US Stocks Rally as 10-Year Yield Hits 16-Year High

Us stocks rally as 10 year yield approaches 16 year high today stock market insights – US stocks rally as 10-year yield approaches 16-year high today stock market insights sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset.

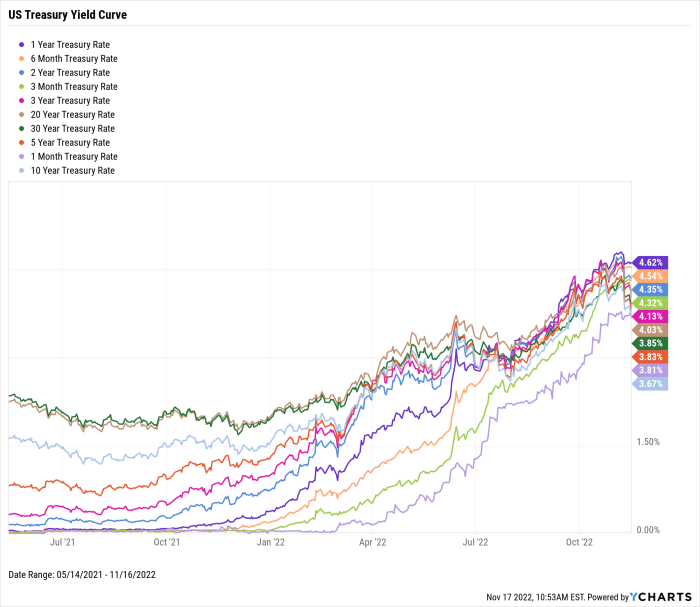

The recent surge in the 10-year Treasury yield, reaching its highest point in 16 years, has sent ripples through the stock market, creating a dynamic interplay between growth and risk. As investors grapple with the implications of rising interest rates, we delve into the factors driving this yield spike and its impact on various sectors and asset classes.

This dramatic rise in the 10-year Treasury yield is a direct result of the Federal Reserve’s ongoing efforts to combat inflation. The Fed’s aggressive rate hikes have made borrowing more expensive, leading to a higher demand for government bonds, which in turn drives up their yield.

This phenomenon, while intended to cool down the economy, presents a double-edged sword for investors. On one hand, it signals a stronger economy, potentially fueling stock market growth. On the other hand, it also increases the cost of borrowing for businesses, potentially slowing down their expansion and impacting their profitability.

Investor Behavior and Sentiment: Us Stocks Rally As 10 Year Yield Approaches 16 Year High Today Stock Market Insights

The recent surge in the 10-year Treasury yield, nearing a 16-year high, has sent ripples through the stock market, prompting investors to reassess their strategies and adapt to the evolving landscape. This shift in the interest rate environment has a profound impact on investor behavior and sentiment, influencing their investment decisions and potentially shaping the market’s trajectory.

Impact on Investment Strategies, Us stocks rally as 10 year yield approaches 16 year high today stock market insights

The rising yield presents both opportunities and challenges for investors. It signals a potential shift in the economic outlook, with implications for growth, inflation, and corporate earnings.

- Shift towards Value Stocks:Investors are increasingly favoring value stocks, which tend to perform well in a rising interest rate environment. Value stocks are typically companies with lower valuations and higher dividend yields, making them more attractive as investors seek higher returns in a period of rising rates.

- Rotation from Growth to Value:The allure of growth stocks, which have historically outperformed in a low-interest rate environment, has diminished as the cost of borrowing rises. Investors are rotating their portfolios from growth-oriented sectors, such as technology, to value-oriented sectors, such as financials and energy.

- Increased Volatility:The rising yield has contributed to increased volatility in the stock market. As investors adjust their portfolios and re-evaluate their risk tolerance, market fluctuations become more pronounced.

Future Market Predictions

The recent surge in the 10-year yield, approaching a 16-year high, has sparked significant discussions about the future trajectory of the stock market. While the current situation presents both opportunities and risks for investors, understanding potential scenarios and expert opinions can help navigate this evolving landscape.

Potential Market Scenarios and the 10-Year Yield

The 10-year yield is a key indicator of interest rates and economic growth. Its recent rise reflects the Federal Reserve’s ongoing efforts to combat inflation through aggressive interest rate hikes. This trend has implications for both the stock market and the economy.

The potential scenarios for the stock market and the 10-year yield can be categorized as follows:

- Scenario 1: Continued Rise in Yields and Market Correction:If the 10-year yield continues its upward trajectory, it could put further pressure on the stock market, potentially leading to a correction. Higher interest rates increase borrowing costs for businesses, impacting growth prospects and reducing the attractiveness of equities.

This scenario could see a decline in stock prices, particularly for growth-oriented companies with high valuations.

- Scenario 2: Yield Stabilization and Market Consolidation:The 10-year yield could stabilize at current levels or experience a slight decline, leading to a period of market consolidation. This scenario would provide investors with an opportunity to re-evaluate their portfolios and potentially make adjustments based on their risk tolerance and investment goals.

- Scenario 3: Yield Decline and Market Rebound:If the Federal Reserve pauses or slows down its rate hikes, the 10-year yield could decline, potentially leading to a rebound in the stock market. This scenario would be fueled by a decrease in borrowing costs, boosting business confidence and economic growth.

Expert Opinions and Market Forecasts

Experts are divided on the future direction of the stock market and the 10-year yield. Some believe that the current market volatility is a sign of a potential correction, while others remain optimistic about long-term growth.

“The market is likely to remain volatile in the near term, with the potential for further corrections. Investors should be prepared for potential market downturns and have a well-defined risk management strategy.”

[Name of Expert]

“The 10-year yield is expected to stabilize in the coming months, but further rate hikes by the Fed could put upward pressure on yields. Investors should carefully consider the impact of interest rates on their investment portfolios.”

[Name of Expert]

Risks and Opportunities for Investors

The current market environment presents both risks and opportunities for investors. Understanding these factors can help investors make informed decisions and navigate the market effectively.

- Risks:

- Market Correction:A significant decline in stock prices, potentially triggered by rising interest rates or other economic factors.

- Inflation:High inflation erodes purchasing power and can lead to higher interest rates, impacting both businesses and consumers.

- Geopolitical Uncertainty:Global events, such as wars or trade disputes, can create market volatility and impact investment decisions.

- Opportunities:

- Value Stocks:Rising interest rates can favor value stocks, which are typically companies with lower valuations and strong fundamentals.

- Fixed Income:Investors seeking income can consider fixed-income investments, such as bonds, which offer relatively stable returns in a rising interest rate environment.

- Diversification:Diversifying investments across different asset classes and sectors can help mitigate risk and potentially enhance returns.

The US stock market saw a rally today, despite the 10-year Treasury yield approaching a 16-year high. This surprising move could be attributed to a number of factors, including a potential shift in investor sentiment or a belief that the Fed might soon pivot on its interest rate hikes.

However, a recent ISM survey paints a less optimistic picture, revealing sluggish growth in the US services sector and record low prices paid. This suggests that the economy might be weakening, which could ultimately put pressure on the stock market.

You can find more insights from the ISM survey in this article: sluggish growth in us services sector and record low prices paid insights from ism survey. Ultimately, the direction of the stock market remains uncertain, and investors will be closely watching economic data and Federal Reserve policy decisions in the coming weeks.

The stock market is in a volatile state today, with the 10-year Treasury yield approaching a 16-year high. This is a significant development, as it reflects rising interest rates and potential economic uncertainty. However, amidst this market turmoil, there’s a bit of good news for sneakerheads: Adidas is launching a new wave of exclusive Yeezy shoes for clearance, adidas launches new wave of exclusive yeezy shoes for clearance.

While this might not directly impact the stock market, it’s a reminder that even in turbulent times, there are still opportunities for savvy shoppers. So, keep an eye on the market and your favorite sneaker sites!

The US stock market is experiencing a roller coaster ride today, with the 10-year yield approaching a 16-year high. This is leading to some volatility, but it’s also a reminder that the market is constantly evolving. Meanwhile, the crypto world is eagerly awaiting the SEC’s decision on Bitcoin ETFs, with the delay sparking speculation and causing ripples in the market.

The latest developments on the Bitcoin ETF front will likely have a significant impact on both the crypto and traditional markets, adding another layer of complexity to the current landscape. It’s a time for investors to stay informed and adapt to the changing tides, whether it’s navigating the fluctuating stock market or keeping an eye on the evolving crypto scene.