US Wall Street Declines Amid Mixed Data, Fed Uncertainty

US Wall Street experiences decline amidst mixed data and uncertainty surrounding fed policy, a scenario that has left investors on edge. The recent downturn, marked by declines in major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq, reflects a complex interplay of economic factors and market sentiment.

A confluence of economic indicators, including inflation, interest rates, unemployment, and GDP growth, is contributing to the market’s volatility. While some indicators suggest a resilient economy, others paint a more cautious picture. The Federal Reserve’s stance on interest rates and monetary policy adds further complexity, as investors grapple with the potential impact of future decisions on the market’s trajectory.

Wall Street’s Recent Decline

Wall Street has experienced a recent decline, with major market indices experiencing significant drops. This downturn has been driven by a confluence of factors, including economic uncertainty, investor sentiment, and concerns about the Federal Reserve’s monetary policy.

Market Indices and Their Decline

The recent decline in Wall Street is reflected in the performance of major market indices. The Dow Jones Industrial Average, a benchmark index of 30 large-cap U.S. companies, has experienced a significant drop, indicating a decline in investor confidence in these blue-chip companies.

The S&P 500, a broader market index encompassing 500 large-cap companies, has also witnessed a decline, suggesting a broader downturn across the U.S. stock market. The Nasdaq Composite, which tracks the performance of technology-focused companies listed on the Nasdaq Stock Market, has experienced a more pronounced decline, highlighting investor concerns about the technology sector.

Factors Contributing to the Decline

Several factors have contributed to the recent decline in Wall Street.

Economic Indicators

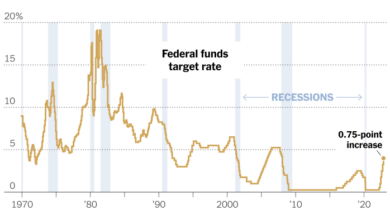

Economic indicators, such as inflation and interest rates, have played a significant role in the market’s recent downturn. High inflation has eroded consumer purchasing power, leading to concerns about economic growth. The Federal Reserve’s aggressive interest rate hikes, aimed at curbing inflation, have also increased borrowing costs for businesses and consumers, further dampening economic activity.

Investor Sentiment

Investor sentiment has been negatively impacted by concerns about the global economic outlook and the potential for a recession. The ongoing war in Ukraine, supply chain disruptions, and rising energy prices have added to the uncertainty surrounding the global economy.

This uncertainty has led investors to become more risk-averse, resulting in a sell-off in the stock market.

Market Volatility

The stock market has experienced increased volatility in recent months, characterized by sharp swings in prices. This volatility is driven by factors such as economic uncertainty, geopolitical tensions, and the Federal Reserve’s monetary policy. The market’s sensitivity to these factors has amplified price fluctuations, making it challenging for investors to navigate the market effectively.

Mixed Economic Data

Wall Street’s recent decline is partly attributed to the mixed economic data released in recent weeks. While some indicators suggest a resilient economy, others point to potential vulnerabilities, creating uncertainty among investors.The conflicting signals from key economic indicators are making it difficult for investors to gauge the direction of the economy and the Federal Reserve’s future monetary policy decisions.

This uncertainty is driving volatility in the stock market.

Inflation

Inflation remains a significant concern for investors and policymakers. While the headline inflation rate has moderated in recent months, core inflation, which excludes volatile food and energy prices, remains stubbornly high.

- The Consumer Price Index (CPI) rose 4.9% in April, marking a slower pace than in previous months, but still significantly above the Federal Reserve’s target of 2%.

- The core CPI, which excludes food and energy, rose 0.4% in April, suggesting that inflation is still broad-based.

The persistence of inflation is forcing the Federal Reserve to maintain its hawkish stance, raising concerns about the potential for a recession.

Interest Rates

The Federal Reserve has raised interest rates aggressively in recent months to combat inflation. The target range for the federal funds rate is now 5.00% to 5.25%, the highest level in more than 15 years.

Wall Street is feeling the jitters these days, with mixed economic data and the Fed’s future policy moves shrouded in uncertainty. It’s a time when investors seek safe havens, and that’s where the timeless allure of gold comes in.

As a traditional safe-haven asset, gold has historically proven its worth during periods of economic turmoil, as outlined in this insightful article on the role of gold as a safe investment. While the current market volatility may persist, understanding gold’s role as a hedge against risk can be a valuable tool for navigating these uncertain times.

- The Fed’s rate hikes are intended to slow economic growth and reduce inflation by making it more expensive for businesses and consumers to borrow money.

- However, the impact of these rate hikes on the economy is uncertain, and there are concerns that they could lead to a recession.

The Fed’s future policy path is uncertain, as it balances the need to tame inflation with the desire to avoid a recession.

Unemployment

The unemployment rate remains low, suggesting a strong labor market. However, there are signs of softening in the labor market, such as a decline in job openings and an increase in layoffs.

- The unemployment rate in April was 3.4%, the lowest level in more than 50 years.

- However, job openings declined in March, and layoff announcements have increased in recent months, suggesting that the labor market may be cooling.

The softening labor market is a mixed signal, as it could help to ease inflationary pressures but also increase the risk of a recession.

Wall Street’s recent decline is a reflection of the mixed economic data and the uncertainty surrounding the Fed’s policy decisions. While investors grapple with these macro concerns, some analysts are looking for bright spots, like the potential success of Tesla’s Cybertruck.

Ark Invest anticipates the Cybertruck to achieve mainstream success comparable to the Model Y , which could provide a much-needed boost to the market. However, it remains to be seen if this optimistic outlook can offset the broader economic headwinds.

GDP Growth

The US economy grew at an annualized rate of 1.3% in the first quarter of 2023, a slowdown from the previous quarter.

Wall Street’s recent decline, driven by mixed economic data and uncertainty about the Fed’s future policy, highlights the volatility of global markets. While the US grapples with these economic headwinds, the world of sports continues to thrive, as evidenced by the massive financial success of the Indian Premier League (IPL), which has become a major force in global cricket.

The IPL’s unique blend of high-quality cricket and entertainment has attracted a huge global audience, making it a lucrative business venture, as explained in this insightful article on the money game of Indian cricket how IPL scores big in finances.

The IPL’s success underscores the power of sport to transcend economic challenges, reminding us that even in times of uncertainty, there are bright spots in the global economy.

- The slowdown in GDP growth was driven by a decline in consumer spending and a decrease in business investment.

- The Federal Reserve’s rate hikes are expected to continue to weigh on economic growth in the coming months.

The slowdown in GDP growth raises concerns about the strength of the economy and the potential for a recession.

Uncertainty Surrounding Fed Policy

The Federal Reserve’s recent actions and pronouncements have injected a significant dose of uncertainty into the market. While the Fed has been vocal about its commitment to combating inflation, the path forward remains unclear, leaving investors grappling with the potential impact on their portfolios.

Current Stance and Potential Impact

The Federal Reserve currently maintains a hawkish stance, aiming to curb inflation by raising interest rates. This tightening of monetary policy has led to a series of rate hikes, with the benchmark federal funds rate now in a range of 5.25% to 5.50%.

The Fed’s objective is to slow down economic growth, reducing demand and ultimately easing inflationary pressures.The impact of the Fed’s decisions on Wall Street is multifaceted. In the short term, rising interest rates can lead to a decline in stock prices, as investors anticipate reduced corporate earnings and a less favorable environment for growth.

Higher borrowing costs can also dampen business investment and consumer spending, further impacting economic activity.However, the long-term implications are more nuanced. While the Fed’s actions may initially cause market volatility, they are ultimately aimed at creating a more stable and sustainable economic environment.

By controlling inflation, the Fed aims to foster a more predictable and reliable backdrop for businesses to operate and investors to allocate capital.

Market Expectations and Uncertainty

The market’s expectations regarding future Fed actions are a constant source of debate and uncertainty. Investors are closely watching economic data releases, seeking clues about the Fed’s likely course. The recent mixed economic data, with some indicators pointing to a slowing economy and others suggesting resilience, has further complicated the outlook.While the Fed has signaled its intent to keep interest rates elevated for an extended period, the market is still grappling with the potential for a shift in policy direction.

The level of uncertainty surrounding these expectations is high, with analysts offering a wide range of forecasts for future rate moves.

“The market is still grappling with the potential for a shift in policy direction.”

This uncertainty has created a volatile environment for investors, with stock prices fluctuating significantly in response to even minor changes in economic data or Fed pronouncements. The ability to accurately predict the Fed’s future actions remains a key challenge for investors, as it can have a profound impact on their investment strategies and portfolio performance.

Investor Sentiment and Market Volatility: Us Wall Street Experiences Decline Amidst Mixed Data And Uncertainty Surrounding Fed Policy

Investor sentiment, a reflection of the overall mood and expectations of market participants, plays a crucial role in shaping market dynamics. It influences trading activity, market volatility, and asset prices. When investors are optimistic, they are more likely to invest, driving up demand and potentially pushing prices higher.

Conversely, pessimism can lead to selling pressure, causing prices to decline.

Impact of Sentiment on Trading Activity and Market Volatility

Investor sentiment directly impacts trading activity and market volatility. High levels of confidence and risk appetite tend to fuel increased trading volumes, as investors are more willing to take positions. This can lead to greater price fluctuations, making markets more volatile.

Conversely, low confidence and risk aversion can result in reduced trading activity and lower volatility.

Examples of Recent Events Influencing Investor Sentiment

Recent events and announcements have significantly influenced investor sentiment and market reactions.

- Inflation Data:Recent inflation data releases, particularly the Consumer Price Index (CPI) and Producer Price Index (PPI), have been closely watched by investors. Higher-than-expected inflation readings have raised concerns about the Federal Reserve’s monetary policy tightening and its potential impact on economic growth, leading to market sell-offs.

- Fed Policy Statements:Statements by Federal Reserve officials regarding interest rate hikes and the pace of quantitative tightening have also significantly impacted market sentiment. Hawkish pronouncements suggesting a more aggressive stance on inflation control have often resulted in increased market volatility and stock market declines.

- Geopolitical Events:Geopolitical events, such as the ongoing war in Ukraine and tensions between the US and China, can also influence investor sentiment. These events create uncertainty and risk aversion, leading to market sell-offs and increased volatility.

Potential Implications for the Future

The current economic and market conditions, characterized by mixed data and uncertainty surrounding the Fed’s policy decisions, have far-reaching implications for various sectors and industries. The potential scenarios for the future depend heavily on the Fed’s actions and the broader economic outlook.

Investors and businesses need to navigate this period of uncertainty and prepare for potential future challenges.

Impact on Different Sectors

The current economic and market conditions are likely to have a significant impact on different sectors and industries.

- Technology:The technology sector, which has been a major driver of market growth in recent years, could be particularly vulnerable to rising interest rates and slowing economic growth. This is because tech companies often rely on borrowing to fund their growth and their valuations are highly sensitive to changes in interest rates.

- Consumer Discretionary:The consumer discretionary sector, which includes companies that sell non-essential goods and services, could also be affected by rising inflation and slowing economic growth. Consumers may cut back on spending on discretionary items if they are concerned about their finances.

- Energy:The energy sector could benefit from rising energy prices and increased demand. However, the sector’s performance will also depend on global geopolitical events and the pace of the transition to renewable energy sources.

- Healthcare:The healthcare sector is typically considered to be more defensive than other sectors, as demand for healthcare services is relatively stable regardless of economic conditions. However, the sector could be affected by rising costs and potential government price controls.

Potential Future Scenarios

The future of the economy and markets is uncertain, and there are several potential scenarios that could play out.

- Scenario 1: Soft Landing:In this scenario, the Fed successfully manages to slow inflation without triggering a recession. This would likely lead to a gradual slowdown in economic growth, but the markets would remain relatively stable.

- Scenario 2: Recession:In this scenario, the Fed’s efforts to curb inflation lead to a recession. This would likely result in a sharp decline in economic activity and a significant drop in stock prices.

- Scenario 3: Stagflation:In this scenario, the economy experiences both high inflation and slow growth. This would be a particularly challenging environment for businesses and investors, as it would be difficult to predict how the economy would evolve.

Navigating Uncertainty, Us wall street experiences decline amidst mixed data and uncertainty surrounding fed policy

Investors and businesses need to be prepared for the potential challenges ahead.

- Diversification:Investors should diversify their portfolios across different asset classes, sectors, and geographies to reduce their exposure to any single risk.

- Risk Management:Businesses should implement robust risk management strategies to identify and mitigate potential threats to their operations.

- Flexibility:Investors and businesses should be prepared to adjust their strategies in response to changing market conditions.

- Long-Term Perspective:It is important to maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations.