US Stock Futures Rise Ahead of Inflation Data

US stock futures inch upward ahead of revised inflation data, signaling a potential shift in investor sentiment. This upward movement comes amidst a backdrop of economic uncertainty, with investors closely watching the upcoming release of inflation data for clues about the Federal Reserve’s future monetary policy decisions.

The data is expected to provide insights into the trajectory of inflation, which has been a major concern for both consumers and businesses.

The upward trend in futures suggests that investors are cautiously optimistic about the economic outlook. This optimism is likely fueled by a combination of factors, including recent corporate earnings reports, signs of cooling inflation, and expectations that the Fed may be nearing the end of its rate-hiking cycle.

However, the market remains volatile, and investors are closely monitoring a range of economic indicators, including consumer spending, employment data, and geopolitical developments.

Market Overview

US stock futures are inching upward in anticipation of the release of revised inflation data. This positive movement reflects a cautiously optimistic sentiment among investors, who are hoping for signs of cooling inflation, a key driver of market volatility in recent months.

The market’s performance is closely tied to the trajectory of inflation, as it influences interest rate expectations and overall economic growth.

Economic Landscape, Us stock futures inch upward ahead of revised inflation data

The economic landscape remains a mixed bag, with investors navigating a complex interplay of factors. While recent data points to a resilient labor market and continued consumer spending, concerns remain about the potential for a recession. The Federal Reserve’s aggressive interest rate hikes are aimed at taming inflation, but they also carry the risk of slowing economic activity.

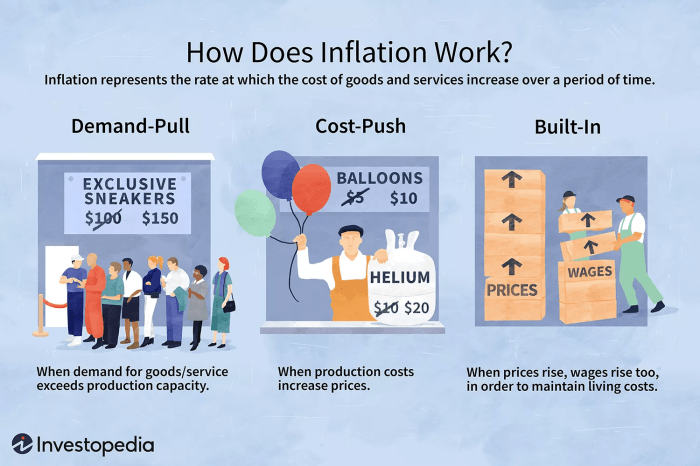

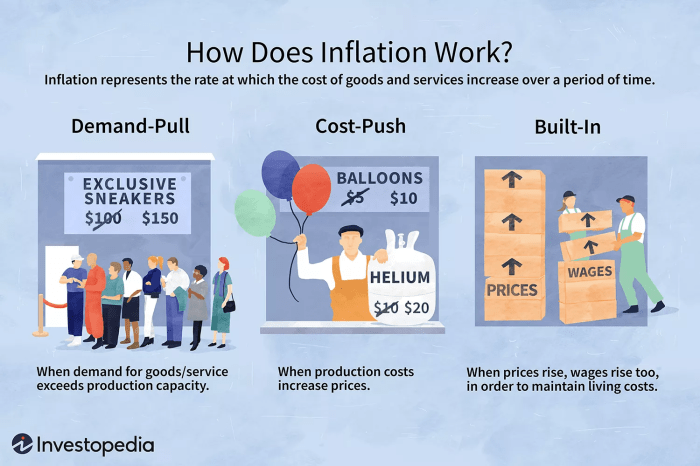

Inflation Data: Us Stock Futures Inch Upward Ahead Of Revised Inflation Data

The market is eagerly awaiting the release of revised inflation data, which is expected to provide further insights into the trajectory of price pressures in the economy. The data, which is expected to be released on [Date], could have a significant impact on market sentiment and investor behavior.

US stock futures are inching upward this morning, likely fueled by anticipation of the revised inflation data due out later today. It’s a positive sign for the market, and it’s interesting to see how this news coincides with Google’s recent update to their Play Store policy, expanding the availability of real-money gaming apps.

This move could potentially inject more capital into the gaming industry, which in turn might impact investor sentiment towards the broader market, especially if we see a positive response to the inflation data.

Key Metrics within the Inflation Data

The inflation data will include several key metrics that investors will closely monitor. These metrics provide a comprehensive picture of the inflation landscape and help investors understand the underlying drivers of price changes.

- Consumer Price Index (CPI):The CPI is a widely followed measure of inflation that tracks changes in the prices of a basket of consumer goods and services. A higher CPI indicates a faster rate of inflation, which can erode purchasing power and weigh on consumer spending.

The US stock futures are inching upward, anticipating the release of revised inflation data. It’s a reminder that even as we’re captivated by groundbreaking advancements like the neuralink successfully implants brain chip in first human , the world of finance continues to move forward, driven by economic indicators and market sentiment.

The revised inflation data could potentially impact investor confidence and influence the trajectory of the markets in the coming days.

- Producer Price Index (PPI):The PPI measures changes in the prices of goods and services at the wholesale level. It provides insights into the cost pressures faced by businesses, which can eventually be passed on to consumers in the form of higher prices.

- Core Inflation:Core inflation excludes volatile food and energy prices, providing a more stable measure of underlying price pressures. This metric is closely watched by policymakers as it helps gauge the persistence of inflation.

Interpretation of the Inflation Data

Market analysts and economists will closely scrutinize the inflation data to assess its implications for monetary policy and economic growth. A higher-than-expected inflation reading could prompt the Federal Reserve to maintain or even accelerate its pace of interest rate hikes to combat inflation.

Conversely, a lower-than-expected inflation reading could signal a potential easing of price pressures and support a more dovish monetary policy stance.

US stock futures are inching upward this morning, likely spurred by anticipation of the revised inflation data release. While the market awaits those figures, a significant legal victory for Tesla could also be influencing sentiment. Tesla successfully defended against monopoly claims in a repair lawsuit, as reported by The Venom Blog , which may be contributing to a more positive outlook for the company and the broader tech sector.

Overall, the market seems to be cautiously optimistic, with the inflation data likely to be the key driver of future movement.

“The inflation data will be a key data point for investors to assess the Fed’s path forward. A higher-than-expected reading could lead to a more hawkish Fed, while a lower-than-expected reading could support a more dovish stance.”

[Name of Economist or Analyst]

Investor Sentiment

The upward trend in stock futures, fueled by the anticipation of the upcoming inflation data release, has injected a wave of optimism into the market. While investors are cautiously optimistic, there are several key factors driving this sentiment, including recent economic news, corporate earnings, and the overall market volatility.

Impact of Recent Economic News

Recent economic news has provided mixed signals to investors. While the latest employment data indicated a robust labor market, concerns remain regarding inflation and its impact on consumer spending and business confidence. The upcoming inflation data release is expected to provide further clarity on the trajectory of price pressures.

Influence of Corporate Earnings

Corporate earnings have been a mixed bag in recent quarters. While some companies have reported strong results, others have struggled with rising costs and supply chain disruptions. The upcoming earnings season will be closely watched by investors for insights into the health of the economy and the outlook for corporate profits.

Market Volatility and Investor Sentiment

The market has experienced a period of heightened volatility in recent months, driven by factors such as rising interest rates, geopolitical tensions, and the ongoing pandemic. While this volatility has created uncertainty for investors, it has also presented opportunities for those willing to take on more risk.

Potential Implications

The revised inflation data could have significant implications for various sectors of the economy, impacting interest rates, monetary policy, and overall economic growth. Understanding these potential impacts is crucial for investors and businesses alike.

Impact on Interest Rates and Monetary Policy

The revised inflation data will likely influence the Federal Reserve’s monetary policy decisions. If inflation proves to be stickier than anticipated, the Fed might feel compelled to maintain or even increase interest rates to curb inflation. Conversely, if inflation shows signs of cooling down, the Fed might consider easing monetary policy, potentially leading to lower interest rates.

Impact on Economic Growth

Higher interest rates can slow down economic growth by making it more expensive for businesses to borrow money for investments and for consumers to take out loans. This can lead to reduced spending and a slowdown in economic activity. Conversely, lower interest rates can stimulate economic growth by encouraging borrowing and investment.

Impact on Key Sectors

The following table illustrates the potential impact of revised inflation data on key sectors:

| Sector | Potential Impact of Higher Inflation | Potential Impact of Lower Inflation |

|---|---|---|

| Technology | Higher interest rates could impact tech companies’ valuations and growth prospects, as investors may favor more value-oriented sectors. | Lower interest rates could boost tech spending and innovation, benefiting companies in the sector. |

| Energy | Higher inflation could lead to increased energy prices, benefiting energy producers but potentially hurting consumers. | Lower inflation could moderate energy prices, potentially benefiting consumers and reducing inflationary pressures. |

| Consumer Goods | Higher inflation could lead to higher prices for consumer goods, potentially impacting consumer spending and demand. | Lower inflation could lead to lower prices for consumer goods, potentially boosting consumer spending and demand. |

Market Outlook

The direction of the US stock market in the coming weeks and months will depend heavily on the trajectory of inflation and the Federal Reserve’s response. While recent data suggests inflation may be cooling, the Fed’s commitment to fighting inflation remains steadfast.

This creates a complex environment for investors, with both potential risks and opportunities.

Potential Risks and Opportunities

Investors need to carefully consider both the potential risks and opportunities presented by the current market conditions.

- Rising Interest Rates:Continued interest rate hikes by the Fed could weigh on corporate earnings and valuations, potentially leading to a correction in the stock market. This could be particularly impactful for sectors heavily reliant on debt financing, such as technology and real estate.

- Economic Slowdown:Persistent inflation and aggressive monetary tightening could push the US economy into a recession, impacting corporate earnings and investor sentiment.

- Geopolitical Uncertainty:Ongoing geopolitical tensions, such as the war in Ukraine and heightened tensions with China, can create market volatility and disrupt supply chains, potentially impacting corporate earnings and economic growth.

- Inflation Volatility:While recent data suggests inflation may be cooling, the path ahead remains uncertain. Unexpected spikes in inflation could force the Fed to tighten monetary policy further, negatively impacting the stock market.

- Earnings Season:Corporate earnings reports in the coming months will provide valuable insights into the health of the economy and the outlook for businesses. Unexpectedly weak earnings could lead to a sell-off in the stock market.

Key Factors to Monitor

Investors should closely monitor the following key factors in the coming days and weeks to gauge the market’s direction:

- Inflation Data:Continue to watch for signs of cooling inflation in the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index. Unexpectedly high inflation readings could lead to increased market volatility and pressure on the Fed to tighten monetary policy further.

- Federal Reserve Policy:Monitor the Fed’s interest rate decisions and statements for clues about the future path of monetary policy. Any hawkish signals could negatively impact the stock market, while dovish signals could provide a boost.

- Economic Data:Pay close attention to key economic indicators, such as GDP growth, unemployment rate, and consumer spending. Weak economic data could signal a potential recession, leading to a sell-off in the stock market.

- Corporate Earnings:Analyze corporate earnings reports for insights into company performance and future prospects. Strong earnings reports could provide support for the stock market, while weak earnings could lead to a sell-off.

- Geopolitical Developments:Stay informed about geopolitical events, such as the war in Ukraine, US-China relations, and global energy markets. Escalating geopolitical tensions could create market volatility and disrupt economic activity.