:As the economy grapples with inflation and rising interest rates, concerns about a potential recession are growing. Investors are becoming increasingly cautious, leading to a flight to safety and a demand for bonds, which are seen as a relatively secure asset class.

This increased demand for bonds pushes their prices higher, resulting in lower yields.

- Fed Policy Expectations:The Fed’s monetary policy stance is a key driver of interest rates. The Fed has been raising interest rates to combat inflation, but there are expectations that it may soon pause or even reverse course if economic growth weakens. This anticipation of a potential pivot in Fed policy is contributing to the easing of yields.

- Global Economic Uncertainty:The global economic outlook is clouded by geopolitical tensions, supply chain disruptions, and the ongoing war in Ukraine. This uncertainty is prompting investors to seek safe haven assets, including bonds, which are perceived as a less risky investment option in times of global instability.

Federal Reserve’s Monetary Policy

The Federal Reserve’s upcoming interest rate decision is a highly anticipated event in the financial markets. Investors are closely watching to see how the Fed will navigate the delicate balance between controlling inflation and supporting economic growth.

Potential Policy Options and Market Impact

The Federal Reserve has a range of policy options at its disposal, each with its own potential impact on the market.

- Maintain Current Rates:If the Fed decides to maintain current interest rates, it would signal that they believe inflation is under control and the economy is on a steady path. This could lead to a positive reaction in the stock market, as investors would feel more confident about the economic outlook.

However, it could also lead to continued pressure on the dollar, as investors might seek higher returns elsewhere.

- Increase Interest Rates:A rate hike would signal that the Fed is concerned about inflation and is taking steps to cool the economy. This could lead to a sell-off in the stock market, as investors would become more cautious about the future. However, it could also strengthen the dollar, as investors would be attracted to the higher interest rates.

- Reduce Interest Rates:A rate cut would signal that the Fed is concerned about economic growth and is taking steps to stimulate the economy. This could lead to a rally in the stock market, as investors would feel more confident about the economic outlook.

However, it could also weaken the dollar, as investors might seek higher returns elsewhere.

Scenarios and Market Implications

Here is a table outlining the potential scenarios for the Federal Reserve’s actions and their corresponding market implications:

| Scenario | Fed Action | Market Impact |

|---|---|---|

| Scenario 1 | Maintain Current Rates | Stock market rally, dollar weakens |

| Scenario 2 | Increase Interest Rates | Stock market sell-off, dollar strengthens |

| Scenario 3 | Reduce Interest Rates | Stock market rally, dollar weakens |

Market Outlook: Wall Street Prepares For Federal Reserve Meeting Amidst Easing Yields

The Federal Reserve’s decision on interest rates will undoubtedly have a significant impact on the stock market. Investors are closely watching for clues about the future direction of monetary policy and its implications for economic growth and inflation.

Short-Term Market Outlook

The short-term market outlook depends heavily on the Federal Reserve’s stance on interest rates. If the Fed signals a pause or even a pivot towards easing monetary policy, the stock market could experience a short-term rally, fueled by optimism about lower borrowing costs and improved economic prospects.

However, if the Fed maintains its hawkish tone and indicates further rate hikes, the market could experience volatility and potential downward pressure.

Potential Risks and Opportunities, Wall street prepares for federal reserve meeting amidst easing yields

The current market environment presents both risks and opportunities for investors.

Risks

- Inflation:Persistent inflation remains a key risk, as it erodes corporate profits and consumer spending power. The Fed’s aggressive rate hikes could lead to a recession if they are not carefully calibrated.

- Geopolitical Uncertainty:The ongoing war in Ukraine and heightened tensions between the US and China contribute to market uncertainty and volatility.

- Valuation Concerns:Some sectors of the market, particularly growth stocks, are still trading at high valuations. A potential correction could occur if these valuations become unsustainable.

Opportunities

- Value Stocks:Companies with strong fundamentals and lower valuations could outperform in a higher interest rate environment.

- Defensive Sectors:Sectors like healthcare, consumer staples, and utilities tend to be less sensitive to economic fluctuations and could provide some downside protection.

- Emerging Markets:Emerging markets could benefit from a weaker US dollar and continued economic growth in some regions.

Key Sectors and Industries

The Federal Reserve’s decision will have a significant impact on various sectors and industries.

Sectors Likely to be Impacted

- Technology:The tech sector is sensitive to interest rates, as growth stocks often rely on future earnings. Higher interest rates could make it more expensive to finance growth and could lead to lower valuations for tech companies.

- Real Estate:The housing market is highly sensitive to interest rates. Higher rates make it more expensive to finance mortgages, which could lead to a slowdown in home sales and prices.

- Financial Services:Banks and other financial institutions benefit from higher interest rates, as they can charge more for loans. However, a sharp rise in rates could also lead to increased loan defaults and higher credit losses.