US Stocks Rally as Techs Rebound, Dow Eyes 10th Win

Us stocks rally as techs rebound and dow eyes 10th consecutive win – US Stocks Rally as Techs Rebound, Dow Eyes 10th Win: The US stock market is experiencing a surge, fueled by a strong rebound in the tech sector and the Dow Jones Industrial Average’s impressive streak of consecutive gains. This rally has injected a wave of optimism into the market, with investors cautiously optimistic about the future.

The tech sector’s resurgence is driven by a combination of factors, including strong earnings reports, positive economic data, and a renewed focus on innovation. The Dow’s impressive performance, meanwhile, is a testament to the resilience of the US economy and the strength of its corporate giants.

This confluence of positive developments has created a favorable environment for investors, although some caution is warranted as market volatility remains a concern.

The recent tech sector rebound has been particularly noteworthy, with major tech companies like Apple, Microsoft, and Amazon leading the charge. These companies have benefited from strong demand for their products and services, as well as from the continued growth of the digital economy.

The Dow Jones Industrial Average, which is comprised of 30 of the largest publicly traded companies in the US, has also been on a tear, with its recent streak of consecutive gains indicating a strong appetite for risk among investors.

This optimism is fueled by a combination of factors, including a robust economy, low interest rates, and the expectation of continued corporate earnings growth. However, it’s important to note that the market is not without its challenges, with inflation, geopolitical tensions, and the potential for interest rate hikes remaining as potential headwinds.

Market Overview

US stocks rallied on Tuesday, with the tech sector leading the charge, as investors cheered positive earnings reports and a softening inflation outlook. The Dow Jones Industrial Average closed at a record high, marking its tenth consecutive winning session. The broader market also saw significant gains, with the S&P 500 and Nasdaq Composite indices closing at their highest levels in months.This surge in the market can be attributed to a combination of factors, including the rebound in the tech sector, the Dow’s impressive winning streak, and the overall positive sentiment among investors.

Tech Sector Rebound, Us stocks rally as techs rebound and dow eyes 10th consecutive win

The tech sector’s rebound has been a key driver of the recent market rally. After a period of underperformance, tech stocks have surged in recent weeks, fueled by strong earnings reports from major companies like Apple and Microsoft. These companies have shown resilience in the face of economic headwinds, demonstrating their ability to continue growing even in a challenging environment.

The tech sector’s strength is a positive sign for the broader market, as it suggests that investors are optimistic about the future of the economy.

Dow Jones Industrial Average’s Winning Streak

The Dow Jones Industrial Average’s ten-day winning streak is a significant event, reflecting a strong level of confidence among investors. The Dow’s performance is a positive indicator of the overall health of the US economy and corporate earnings. It also suggests that investors are optimistic about the future, as they continue to buy stocks despite the ongoing economic uncertainty.

The Dow’s sustained gains have helped to lift the broader market, boosting investor sentiment and encouraging further buying activity.

Tech Sector Rebound: Us Stocks Rally As Techs Rebound And Dow Eyes 10th Consecutive Win

The tech sector, a significant driver of the broader market, has experienced a notable rebound, contributing to the overall rally in U.S. stocks. This resurgence can be attributed to a confluence of factors, including easing inflation concerns, a more accommodative monetary policy stance, and positive earnings reports from major tech companies.

Factors Driving the Tech Sector’s Rebound

The tech sector’s rebound is driven by a combination of factors:

- Easing Inflation Concerns:Declining inflation rates have reduced investor anxieties about aggressive interest rate hikes by the Federal Reserve, boosting confidence in the tech sector’s growth prospects. As inflation cools, the pressure on the Fed to raise rates less aggressively diminishes, creating a more favorable environment for growth-oriented sectors like technology.

- Accommodative Monetary Policy:The Federal Reserve’s recent shift towards a more accommodative monetary policy stance, with hints of potential rate cuts in the future, has further fueled the tech sector’s rally. A more accommodative policy reduces borrowing costs for tech companies, allowing them to invest more in research and development, expansion, and innovation.

- Positive Earnings Reports:Strong earnings reports from major tech companies have provided further evidence of the sector’s resilience and growth potential. Companies like Microsoft, Apple, and Amazon have exceeded analysts’ expectations, demonstrating robust revenue growth and strong demand for their products and services.

Performance of Major Tech Companies

Major tech companies have played a pivotal role in the sector’s rebound, with their strong performances contributing significantly to the rally.

The US stock market is on a roll, with tech stocks leading the charge and the Dow Jones Industrial Average eyeing its 10th consecutive win. This positive momentum comes amid persistent inflation, but investors seem unfazed. To better understand and navigate this volatile economic landscape, check out the inflation guide tips to understand and manage rising prices – it’s a valuable resource for anyone looking to make informed financial decisions in this inflationary environment.

With inflation likely to remain a key factor in the market for some time, understanding its impact is crucial for investors seeking to capitalize on the current upswing.

- Microsoft:Microsoft’s stock has surged on the back of strong demand for its cloud computing services, particularly Azure, which has benefited from businesses’ increasing adoption of cloud technologies.

- Apple:Apple’s stock has climbed as the company continues to dominate the smartphone market and expand its services offerings, including subscriptions for Apple Music, Apple TV+, and iCloud.

- Amazon:Amazon’s stock has risen on the strength of its e-commerce business, driven by a surge in online shopping, and its cloud computing platform, Amazon Web Services (AWS), which continues to see robust growth.

Comparison with Previous Trends

The current tech sector rebound differs from previous trends in several key ways:

- Inflationary Environment:The current rebound occurs in a relatively high-inflation environment, compared to previous rallies that took place during periods of low or declining inflation. This suggests that the tech sector’s resilience is more pronounced, indicating its ability to navigate challenging macroeconomic conditions.

- Focus on AI:The current rally is characterized by a strong focus on artificial intelligence (AI), with companies like Google, Microsoft, and Amazon investing heavily in AI research and development. This focus on AI is expected to drive further growth in the tech sector, as AI applications become increasingly prevalent across industries.

- Growth in Cloud Computing:The current tech sector rebound is fueled by continued growth in cloud computing, with companies like Microsoft, Amazon, and Google leading the charge. Cloud computing has become a critical component of businesses’ digital transformation strategies, driving strong demand for cloud services and fueling the tech sector’s growth.

The tech sector’s rebound is driving the US stock market rally, with the Dow Jones Industrial Average poised for its 10th consecutive win. This surge in optimism comes alongside Bank of America’s aggressive expansion across four US states, a move aimed at closing the gap with industry giant JP Morgan.

This expansion signals a fierce competition for market share, potentially fueling further growth in the financial sector and contributing to the overall positive market sentiment.

Dow Jones Performance

The Dow Jones Industrial Average (DJIA) has been on a tear recently, experiencing a remarkable streak of consecutive gains. This surge in the Dow’s performance is a significant indicator of overall market sentiment, suggesting investor optimism and a robust economic outlook.

Factors Contributing to the Dow’s Consecutive Gains

Several key factors have contributed to the Dow’s recent upward momentum. These include:

- Strong Corporate Earnings:Robust earnings reports from major companies have fueled investor confidence. As businesses demonstrate resilience and continued growth, the market responds positively, driving up stock prices.

- Economic Resilience:Despite global economic uncertainties, the US economy has shown surprising strength. Positive economic data, including low unemployment and steady consumer spending, reinforce investor confidence in the market’s long-term prospects.

- Falling Inflation:Declining inflation rates have eased concerns about rising prices and increased spending power for consumers. This has boosted investor optimism, as it suggests a less volatile economic environment and potentially higher corporate profits.

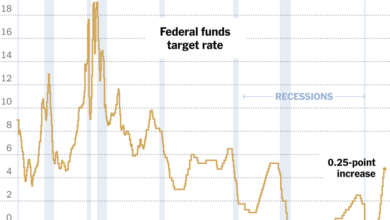

- Federal Reserve Policy:The Federal Reserve’s gradual approach to raising interest rates has provided some stability for the market. While interest rate hikes can impact growth, the Fed’s measured steps have helped to avoid a sharp correction in stock prices.

Investor Sentiment

The recent market rally, fueled by a rebound in the tech sector and the Dow Jones Industrial Average’s impressive streak, has injected a wave of optimism into the market. Investors are cautiously embracing the positive momentum, but concerns about inflation and geopolitical tensions still linger.

Impact of Tech Sector Rebound and Dow Performance

The tech sector’s resurgence, after a prolonged period of underperformance, has been a significant driver of the market’s upward trajectory. This rebound has restored confidence among investors who had grown wary of the sector’s valuation. The Dow Jones Industrial Average’s ten consecutive winning days, a rare feat, further underscores the market’s positive sentiment.

The US stock market is on a roll, with tech stocks leading the charge and the Dow Jones poised for its 10th consecutive win. This bullish momentum reflects a renewed confidence in the economy, and it’s a great time to consider investing in your own future.

If you’re looking for ways to capitalize on this positive trend, explore profitable low investment business ideas unlocking high returns. With a little creativity and effort, you can leverage this market optimism to build your own financial success.

As the market continues to climb, keep an eye on key indicators and be prepared to adjust your strategy as needed.

This sustained performance has bolstered investor confidence, encouraging them to maintain their positions or even increase their exposure to the market.

Potential Risks and Opportunities

Despite the prevailing optimism, investors remain mindful of potential risks that could disrupt the current market rally.

- Inflation, although showing signs of easing, remains a concern. Persistent inflationary pressures could force the Federal Reserve to maintain its aggressive monetary tightening policy, potentially slowing economic growth and dampening market performance.

- Geopolitical tensions, particularly the ongoing conflict in Ukraine, continue to create uncertainty and volatility in the market. Escalation of the conflict or unexpected developments could trigger market sell-offs.

- Rising interest rates, a consequence of the Fed’s rate hikes, increase borrowing costs for businesses and consumers, potentially impacting economic activity and corporate earnings.

Despite these risks, the market rally presents opportunities for investors.

- The tech sector’s rebound suggests a potential for further growth in the sector, particularly as interest rates stabilize and economic conditions improve.

- The Dow’s sustained performance indicates a broader market confidence, suggesting potential for continued upward momentum in the near term.

Economic Outlook

The current economic landscape is a complex mix of positive and negative signals, impacting the stock market’s direction. While the recent rally reflects optimism, several factors could influence the market’s future trajectory.

Inflation and Interest Rates

Inflation remains a key concern, although it has shown signs of cooling. The Federal Reserve’s aggressive interest rate hikes aim to tame inflation, but they also pose risks to economic growth. The market is closely watching for signs of a potential recession, which could negatively impact corporate earnings and stock prices.

The Fed’s target inflation rate is 2%, and they are committed to achieving this goal, even if it means further rate hikes.

Geopolitical Events

Geopolitical events, such as the ongoing war in Ukraine and tensions with China, contribute to market volatility. These events can disrupt supply chains, increase energy prices, and create uncertainty for businesses.

The war in Ukraine has already caused significant disruptions to global energy markets and food supplies, leading to higher prices for consumers and businesses.

US Economic Outlook

The US economy is showing resilience, with strong consumer spending and a robust labor market. However, the ongoing war in Ukraine, rising interest rates, and potential recessionary pressures create uncertainty for the future.

The US economy grew at an annualized rate of 2.9% in the fourth quarter of 2022, demonstrating continued growth despite headwinds.

Market Volatility

The current market rally, fueled by optimism around artificial intelligence (AI) and a potential pause in interest rate hikes, has brought a sense of calm to investors. However, beneath the surface, volatility still lurks, and understanding its potential impact is crucial for navigating market swings.

Factors Contributing to Volatility

Volatility is an inherent part of the market, and several factors can contribute to its fluctuations.

- Economic Data Releases:Key economic indicators, such as inflation reports, employment figures, and manufacturing data, can significantly impact market sentiment. Surprises in these releases, whether positive or negative, can trigger volatility. For example, a higher-than-expected inflation reading could lead to concerns about further interest rate hikes, causing market uncertainty and potentially pushing stocks lower.

- Geopolitical Events:Global events, such as international conflicts, political instability, and trade tensions, can also create market uncertainty and increase volatility. The ongoing war in Ukraine, for instance, has caused energy price fluctuations and global supply chain disruptions, impacting investor confidence and market stability.

- Interest Rate Decisions:Central bank decisions on interest rates play a crucial role in market volatility. When interest rates rise, borrowing becomes more expensive, potentially slowing economic growth and leading to a decline in corporate profits. Conversely, rate cuts can stimulate economic activity and boost stock prices.

The Federal Reserve’s (Fed) decisions on interest rates, particularly the timing and magnitude of rate hikes, are closely watched by investors, and any unexpected moves can trigger market swings.

- Corporate Earnings:Company earnings reports can also drive volatility. When a company’s earnings exceed expectations, its stock price may rise, but if earnings disappoint, the stock could decline. Overall earnings season can create a period of heightened volatility as investors assess the health of the economy and corporate profitability.

- Market Sentiment:Investor sentiment, which is the overall feeling or attitude towards the market, can also influence volatility. Positive sentiment can lead to increased buying and a rising market, while negative sentiment can lead to selling pressure and a declining market. Market sentiment can be influenced by a variety of factors, including economic data, geopolitical events, and news headlines.

Navigating Market Swings

In a volatile market, investors can employ strategies to mitigate risk and potentially benefit from market swings.

- Diversification:Spreading investments across different asset classes, such as stocks, bonds, real estate, and commodities, can help reduce portfolio volatility. By diversifying, investors can minimize the impact of any single asset class’s performance on their overall portfolio.

- Long-Term Perspective:Maintaining a long-term investment horizon can help investors ride out short-term market fluctuations. Short-term market volatility is a normal part of the investment cycle, and focusing on long-term goals can help investors avoid making impulsive decisions based on short-term market movements.

- Dollar-Cost Averaging:This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. By investing consistently over time, investors can average out their purchase price and potentially reduce the impact of market volatility.

- Rebalancing:Periodically reviewing and adjusting portfolio allocations can help maintain a desired risk level. Rebalancing involves selling assets that have outperformed and buying assets that have underperformed, bringing the portfolio back to its original target asset allocation.