US Stock Market News Today: Wall Street Opens Positive on Cooling Inflation

Us stock market news today wall street begins on a positive note with cooling inflation – US Stock Market News Today: Wall Street Opens Positive on Cooling Inflation – It’s a refreshing change of pace as Wall Street kicks off the day on a positive note, fueled by the cooling of inflation. This shift in the economic landscape is causing ripples throughout the market, and investors are taking notice.

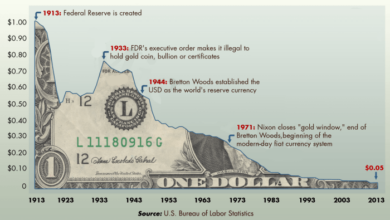

The recent decline in inflation figures has sparked optimism, with investors seeing this as a potential turning point. The Federal Reserve’s aggressive interest rate hikes, aimed at curbing inflation, are showing signs of impact. As the market digests this news, we’ll explore how cooling inflation could influence investor sentiment, investment strategies, and even the Fed’s future monetary policy decisions.

Market Outlook: Us Stock Market News Today Wall Street Begins On A Positive Note With Cooling Inflation

Wall Street opened on a positive note today, driven by cooling inflation data. This suggests that the Federal Reserve might be nearing the end of its aggressive interest rate hikes, potentially leading to a more stable market environment. However, several factors could influence the market’s direction in the coming months, making it crucial for investors to stay informed and adapt their strategies accordingly.

Short-Term Market Influences

The short-term market outlook is characterized by a delicate balance of positive and negative factors. While cooling inflation provides a glimmer of hope for a less hawkish Fed, the ongoing geopolitical tensions, particularly the war in Ukraine, continue to create uncertainty.

Additionally, the possibility of a recession in the US economy remains a concern, with the latest economic data showing mixed signals.

- Interest Rate Hikes:The Federal Reserve’s stance on interest rates will continue to be a key driver of market sentiment. While the recent inflation data suggests a potential pause in rate hikes, the Fed’s ultimate decision will depend on future economic indicators and inflation trends.

Investors will closely watch the Fed’s communication and any potential shift in its monetary policy stance.

- Geopolitical Risks:The war in Ukraine continues to create global uncertainty, impacting energy prices, supply chains, and overall economic stability. The potential for escalation or spillover effects in other regions could further disrupt markets. Additionally, tensions between the US and China remain a source of volatility.

- Economic Growth:The US economy is showing signs of slowing down, with concerns about a potential recession. However, the labor market remains robust, which could provide some support to the economy. Investors will be monitoring economic data, including GDP growth, unemployment rates, and consumer spending, to gauge the health of the economy.

Long-Term Market Opportunities

Despite the short-term uncertainties, the long-term market outlook remains positive. The US economy has a strong foundation, driven by innovation and technological advancements. This creates opportunities for investors to capitalize on long-term growth trends in sectors like technology, healthcare, and renewable energy.

- Technological Advancements:The rapid pace of technological innovation continues to create new industries and opportunities for growth. Artificial intelligence, cloud computing, and cybersecurity are just a few examples of sectors with significant long-term potential. Investors can look for companies that are at the forefront of these advancements and have a strong track record of innovation.

- Healthcare Innovation:The healthcare industry is constantly evolving, with new treatments, technologies, and services emerging. The aging population and rising healthcare costs create a strong demand for innovative solutions. Investors can consider companies that are developing new drugs, medical devices, or healthcare technologies.

- Renewable Energy:The transition to a more sustainable future is creating a significant opportunity for renewable energy companies. Governments around the world are setting ambitious targets for clean energy production, driving investment in solar, wind, and other renewable energy sources. Investors can look for companies that are leading the charge in this sector.

Potential Risks for Investors, Us stock market news today wall street begins on a positive note with cooling inflation

While the long-term market outlook is positive, investors need to be aware of potential risks. The current geopolitical uncertainties, inflation, and potential economic slowdown could create volatility in the market. Additionally, the rising interest rates could impact the valuations of companies, especially those with high debt levels.

- Market Volatility:The current environment is characterized by increased volatility, driven by various factors like inflation, interest rate hikes, and geopolitical tensions. Investors need to be prepared for potential market swings and adjust their investment strategies accordingly. Diversification and a long-term perspective can help mitigate risk.

- Inflation:While inflation has shown signs of cooling, it remains a concern for investors. High inflation can erode purchasing power and impact corporate profits. Investors need to consider companies with strong pricing power and the ability to pass on rising costs to consumers.

- Interest Rate Risk:Rising interest rates can impact the valuations of companies, especially those with high debt levels. As interest rates rise, the cost of borrowing increases, potentially reducing profitability. Investors should carefully evaluate the financial health of companies and their ability to manage debt.

Wall Street opened strong today, buoyed by news of cooling inflation, but a counterintuitive trend emerged in the energy sector. Despite OPEC’s efforts to restrain supply, oil prices dipped , potentially reflecting a more cautious outlook on global demand. This unexpected downturn in oil prices might actually serve to further bolster the positive sentiment on Wall Street, as lower energy costs could contribute to continued economic growth.

Wall Street opened on a positive note today, fueled by news of cooling inflation. This optimistic start comes amidst a backdrop of mixed earnings reports and the ever-present anticipation of the Federal Reserve’s interest rate decision, which you can follow in detail on this live news coverage.

While the market seems to be riding a wave of hope for a potential slowdown in rate hikes, the impact of those mixed earnings and the Fed’s decision will ultimately shape the direction of the market in the coming days.

Wall Street opened strong today, buoyed by news of cooling inflation, but the mood might be dampened by the growing impact of new EU regulations on major US tech companies. These rules, which you can read more about in detail here , could significantly impact the tech giants’ operations and profitability in the coming months, potentially affecting investor sentiment in the long run.